Indian billionaire Mukesh Ambani plans to launch the IPO for his telecom business Jio in 2025 with a target valuation of over $100 billion. Ambani, who hasn't updated his IPO timelines since 2019, has successfully raised $25 billion from investors for his digital, telecom, and retail ventures in recent years. However, the IPO for his retail unit is not expected until after 2025 as the company needs to address some internal business and operational challenges.

Reliance Jio IPO: Ambitious Plans for a Mega Listing

Reliance Industries Limited (RIL), headed by Indian business magnate Mukesh Ambani, has ambitious plans to launch the initial public offering (IPO) of its telecom subsidiary, Reliance Jio, in 2025. The IPO is expected to value the company at over $100 billion, making it one of the largest public offerings in history.

Background

Reliance Jio was launched in 2016 and quickly became India's largest telecom operator, disrupting the market with its affordable data plans and high-speed connectivity. The company has over 400 million subscribers and generates significant revenue from mobile services, broadband, and digital content.

In 2019, Ambani announced plans to list Jio on the stock exchange in 2020. However, the IPO was delayed due to concerns related to the COVID-19 pandemic and regulatory approvals.

Latest Updates

Recently, Ambani revealed that Jio's IPO is now targeted for 2025. He also stated that the company has successfully raised $25 billion from investors in recent years for its various digital, telecom, and retail ventures.

However, the IPO for Reliance's retail unit, Reliance Retail, is not expected until after 2025, as the company addresses some internal business and operational challenges.

Top 5 FAQs

When is Reliance Jio's IPO expected to take place?

What is the target valuation for the IPO?

Why was the previous IPO plan for Jio delayed?

Is the IPO for Reliance Retail also expected in 2025?

What are the reasons for the delay in Reliance Retail's IPO?

Conclusion

Reliance Jio's IPO is a highly anticipated event that could create a significant impact on the Indian stock market. The company's dominant position in the telecom sector, coupled with its growing digital and retail businesses, makes it an attractive investment opportunity. However, investors should be mindful of the potential risks associated with any IPO, including market volatility and the company's ability to execute its growth plans.

According to sources, Mukesh Ambani, the chairman and managing director of Reliance Industries, has set a target to list the group's telecom business, Jio, next year with a valuation of over USD 100 billion. The conglomerate also plans to launch the IPO of its retail unit at a later time. Ambani had previously announced a timeline of five years for Reliance Jio and Reliance Retail to go public, but the company has now firmed up plans to launch the Jio IPO in 2025, indicating confidence in its stable business and revenue stream as India's top telecom player.

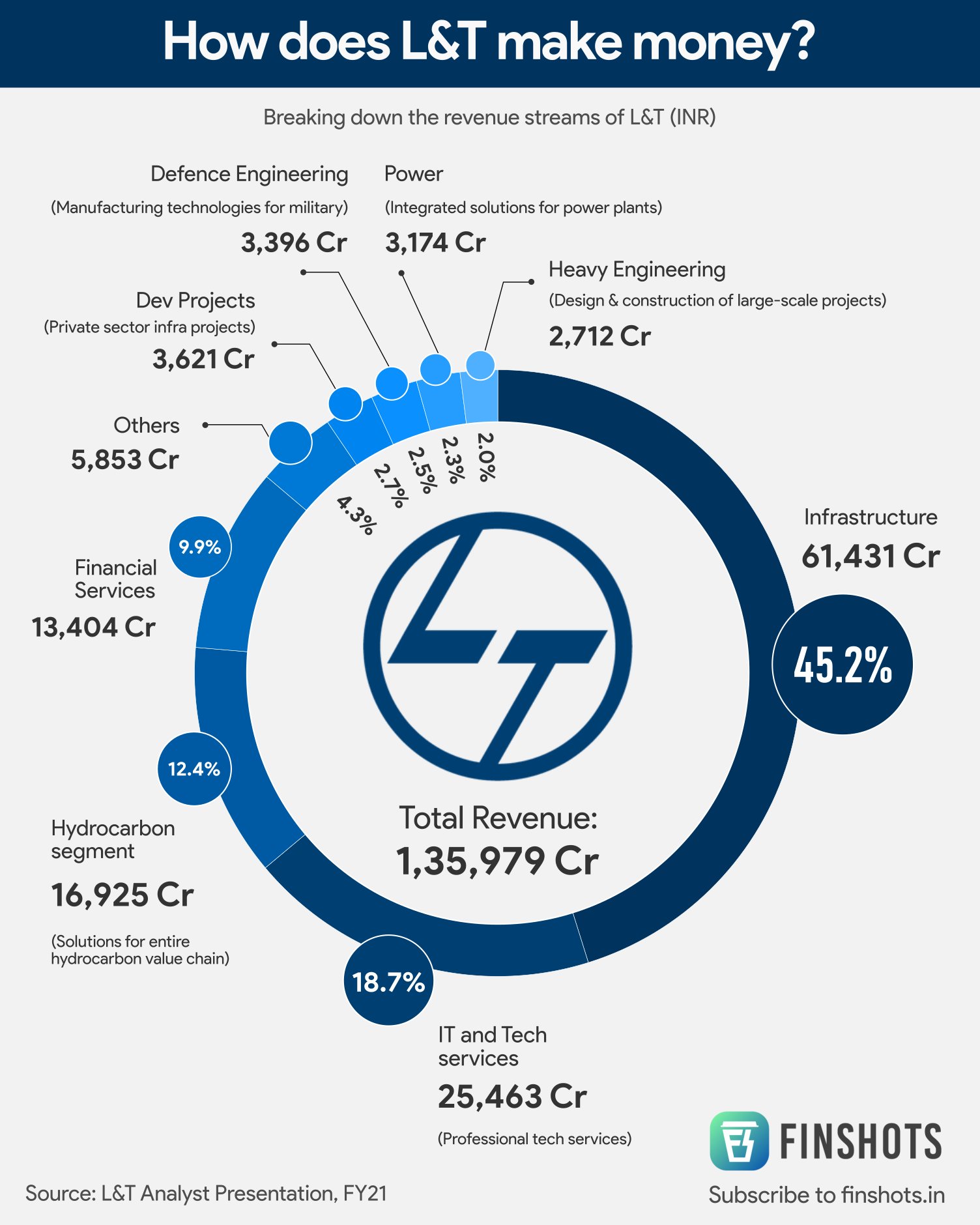

Larsen & Toubro (L&T) continues to see strong growth, with consolidated revenue reaching Rs 61,555 crore in the latest quarter. The company's international revenues accounted for 52% of overall revenues, highlighting its global presence and success. Some big names to watch in the stock market today include L&T, Tata Power, and Biocon, with many expecting significant price movement. L&T also recently announced a new project in India, involving the construction of a 15.09 km elevated viaduct, 14 stations, and a 2.61 km depot, with a targeted completion date of 30 months.

ACME Solar Holdings, a Gurugram-based renewable energy company, has announced the pricing for its initial public offering (IPO) of Rs 2,900 crore, with a price band of Rs 275 to Rs 289 per share. The company plans to use the proceeds from the fresh issuance to pay off debt and for general corporate purposes. With a diversified portfolio and a revenue stream from selling electricity to government-backed entities, ACME Solar has seen a turnaround from loss-making to a profit of Rs 698.23 crore in FY24.

As rental rates continue to rise in Dubai, tenants are seeking more flexibility in payment options. Landlords, facing high demand for rental properties, are becoming more open to multiple cheque payments and issuing fewer eviction notices. This trend is reflected in the latest data from Allsopp & Allsopp, where a majority of tenants are opting to pay their rent in 6-8 cheques. The Dubai Land Department's Rera rental index is also playing a role in promoting transparency and fairness in the rental market.

The State of Michigan has made headlines by becoming the first pension fund to publicly disclose its acquisition of spot Ethereum ETFs. In addition to their already disclosed Bitcoin ETF holdings, the fund now holds $10 million worth of Ethereum ETFs, making them a top holder in the market. This move further solidifies the growing interest and adoption of cryptocurrencies by mainstream financial institutions.

The Chhattisgarh Police has recently released the admit card for the Document Verification, Physical Measurement Test (PMT), and Physical Endurance Test (PET) for the recruitment of Constables in the District Police Force Cadre. Candidates can download their admit card by visiting the official website or clicking on the provided links. The admit card can be downloaded using the registered mobile number and password. Detailed steps on how to download the admit card are also mentioned in the article.

After raising $25 billion from top investors, Mukesh Ambani's Reliance Jio is planning to go public with an estimated IPO valuation of $112 billion, surpassing Hyundai India's earlier record. The telecom giant, which currently boasts a subscriber count of 479 million, plans to list its retail and telecom units separately. While Jio is expected to go public in 2025, the retail arm's IPO is likely to follow at a later date due to operational challenges. The company is also increasing its competitive edge with partnerships and collaborations in the tech sector.

Short interest in MiMedx Group Inc (NASDAQ:MDXG) has decreased, indicating a potential decline in the company's stock. This data is updated every two weeks and gives investors a sense of how many are betting on a decline in the stock. With an average trading volume of 392.13K shares per day, holders of this short interest may need 10.27 days to close their positions without causing a significant increase in the stock price. Interested in the most shorted stocks? Read on.

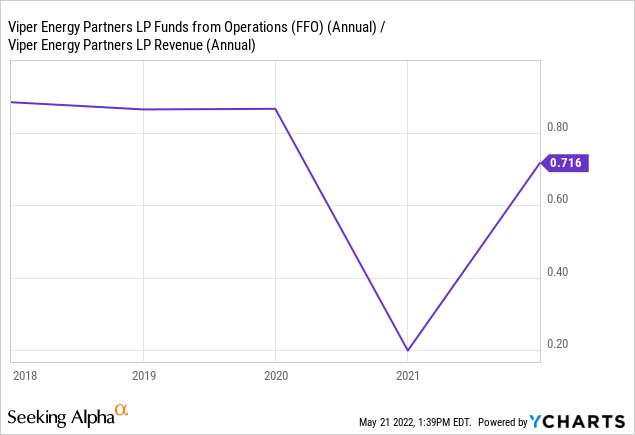

Viper Energy Inc (NASDAQ:VNOM) has released its Q3 2024 earnings, beating analysts' expectations with $0.22 million in revenue and a 25.25% earnings surprise. However, expected revenue and earnings for the full year 2024 have seen a decline, while estimates for 2025 have increased. With a current average price target of $52.73 and a "Strong Buy" average brokerage recommendation, there is potential for upside in the stock. However, GuruFocus estimates a downside of -37.35% in one year, urging caution before investing in the stock.