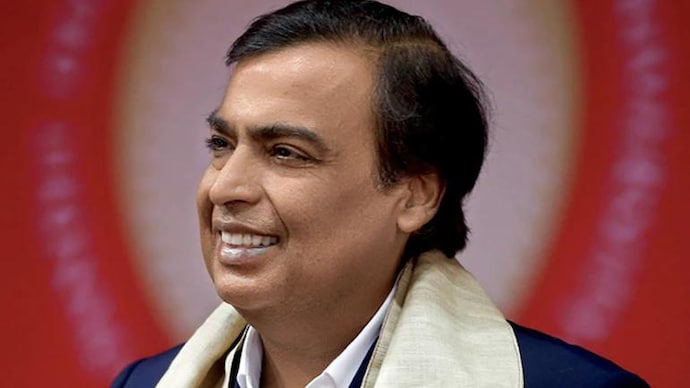

After raising $25 billion from top investors, Mukesh Ambani's Reliance Jio is planning to go public with an estimated IPO valuation of $112 billion, surpassing Hyundai India's earlier record. The telecom giant, which currently boasts a subscriber count of 479 million, plans to list its retail and telecom units separately. While Jio is expected to go public in 2025, the retail arm's IPO is likely to follow at a later date due to operational challenges. The company is also increasing its competitive edge with partnerships and collaborations in the tech sector.

Reliance Jio IPO: India's Biggest IPO in the Making

Background

Reliance Industries Limited (RIL), India's largest conglomerate, has been aggressively expanding its telecommunications business through its subsidiary, Reliance Jio Infocomm Limited (Jio). Since its launch in 2016, Jio has become the largest mobile network operator in India, with over 479 million subscribers.

IPO Plans

After raising $25 billion from global investors in 2023, Reliance Jio is planning to go public with an estimated IPO valuation of $112 billion, surpassing the record set by Hyundai India's IPO. The IPO is expected to include separate listings for Jio's retail and telecom units.

Valuation and Timing

RIL's chairman and managing director, Mukesh Ambani, has stated that the telecom unit's IPO is likely to take place in 2025, while the retail arm's IPO may follow at a later date due to operational challenges. The company's strong subscriber base, high-speed 5G network, and partnerships with global tech giants have made it an attractive investment proposition.

Competitive Edge

Jio has been actively investing in new technologies to maintain its competitive edge. It has launched 5G services in major Indian cities and has partnered with Google to develop a low-cost 4G smartphone. The company has also acquired cloud computing and data center businesses to expand its digital offerings.

Top 5 FAQs

1. When is the Reliance Jio IPO expected to happen?

2. What is the estimated valuation of the Reliance Jio IPO?

3. Why is Reliance Jio planning to list its units separately?

4. What are Jio's key growth drivers?

5. How will the IPO proceeds be used?

As rental rates continue to rise in Dubai, tenants are seeking more flexibility in payment options. Landlords, facing high demand for rental properties, are becoming more open to multiple cheque payments and issuing fewer eviction notices. This trend is reflected in the latest data from Allsopp & Allsopp, where a majority of tenants are opting to pay their rent in 6-8 cheques. The Dubai Land Department's Rera rental index is also playing a role in promoting transparency and fairness in the rental market.

Indian billionaire Mukesh Ambani plans to launch the IPO for his telecom business Jio in 2025 with a target valuation of over $100 billion. Ambani, who hasn't updated his IPO timelines since 2019, has successfully raised $25 billion from investors for his digital, telecom, and retail ventures in recent years. However, the IPO for his retail unit is not expected until after 2025 as the company needs to address some internal business and operational challenges.

The State of Michigan has made headlines by becoming the first pension fund to publicly disclose its acquisition of spot Ethereum ETFs. In addition to their already disclosed Bitcoin ETF holdings, the fund now holds $10 million worth of Ethereum ETFs, making them a top holder in the market. This move further solidifies the growing interest and adoption of cryptocurrencies by mainstream financial institutions.

The Chhattisgarh Police has recently released the admit card for the Document Verification, Physical Measurement Test (PMT), and Physical Endurance Test (PET) for the recruitment of Constables in the District Police Force Cadre. Candidates can download their admit card by visiting the official website or clicking on the provided links. The admit card can be downloaded using the registered mobile number and password. Detailed steps on how to download the admit card are also mentioned in the article.

Short interest in MiMedx Group Inc (NASDAQ:MDXG) has decreased, indicating a potential decline in the company's stock. This data is updated every two weeks and gives investors a sense of how many are betting on a decline in the stock. With an average trading volume of 392.13K shares per day, holders of this short interest may need 10.27 days to close their positions without causing a significant increase in the stock price. Interested in the most shorted stocks? Read on.

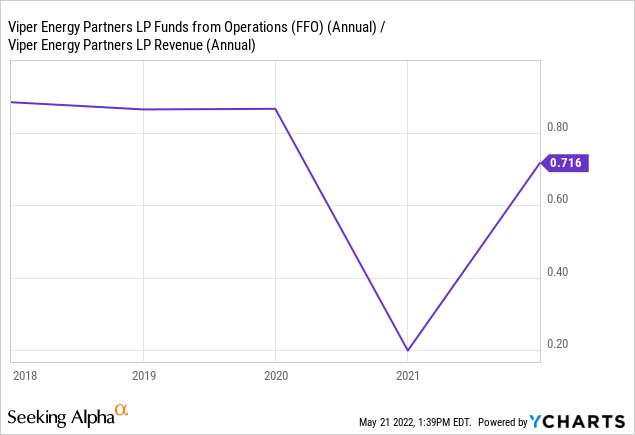

Viper Energy Inc (NASDAQ:VNOM) has released its Q3 2024 earnings, beating analysts' expectations with $0.22 million in revenue and a 25.25% earnings surprise. However, expected revenue and earnings for the full year 2024 have seen a decline, while estimates for 2025 have increased. With a current average price target of $52.73 and a "Strong Buy" average brokerage recommendation, there is potential for upside in the stock. However, GuruFocus estimates a downside of -37.35% in one year, urging caution before investing in the stock.

In a recent incident, an Indian Air Force MiG-29 fighter jet crashed in a field near Agra due to a system malfunction during a routine training mission. The pilot managed to guide the aircraft away from populated areas before ejecting safely. A Court of Inquiry has been initiated to investigate the cause of the crash. This is the second MiG-29 crash in less than a month, raising concerns about the safety and reliability of the aircraft.

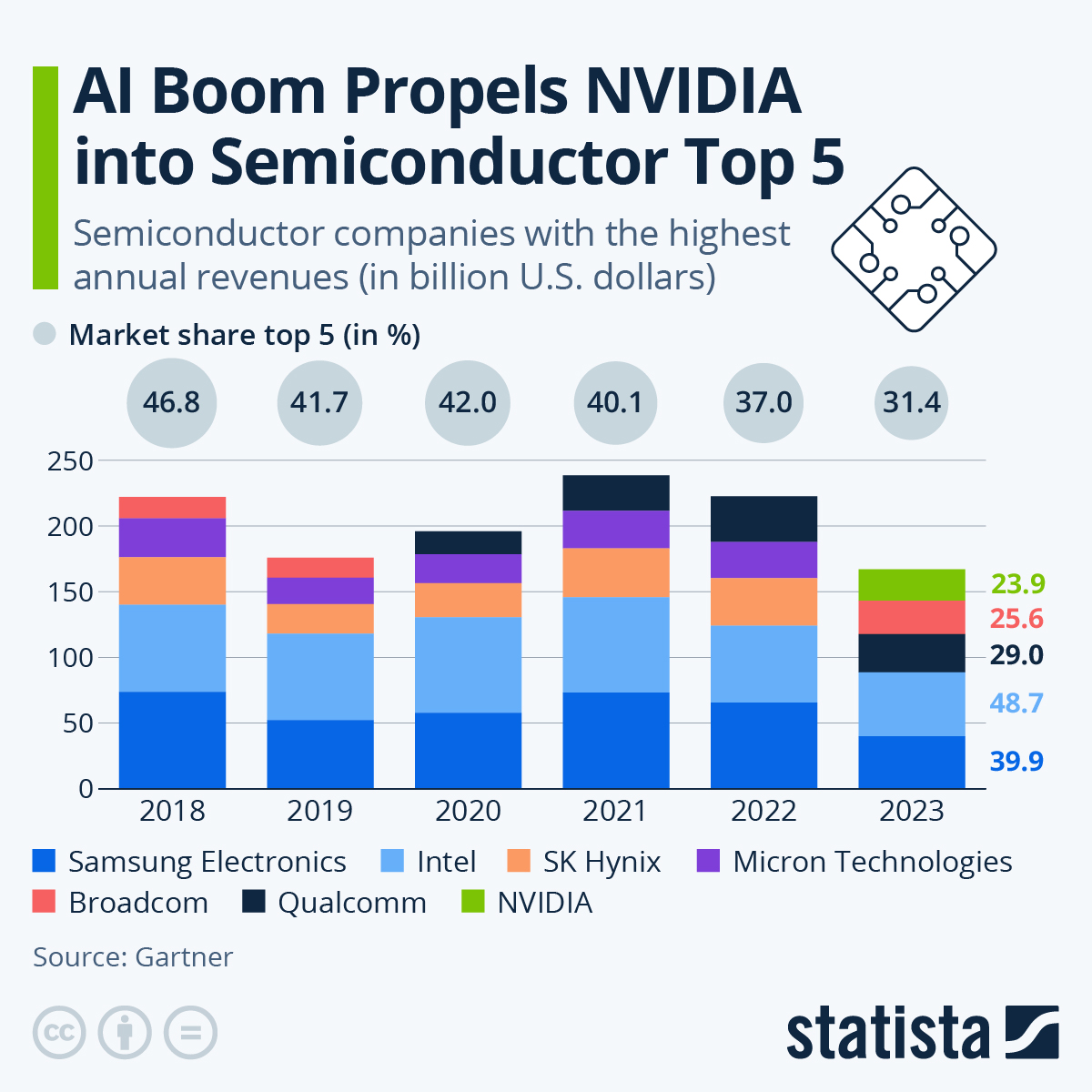

Nvidia, one of the top-performing stocks of 2024, has seen impressive market returns due to the growing demand for AI technology in various industries. However, concerns about the company's valuation and a potential AI bubble have emerged. On top of that, Nvidia's largest customer, Super Micro Computer Inc., is facing possible delisting and a DOJ investigation, which could impact the chipmaker's future earnings. With NVIDIA's Q4 2024 earnings report set to be released on November 20, the stock could face further challenges in maintaining its impressive performance.

Chelsea manager Enzo Maresca has demoted record signing Enzo Fernandez to the second string for Premier League games and said that no player is irreplaceable in his team. The £107 million midfielder joined Chelsea from Benfica in January 2023 but has not started in the past two top-flight games. Maresca has preferred the less experienced Romeo Lavia as the midfield partner for Moises Caicedo, citing a lack of physicality as the reason for Fernandez's absence. Reports suggest that Real Madrid could make a move for the Argentine in a cash-plus-player deal.