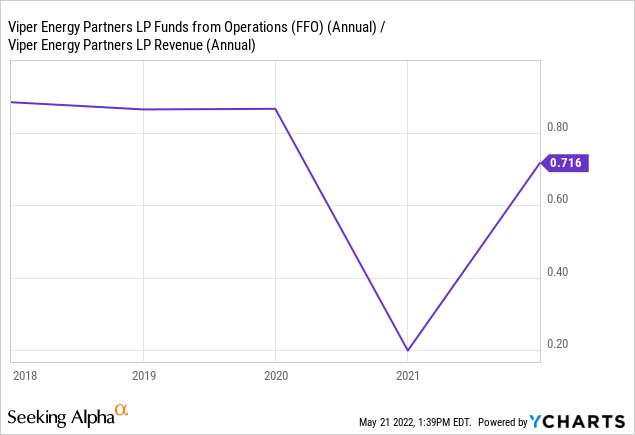

Viper Energy Inc (NASDAQ:VNOM) has released its Q3 2024 earnings, beating analysts' expectations with $0.22 million in revenue and a 25.25% earnings surprise. However, expected revenue and earnings for the full year 2024 have seen a decline, while estimates for 2025 have increased. With a current average price target of $52.73 and a "Strong Buy" average brokerage recommendation, there is potential for upside in the stock. However, GuruFocus estimates a downside of -37.35% in one year, urging caution before investing in the stock.

Viper Energy Inc. Q3 2024 Earnings Report: A Beat But Challenges Remain

Background

Viper Energy Inc. (NASDAQ: VNOM) is an independent oil and gas exploration and production company headquartered in Houston, Texas. The company primarily operates in the Permian Basin in West Texas and the Gulf Coast in Louisiana.

Q3 2024 Earnings

On November 14, 2023, Viper Energy reported its financial results for the third quarter of 2024. The company reported revenue of $0.22 million, beating analysts' expectations by 25.25%. The earnings per share (EPS) came in at $0.01, a significant improvement from the loss per share of $0.12 reported in Q3 2023.

Full-Year Outlook

While the Q3 results were positive, Viper Energy revised its full-year 2024 guidance downward. The company now expects revenue of between $1.05 million and $1.15 million, down from the previous range of $1.2 million to $1.3 million. EPS is expected to be in the range of $0.10 to $0.14, down from the previous guidance of $0.20 to $0.24.

However, the company's outlook for 2025 has improved. Revenue is now expected to be in the range of $1.6 million to $1.8 million, up from the previous range of $1.5 million to $1.7 million. EPS is expected to be in the range of $0.30 to $0.38, up from the previous guidance of $0.25 to $0.35.

Analyst Commentary

Analysts remain bullish on Viper Energy despite the revised full-year guidance. The average price target for the stock is currently $52.73, with an average brokerage recommendation of "Strong Buy."

Top 5 FAQs

Indian billionaire Mukesh Ambani plans to launch the IPO for his telecom business Jio in 2025 with a target valuation of over $100 billion. Ambani, who hasn't updated his IPO timelines since 2019, has successfully raised $25 billion from investors for his digital, telecom, and retail ventures in recent years. However, the IPO for his retail unit is not expected until after 2025 as the company needs to address some internal business and operational challenges.

The State of Michigan has made headlines by becoming the first pension fund to publicly disclose its acquisition of spot Ethereum ETFs. In addition to their already disclosed Bitcoin ETF holdings, the fund now holds $10 million worth of Ethereum ETFs, making them a top holder in the market. This move further solidifies the growing interest and adoption of cryptocurrencies by mainstream financial institutions.

The Chhattisgarh Police has recently released the admit card for the Document Verification, Physical Measurement Test (PMT), and Physical Endurance Test (PET) for the recruitment of Constables in the District Police Force Cadre. Candidates can download their admit card by visiting the official website or clicking on the provided links. The admit card can be downloaded using the registered mobile number and password. Detailed steps on how to download the admit card are also mentioned in the article.

After raising $25 billion from top investors, Mukesh Ambani's Reliance Jio is planning to go public with an estimated IPO valuation of $112 billion, surpassing Hyundai India's earlier record. The telecom giant, which currently boasts a subscriber count of 479 million, plans to list its retail and telecom units separately. While Jio is expected to go public in 2025, the retail arm's IPO is likely to follow at a later date due to operational challenges. The company is also increasing its competitive edge with partnerships and collaborations in the tech sector.

Short interest in MiMedx Group Inc (NASDAQ:MDXG) has decreased, indicating a potential decline in the company's stock. This data is updated every two weeks and gives investors a sense of how many are betting on a decline in the stock. With an average trading volume of 392.13K shares per day, holders of this short interest may need 10.27 days to close their positions without causing a significant increase in the stock price. Interested in the most shorted stocks? Read on.

In a recent incident, an Indian Air Force MiG-29 fighter jet crashed in a field near Agra due to a system malfunction during a routine training mission. The pilot managed to guide the aircraft away from populated areas before ejecting safely. A Court of Inquiry has been initiated to investigate the cause of the crash. This is the second MiG-29 crash in less than a month, raising concerns about the safety and reliability of the aircraft.

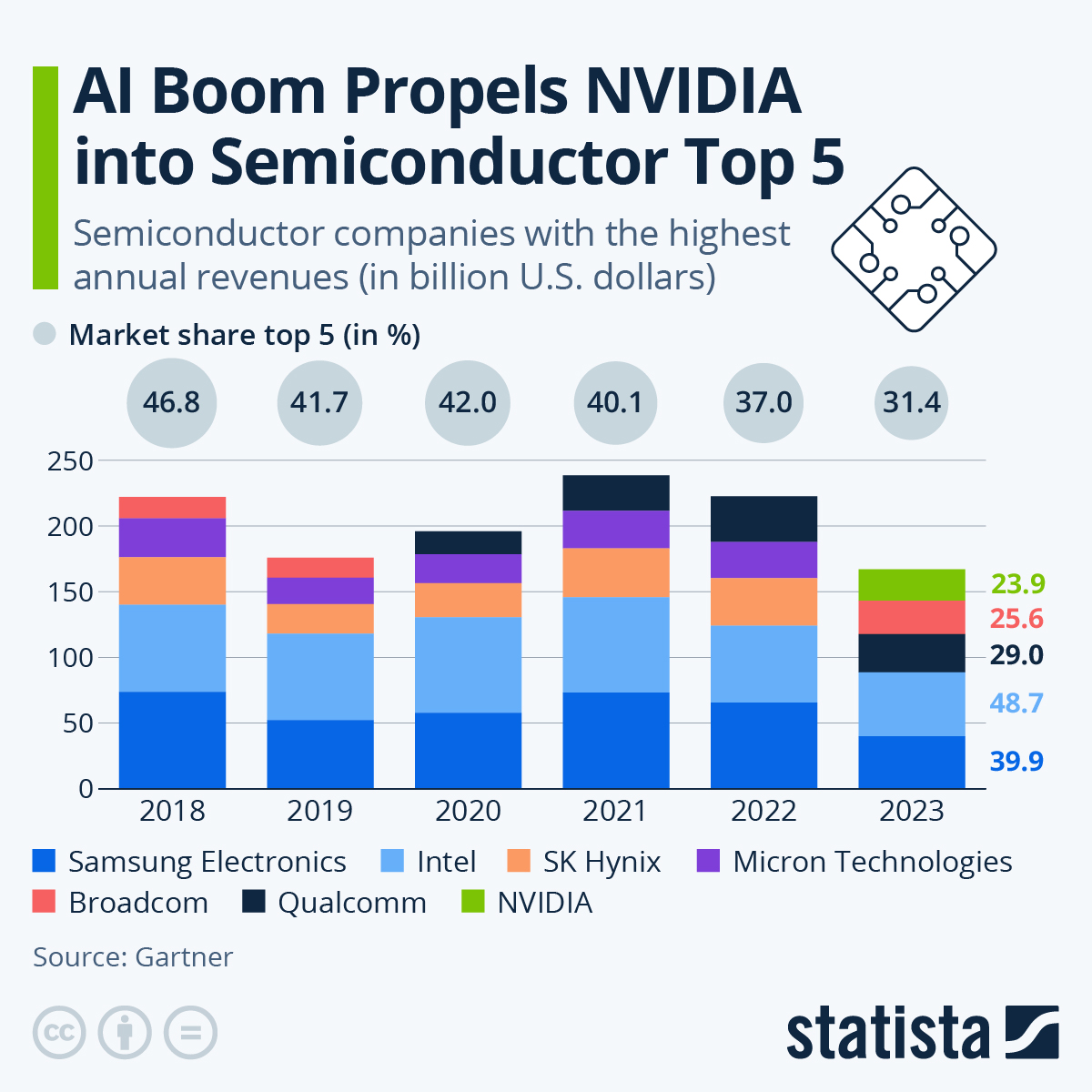

Nvidia, one of the top-performing stocks of 2024, has seen impressive market returns due to the growing demand for AI technology in various industries. However, concerns about the company's valuation and a potential AI bubble have emerged. On top of that, Nvidia's largest customer, Super Micro Computer Inc., is facing possible delisting and a DOJ investigation, which could impact the chipmaker's future earnings. With NVIDIA's Q4 2024 earnings report set to be released on November 20, the stock could face further challenges in maintaining its impressive performance.

Chelsea manager Enzo Maresca has demoted record signing Enzo Fernandez to the second string for Premier League games and said that no player is irreplaceable in his team. The £107 million midfielder joined Chelsea from Benfica in January 2023 but has not started in the past two top-flight games. Maresca has preferred the less experienced Romeo Lavia as the midfield partner for Moises Caicedo, citing a lack of physicality as the reason for Fernandez's absence. Reports suggest that Real Madrid could make a move for the Argentine in a cash-plus-player deal.

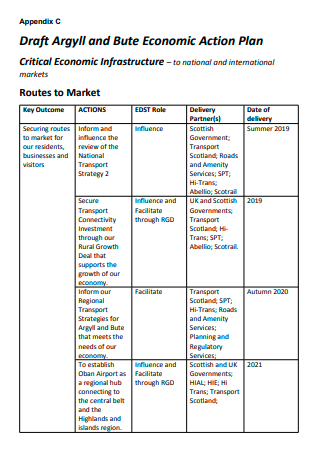

The Green River Area Development District (GRADD) is inviting feedback on their draft of the Comprehensive Economic Development Strategy report, which serves as an action plan for economic growth in seven counties in Kentucky. This report is a requirement from the U.S. Department of Commerce's Economic Development Administration and covers topics such as infrastructure, industry, and the workforce. The public has until November 13 to give their input on the 2024 update draft.