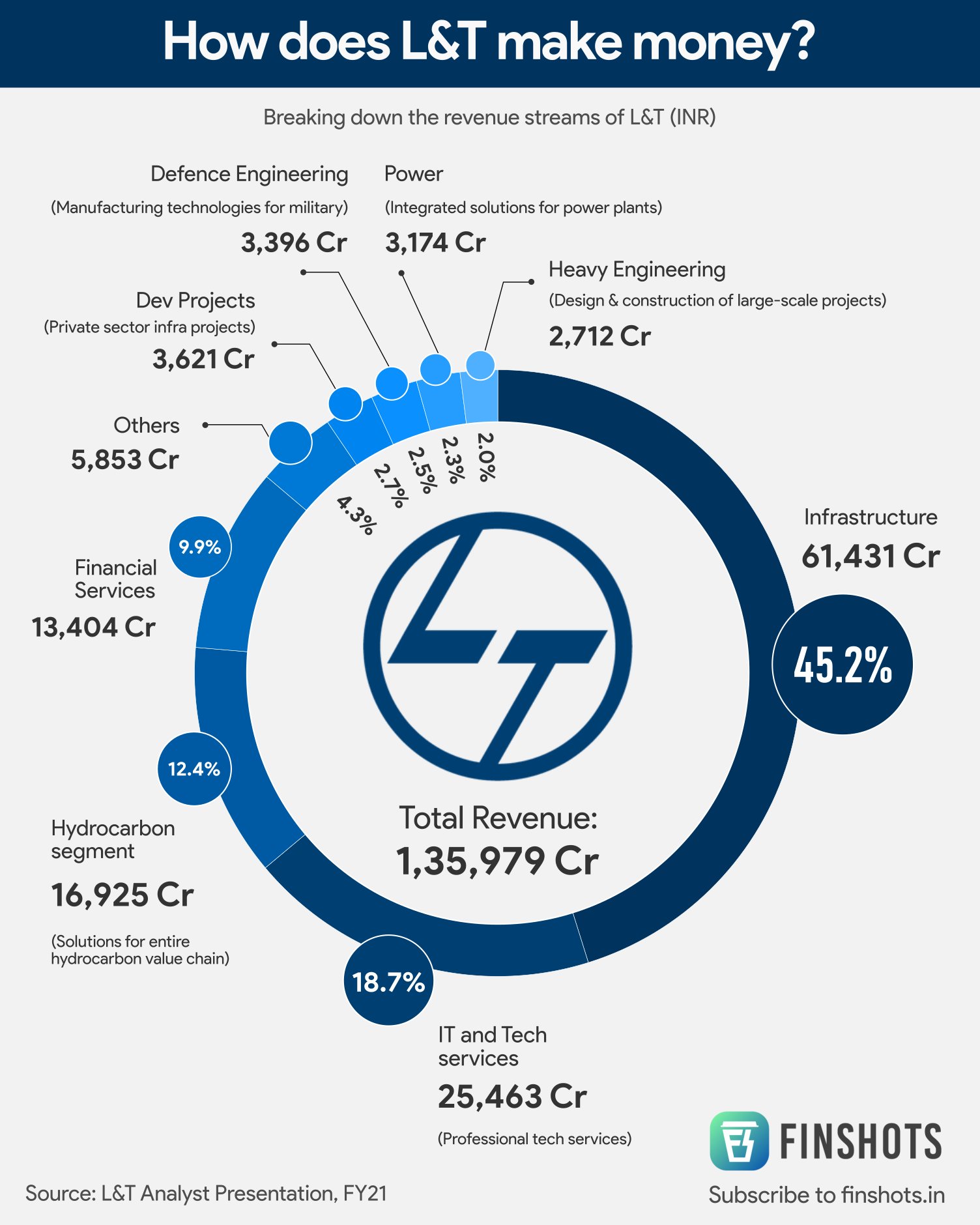

Larsen & Toubro (L&T) continues to see strong growth, with consolidated revenue reaching Rs 61,555 crore in the latest quarter. The company's international revenues accounted for 52% of overall revenues, highlighting its global presence and success. Some big names to watch in the stock market today include L&T, Tata Power, and Biocon, with many expecting significant price movement. L&T also recently announced a new project in India, involving the construction of a 15.09 km elevated viaduct, 14 stations, and a 2.61 km depot, with a targeted completion date of 30 months.

Larsen & Toubro: Strong Growth and International Expansion

Larsen & Toubro (L&T), an Indian multinational conglomerate, has reported impressive financial results with consolidated revenue reaching Rs 61,555 crore in the latest quarter. This growth is driven by both domestic and international operations, with international revenues accounting for 52% of the total.

Background

L&T is one of the largest engineering and construction companies in India. Founded in 1938, the company has a diversified presence across various industries including infrastructure, power, heavy engineering, shipbuilding, and defense. It has a strong global footprint with operations in over 30 countries.

International Expansion and Growth

In recent years, L&T has focused on expanding its international operations to capitalize on growing infrastructure and construction markets. The company has secured major projects in the Middle East, Southeast Asia, and Africa. This international presence has contributed significantly to its overall growth and revenue generation.

Domestic Projects

Despite its international expansion, L&T continues to play a vital role in India's infrastructure development. The company has recently announced a new project to construct a 15.09 km elevated viaduct, 14 stations, and a 2.61 km depot in India. This project is expected to be completed within 30 months and will enhance connectivity and infrastructure in the region.

Stock Market Performance

L&T is a key player in the Indian stock market and its performance is closely watched by investors. The company's stock has seen significant growth in recent years, reflecting its strong fundamentals and future prospects. Analysts expect L&T to continue to perform well in the stock market due to its consistent growth and diversified operations.

Top 5 FAQs and Answers

What is the revenue of L&T?

What is the international revenue share of L&T?

What is L&T's biggest project in India?

Is L&T a good investment?

What are L&T's future plans?

With an initial public offering (IPO) scheduled to open on November 7, Niva Bupa Health Insurance is looking to raise Rs 2,200 crore from the market. The joint venture between Bupa Group and Fettle Tone LLP has set the price band for its shares at Rs 70 to Rs 74 each and aims to use the proceeds to strengthen its capital base and enhance solvency levels. With strong growth reported in revenue and profits, this IPO presents a promising opportunity for investors.

According to sources, Mukesh Ambani, the chairman and managing director of Reliance Industries, has set a target to list the group's telecom business, Jio, next year with a valuation of over USD 100 billion. The conglomerate also plans to launch the IPO of its retail unit at a later time. Ambani had previously announced a timeline of five years for Reliance Jio and Reliance Retail to go public, but the company has now firmed up plans to launch the Jio IPO in 2025, indicating confidence in its stable business and revenue stream as India's top telecom player.

ACME Solar Holdings, a Gurugram-based renewable energy company, has announced the pricing for its initial public offering (IPO) of Rs 2,900 crore, with a price band of Rs 275 to Rs 289 per share. The company plans to use the proceeds from the fresh issuance to pay off debt and for general corporate purposes. With a diversified portfolio and a revenue stream from selling electricity to government-backed entities, ACME Solar has seen a turnaround from loss-making to a profit of Rs 698.23 crore in FY24.

As rental rates continue to rise in Dubai, tenants are seeking more flexibility in payment options. Landlords, facing high demand for rental properties, are becoming more open to multiple cheque payments and issuing fewer eviction notices. This trend is reflected in the latest data from Allsopp & Allsopp, where a majority of tenants are opting to pay their rent in 6-8 cheques. The Dubai Land Department's Rera rental index is also playing a role in promoting transparency and fairness in the rental market.

Indian billionaire Mukesh Ambani plans to launch the IPO for his telecom business Jio in 2025 with a target valuation of over $100 billion. Ambani, who hasn't updated his IPO timelines since 2019, has successfully raised $25 billion from investors for his digital, telecom, and retail ventures in recent years. However, the IPO for his retail unit is not expected until after 2025 as the company needs to address some internal business and operational challenges.

The State of Michigan has made headlines by becoming the first pension fund to publicly disclose its acquisition of spot Ethereum ETFs. In addition to their already disclosed Bitcoin ETF holdings, the fund now holds $10 million worth of Ethereum ETFs, making them a top holder in the market. This move further solidifies the growing interest and adoption of cryptocurrencies by mainstream financial institutions.

The Chhattisgarh Police has recently released the admit card for the Document Verification, Physical Measurement Test (PMT), and Physical Endurance Test (PET) for the recruitment of Constables in the District Police Force Cadre. Candidates can download their admit card by visiting the official website or clicking on the provided links. The admit card can be downloaded using the registered mobile number and password. Detailed steps on how to download the admit card are also mentioned in the article.

After raising $25 billion from top investors, Mukesh Ambani's Reliance Jio is planning to go public with an estimated IPO valuation of $112 billion, surpassing Hyundai India's earlier record. The telecom giant, which currently boasts a subscriber count of 479 million, plans to list its retail and telecom units separately. While Jio is expected to go public in 2025, the retail arm's IPO is likely to follow at a later date due to operational challenges. The company is also increasing its competitive edge with partnerships and collaborations in the tech sector.

Short interest in MiMedx Group Inc (NASDAQ:MDXG) has decreased, indicating a potential decline in the company's stock. This data is updated every two weeks and gives investors a sense of how many are betting on a decline in the stock. With an average trading volume of 392.13K shares per day, holders of this short interest may need 10.27 days to close their positions without causing a significant increase in the stock price. Interested in the most shorted stocks? Read on.