The Chhattisgarh Police has recently released the admit card for the Document Verification, Physical Measurement Test (PMT), and Physical Endurance Test (PET) for the recruitment of Constables in the District Police Force Cadre. Candidates can download their admit card by visiting the official website or clicking on the provided links. The admit card can be downloaded using the registered mobile number and password. Detailed steps on how to download the admit card are also mentioned in the article.

Chhattisgarh Police Admit Card 2023: A Detailed Guide

Background

The Chhattisgarh Police is responsible for maintaining law and order in the state of Chhattisgarh. As part of its recruitment process, the department conducts examinations for various positions, including Constables in the District Police Force Cadre.

Recent Announcement

On [date], the Chhattisgarh Police released the admit cards for the Document Verification, Physical Measurement Test (PMT), and Physical Endurance Test (PET) for the Constable recruitment process. Candidates who have successfully passed the written examination are eligible to appear for these tests.

How to Download the Admit Card

Candidates can download their admit cards by following these steps:

Important Instructions

Candidates are advised to carefully read the following instructions before downloading their admit cards:

Top 5 FAQs

Q1: When is the last date to download the admit card? A1: The last date to download the admit card is [date].

Q2: What is the format of the admit card? A2: The admit card will be in PDF format.

Q3: Can I download the admit card multiple times? A3: Yes, you can download the admit card as many times as needed.

Q4: What should I do if I lose my admit card? A4: In case you lose your admit card, you can contact the helpline number provided on the official website.

Q5: What is the contact information for the Chhattisgarh Police? A5: You can reach the Chhattisgarh Police at +91-0771-[phone number] or email at [email address].

Reliance Industries Ltd. (RIL) is preparing for the highly anticipated IPO of its telecommunications subsidiary, Jio Platforms Ltd., with plans for a listing by 2025. The valuation of Jio is currently estimated at over $100 billion, with analysts predicting a potential IPO valuation of $112 billion. The IPO will allow existing investors to exit, while RIL's chairman Mukesh Ambani aims to list Jio as a subsidiary structure rather than demerging it. In 2020, Jio secured investments from several strategic partners, including Meta and Google, and recently announced a partnership with Nvidia to develop AI data centers in India.

With an initial public offering (IPO) scheduled to open on November 7, Niva Bupa Health Insurance is looking to raise Rs 2,200 crore from the market. The joint venture between Bupa Group and Fettle Tone LLP has set the price band for its shares at Rs 70 to Rs 74 each and aims to use the proceeds to strengthen its capital base and enhance solvency levels. With strong growth reported in revenue and profits, this IPO presents a promising opportunity for investors.

According to sources, Mukesh Ambani, the chairman and managing director of Reliance Industries, has set a target to list the group's telecom business, Jio, next year with a valuation of over USD 100 billion. The conglomerate also plans to launch the IPO of its retail unit at a later time. Ambani had previously announced a timeline of five years for Reliance Jio and Reliance Retail to go public, but the company has now firmed up plans to launch the Jio IPO in 2025, indicating confidence in its stable business and revenue stream as India's top telecom player.

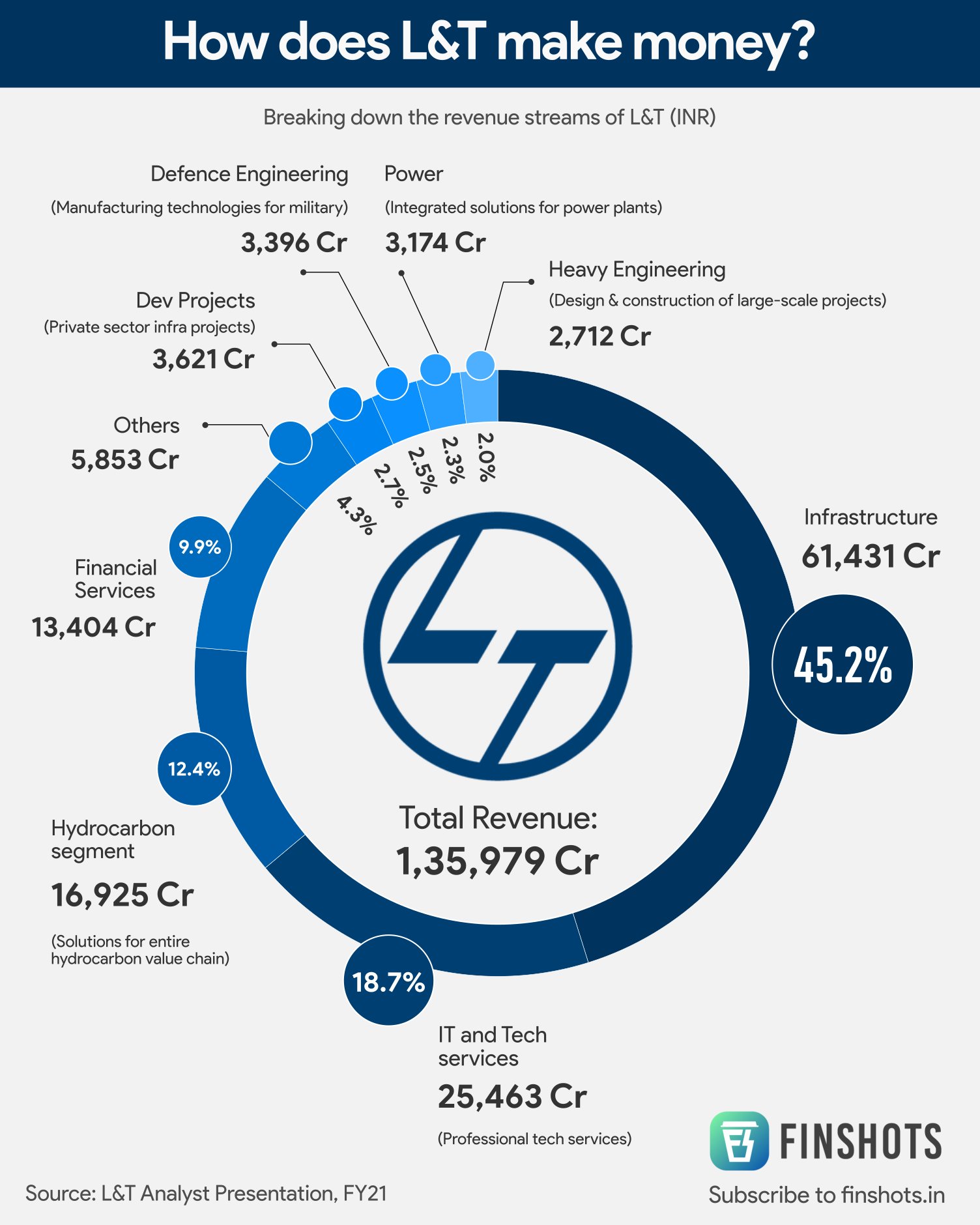

Larsen & Toubro (L&T) continues to see strong growth, with consolidated revenue reaching Rs 61,555 crore in the latest quarter. The company's international revenues accounted for 52% of overall revenues, highlighting its global presence and success. Some big names to watch in the stock market today include L&T, Tata Power, and Biocon, with many expecting significant price movement. L&T also recently announced a new project in India, involving the construction of a 15.09 km elevated viaduct, 14 stations, and a 2.61 km depot, with a targeted completion date of 30 months.

ACME Solar Holdings, a Gurugram-based renewable energy company, has announced the pricing for its initial public offering (IPO) of Rs 2,900 crore, with a price band of Rs 275 to Rs 289 per share. The company plans to use the proceeds from the fresh issuance to pay off debt and for general corporate purposes. With a diversified portfolio and a revenue stream from selling electricity to government-backed entities, ACME Solar has seen a turnaround from loss-making to a profit of Rs 698.23 crore in FY24.

As rental rates continue to rise in Dubai, tenants are seeking more flexibility in payment options. Landlords, facing high demand for rental properties, are becoming more open to multiple cheque payments and issuing fewer eviction notices. This trend is reflected in the latest data from Allsopp & Allsopp, where a majority of tenants are opting to pay their rent in 6-8 cheques. The Dubai Land Department's Rera rental index is also playing a role in promoting transparency and fairness in the rental market.

Indian billionaire Mukesh Ambani plans to launch the IPO for his telecom business Jio in 2025 with a target valuation of over $100 billion. Ambani, who hasn't updated his IPO timelines since 2019, has successfully raised $25 billion from investors for his digital, telecom, and retail ventures in recent years. However, the IPO for his retail unit is not expected until after 2025 as the company needs to address some internal business and operational challenges.

The State of Michigan has made headlines by becoming the first pension fund to publicly disclose its acquisition of spot Ethereum ETFs. In addition to their already disclosed Bitcoin ETF holdings, the fund now holds $10 million worth of Ethereum ETFs, making them a top holder in the market. This move further solidifies the growing interest and adoption of cryptocurrencies by mainstream financial institutions.

After raising $25 billion from top investors, Mukesh Ambani's Reliance Jio is planning to go public with an estimated IPO valuation of $112 billion, surpassing Hyundai India's earlier record. The telecom giant, which currently boasts a subscriber count of 479 million, plans to list its retail and telecom units separately. While Jio is expected to go public in 2025, the retail arm's IPO is likely to follow at a later date due to operational challenges. The company is also increasing its competitive edge with partnerships and collaborations in the tech sector.