Trump's appointment of crypto advocate Paul Atkins as SEC Chair, coupled with plans for a White House crypto policy role and Elon Musk leading the Department of Government Efficiency, has driven Bitcoin to an all-time high of $100,000. With increasing institutional confidence and anticipated friendly regulatory reforms, the market is poised for further growth and widespread adoption. Atkins' expected lighter touch on crypto regulation compared to his predecessor adds to the positive sentiment towards Bitcoin, which has outperformed traditional markets and garnered support from a once crypto-skeptic Trump.

On the verge of reaching a record-breaking $90,000, Bitcoin has experienced a surge in value since the election of Donald Trump as U.S. president. This growth in the world's biggest cryptocurrency is largely attributed to expectations of the Trump administration being more crypto-friendly. With allies like Elon Musk's Tesla and Trump's pro-digital assets stance, investors are confident in the success of the industry under Trump's leadership. This has also lead to an increase in demand for crypto stocks and currencies, solidifying the notion of the U.S. becoming the "crypto capital of the planet".

Former President Donald Trump voiced his support for Bitcoin at the 2024 conference in Nashville, Tennessee. He labeled the cryptocurrency as the future of currency, causing a surge in Bitcoin's value. This comes after Trump's recent praise for blockchain technology and his own involvement in the industry.

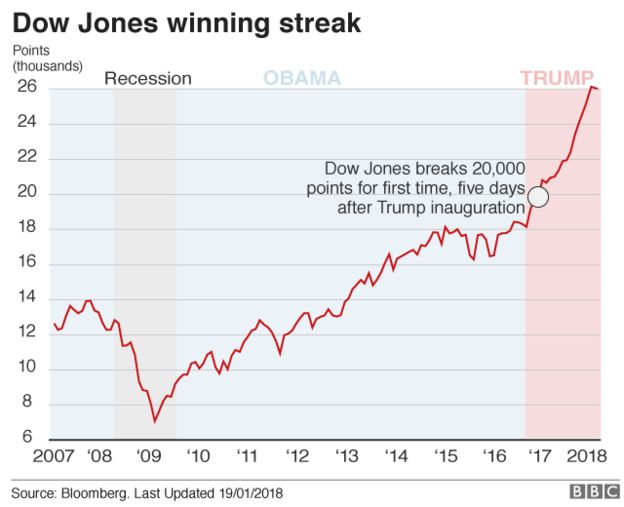

In a surprise victory, Donald Trump is elected for a second term as president, causing the stock market to rally with the Dow Jones, S&P 500, and Nasdaq all closing at record highs. The 10-year Treasury note also experienced a rise in yields, along with Bitcoin reaching a new record high. Republicans also flipped the Senate, while control of the House of Representatives remains uncertain. This election result is viewed as beneficial for the financial sector, with regional banks experiencing a massive rally. Tesla stock also surged, supported by Trump's policies and CEO Elon Musk's public endorsement.

Bitcoin has hit its all-time high of $75,000, with its market cap reaching $1.5 trillion and its volume at nearly $77 billion in the past 24 hours. This surge is attributed to significant inflows into exchange-traded funds (ETFs) and speculation around the US presidential election results, where Republican Donald Trump is leading with 246 electoral votes. Experts predict that the momentum of the crypto industry is undeniable, regardless of the election outcome, and a Trump victory could further fuel its upward trajectory with potential regulatory-friendly policies. Since its inception, Bitcoin has experienced significant price movements during US elections, with prices continuing to rise in the long-term.