On the verge of reaching a record-breaking $90,000, Bitcoin has experienced a surge in value since the election of Donald Trump as U.S. president. This growth in the world's biggest cryptocurrency is largely attributed to expectations of the Trump administration being more crypto-friendly. With allies like Elon Musk's Tesla and Trump's pro-digital assets stance, investors are confident in the success of the industry under Trump's leadership. This has also lead to an increase in demand for crypto stocks and currencies, solidifying the notion of the U.S. becoming the "crypto capital of the planet".

Introduction

Since the election of Donald Trump as U.S. President, Bitcoin has witnessed a remarkable surge in value. This unprecedented growth has been attributed primarily to expectations of a more crypto-friendly Trump administration.

Reasons for Bitcoin's Rise

Trump's Impact on the Cryptocurrency Industry

Trump's presidency has had a profound impact on the cryptocurrency industry:

FAQs

1. What are the key factors driving Bitcoin's price?

2. How has Trump's presidency impacted Bitcoin?

3. What are the risks associated with investing in Bitcoin?

4. What is the future of Bitcoin under Biden's presidency?

5. What other cryptocurrencies are gaining traction?

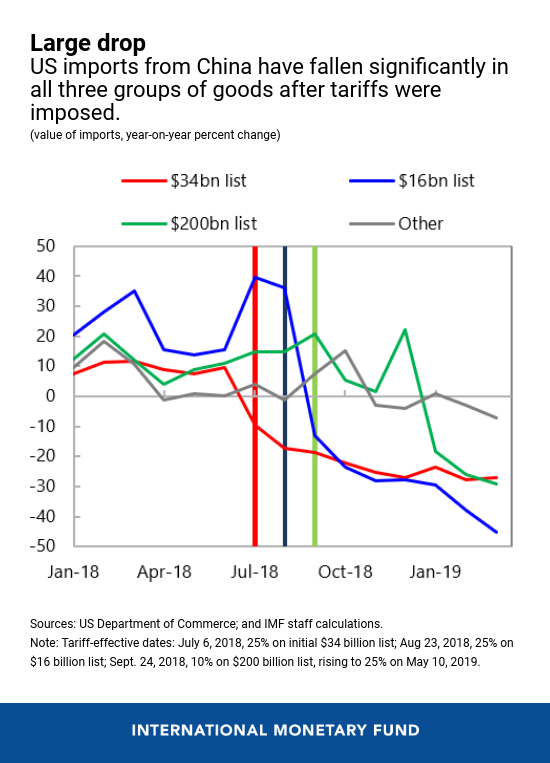

US stocks took a hit on Friday as the White House announced tariffs on goods from Mexico, Canada, and China, reigniting fears of a trade war with the nation's closest trading partners. The S&P 500 and the Dow Jones Industrial Average both fell into the red, while the tech-heavy Nasdaq Composite reversed earlier gains. The news overshadowed positive updates earlier in the day from Apple's solid earnings and a matched inflation reading. The looming tariff deadline has sparked concerns about the impact on the US economy and uncertainty over potential inflamed inflation has put Federal Reserve Chair Jerome Powell in a wait-and-see position.

The benchmark indices in India, Sensex and Nifty, surged thanks to a strong performance by Vedanta, whose impressive Q3 results led to investor sentiment. However, the Economic Survey 2025 highlights potential risks to Indian markets, with high valuations and excessive optimism in the US stock market. All eyes are now on the upcoming Budget for further cues, as the Indian market is sensitive to fluctuations in the US market.

As part of the Budget for 2025-26, Finance Minister Nirmala Sitharaman announced that contributions of up to Rs 50,000 per year towards the NPS Vatsalya scheme, a children's welfare scheme, will be eligible for tax exemption. This move aims to make the scheme more appealing, with the tax benefits also available to regular NPS accounts. The number of enrolments in the scheme is expected to increase with this announcement, providing a secure and prosperous financial future for minors.

The recently released Union Budget for 2025 has sparked positive reactions from various stakeholders in the MSME sector. The budget includes measures such as increased credit guarantee cover and customised credit cards for small businesses, which are seen as crucial steps in promoting financial inclusion and aiding India's position as a global manufacturing hub. However, experts emphasize the importance of simplifying access to these schemes and ensuring efficient disbursement of funds. The budget also focuses on building export competitiveness through digital trade networks and strong buyer-supplier ecosystems.

The Finance Minister, in her Budget 2025 speech, announced significant changes in taxation including a nil tax slab limit of Rs 12 lakh, increased from Rs 7 lakh, and an extended time limit of 4 years to file an updated income tax return. The threshold for TDS deduction on rent has also been raised from Rs 2.4 lakhs to Rs 6 lakhs while the exemption limit for TCS on remittances has been increased from Rs 7 lakhs to Rs 10 lakhs. Additionally, TCS on sale of goods will be omitted to ease compliance difficulties.

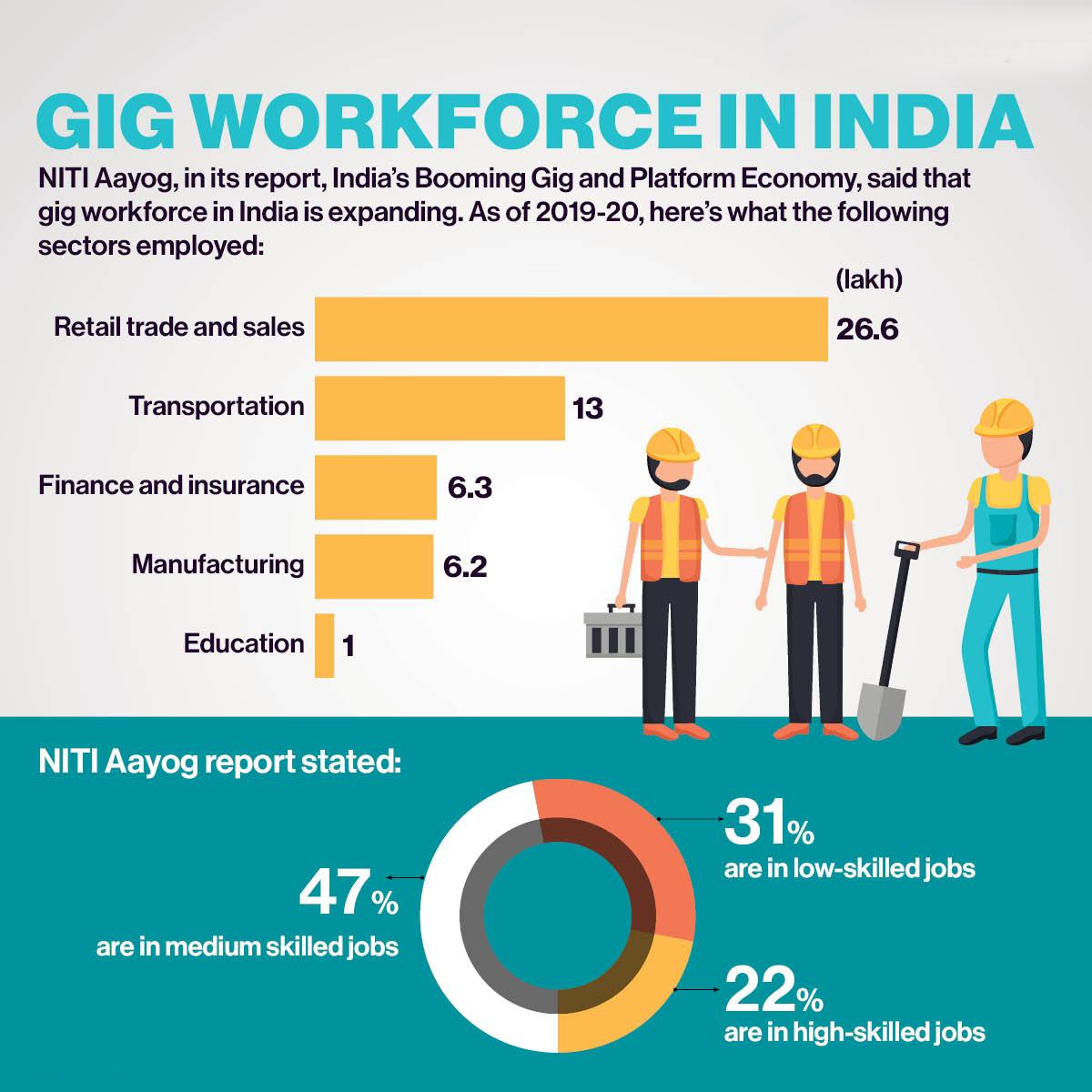

The finance minister announced plans to provide social security and health benefits to gig workers under the government's flagship schemes, including the e-Shram portal which will create a national database. However, unions representing gig workers in Pune expressed dissatisfaction with the budget, questioning why existing health insurance schemes are not being extended to gig workers, and raising concerns about working conditions and lack of a grievance redressal mechanism. While some welcome the government's recognition of gig workers, others argue that the budget does not go far enough in regulating the relationship between workers and companies.

BTTV, a leading business news network, has launched a new market show titled 'Daily Calls' that aims to provide viewers with valuable insights and clarity through live sessions with expert analysts. The show, available on BT TV and Reels, is a must-watch for anyone looking for guidance on investing and portfolio building. With this new addition, BTTV continues to be a go-to source for all things business.

In her eighth consecutive Union Budget, Finance Minister Nirmala Sitharaman has announced a major relief for the middle class in India. People with an annual income of up to Rs 12 lakh will not have to pay any income tax, owing to a tax rebate and the availability of a standard deduction of Rs 75,000 under the new tax regime. However, tax experts state that individuals with zero tax liability are still required to file an income tax return, leading to a cleaner financial record.

Enabling works have begun on the £5.2million redevelopment of Bilston Outdoor Market, which is part of the Bilston Health & Regeneration Programme. The project, funded by the UK Government, will include improvements such as new retail units, a taller canopy for the stalls, and improved pedestrian access from the bus/metro station. Despite the temporary relocation of outdoor traders, the Indoor Market will remain open during the construction. City of Wolverhampton Council Cabinet Member for Resident Services, Councillor Bhupinder Gakhal, expressed excitement for the project that has received positive feedback from traders and residents.

The Indian market showed positive signs as the Sensex and Nifty started the day with gains, ahead of the Union Budget 2025 announcement. However, top gainers on the Sensex included Sun Pharma, UltraTech Cement, IndusInd Bank, Zomato, and Adani Ports, while the top losers were Titan, Bajaj Finserv, Kotak Bank, Nestle, and Asian Paint. The Economic Survey presented by Finance Minister Nirmala Sitharaman projected India's economy to grow between 6.3 to 6.8 per cent in the upcoming 2025-26 fiscal year. However, market experts are looking for growth-stimulating measures in the budget rather than market-related taxation relief. The market response to the budget is expected to last only a few days and will be heavily influenced by trends in growth and earnings recovery.