In a surprise victory, Donald Trump is elected for a second term as president, causing the stock market to rally with the Dow Jones, S&P 500, and Nasdaq all closing at record highs. The 10-year Treasury note also experienced a rise in yields, along with Bitcoin reaching a new record high. Republicans also flipped the Senate, while control of the House of Representatives remains uncertain. This election result is viewed as beneficial for the financial sector, with regional banks experiencing a massive rally. Tesla stock also surged, supported by Trump's policies and CEO Elon Musk's public endorsement.

Tesla Soars as Trump Wins Second Term, Market Rallies

In a stunning upset, Donald Trump emerged victorious in the 2024 presidential election, becoming the first president to win a second term after losing the popular vote. This unexpected outcome sent shockwaves through the market, triggering a surge in stocks across the board.

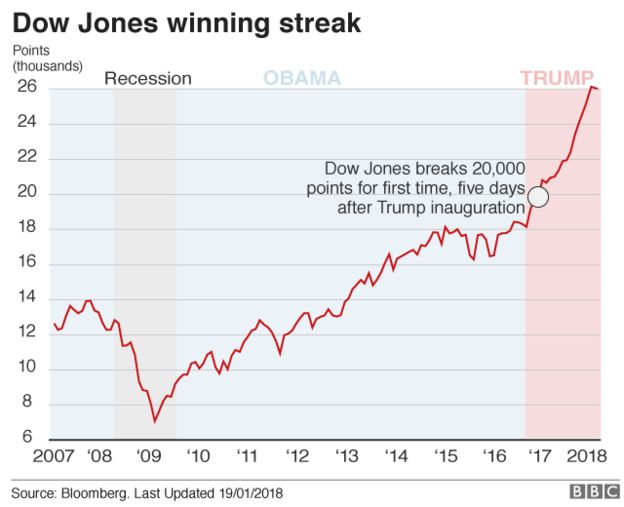

Market Rally

The Dow Jones Industrial Average, S&P 500, and Nasdaq all closed at record highs in the wake of Trump's victory. The 10-year Treasury note also experienced a rise in yields, signaling investor confidence in the economy.

Tesla's Surge

Among the big winners was Tesla, whose stock surged by over 10%. This rally was attributed to Trump's pro-business policies and CEO Elon Musk's public endorsement of Trump during the campaign.

Financial Sector Boost

The financial sector, particularly regional banks, benefited from the election outcome. Banks with less exposure to international markets were seen as safer investments in a climate of uncertainty.

Republican Senate, Uncertain House

In addition to the presidency, Republicans also flipped the Senate, giving them control of both chambers of Congress. However, control of the House of Representatives remains uncertain, with several key races still too close to call.

FAQs

1. Why did Tesla stock surge after Trump's victory? Tesla has benefited from Trump's pro-business policies and CEO Elon Musk's public endorsement of the president. Additionally, Trump's victory has created a positive sentiment in the market, boosting confidence in companies like Tesla.

2. What impact will Trump's second term have on the economy? Trump's second term is likely to continue his pro-business policies, including tax cuts and deregulation. This could potentially boost economic growth but may also lead to higher inflation and budget deficits.

3. How will the Republican-controlled Senate affect Tesla? A Republican-controlled Senate could potentially pass legislation favorable to Tesla, such as tax breaks for electric vehicles. However, it is also possible that the Senate will focus on other priorities, such as healthcare or immigration.

4. What is the significance of the uncertain House control? A divided Congress could lead to gridlock and make it difficult to pass significant legislation. This could impact Tesla's ability to obtain government support or pass favorable laws.

5. What are the potential risks associated with Trump's second term? Trump's second term could bring increased trade tensions, geopolitical instability, and political polarization. These factors could negatively impact the stock market and Tesla's business.

Get the latest and most trusted insights on the world of business and finance delivered straight to your inbox by subscribing to our newsletters. Our team of experts curates exclusive content that you can rely on, without any bias or external influence. Stay informed and ahead in the ever-changing world of business with our newsletters.

Several financial entities including SBI Life Insurance, Aditya Birla Mutual Fund, Morgan Stanley, and Goldman Sachs have collectively purchased a 6% stake in Aditya Birla Lifestyle Brands (ABLBL) from Flipkart Investments for Rs 998 crore through open market transactions. The acquisitions were made by renowned names such as Amansa Capital, Nippon India Mutual Fund, ICICI Prudential MF, UTI MF, among others. Following the transaction, SBI Life's stake in the company has risen to 3.65% from 2.23%. The transaction resulted in a significant increase in the share price of Aditya Birla Lifestyle Brands, rising by 7.01% and closing at Rs 146.01.

The head of the International Monetary Fund, Kristalina Georgieva, cautioned that the current state of the global economy is uncertain and may face more challenges in the future. She pointed to ongoing issues such as the US-China trade war and record gold prices as potential threats. Despite the IMF's prediction of modest growth, Georgieva stressed the importance of proactive measures, such as addressing imbalances and reducing public sector deficits, in order to avoid further instability. She also acknowledged the widespread frustration and anger in many countries, especially among younger generations, demanding better opportunities.

After years of speculation, Hyundai has finally announced the launch of its luxury brand, Genesis, in India in 2027. This move is a part of the company's broader global expansion strategy and aims to boost margins and reduce reliance on the US market. Along with the launch, Hyundai also plans to assemble the Genesis models locally, which could result in competitive pricing for Indian consumers. The luxury SUVs, GV80 and GV80 coupe-SUV, are expected to be the first models to hit the Indian market, taking advantage of the popularity of SUVs in the country.

In a major move that aligns with the government's "Viksit Bharat" vision, Google has announced a $15 billion investment to set up its first AI hub in India located in Visakhapatnam, Andhra Pradesh. The tech giant has partnered with the Adani Group to build a cutting-edge campus that combines advanced AI infrastructure, renewable energy solutions, and an expanded fibre-optic network. This investment marks Google's largest AI hub outside the United States and is expected to drive growth and innovation in the country's digital economy. Prime Minister Narendra Modi has hailed this announcement as a powerful step towards democratizing technology and securing India's place as a global technology leader.

EPFO introduces new rules for partial withdrawals, allowing members to withdraw up to 75% of their provident fund corpus with a minimum balance of 25%. The move aims to provide financial support for immediate needs without sacrificing long-term retirement savings. The rules also include increased time for availing premature settlements, simplification of withdrawal process, and collaboration with India Post for doorstep services. These measures are expected to improve financial flexibility while ensuring sustainability of retirement savings. Category: Business Title: EPFO Eases Rules for Provident Fund Withdrawals, Including 75% Partial Withdrawal and Simplified Process

Google CEO Sundar Pichai and Indian Prime Minister Narendra Modi discuss the tech company's investment in India's digital economy, including plans for a new AI hub in Visakhapatnam. This hub will provide access to cutting-edge AI technology and support industries such as healthcare, education, agriculture, and logistics. It will also connect with Google's global network of AI centers in 12 countries.

During a visit to Chennai, Union Minister Nitin Gadkari announced plans for India to become a leader in the production of alternative and biofuels. He also highlighted the country's growth in the automobile industry, job creation, and improved road infrastructure. Plans for several new highway projects in Puducherry were also announced, showcasing progress and development in the region.

Stocks were headed for a tough day on Tuesday before Fed Chair Jerome Powell's comments turned the tide. After falling about 1%, major indexes rallied in the afternoon when Powell hinted at the possibility of future rate cuts. Investors welcomed the news with relief as it stopped the downward trend and prevented what would have been the second down day in three sessions.

Prime Minister Modi will visit Ayodhya on November 25 to take part in the official completion ceremony of the iconic Ram Temple, where he will be hoisting a 21-foot flag atop the temple. This coincides with the auspicious date of Ram Vivah Panchami in the Hindu calendar. The temple holds great significance not just for India, but for the world as PM Modi envisions it as a symbol of unity and harmony among all communities. The five-day ceremony will be led by scholars and Vedic priests and is expected to be a historic moment for Ayodhya as it opens its doors to global visitors.