The ongoing arbitration between ZEEL and Culver Max Entertainment Pvt Ltd (CMEPL) has come to a conclusion as both companies have agreed to withdraw all claims against each other, including the respective Composite Schemes of Arrangement from the NCLT. Sony had initially claimed a termination fee of USD 90 million from ZEEL after the termination of their proposed merger, but was denied any interim relief by the SIAC. ZEEL also moved the NCLT to implement the merger but later withdrew its plea.

Sony and Zee Entertainment Reach Agreement, Withdraw Claims

Background

In September 2021, Sony Pictures Networks India (SPNI) and Zee Entertainment Enterprises Limited (ZEEL) announced a merger agreement to create a media behemoth. However, the deal hit a snag due to legal challenges and regulatory hurdles.

In May 2022, Sony terminated the merger citing delays and non-receipt of necessary approvals. ZEEL contested the termination and demanded a termination fee of $90 million. Sony sought damages from ZEEL for alleged breaches of their agreement.

Resolution

After an extensive arbitration process, Sony and ZEEL have agreed to withdraw all claims against each other. This includes the termination fee and the respective Composite Schemes of Arrangement that were filed with the National Company Law Tribunal (NCLT).

The settlement brings an end to the legal battle between the two companies. It clears the way for ZEEL to explore other strategic options for its business.

FAQs

1. Why did Sony terminate the merger agreement with ZEEL? Sony terminated the merger due to delays and the failure of ZEEL to obtain the necessary regulatory approvals.

2. What was the disputed termination fee? Sony had claimed a termination fee of $90 million from ZEEL. ZEEL contested this claim.

3. What was the outcome of the arbitration? The arbitration concluded with both Sony and ZEEL agreeing to withdraw all claims against each other.

4. What were the Composite Schemes of Arrangement? The Composite Schemes of Arrangement were plans submitted to the NCLT seeking approval for the merger. They were withdrawn as part of the settlement.

5. What are the implications for ZEEL moving forward? The settlement allows ZEEL to focus on its core business operations and explore other strategic options without the legal distraction from the merger dispute.

In a heartening initiative, Dharavi Social Mission, under the Dharavi Redevelopment Project Private Limited (DRPPL), has facilitated the sale of one million handcrafted diyas from Dharavi's Kumbharwada for this Diwali. The diyas will be used by Mumbai International Airport and the Adani Foundation in their festive season programmes, benefiting around 500 artisans and allied people. This initiative not only supports the local community and their traditions, but also showcases the love, skill and spirit behind each diya.

Trump Media & Technology Group, the parent company of former US President Donald Trump's social media platform Truth Social, has quadrupled its value to over $10 billion, surpassing that of Elon Musk's X Holdings. This increase in value is largely driven by Trump's improved chances of re-election, causing TMTG stock to surge. Despite being unprofitable and struggling to generate revenue, TMTG is now worth more than companies like Caesars Entertainment, Match Group, Walgreens Boots Alliance, and Hasbro. Meanwhile, Musk, a vocal supporter of Trump, has seen his company's value decline since taking over Twitter.

The smallcap stock, Elcid Investments, has seen an unprecedented increase of 66,92,535% in a single trading session, making it the most expensive stock in India. This monumental rise, driven by a special call auction, has propelled the company to surpass MRF, the previous titleholder. With strong ties to Asian Paints and limited availability of shares, Elcid's high book value was a major factor in its surge. Market analysts are amazed by this development, citing the special call auction as a crucial mechanism in determining the true market value of a stock.

Elcid Investments made history as its stock price skyrocketed 67 lakh percent in a single day, surpassing MRF to become India's most valuable stock. The surge was a result of the BSE auction for price discovery of select investment holding companies, with Elcid Investments' shares valued at Rs 2.25 lakh apiece. This development comes in the wake of SEBI's proposal to enhance price discovery for investment holding companies, which may offer a boost to liquidity and investor interest.

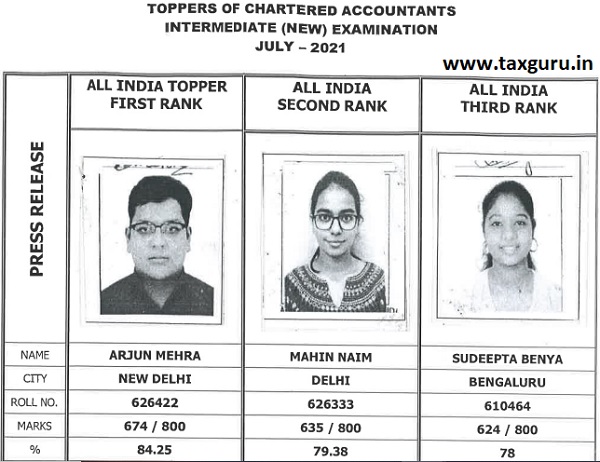

The Institute of Chartered Accountants of India (ICAI) has announced the exam dates for the January 2025 CA Foundation and Intermediate exams. This year, the CA Intermediate exams saw women dominating the top ranks, with Mumbai's Parami Umesh Parekh leading the way with an impressive score of 80.67%. The progress of women in the accounting profession is evident, with the number of female ICAI members expected to reach 50% in the next five years. Along with the results, the ICAI has also declared the CA inter UNITS September 2024 result and the merit list, which can be accessed from various websites.

As the festive season begins, IRCTC's VIKALP scheme comes as a much-needed relief for train passengers struggling to get confirmed tickets. This initiative provides an alternative train option for passengers who are unable to get confirmed seats with their original booking. Although it doesn't guarantee a confirmed berth, VIKALP ensures no additional charges for the passenger and allows them to select up to seven alternate trains.

Swiggy, a popular food delivery platform in India, has officially announced the opening of its initial public offering (IPO) on November 6th. With a fixed price band of Rs 371-390 apiece, the company is looking to raise a total of Rs 11,327.42 crore through the IPO. This includes a fresh share sale of Rs 4,499 crore and an offer-for-sale of up to 17,50,87,863 equity shares by its existing selling shareholders. The IPO has already generated interest from prominent investors and will offer investment opportunities for both institutional and retail investors.

Trump's social media company, Truth Social, has climbed in value surpassing ally Elon Musk's company X, just one week after its launch. The parent company, Trump Media & Technology Group, is now valued at over $10 billion, four times higher than its value last month. While Trump has no active role in the company, he still owns the majority share and founded Truth Social after being banned from other social media platforms. The surge in company value has prompted trading to pause multiple times this week. Follow Misty Severi on X for more coverage of this development.

Elcid Investments, an investment company, witnessed a massive surge in its stock value on Tuesday, rising a staggering 6.7 million per cent and overtaking MRF as the highest-priced stock in India. The surge was a result of a special call auction held "with no price bands" for the stock, which had previously traded at a mere ₹3.5 per share. This sudden increase has resulted in the stock's price reaching a staggering ₹2,36,250 per share, despite having a book value of over ₹4 lakh per share. Investors are now keeping a close eye on the company's future developments.

Elcid Investments Ltd., a subsidiary of the ELCIDIN Group (XT), has seen a significant increase in profits over the past 15 days, according to data from Rediff.com. The company's success has earned them a coveted spot in RediffGurus' list of top performers in the market. With a current net worth of Rs. 000.00, it is clear that Elcid Investments Ltd. is a force to be reckoned with in the business world.