Swiggy, a popular food delivery platform in India, has officially announced the opening of its initial public offering (IPO) on November 6th. With a fixed price band of Rs 371-390 apiece, the company is looking to raise a total of Rs 11,327.42 crore through the IPO. This includes a fresh share sale of Rs 4,499 crore and an offer-for-sale of up to 17,50,87,863 equity shares by its existing selling shareholders. The IPO has already generated interest from prominent investors and will offer investment opportunities for both institutional and retail investors.

Swiggy Gears Up for Rs 11,327 Crore IPO: A Deep Dive

Background:

Swiggy is a leading food delivery platform in India, founded in 2014. Over the years, it has established a wide network of restaurants, delivery partners, and customers across the country. The company has raised significant funding from investors, including SoftBank, Naspers, and DST Global.

Upcoming IPO:

On November 6th, Swiggy announced the opening of its initial public offering (IPO). The company seeks to raise Rs 11,327.42 crore through the sale of new shares worth Rs 4,499 crore and an offer-for-sale of up to 17,50,87,863 equity shares by existing investors.

IPO Details:

Investor Interest:

The Swiggy IPO has garnered interest from domestic and global investors. Anchor investors, including Morgan Stanley, Goldman Sachs, and Abu Dhabi Investment Authority, have already committed to invest Rs 2,537.5 crore.

Top 5 FAQs:

1. Why is Swiggy going public?

To raise funds for business expansion, invest in technology and infrastructure, and provide liquidity to existing investors.

2. What is the expected valuation of Swiggy?

Based on the price band, the company is seeking a valuation of around Rs 65,000-68,250 crore.

3. Who are the major selling shareholders in the IPO?

Naspers, SoftBank, and Prosus will offload a significant portion of their holdings.

4. Will there be a retail component in the IPO?

Yes, retail investors can participate in the IPO by applying through their respective investment platforms.

5. What is the track record of past food delivery platform IPOs?

In the recent past, other food delivery platforms such as Zomato and Uber Eats had successful IPOs. However, their stock prices have been volatile in the aftermath of the IPOs.

Conclusion:

Swiggy's IPO is a significant milestone for the Indian food delivery sector. The company's strong market position, wide network, and growth potential are expected to attract investor interest. The IPO proceeds will provide Swiggy with the necessary resources to accelerate its growth and further consolidate its leadership in the Indian food delivery market.

Elcid Investments made history as its stock price skyrocketed 67 lakh percent in a single day, surpassing MRF to become India's most valuable stock. The surge was a result of the BSE auction for price discovery of select investment holding companies, with Elcid Investments' shares valued at Rs 2.25 lakh apiece. This development comes in the wake of SEBI's proposal to enhance price discovery for investment holding companies, which may offer a boost to liquidity and investor interest.

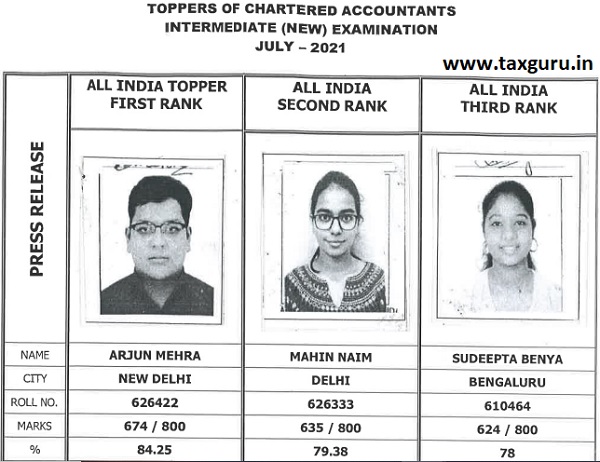

The Institute of Chartered Accountants of India (ICAI) has announced the exam dates for the January 2025 CA Foundation and Intermediate exams. This year, the CA Intermediate exams saw women dominating the top ranks, with Mumbai's Parami Umesh Parekh leading the way with an impressive score of 80.67%. The progress of women in the accounting profession is evident, with the number of female ICAI members expected to reach 50% in the next five years. Along with the results, the ICAI has also declared the CA inter UNITS September 2024 result and the merit list, which can be accessed from various websites.

As the festive season begins, IRCTC's VIKALP scheme comes as a much-needed relief for train passengers struggling to get confirmed tickets. This initiative provides an alternative train option for passengers who are unable to get confirmed seats with their original booking. Although it doesn't guarantee a confirmed berth, VIKALP ensures no additional charges for the passenger and allows them to select up to seven alternate trains.

Trump's social media company, Truth Social, has climbed in value surpassing ally Elon Musk's company X, just one week after its launch. The parent company, Trump Media & Technology Group, is now valued at over $10 billion, four times higher than its value last month. While Trump has no active role in the company, he still owns the majority share and founded Truth Social after being banned from other social media platforms. The surge in company value has prompted trading to pause multiple times this week. Follow Misty Severi on X for more coverage of this development.

Elcid Investments, an investment company, witnessed a massive surge in its stock value on Tuesday, rising a staggering 6.7 million per cent and overtaking MRF as the highest-priced stock in India. The surge was a result of a special call auction held "with no price bands" for the stock, which had previously traded at a mere ₹3.5 per share. This sudden increase has resulted in the stock's price reaching a staggering ₹2,36,250 per share, despite having a book value of over ₹4 lakh per share. Investors are now keeping a close eye on the company's future developments.

Elcid Investments Ltd., a subsidiary of the ELCIDIN Group (XT), has seen a significant increase in profits over the past 15 days, according to data from Rediff.com. The company's success has earned them a coveted spot in RediffGurus' list of top performers in the market. With a current net worth of Rs. 000.00, it is clear that Elcid Investments Ltd. is a force to be reckoned with in the business world.

The Employees’ Provident Fund Organisation (EPFO) has announced that pensioners under the Employee’s Pension Scheme (EPS) will receive their pension for the month of October in advance on October 29 due to Diwali festivities. This will ensure timely payment without any delay and helps pensioners to withdraw their funds on October 30. The EPS-95 scheme was launched in 1995 for employees in the private organised sector, where both employers and employees contribute towards the provident fund for a fixed pension after retirement.

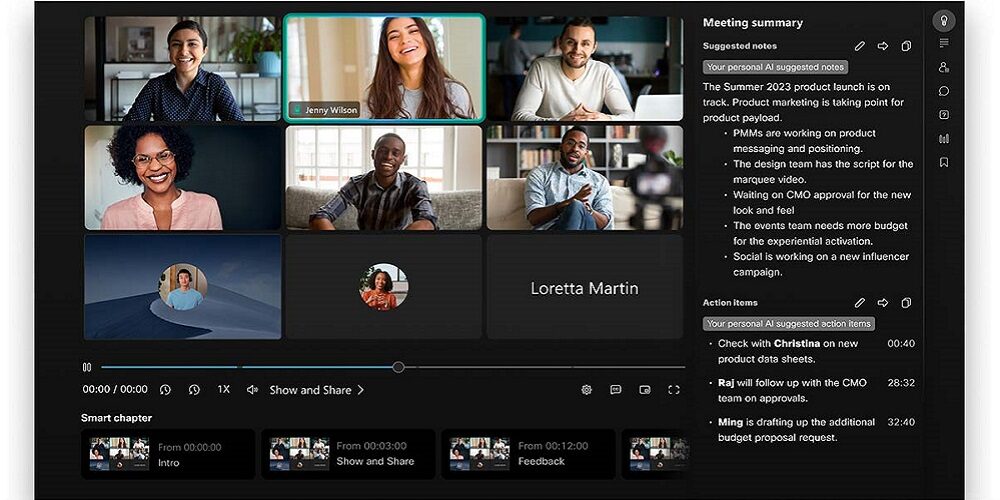

Dubai, UAE - At the WebexOne conference, Cisco unveiled its latest AI-powered innovations, including the Webex AI Agent, AI Agent Studio, and Cisco AI Assistant for Webex Contact Center. These AI solutions utilize advanced conversational intelligence and automation to provide efficient and effective customer interactions, ultimately boosting customer satisfaction and confidence. The newly launched Webex AI Agent acts as a self-service concierge, utilizing natural dialogue to quickly handle customer inquiries and eliminate wait times. Additionally, the AI Agent Studio simplifies and scales the contact center by allowing business users and IT administrators to easily train and deploy AI agents. Overall, these AI solutions will help to transform the customer experience and improve brand loyalty.

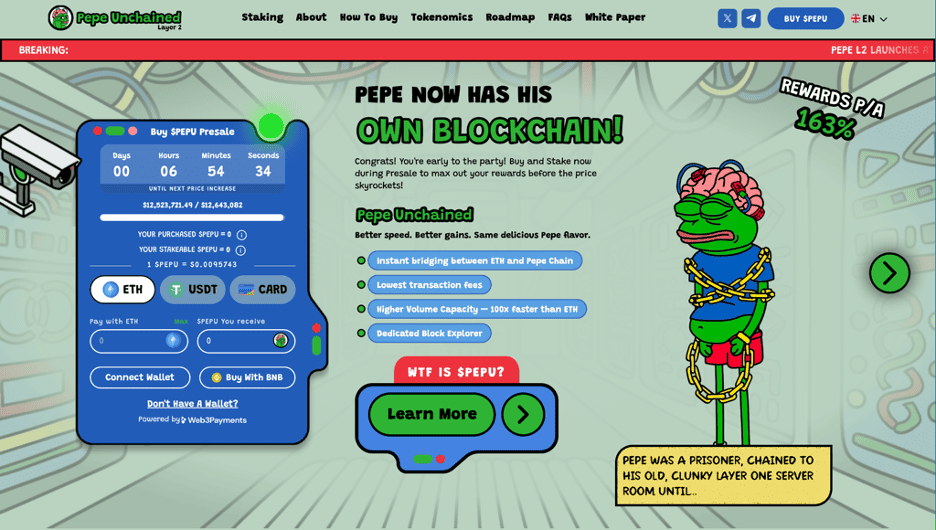

As the stock market continues to break records, Pepe Unchained is following suit with its highly successful token presale, raising $23 million and gaining unstoppable momentum. With new projects in the works, including an Ethereum Layer 2 chain and developer grant applications, Pepe Unchained is poised for even more growth in November. As former U.S. President Trump takes the lead over Vice President Harris in the polls, investors may find Pepe Unchained to be a promising investment opportunity.