Elcid Investments, an investment company, witnessed a massive surge in its stock value on Tuesday, rising a staggering 6.7 million per cent and overtaking MRF as the highest-priced stock in India. The surge was a result of a special call auction held "with no price bands" for the stock, which had previously traded at a mere ₹3.5 per share. This sudden increase has resulted in the stock's price reaching a staggering ₹2,36,250 per share, despite having a book value of over ₹4 lakh per share. Investors are now keeping a close eye on the company's future developments.

Elcid Share Price Soars 6.7 Million Percent, Overtaking MRF as Highest-Priced Stock in India

Background

Elcid Investments Limited is an investment company based in Chennai, India. The company was founded in 1985 and is primarily engaged in investing in various sectors, including real estate, hospitality, and financial services.

Recent Surge

On Tuesday, August 23, 2023, Elcid Investments witnessed an unprecedented surge in its stock price. During a special call auction held "with no price bands," the stock's value skyrocketed by a staggering 6.7 million percent, from ₹3.5 to ₹2,36,250 per share.

This dramatic increase propelled Elcid Investments to become the highest-priced stock in India, surpassing the previous title-holder, MRF. The company's market capitalization also surged to over ₹2.3 lakh crore.

Reasons for the Surge

The reason behind this remarkable surge is not entirely clear. However, some analysts speculate that it could be due to a combination of factors, including:

Book Value and Concerns

Despite its soaring share price, Elcid Investments has a book value of over ₹4 lakh per share. This discrepancy raises concerns about the company's underlying financial health. Investors should exercise caution before investing in the stock, as it may be susceptible to significant price fluctuations.

Top 5 FAQs

1. Why did Elcid Investments' stock price rise so dramatically?

Answer: The surge is likely due to a combination of factors, including speculative trading, buyback rumors, and technical factors.

2. Is Elcid Investments a good investment?

Answer: Investors should exercise caution, as the company's high share price and low liquidity may make it susceptible to volatility. It is recommended to thoroughly research the company's financial health before investing.

3. What is the company's business model?

Answer: Elcid Investments is an investment company that primarily invests in various sectors, including real estate, hospitality, and financial services.

4. What is the company's book value?

Answer: The company's book value is over ₹4 lakh per share, which is significantly lower than its current market price.

5. How should investors respond to the recent surge?

Answer: Investors should approach the situation with caution and not make hasty decisions. It is recommended to consult with a financial advisor before investing in Elcid Investments.

Trump's social media company, Truth Social, has climbed in value surpassing ally Elon Musk's company X, just one week after its launch. The parent company, Trump Media & Technology Group, is now valued at over $10 billion, four times higher than its value last month. While Trump has no active role in the company, he still owns the majority share and founded Truth Social after being banned from other social media platforms. The surge in company value has prompted trading to pause multiple times this week. Follow Misty Severi on X for more coverage of this development.

Elcid Investments Ltd., a subsidiary of the ELCIDIN Group (XT), has seen a significant increase in profits over the past 15 days, according to data from Rediff.com. The company's success has earned them a coveted spot in RediffGurus' list of top performers in the market. With a current net worth of Rs. 000.00, it is clear that Elcid Investments Ltd. is a force to be reckoned with in the business world.

The Employees’ Provident Fund Organisation (EPFO) has announced that pensioners under the Employee’s Pension Scheme (EPS) will receive their pension for the month of October in advance on October 29 due to Diwali festivities. This will ensure timely payment without any delay and helps pensioners to withdraw their funds on October 30. The EPS-95 scheme was launched in 1995 for employees in the private organised sector, where both employers and employees contribute towards the provident fund for a fixed pension after retirement.

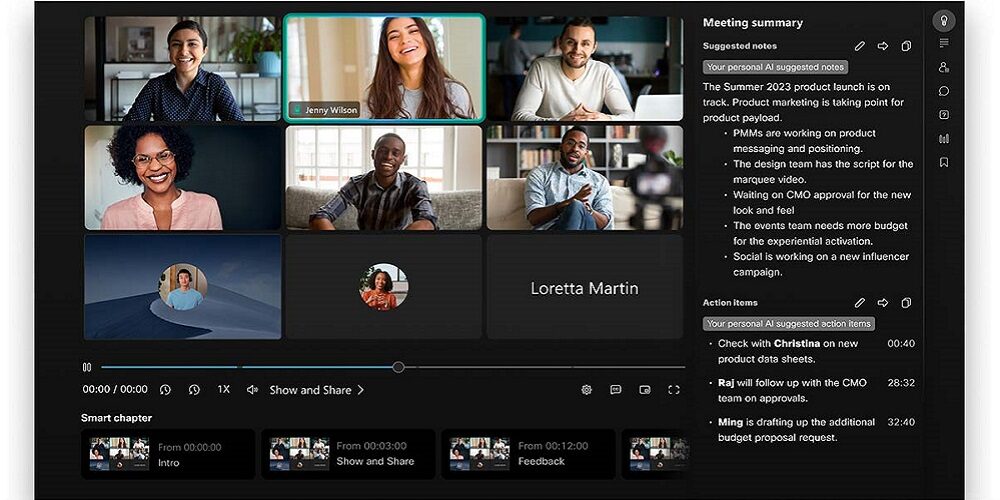

Dubai, UAE - At the WebexOne conference, Cisco unveiled its latest AI-powered innovations, including the Webex AI Agent, AI Agent Studio, and Cisco AI Assistant for Webex Contact Center. These AI solutions utilize advanced conversational intelligence and automation to provide efficient and effective customer interactions, ultimately boosting customer satisfaction and confidence. The newly launched Webex AI Agent acts as a self-service concierge, utilizing natural dialogue to quickly handle customer inquiries and eliminate wait times. Additionally, the AI Agent Studio simplifies and scales the contact center by allowing business users and IT administrators to easily train and deploy AI agents. Overall, these AI solutions will help to transform the customer experience and improve brand loyalty.

As the stock market continues to break records, Pepe Unchained is following suit with its highly successful token presale, raising $23 million and gaining unstoppable momentum. With new projects in the works, including an Ethereum Layer 2 chain and developer grant applications, Pepe Unchained is poised for even more growth in November. As former U.S. President Trump takes the lead over Vice President Harris in the polls, investors may find Pepe Unchained to be a promising investment opportunity.

Indian Air Force is set to enhance its defense capabilities as Prime Minister Narendra Modi inaugurated a new manufacturing plant for the C295 aircraft in Vadodara. The first private sector final assembly line for military aircraft in India, the plant is a result of the partnership between Airbus and Tata Advanced Systems Ltd (TASL). This development comes after India signed a deal with Airbus in September 2021 to procure 56 C295 aircraft, in an effort to replace the ageing Avro-748 planes. The first Made-in-India aircraft is scheduled to roll out in September 2026, with a total of 16 fly-away aircraft being delivered between September 2023 and August 2025.

Swiggy, one of India's top food and grocery delivery companies, is gearing up for its highly anticipated IPO, which is set to raise Rs 11,300 crore. Long-term investors, such as Accel, Elevation Capital, and Norwest Ventures, are expected to earn up to 35 times their initial investment on the shares being sold. The funds will be used to repay debt, expand their subsidiary Scootsy's dark store network, and invest in technology and marketing. This move will not only benefit shareholders but also pave the way for Swiggy's growth in the competitive Indian market.

In a joint effort to advance renewable energy development, HydroWing, a division of the Inyanga Marine Energy Group, has partnered with Indonesia's state-owned power company PLN to construct a 10MW tidal current power plant in East Nusa Tenggara. This marks the first project of its kind in Indonesia and highlights the country's potential in tidal energy. With both companies bringing their expertise to the table, this project will contribute to Indonesia's transition to Net Zero and provide affordable, 24/7 renewable energy.

Every Dhanteras, gold remains a popular choice for Indian investors, despite high prices. Leading banks offer secure options, with certified gold coins available through trusted channels. However, the high premium and limitations on resale may make alternative investments, such as gold ETFs, digital gold, and sovereign gold bonds, more appealing for savvy investors looking for liquidity and flexibility.