On December 9, 2024, the Reserve Bank of India (RBI) made a significant change to its leadership as it announced Sanjay Malhotra as the new governor. Known for his strong consensus-building skills, Malhotra's appointment has been well-received by experts. In the upcoming RBI policy meeting, Malhotra's plans for inflation and economic growth are highly anticipated. Even with elevated rates, Governor Das believes that they will not hinder economic growth. Experts believe that the latest RBI credit policy effectively balances the concerns of inflation and growth.

RBI Governor Appointment and Monetary Policy

Background

The Reserve Bank of India (RBI), India's central bank, is responsible for regulating the country's financial system and managing its monetary policy. The governor of the RBI plays a crucial role in shaping the economic policies of the nation.

Appointment of Sanjay Malhotra as RBI Governor

On December 9, 2024, the RBI announced the appointment of Sanjay Malhotra as its new governor. Malhotra, who was previously the deputy governor of the RBI, has a reputation for strong consensus-building skills. His appointment has been met with positive reactions from economic experts.

Upcoming RBI Policy Meeting

The RBI is scheduled to hold its next policy meeting in the near future. Market participants are keenly anticipating Malhotra's plans for inflation and economic growth in this meeting. Inflation has been a major concern in India, and the RBI has been raising interest rates to curb it. However, there is a delicate balance between controlling inflation and stimulating economic growth.

RBI's Current Stance on Interest Rates

Despite elevated interest rates, Governor Malhotra has indicated that he does not believe they will hinder economic growth. He believes that the RBI's latest credit policy effectively balances the concerns of inflation and growth.

Top 5 FAQs Related to RBI Governor and Monetary Policy

1. What is the role of the RBI governor? The RBI governor is responsible for overseeing the operations of the RBI and shaping India's monetary policy. They have a significant influence on the country's economic growth, inflation, and interest rates.

2. What are the challenges facing the RBI governor? Inflation, exchange rate fluctuations, and economic growth are among the key challenges facing the RBI governor. They must navigate these challenges while maintaining the stability of the financial system.

3. What is monetary policy? Monetary policy refers to the actions taken by the central bank to influence the money supply and interest rates in the economy. It plays a vital role in managing inflation, economic growth, and financial stability.

4. What are the tools of monetary policy? Common tools of monetary policy include open market operations, changes in reserve requirements, and changes in interest rates. These tools allow the central bank to influence the amount of money available in the economy.

5. How does monetary policy affect the economy? Monetary policy can impact inflation, interest rates, economic growth, and employment. By adjusting the money supply and interest rates, the central bank can influence the behavior of businesses and consumers, leading to changes in economic activity.

Shantanu Naidu, a close confidante and friend of the late Tata Group chief Ratan Tata, has now been promoted to General Manager and head of Strategic Initiatives at Tata Motors. Naidu, who previously worked as an executive at Tata Group, took to LinkedIn to announce the news and shared a heartfelt note, expressing his gratitude to his father and the company. Naidu's new role marks a full circle in his life, as his father used to work at Tata Motors and Naidu himself completed his graduation from Pune University in 2014.

Shantanu Naidu, an MBA graduate and longtime associate of Ratan Tata, has been appointed as the General Manager and Head of Strategic Initiatives at Tata Motors. Naidu, who shares a deep connection with the Tata Group, reflected on his father's past employment at Tata Motors and his own unexpected journey to working with the tycoon. Their bond goes beyond professional, as Tata named Naidu as his Executive Assistant and supported his NGO, Motopaws. Naidu's new role highlights the close relationship between the two and their shared commitment to socially impactful projects.

After its debut on the stock market, ITC Hotels' shares were removed from the benchmark Sensex and other BSE indices, causing a drop in its share price. The demerged entity of FMCG conglomerate ITC had seen a volatile start, with shares dropping for the fourth consecutive session. The demerger was part of a larger plan by ITC to allow its hotel business to focus on growth and maximize shareholder returns.

Allegion, a leading global security products and solutions company, announced its acquisition of Next Door, a privately held business, to strengthen its presence in the Americas. The acquisition includes Next Door's brands and assets, and will be overseen by Allegion's senior vice president Dave Ilardi. Next Door's owner, Justin Schechter, will join Allegion to assist in the transition and drive growth for both companies. The terms of the deal have not been disclosed.

Kalyan Jewellers, one of India's largest jewellers, reported a significant increase in consolidated net profit for the third quarter of the 2024-25 fiscal year due to strong sales. The company's stock saw a surge of nearly 13%, reaching Rs 496.80 on the BSE and Rs 496.85 on the NSE. With a 40% increase in total income and plans for expanding showrooms, Kalyan Jewellers is set to end the financial year on a high note.

Get ready to invest as two companies, Dr Agarwals Healthcare and Malpani Pipes and Fittings, are all set to launch their initial public offers this week worth a combined total of Rs 3,053 crore. Dr Agarwals Healthcare, a Chennai-based eye care specialist, will have an IPO worth Rs 3,027 crore, while Malpani Pipes and Fittings, which specializes in pipe fittings, will have an IPO worth Rs 25.9 crore. Both companies will open for bidding on January 29 and are expected to be listed on February 5.

The "Farting Unicorn by Elon Musk" project is gaining attention in the crypto world with its introduction of $FU, a meme coin on the Solana blockchain. The project seeks to build a playful and engaged community through social media platforms and future airdrops. By utilizing Solana's technology, $FU aims to provide an efficient and affordable experience for its users, while also leveraging the influence of Elon Musk. Stay tuned for more updates as the project evolves.

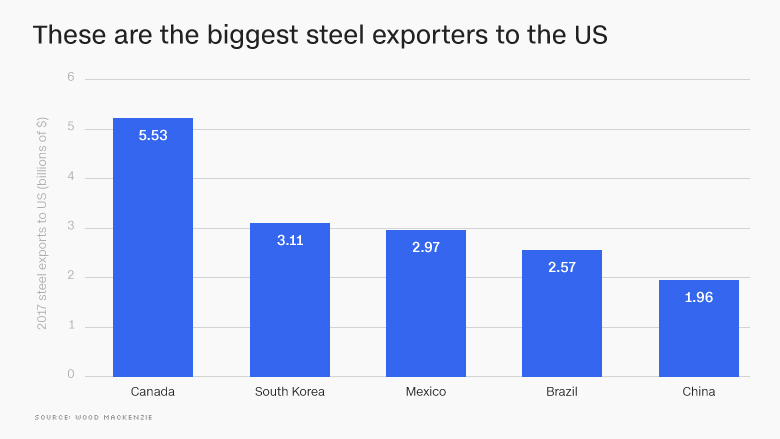

Canada has announced that it will challenge the new 25% tariffs imposed by US President Donald Trump through international legal channels. In response, Canada has also introduced its own tariffs on American products, affecting 17% of all US imports. The move is seen as a violation of trade agreements between the two countries and has raised concerns about the impact on global economic growth and inflation. Meanwhile, Nirmala Sitharaman has presented the second Budget for the BJP government, with a focus on reviving the Indian economy through healthcare, infrastructure, and privatization, though critics argue these measures should have been implemented earlier.

Samvardhana Motherson International has approved the sale of its joint venture company, Marelli Motherson Auto Suspension, to Gabriel India for Rs 60 crore. The joint venture, established in 2014 to manufacture suspension components for vehicles in India, will be transferred to Gabriel India along with fixed assets, inventory, and employees. The Indian auto component maker, which contributed 0.3% of Samvardhana Motherson's revenue in FY24, stated that the sale is aligned with their long-term strategy and will not affect their other businesses. The acquisition will expand Gabriel India's product portfolio and manufacturing capacity, positioning them for further growth in the market.

Mumbai's Ranji Trophy team receives a major boost as India T20 captain Suryakumar Yadav and all-rounder Shivam Dube make themselves available for the quarter-final against Haryana. Despite Yadav's series of low scores in the ongoing T20Is against England, his presence will greatly benefit the team. The MCA has confirmed that the two players have informed them of their availability and the selection committee will soon meet to pick the squad. Both players have been busy with national duty but have previously played for Mumbai in the Vijay Hazare Trophy and Syed Mushtaq Ali Trophy. The quarter-finals are set to begin on February 8.