Kalyan Jewellers, one of India's largest jewellers, reported a significant increase in consolidated net profit for the third quarter of the 2024-25 fiscal year due to strong sales. The company's stock saw a surge of nearly 13%, reaching Rs 496.80 on the BSE and Rs 496.85 on the NSE. With a 40% increase in total income and plans for expanding showrooms, Kalyan Jewellers is set to end the financial year on a high note.

Kalyan Jewellers Soars High: Strong Sales and Expansion Plans Drive Profit

Kalyan Jewellers, a prominent Indian jeweller, has reported a remarkable increase in its consolidated net profit for the third quarter of the 2024-25 fiscal year. This surge in profitability is attributed to a robust performance in sales.

Background

Kalyan Jewellers was founded in 1993 by T.S. Kalyanaraman. The company operates over 150 showrooms across India and has a global presence in the Middle East, Singapore, and the United States. Kalyan Jewellers is known for its wide range of gold, diamond, and gemstone jewellery, as well as its strong focus on customer service.

Key Highlights

Expansion Plans

Kalyan Jewellers is actively pursuing expansion plans to cater to its growing customer base. The company aims to add 50 new showrooms by the end of this fiscal year. These new locations will be strategically located in both metro and non-metro cities.

Top 5 FAQs and Answers

1. Why did Kalyan Jewellers' profit experience a significant increase? Answer: Strong sales, particularly during the festive season, contributed to the profit surge.

2. What is the current share price of Kalyan Jewellers? Answer: As of the latest market data, the share price is around Rs 496.80 on the BSE and Rs 496.85 on the NSE.

3. How many showrooms does Kalyan Jewellers operate? Answer: Over 150 showrooms across India and international locations.

4. What are the key expansion plans of Kalyan Jewellers? Answer: The company plans to open 50 new showrooms by the end of the fiscal year.

5. Is Kalyan Jewellers publicly traded? Answer: Yes, the company is listed on both the BSE and NSE.

Conclusion

Kalyan Jewellers' strong performance in the third quarter of FY2025 underscores the company's resilience and growth potential. With its ongoing expansion plans, Kalyan Jewellers is well-positioned to maintain its position as a leading jeweller in India and beyond. The company's commitment to customer satisfaction and its wide range of products continue to resonate with consumers, driving its continued success.

Allegion, a leading global security products and solutions company, announced its acquisition of Next Door, a privately held business, to strengthen its presence in the Americas. The acquisition includes Next Door's brands and assets, and will be overseen by Allegion's senior vice president Dave Ilardi. Next Door's owner, Justin Schechter, will join Allegion to assist in the transition and drive growth for both companies. The terms of the deal have not been disclosed.

Get ready to invest as two companies, Dr Agarwals Healthcare and Malpani Pipes and Fittings, are all set to launch their initial public offers this week worth a combined total of Rs 3,053 crore. Dr Agarwals Healthcare, a Chennai-based eye care specialist, will have an IPO worth Rs 3,027 crore, while Malpani Pipes and Fittings, which specializes in pipe fittings, will have an IPO worth Rs 25.9 crore. Both companies will open for bidding on January 29 and are expected to be listed on February 5.

The "Farting Unicorn by Elon Musk" project is gaining attention in the crypto world with its introduction of $FU, a meme coin on the Solana blockchain. The project seeks to build a playful and engaged community through social media platforms and future airdrops. By utilizing Solana's technology, $FU aims to provide an efficient and affordable experience for its users, while also leveraging the influence of Elon Musk. Stay tuned for more updates as the project evolves.

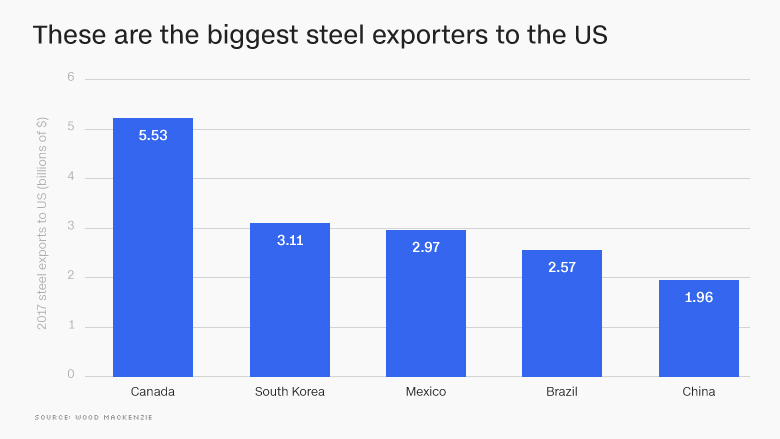

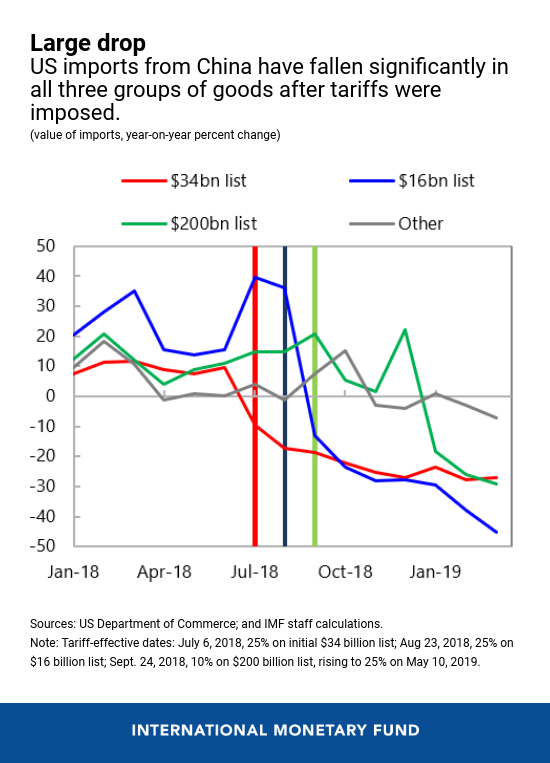

Canada has announced that it will challenge the new 25% tariffs imposed by US President Donald Trump through international legal channels. In response, Canada has also introduced its own tariffs on American products, affecting 17% of all US imports. The move is seen as a violation of trade agreements between the two countries and has raised concerns about the impact on global economic growth and inflation. Meanwhile, Nirmala Sitharaman has presented the second Budget for the BJP government, with a focus on reviving the Indian economy through healthcare, infrastructure, and privatization, though critics argue these measures should have been implemented earlier.

Samvardhana Motherson International has approved the sale of its joint venture company, Marelli Motherson Auto Suspension, to Gabriel India for Rs 60 crore. The joint venture, established in 2014 to manufacture suspension components for vehicles in India, will be transferred to Gabriel India along with fixed assets, inventory, and employees. The Indian auto component maker, which contributed 0.3% of Samvardhana Motherson's revenue in FY24, stated that the sale is aligned with their long-term strategy and will not affect their other businesses. The acquisition will expand Gabriel India's product portfolio and manufacturing capacity, positioning them for further growth in the market.

Mumbai's Ranji Trophy team receives a major boost as India T20 captain Suryakumar Yadav and all-rounder Shivam Dube make themselves available for the quarter-final against Haryana. Despite Yadav's series of low scores in the ongoing T20Is against England, his presence will greatly benefit the team. The MCA has confirmed that the two players have informed them of their availability and the selection committee will soon meet to pick the squad. Both players have been busy with national duty but have previously played for Mumbai in the Vijay Hazare Trophy and Syed Mushtaq Ali Trophy. The quarter-finals are set to begin on February 8.

US stocks took a hit on Friday as the White House announced tariffs on goods from Mexico, Canada, and China, reigniting fears of a trade war with the nation's closest trading partners. The S&P 500 and the Dow Jones Industrial Average both fell into the red, while the tech-heavy Nasdaq Composite reversed earlier gains. The news overshadowed positive updates earlier in the day from Apple's solid earnings and a matched inflation reading. The looming tariff deadline has sparked concerns about the impact on the US economy and uncertainty over potential inflamed inflation has put Federal Reserve Chair Jerome Powell in a wait-and-see position.

The benchmark indices in India, Sensex and Nifty, surged thanks to a strong performance by Vedanta, whose impressive Q3 results led to investor sentiment. However, the Economic Survey 2025 highlights potential risks to Indian markets, with high valuations and excessive optimism in the US stock market. All eyes are now on the upcoming Budget for further cues, as the Indian market is sensitive to fluctuations in the US market.

As part of the Budget for 2025-26, Finance Minister Nirmala Sitharaman announced that contributions of up to Rs 50,000 per year towards the NPS Vatsalya scheme, a children's welfare scheme, will be eligible for tax exemption. This move aims to make the scheme more appealing, with the tax benefits also available to regular NPS accounts. The number of enrolments in the scheme is expected to increase with this announcement, providing a secure and prosperous financial future for minors.