After its debut on the stock market, ITC Hotels' shares were removed from the benchmark Sensex and other BSE indices, causing a drop in its share price. The demerged entity of FMCG conglomerate ITC had seen a volatile start, with shares dropping for the fourth consecutive session. The demerger was part of a larger plan by ITC to allow its hotel business to focus on growth and maximize shareholder returns.

ITC Hotels Removed from BSE Indices: Background and Impact

In a recent development, ITC Hotels, the demerged entity of FMCG giant ITC, has been removed from the benchmark Sensex and other BSE indices. This move has been met with a downturn in the company's share price, which has dropped for the fourth consecutive session.

Background

ITC Hotels was created as a separate entity after a demerger from ITC in December 2022. The demerger was part of ITC's strategy to focus on its core businesses and unlock value for shareholders. ITC Hotels operates a portfolio of luxury, mid-market, and budget hotels under various brands across India.

Removal from BSE Indices

On September 20, 2023, BSE Limited announced the removal of ITC Hotels from its indices, effective September 21, 2023. The decision was made in accordance with the index construction and maintenance methodology.

The removal from the indices is attributed to the company's low free-float market capitalization. Free-float refers to the portion of a company's shares that are publicly traded and available for purchase. ITC Hotels has a relatively low free-float compared to other companies in the BSE indices.

Impact on Share Price

The news of the removal from the BSE indices has negatively impacted ITC Hotels' share price. The stock fell by nearly 5% on the day of the announcement and has continued to slide in subsequent trading sessions.

The removal from the indices means that investors who track these indices will no longer have exposure to ITC Hotels. This can lead to a decrease in demand for the company's shares, resulting in a lower share price.

FAQs

1. Why was ITC Hotels removed from the BSE indices? Answer: Due to its low free-float market capitalization, which is below the threshold requirement for inclusion in the indices.

2. What impact will this have on ITC Hotels' business? Answer: The removal from the indices may have a negative impact on the company's share price and could potentially reduce investor interest. However, it is unlikely to have a significant impact on ITC Hotels' core business operations.

3. What are the growth prospects for ITC Hotels? Answer: ITC Hotels has identified several growth areas, including the expansion of its luxury and mid-market portfolio, the development of new hotels in key destinations, and the enhancement of its customer experience.

4. How has ITC Hotels performed since the demerger? Answer: The company has reported a volatile trading performance since the demerger. Its share price has fluctuated significantly, and the company has faced challenges in improving profitability.

5. What is the future outlook for ITC Hotels? Answer: The company remains committed to its growth strategy and is focusing on strengthening its position in the hospitality industry. The long-term outlook for ITC Hotels will depend on various factors, including the overall economic environment, the competitive landscape, and the company's execution of its growth initiatives.

Shantanu Naidu, a close confidante and friend of the late Tata Group chief Ratan Tata, has now been promoted to General Manager and head of Strategic Initiatives at Tata Motors. Naidu, who previously worked as an executive at Tata Group, took to LinkedIn to announce the news and shared a heartfelt note, expressing his gratitude to his father and the company. Naidu's new role marks a full circle in his life, as his father used to work at Tata Motors and Naidu himself completed his graduation from Pune University in 2014.

Shantanu Naidu, an MBA graduate and longtime associate of Ratan Tata, has been appointed as the General Manager and Head of Strategic Initiatives at Tata Motors. Naidu, who shares a deep connection with the Tata Group, reflected on his father's past employment at Tata Motors and his own unexpected journey to working with the tycoon. Their bond goes beyond professional, as Tata named Naidu as his Executive Assistant and supported his NGO, Motopaws. Naidu's new role highlights the close relationship between the two and their shared commitment to socially impactful projects.

Allegion, a leading global security products and solutions company, announced its acquisition of Next Door, a privately held business, to strengthen its presence in the Americas. The acquisition includes Next Door's brands and assets, and will be overseen by Allegion's senior vice president Dave Ilardi. Next Door's owner, Justin Schechter, will join Allegion to assist in the transition and drive growth for both companies. The terms of the deal have not been disclosed.

Kalyan Jewellers, one of India's largest jewellers, reported a significant increase in consolidated net profit for the third quarter of the 2024-25 fiscal year due to strong sales. The company's stock saw a surge of nearly 13%, reaching Rs 496.80 on the BSE and Rs 496.85 on the NSE. With a 40% increase in total income and plans for expanding showrooms, Kalyan Jewellers is set to end the financial year on a high note.

Get ready to invest as two companies, Dr Agarwals Healthcare and Malpani Pipes and Fittings, are all set to launch their initial public offers this week worth a combined total of Rs 3,053 crore. Dr Agarwals Healthcare, a Chennai-based eye care specialist, will have an IPO worth Rs 3,027 crore, while Malpani Pipes and Fittings, which specializes in pipe fittings, will have an IPO worth Rs 25.9 crore. Both companies will open for bidding on January 29 and are expected to be listed on February 5.

The "Farting Unicorn by Elon Musk" project is gaining attention in the crypto world with its introduction of $FU, a meme coin on the Solana blockchain. The project seeks to build a playful and engaged community through social media platforms and future airdrops. By utilizing Solana's technology, $FU aims to provide an efficient and affordable experience for its users, while also leveraging the influence of Elon Musk. Stay tuned for more updates as the project evolves.

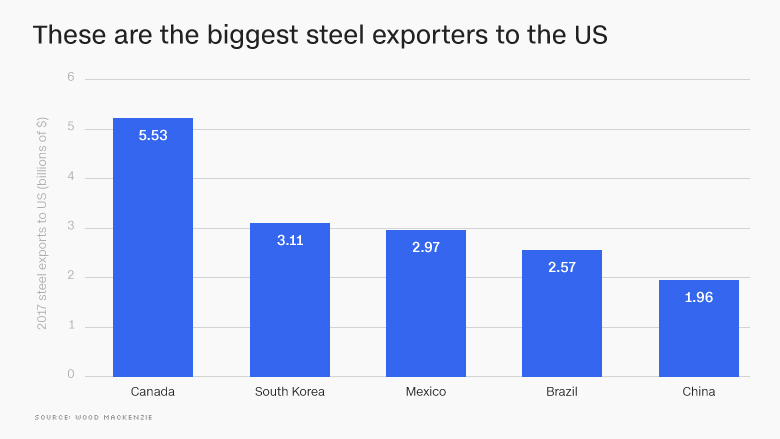

Canada has announced that it will challenge the new 25% tariffs imposed by US President Donald Trump through international legal channels. In response, Canada has also introduced its own tariffs on American products, affecting 17% of all US imports. The move is seen as a violation of trade agreements between the two countries and has raised concerns about the impact on global economic growth and inflation. Meanwhile, Nirmala Sitharaman has presented the second Budget for the BJP government, with a focus on reviving the Indian economy through healthcare, infrastructure, and privatization, though critics argue these measures should have been implemented earlier.

Samvardhana Motherson International has approved the sale of its joint venture company, Marelli Motherson Auto Suspension, to Gabriel India for Rs 60 crore. The joint venture, established in 2014 to manufacture suspension components for vehicles in India, will be transferred to Gabriel India along with fixed assets, inventory, and employees. The Indian auto component maker, which contributed 0.3% of Samvardhana Motherson's revenue in FY24, stated that the sale is aligned with their long-term strategy and will not affect their other businesses. The acquisition will expand Gabriel India's product portfolio and manufacturing capacity, positioning them for further growth in the market.

Mumbai's Ranji Trophy team receives a major boost as India T20 captain Suryakumar Yadav and all-rounder Shivam Dube make themselves available for the quarter-final against Haryana. Despite Yadav's series of low scores in the ongoing T20Is against England, his presence will greatly benefit the team. The MCA has confirmed that the two players have informed them of their availability and the selection committee will soon meet to pick the squad. Both players have been busy with national duty but have previously played for Mumbai in the Vijay Hazare Trophy and Syed Mushtaq Ali Trophy. The quarter-finals are set to begin on February 8.