After months of anticipation, the Revo Casino and Social House is finally set to open its doors in Conway. While owner Dick Anagnost initially announced a February 1 opening, a new statement from a spokesperson has revealed that the launch date has been moved up to January 29. The highly-anticipated casino is expected to become a major hotspot for entertainment and socializing in the area.

Revo Casino and Social House to Open in Conway on January 29

Conway, a city in South Carolina, is getting ready to welcome a new entertainment and social hub. The Revo Casino and Social House is finally set to open its doors on January 29, much to the excitement of residents and visitors alike.

Background

The project was initially announced in 2019 and was originally scheduled to open in February 2023. However, construction delays and other factors pushed back the opening date. The casino is owned by Dick Anagnost, a local businessman with experience in the entertainment industry.

Features

The Revo Casino and Social House will offer a wide range of entertainment options, including:

The casino will also feature a social club with a variety of amenities, such as:

Economic Impact

The Revo Casino and Social House is expected to have a significant economic impact on Conway. The project created hundreds of construction jobs and is expected to create over 200 permanent jobs once it opens. It is also expected to attract visitors to Conway, boosting the local economy.

FAQs

1. What is the address of the Revo Casino and Social House?

The Revo Casino and Social House is located at 1911 Church Street, Conway, SC 29526.

2. What are the hours of operation for the casino?

The casino will be open 24 hours a day, 7 days a week.

3. What is the dress code for the casino?

The dress code is casual. However, guests are asked to avoid wearing athletic shoes or clothing with offensive language.

4. Is there a smoking area in the casino?

There is a designated smoking area outside the casino.

5. Can I bring my children to the casino?

Minors are not permitted in the casino or social club.

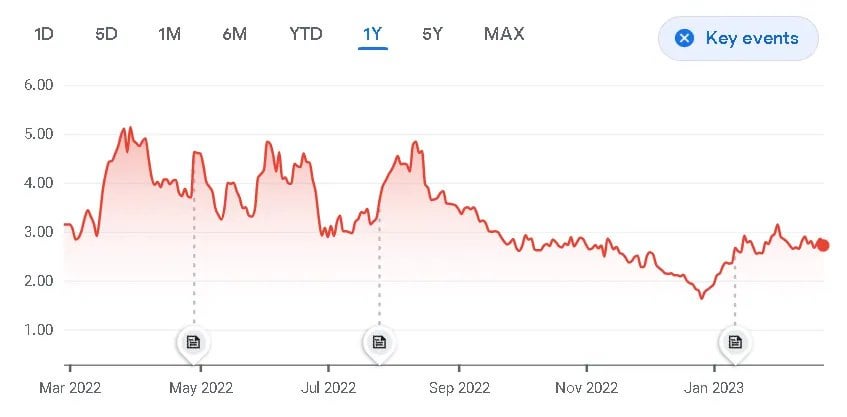

India's Central Depository Services Ltd. (CDSL) witnessed a sharp decline in its share price, following a notable decline in total income and net profit for the December quarter. Despite opening a significant number of new demat accounts, the company's demat custody also saw a decline from the previous quarter. This marks a significant setback for the company, as it reported a significant drop in its EBITDA and net profit. However, CDSL did achieve a milestone by registering over 14.65 crore demat accounts, making it the first depository to do so.

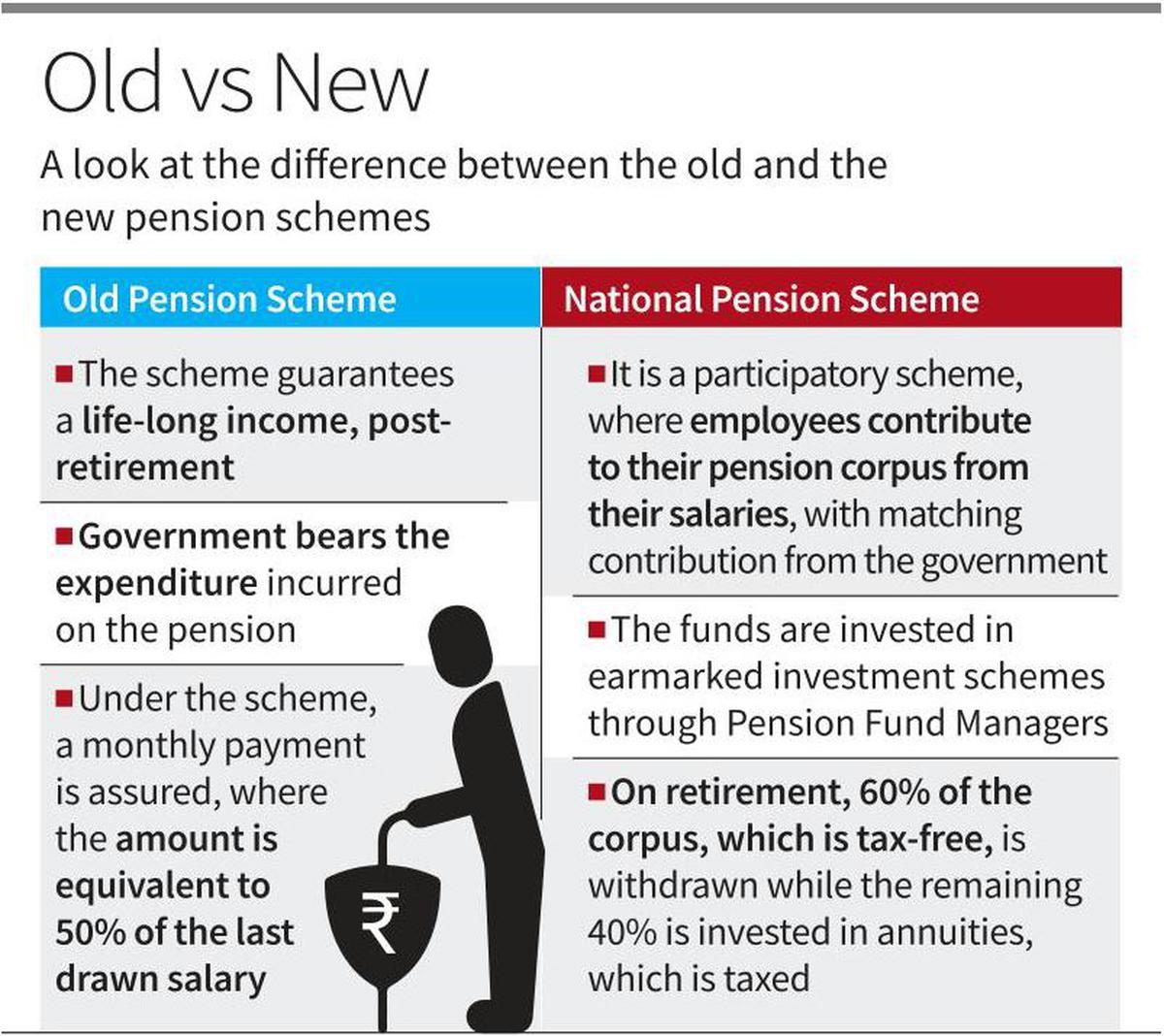

The Indian government recently introduced the Unified Pension Scheme (UPS), which combines features from the National Pension System (NPS) and the old pension scheme. Set to be implemented by April, the UPS aims to bridge key gaps in retirement planning for government employees. This move has the potential to significantly impact the financial future of a significant portion of India's workforce.

Jupiter, the leading decentralized exchange on Solana, has begun its Jupuary airdrop, making over 2 million wallets eligible to claim 700 million JUP tokens. This airdrop, one of the largest in recent times, aims to boost community engagement and onboard users. Despite some initial challenges with high demand, the airdrop has already caused JUP's trading volume to surge by over 100%. Additionally, JUP has caught the attention of institutional investors, with its recent addition to Grayscale's list of potential investment assets for 2024.

The Indian finance ministry has announced the implementation of the Unified Pension Scheme (UPS) for central government employees starting from April 2025. Under this scheme, employees who opt for it will receive a pension equivalent to 50 per cent of their average basic pay drawn in the 12 months before retirement, provided they complete 25 years of service. The scheme aims to provide guaranteed retirement benefits to nearly 2.3 million central government employees, as approved by the Union Cabinet last year.

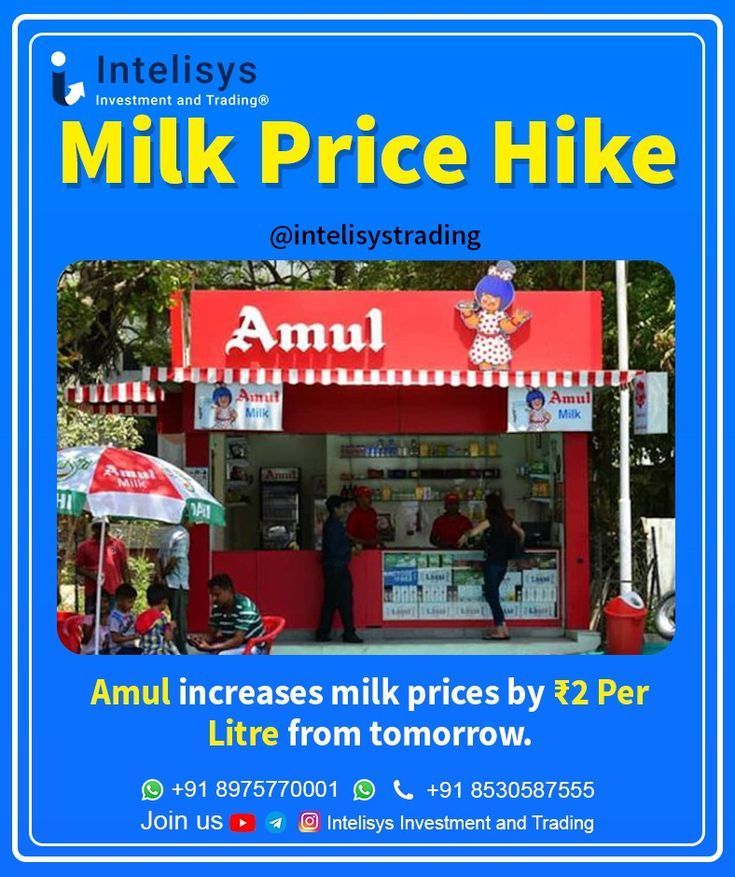

In a move to boost sales and accommodate excess milk supply, Amul has decided to reduce the prices of its top products, such as Amul Gold, Amul Taaza, and Amul Tea Special, by Re 1 per litre across India. This price cut is expected to drive demand for larger pack sizes while maintaining Amul's competitive edge in the dairy industry. However, no changes have been made to the prices of other products and packages.

With the constant stream of information on social media, Twitter stands out as a valuable source for breaking news, alerts, and tips for making trading decisions. However, with millions of feeds constantly updating, it can be overwhelming to find useful posts. That's why some money managers use social media dashboard apps to filter their results. For individual investors looking to stay on top of the latest financial news, consider following these 10 feeds, including well-known outlets like CNBC and The Wall Street Journal, as well as lesser-known sources like Stocktwits and @BreakoutStocks.

In recent months, Archer Aviation Inc (ACHR) has seen a significant increase in stock price, gaining over 116% in the past six months and 223% in the last three months. Despite this volatility, the company boasts a gross margin of 116.89% and a strong profit margin, making it an attractive investment for many. However, with market capitalization at $4.21 billion and a Price-to-Book Ratio of 8.98, investors may want to approach with caution. Additionally, insider trades by top executives, including a recent sale of 191,513 shares by Director Michael Spellacy, may also impact the stock's performance. With industry experts like JP Morgan placing a Neutral rating on the company, investors should closely monitor Archer Aviation Inc (ACHR) stock for potential fluctuations.

Despite entering a new year, MicroStrategy, led by CEO Michael Saylor, continues its acquisition strategy for Bitcoin as it buys another $101 million worth of the cryptocurrency. This brings their total holdings to an impressive 447,470 BTC. The company recently sold off shares to finance the purchase, but still has plans to acquire more BTC in the future. The firm's recent purchase is part of their 21/21 plan, which includes equity and fixed-income securities capital raise to fund further BTC purchases.

Inspired by a private bus on the Kasaragod-Bantadukka route, KSRTC is considering converting its old superfast buses to air-conditioned ones. This initiative comes as a response to the growing demand for AC premium buses. Technical experts have been appointed to study the feasibility, with the aim to reduce the cost of conversion to ₹4 lakh per bus. The private company's innovative mechanism, which uses a dynamo to generate electricity, is expected to improve fuel efficiency.