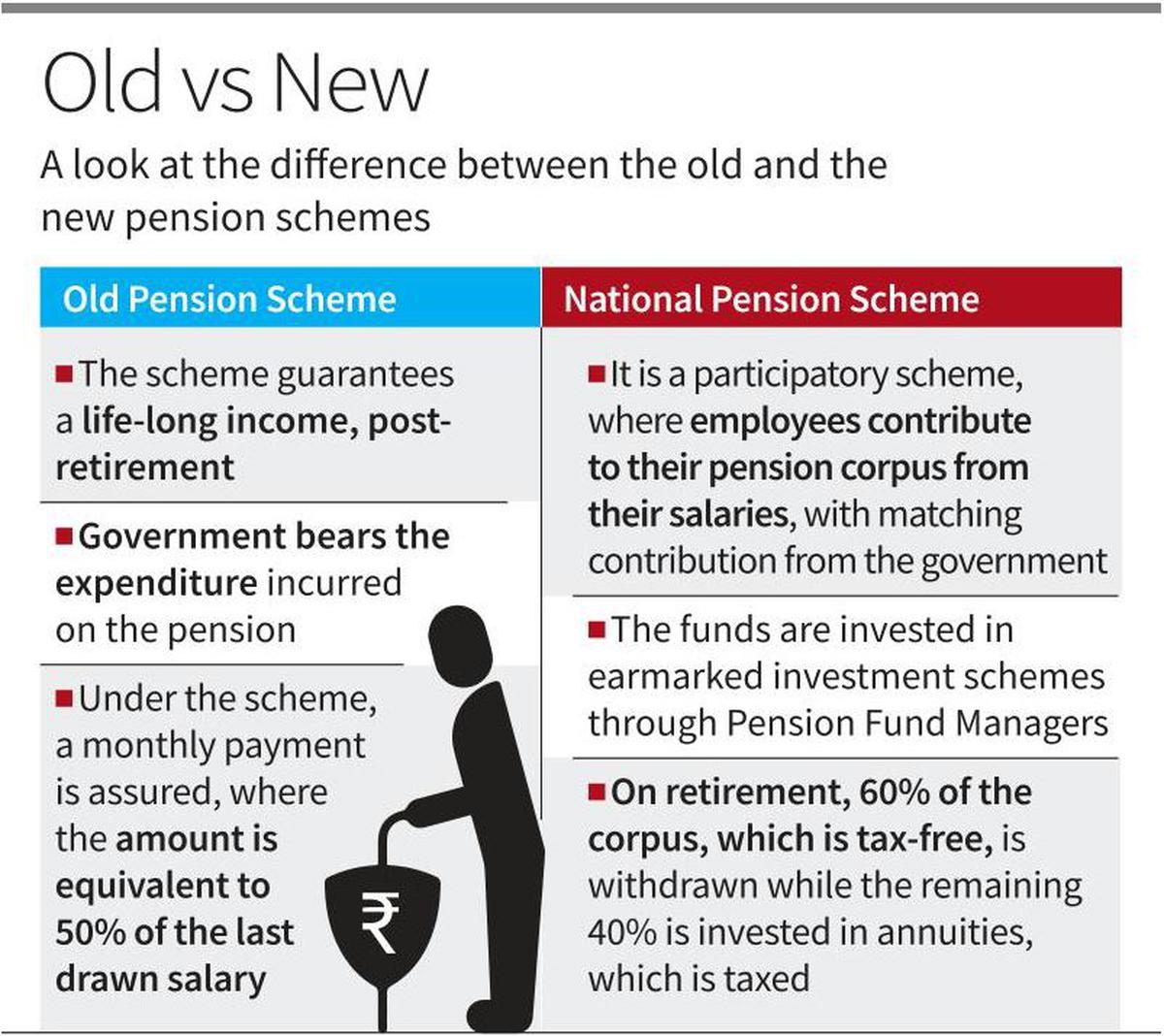

The Indian government recently introduced the Unified Pension Scheme (UPS), which combines features from the National Pension System (NPS) and the old pension scheme. Set to be implemented by April, the UPS aims to bridge key gaps in retirement planning for government employees. This move has the potential to significantly impact the financial future of a significant portion of India's workforce.

Background on the Unified Pension Scheme (UPS)

The Unified Pension Scheme (UPS) is a comprehensive pension plan introduced by the Indian government to address the retirement needs of government employees. The scheme is designed to replace multiple existing pension systems and provide a uniform and sustainable pension structure. The UPS was announced in the Union Budget 2023-24 and is expected to be implemented by April 2023.

The UPS combines features from the National Pension System (NPS) and the old pension scheme. The NPS is a defined contribution scheme where employees contribute a portion of their salary to a pension fund. The old pension scheme is a defined benefit scheme where employees receive a fixed pension based on their years of service and last drawn salary.

Key Features of the UPS

The key features of the Unified Pension Scheme include:

Benefits of the UPS

The UPS is expected to provide several benefits to government employees, including:

Top 5 FAQs on the UPS

1. When will the UPS be implemented?

The UPS is expected to be implemented by April 2023.

2. Who will be eligible for the UPS?

All new government employees joining on or after April 2023 will be eligible for the UPS.

3. How much will employees contribute to the UPS?

Employees will contribute 10% of their basic salary (excluding dearness allowance) to the pension fund.

4. How will the pension fund be invested?

The pension fund will be invested in a mix of equity and debt instruments. Employees will have the option to choose from different investment strategies based on their risk appetite.

5. What are the retirement benefits under the UPS?

At retirement, employees will receive a lump sum and a monthly pension. The lump sum will be equal to 60% of the accumulated pension fund, while the monthly pension will be 40% of the fund.

After months of anticipation, the Revo Casino and Social House is finally set to open its doors in Conway. While owner Dick Anagnost initially announced a February 1 opening, a new statement from a spokesperson has revealed that the launch date has been moved up to January 29. The highly-anticipated casino is expected to become a major hotspot for entertainment and socializing in the area.

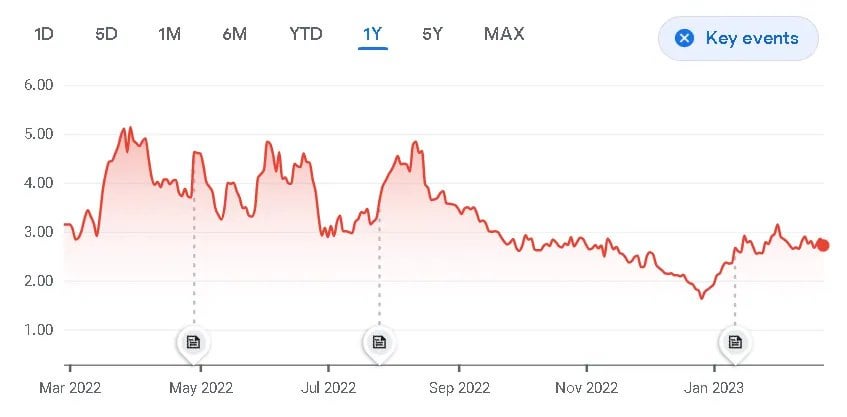

Jupiter, the leading decentralized exchange on Solana, has begun its Jupuary airdrop, making over 2 million wallets eligible to claim 700 million JUP tokens. This airdrop, one of the largest in recent times, aims to boost community engagement and onboard users. Despite some initial challenges with high demand, the airdrop has already caused JUP's trading volume to surge by over 100%. Additionally, JUP has caught the attention of institutional investors, with its recent addition to Grayscale's list of potential investment assets for 2024.

The Indian finance ministry has announced the implementation of the Unified Pension Scheme (UPS) for central government employees starting from April 2025. Under this scheme, employees who opt for it will receive a pension equivalent to 50 per cent of their average basic pay drawn in the 12 months before retirement, provided they complete 25 years of service. The scheme aims to provide guaranteed retirement benefits to nearly 2.3 million central government employees, as approved by the Union Cabinet last year.

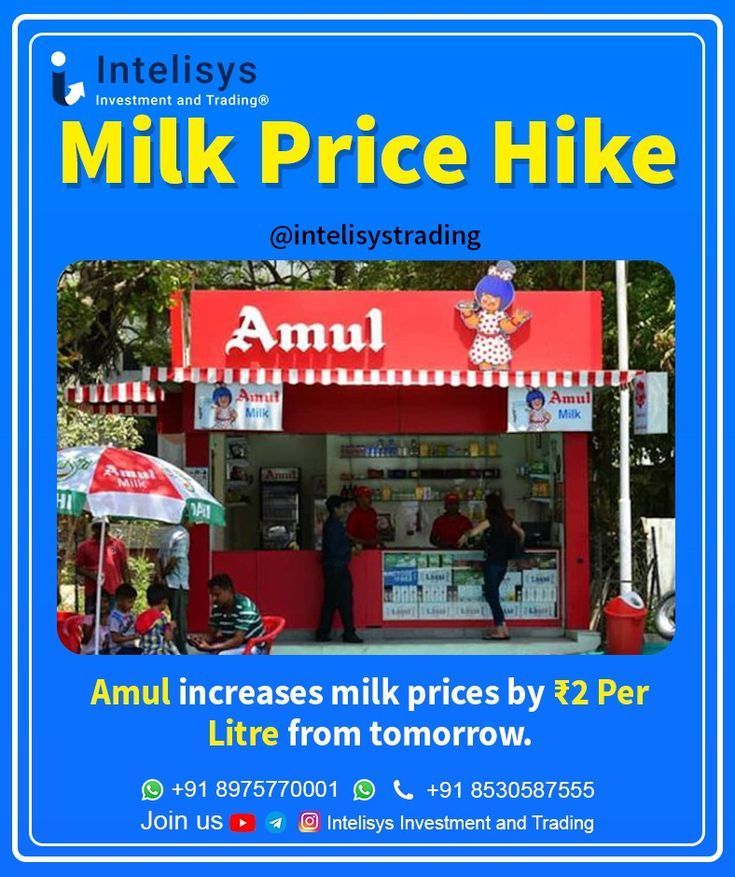

In a move to boost sales and accommodate excess milk supply, Amul has decided to reduce the prices of its top products, such as Amul Gold, Amul Taaza, and Amul Tea Special, by Re 1 per litre across India. This price cut is expected to drive demand for larger pack sizes while maintaining Amul's competitive edge in the dairy industry. However, no changes have been made to the prices of other products and packages.

With the constant stream of information on social media, Twitter stands out as a valuable source for breaking news, alerts, and tips for making trading decisions. However, with millions of feeds constantly updating, it can be overwhelming to find useful posts. That's why some money managers use social media dashboard apps to filter their results. For individual investors looking to stay on top of the latest financial news, consider following these 10 feeds, including well-known outlets like CNBC and The Wall Street Journal, as well as lesser-known sources like Stocktwits and @BreakoutStocks.

In recent months, Archer Aviation Inc (ACHR) has seen a significant increase in stock price, gaining over 116% in the past six months and 223% in the last three months. Despite this volatility, the company boasts a gross margin of 116.89% and a strong profit margin, making it an attractive investment for many. However, with market capitalization at $4.21 billion and a Price-to-Book Ratio of 8.98, investors may want to approach with caution. Additionally, insider trades by top executives, including a recent sale of 191,513 shares by Director Michael Spellacy, may also impact the stock's performance. With industry experts like JP Morgan placing a Neutral rating on the company, investors should closely monitor Archer Aviation Inc (ACHR) stock for potential fluctuations.

Despite entering a new year, MicroStrategy, led by CEO Michael Saylor, continues its acquisition strategy for Bitcoin as it buys another $101 million worth of the cryptocurrency. This brings their total holdings to an impressive 447,470 BTC. The company recently sold off shares to finance the purchase, but still has plans to acquire more BTC in the future. The firm's recent purchase is part of their 21/21 plan, which includes equity and fixed-income securities capital raise to fund further BTC purchases.

Inspired by a private bus on the Kasaragod-Bantadukka route, KSRTC is considering converting its old superfast buses to air-conditioned ones. This initiative comes as a response to the growing demand for AC premium buses. Technical experts have been appointed to study the feasibility, with the aim to reduce the cost of conversion to ₹4 lakh per bus. The private company's innovative mechanism, which uses a dynamo to generate electricity, is expected to improve fuel efficiency.

Volvo's highly anticipated EX30 electric SUV, originally promised at an affordable price, will now have a higher price tag due to production delays and potential tariffs. The car's compact design and competitive pricing made it a success in Europe, and Volvo is hoping for a similar reception in the US market. Despite the price increase, the EX30 is still set to feature a powerful 422 horsepower engine, making it a strong contender in the EV market.