In a much-awaited move, the RBI announced a 25 basis point (0.25%) cut in the repo rate, taking it down to 6.25%. This decision comes in light of the recent budget announcement which introduced tax relief for individuals earning over ₹24 lakh annually. The rate cut is expected to make home loans more affordable, with potential savings of up to ₹22,000 per month for individuals with a salary of ₹25 lakh and a home loan of ₹50 lakh. This, coupled with the income tax slab changes, means a substantial boost for the middle class in the upcoming financial year.

Background

The repo rate is the interest rate at which the central bank of a country lends money to commercial banks. In India, the Reserve Bank of India (RBI) sets the repo rate. When the RBI raises the repo rate, it becomes more expensive for banks to borrow money from the central bank. This, in turn, leads to higher interest rates on loans for businesses and individuals. Conversely, when the RBI lowers the repo rate, it becomes cheaper for banks to borrow money, leading to lower interest rates on loans.

Recent Developments

On February 8, 2023, the RBI announced a 25 basis point (0.25%) cut in the repo rate, bringing it down to 6.25%. This decision was taken in light of the recent budget announcement which introduced tax relief for individuals earning over ₹24 lakh annually.

Impact of the Repo Rate Cut

The repo rate cut is expected to have a positive impact on the economy in several ways:

Top 5 FAQs

1. What is the difference between the repo rate and the reverse repo rate? The repo rate is the interest rate at which the RBI lends money to commercial banks. The reverse repo rate is the interest rate at which the RBI borrows money from commercial banks.

2. Why does the RBI change the repo rate? The RBI changes the repo rate to manage inflation and to achieve its monetary policy objectives. If inflation is too high, the RBI will raise the repo rate to cool down the economy. If inflation is too low, the RBI will cut the repo rate to stimulate the economy.

3. What is the impact of a repo rate cut on inflation? A repo rate cut can lead to lower inflation in the long run. By making it cheaper for businesses to borrow money, a repo rate cut can stimulate investment and economic growth. This can lead to increased supply of goods and services, which can help to reduce inflation.

4. What is the impact of a repo rate cut on the stock market? A repo rate cut can have a positive impact on the stock market. When interest rates are lower, it is cheaper for companies to raise money through the issuance of bonds. This can lead to higher stock prices, as investors are willing to pay more for companies that can borrow money cheaply.

5. What are the risks of cutting the repo rate? Cutting the repo rate too quickly or too much can lead to inflation and asset bubbles. If the RBI cuts the repo rate too quickly, it can lead to excessive demand for goods and services, which can drive up prices. If the RBI cuts the repo rate too much, it can lead to asset bubbles, such as a housing bubble or a stock market bubble.

In a move to further establish itself in the market, food delivery company Zomato Limited has officially changed its name to Eternal Limited. Despite the name change, the brand will still be known as Zomato. The decision to change the name came after the company's acquisition of Blinkit and its increasing significance in the company's future plans. The successful listing of Zomato on the stock market in 2021 and its inclusion in the BSE Sensex in 2024 solidifies its position in the industry.

The Fortis Hospital Bannerghatta Road in Bengaluru launched the Fortis Stride Support Group, a unique initiative focused on joint health and recovery under the guidance of Dr. Narayan Hulse, the Principal Director of Orthopedics. The support group aims to connect patients, caregivers, and healthcare professionals in a supportive and informative environment to share experiences, gain expert insights, and access valuable guidance for improved recovery. The inaugural event saw impressive participation, with inspiring patient stories, informative presentations, and discussions about effective strategies for recovery. Minister Ramalinga Reddy and Dr. V V Chiniwalar, a senior surgeon and President of IMA-Karnataka, shared their personal experiences with robotic knee replacement surgery and how it has positively impacted their lives. The Fortis Hospital team is committed to providing ongoing support and empowering individuals on their journey towards a stronger and more active future.

Start managing your budget like a pro using Excel as your ultimate tool. From creating a customizable template to utilizing Excel's formulas and functions for accurate calculations, this article offers essential tips on tracking your income and expenses. Learn how to categorize and set budget goals, and visualize your financial habits with dynamic charts and graphs. Get ahead of your finances with Excel.

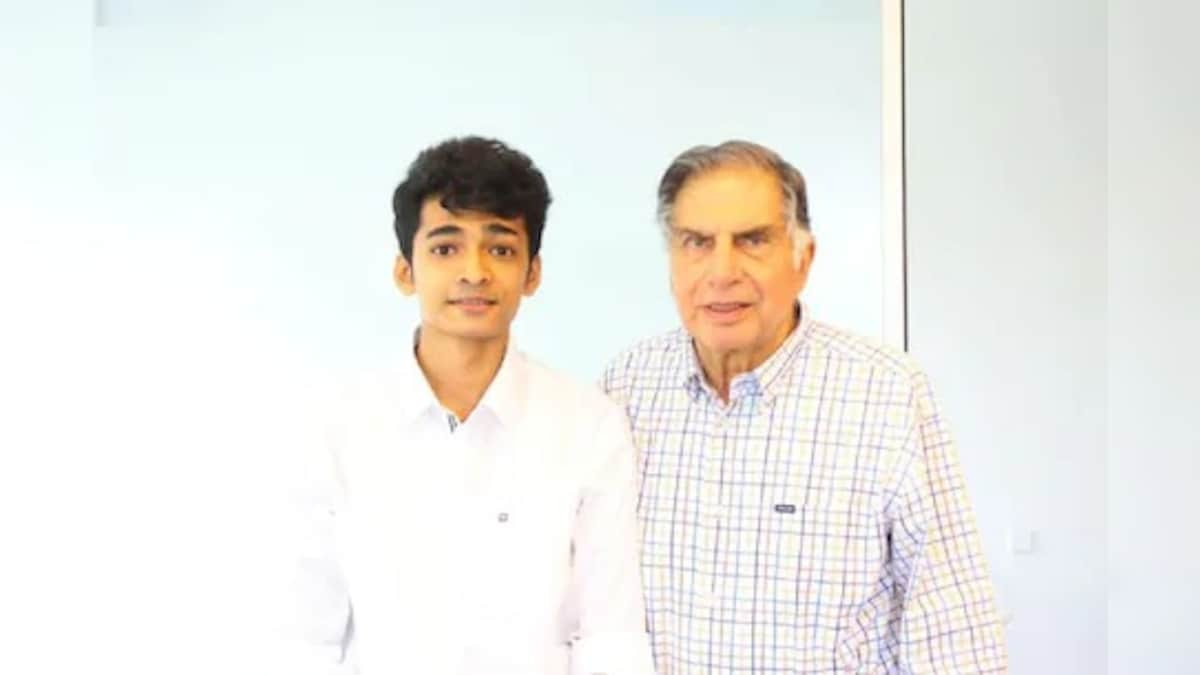

Shantanu Naidu, a close confidante and friend of the late Tata Group chief Ratan Tata, has now been promoted to General Manager and head of Strategic Initiatives at Tata Motors. Naidu, who previously worked as an executive at Tata Group, took to LinkedIn to announce the news and shared a heartfelt note, expressing his gratitude to his father and the company. Naidu's new role marks a full circle in his life, as his father used to work at Tata Motors and Naidu himself completed his graduation from Pune University in 2014.

Shantanu Naidu, an MBA graduate and longtime associate of Ratan Tata, has been appointed as the General Manager and Head of Strategic Initiatives at Tata Motors. Naidu, who shares a deep connection with the Tata Group, reflected on his father's past employment at Tata Motors and his own unexpected journey to working with the tycoon. Their bond goes beyond professional, as Tata named Naidu as his Executive Assistant and supported his NGO, Motopaws. Naidu's new role highlights the close relationship between the two and their shared commitment to socially impactful projects.

After its debut on the stock market, ITC Hotels' shares were removed from the benchmark Sensex and other BSE indices, causing a drop in its share price. The demerged entity of FMCG conglomerate ITC had seen a volatile start, with shares dropping for the fourth consecutive session. The demerger was part of a larger plan by ITC to allow its hotel business to focus on growth and maximize shareholder returns.

Allegion, a leading global security products and solutions company, announced its acquisition of Next Door, a privately held business, to strengthen its presence in the Americas. The acquisition includes Next Door's brands and assets, and will be overseen by Allegion's senior vice president Dave Ilardi. Next Door's owner, Justin Schechter, will join Allegion to assist in the transition and drive growth for both companies. The terms of the deal have not been disclosed.

Kalyan Jewellers, one of India's largest jewellers, reported a significant increase in consolidated net profit for the third quarter of the 2024-25 fiscal year due to strong sales. The company's stock saw a surge of nearly 13%, reaching Rs 496.80 on the BSE and Rs 496.85 on the NSE. With a 40% increase in total income and plans for expanding showrooms, Kalyan Jewellers is set to end the financial year on a high note.

Get ready to invest as two companies, Dr Agarwals Healthcare and Malpani Pipes and Fittings, are all set to launch their initial public offers this week worth a combined total of Rs 3,053 crore. Dr Agarwals Healthcare, a Chennai-based eye care specialist, will have an IPO worth Rs 3,027 crore, while Malpani Pipes and Fittings, which specializes in pipe fittings, will have an IPO worth Rs 25.9 crore. Both companies will open for bidding on January 29 and are expected to be listed on February 5.