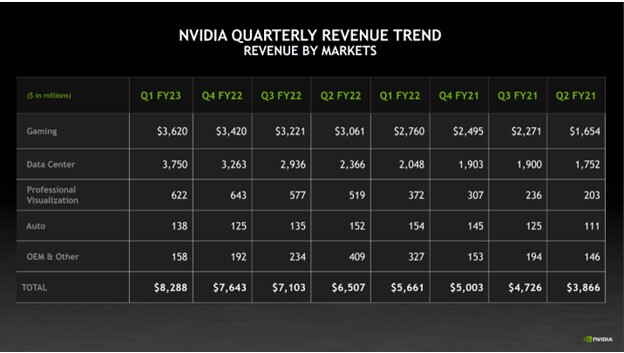

According to an analyst firm, Nvidia has reached a record market share of 88% in Q1 2024, mainly at AMD’s expense. This could put pressure on AMD to make their upcoming RDNA 4 cards more appealing to consumers. However, some argue that the current market situation may not necessarily result in lower prices for consumers.

Nvidia's Dominance in the GPU Market: 88% Market Share and Potential Impact

Background:

Nvidia has been a leader in the graphics processing unit (GPU) market for years, powering everything from gaming PCs to artificial intelligence applications. AMD, on the other hand, has consistently been its closest competitor. In the past, AMD has often offered more affordable options, challenging Nvidia's market dominance.

Current Market Situation:

As of Q1 2024, Nvidia has reached a record-breaking market share of 88%, according to an analyst firm. This significant increase has come primarily at the expense of AMD, which has seen its share of the market decline. Several factors have contributed to Nvidia's dominance:

Potential Impact:

Nvidia's dominance could have several implications:

FAQs:

1. What is the main reason for Nvidia's market share increase? A: Strong demand for gaming GPUs and growth in AI applications, coupled with AMD's production challenges.

2. What does this mean for consumers? A: It could potentially lead to higher GPU prices, but also increased innovation if AMD responds with more competitive products.

3. How has AMD responded to Nvidia's dominance? A: AMD has announced its upcoming RDNA 4 architecture, which is expected to offer improved performance and efficiency.

4. What were the market share trends before Q1 2024? A: Nvidia had consistently held a strong market share, but AMD had been gaining ground in recent years.

5. What other players are there in the GPU market besides Nvidia and AMD? A: There are smaller players such as Intel and Qualcomm, but they currently have a limited market share compared to the two giants.

Ajax Engineering, a Bengaluru-based company that specializes in manufacturing concrete equipment, is starting the bidding process for its Rs 1,269.35 crore IPO today. The company has seen strong demand in the grey market and raised Rs 379.31 crore from anchor investors. It has a wide distribution network in India and abroad with continued growth and profitability. Investors should keep a close eye on this IPO and its potential for listing gains.

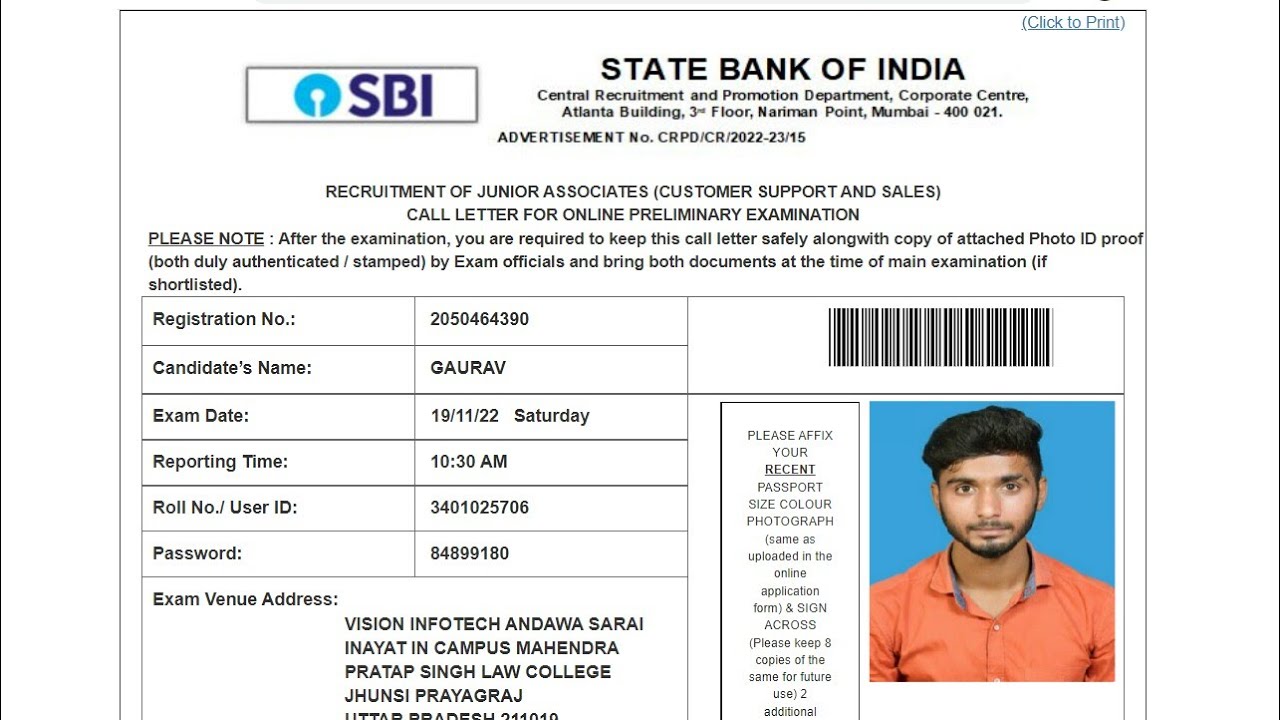

The State Bank of India is set to release the SBI Clerk Prelims Admit Card 2025 on 10 February along with the exam date for the 14,191 vacancies of Junior Associate (Clerk). Candidates can download their admit card from the official website, sbi.co.in, using their registration number and DOB/password. Make sure to have all necessary documents ready and follow the steps provided to ensure a smooth exam experience.

The State Bank of India has released the admit card for the first phase of the SBI Clerk recruitment exam. The exam is scheduled for February and March of 2025 and will have negative marking for wrong answers. This recruitment is for 13,735 positions for Junior Associates and candidates are advised to prepare well and download their admit cards in advance. The story also includes a mention of a woman who left her MNC job to become an IPS officer and encourages readers to check out the publication's editorial guidelines and standards.

The Board of Control for Cricket in India (BCCI) has recently released copyright regulations for the year 2025, outlining the organization's terms and policies for content usage. In a move to protect their intellectual property, BCCI has set strict guidelines and penalties for unauthorized use of their materials. These regulations cover various aspects such as copyrights, terms and conditions, privacy policies, and more, aiming to safeguard BCCI's rights and interest. As the cricket world gears up for future tournaments, these regulations may have a significant impact on the use and distribution of BCCI's content by individuals and organizations.

A recent study by the Research Institute of Economy, Trade and Industry sheds light on the burden of inflation tax and its effect on intergenerational imbalances. Contrary to previous studies, this research found that inflation or deflation can greatly impact the burden faced by both current and future generations. Additionally, the study suggests that implementing economic growth strategies alone will not be enough to eliminate these imbalances, and calls for concurrent reform in public finance and social security systems. These findings have significant implications for policy makers and economists.

The wait is almost over as Finance Minister Nirmala Sitharaman gets ready to present the Union Budget at 11 am today. This highly anticipated event will see several major announcements that are expected to have a significant impact on the country's economy. To fully grasp the details of the budget, it is important to understand key terms such as GDP, nominal GDP, real GDP, and capital receipts. These terms include important aspects such as economic growth, inflation, and the government's borrowing requirements, which can help individuals make sense of the budget speech. So, let's delve into the world of economics and get ready for the Union Budget 2025.

On this Chocolate Day 2025, let's celebrate love and sweetness with delicious delicacies in hand. As part of Valentine's Week, February 9 marks the day of honoring the beloved chocolate delicacies that have been bringing delight and affection to couples for generations. And as the "month of love" is believed to have been chosen as the date for Chocolate Day, it's the perfect opportunity to express admiration and gratitude to loved ones with these warm wishes and greetings.

Indian-origin entrepreneur Vivek Ramaswamy denied any rift with Elon Musk and instead praised the Tesla CEO's leadership of DOGE. Ramaswamy also hinted at a potential bid for Ohio governor, citing the area's potential for economic growth in the future. He emphasized the need for both technology and government to work together in reviving the country, stating that he and Musk had complementary approaches in their work on DOGE.

In its final monetary policy meeting of the fiscal year 2025, the Reserve Bank of India has announced a 25 basis point reduction in the repo rate, marking the country's first rate cut in nearly five years. Along with the rate cut, the SDF and MSF have also been reduced, and the bank rate has been brought down to 6.5%. RBI Governor Sanjay Malhotra has projected India's GDP growth for the next fiscal year and maintained the inflation target, while industry leaders in the fintech sector have praised the central bank's focus on strengthening digital security and enhancing user protection.

In a much-awaited move, the RBI announced a 25 basis point (0.25%) cut in the repo rate, taking it down to 6.25%. This decision comes in light of the recent budget announcement which introduced tax relief for individuals earning over ₹24 lakh annually. The rate cut is expected to make home loans more affordable, with potential savings of up to ₹22,000 per month for individuals with a salary of ₹25 lakh and a home loan of ₹50 lakh. This, coupled with the income tax slab changes, means a substantial boost for the middle class in the upcoming financial year.