Just when we thought the hype around AI couldn't get any bigger, a new chatbot called DeepSeek emerged as a major competitor to models like OpenAI's ChatGPT - and it's dominating app stores globally. But with doubts about its potential longevity in the US market, its impact on tech giants like Nvidia is calling into question the transparency and truthfulness of the company. As TechRadar's Lance Ulanoff dives into the controversy, one thing remains clear: DeepSeek is quickly making a name for itself in the AI world.

The sudden popularity of Chinese AI chatbot, DeepSeek, has sent shockwaves through the tech industry and caused a significant drop in stock values for major players like Nvidia, Microsoft, and Google. The app, reportedly developed at a fraction of the cost of its rivals, has become the most downloaded free app in the US. This development raises questions about the future of America's AI dominance and the scale of investments being made in research and development. Meanwhile, DeepSeek has also faced technical challenges, temporarily limiting registrations due to malicious attacks.

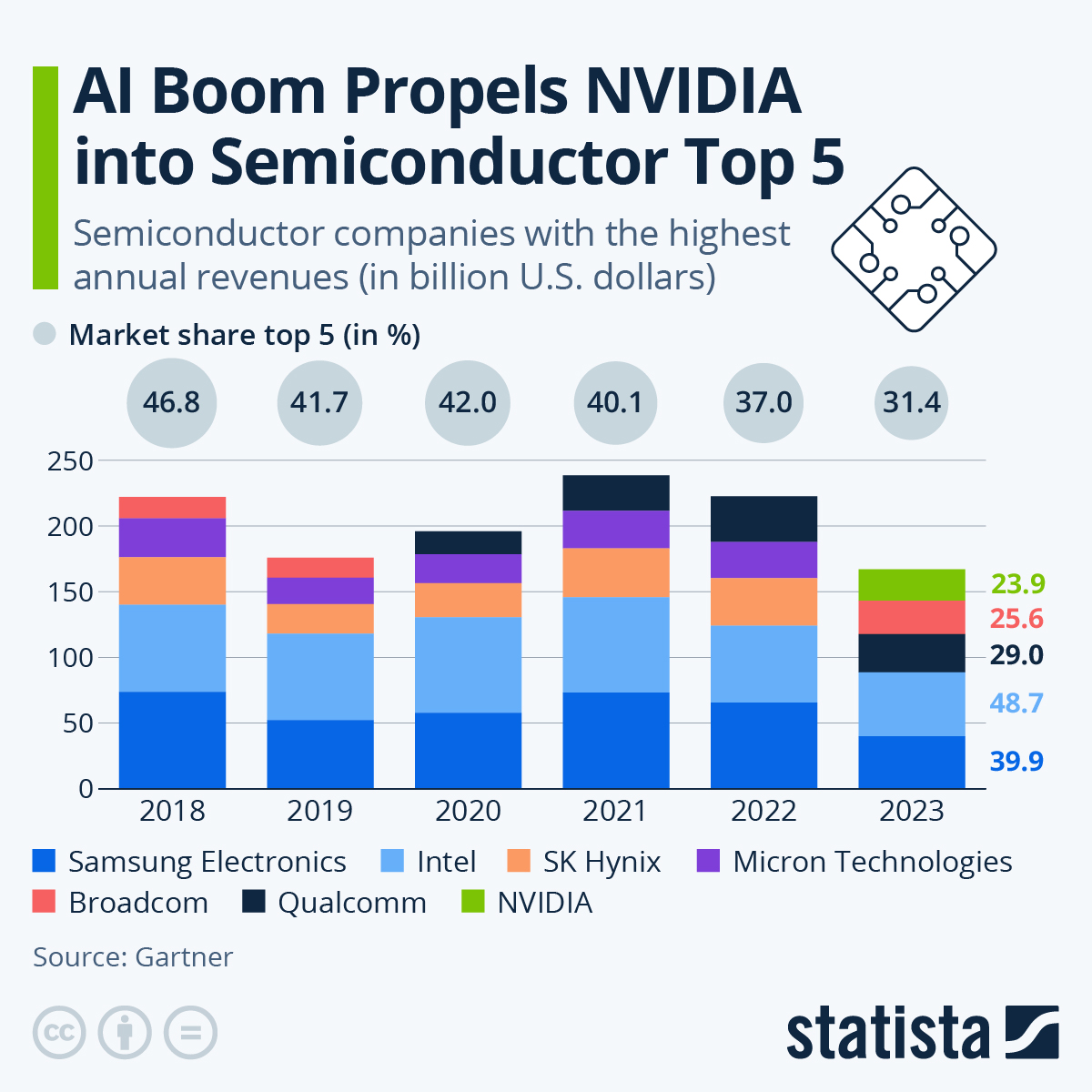

Chinese startup DeepSeek AI's new AI model has raised concerns about the future of AI investment and potentially lower costs for training models. This news has led to a drop in Nvidia's stock and other chip stocks in the market. However, analysts believe it may drive US companies to leverage their access to GPUs and improve their advantage in the AI market.

Fears over competition in the artificial intelligence market sparked a nearly 18% drop in Nvidia's stock on the heels of a major announcement from a Chinese startup. The release of DeepSeek's new AI tool, R1, sent ripples through the tech industry, with other major players such as Microsoft and SoftBank also seeing declines. OpenAI's market dominance is now being challenged, and the impact on the tech industry could be significant.

NVIDIA has launched its highly-anticipated latest generation of GPUs, the RTX 50 series, with significant improvements in speed and performance. The flagship model, RTX 5090, boasts 92 billion transistors and a whopping 3,352 TOPS of AI performance, making it a dream for 4K gaming enthusiasts. While the RTX 5090 is priced at a steep Rs 2,14,000, other variants like the RTX 5080, RTX 5070 Ti, and RTX 5070 offer more affordable options for gamers. However, prices may vary for models from different vendors like ASUS and MSI. Stay updated and informed about these groundbreaking graphics cards for making smarter decisions in your gaming journey.

At CES 2025, NVIDIA's CEO announced the company's latest flagship desktop GPU, the GeForce RTX 50-series, which boasts impressive AI modeling capabilities and can dramatically improve gaming performance. Along with the new graphics cards, NVIDIA also unveiled a new supercomputer for AI research, a humanoid robot learning modality, a world foundation model platform, and a partnership with Toyota for autonomous vehicles. The RTX 50-series will be available in various laptops from popular brands starting in March and April.

The stock market saw a sharp decline on Tuesday, with the S&P 500 and Nasdaq Composite falling 0.9% and 1.6%, respectively. This was fueled by a rise in the yield of 10-year Treasurys, indicating concerns about the future of interest rates. The release of strong economic data, including better-than-expected job openings in November, also raised questions about the Fed's decision-making on rates. The tech sector was hit hard, with AI chipmaker Nvidia's stock dropping 5% after hitting an all-time high earlier in the day.

Intel kicked off Supercomputing 2019 with a bang, unveiling its first 7nm Xe GPU for the data center, codenamed Ponte Vecchio. As the company strives to compete with industry giants Nvidia and AMD, the new GPU is set to make an impact with its high-performance computing and artificial intelligence capabilities. The announcement marks a major step for Intel's re-entry into the discrete GPU market and sets the stage for exciting developments in the future of computing.

Reliance Industries Ltd. (RIL) is preparing for the highly anticipated IPO of its telecommunications subsidiary, Jio Platforms Ltd., with plans for a listing by 2025. The valuation of Jio is currently estimated at over $100 billion, with analysts predicting a potential IPO valuation of $112 billion. The IPO will allow existing investors to exit, while RIL's chairman Mukesh Ambani aims to list Jio as a subsidiary structure rather than demerging it. In 2020, Jio secured investments from several strategic partners, including Meta and Google, and recently announced a partnership with Nvidia to develop AI data centers in India.

Nvidia, one of the top-performing stocks of 2024, has seen impressive market returns due to the growing demand for AI technology in various industries. However, concerns about the company's valuation and a potential AI bubble have emerged. On top of that, Nvidia's largest customer, Super Micro Computer Inc., is facing possible delisting and a DOJ investigation, which could impact the chipmaker's future earnings. With NVIDIA's Q4 2024 earnings report set to be released on November 20, the stock could face further challenges in maintaining its impressive performance.