Reliance Industries Ltd. (RIL) is preparing for the highly anticipated IPO of its telecommunications subsidiary, Jio Platforms Ltd., with plans for a listing by 2025. The valuation of Jio is currently estimated at over $100 billion, with analysts predicting a potential IPO valuation of $112 billion. The IPO will allow existing investors to exit, while RIL's chairman Mukesh Ambani aims to list Jio as a subsidiary structure rather than demerging it. In 2020, Jio secured investments from several strategic partners, including Meta and Google, and recently announced a partnership with Nvidia to develop AI data centers in India.

Reliance Industries' Jio IPO: Unveiling the Details

Background

Reliance Industries Limited (RIL), India's largest conglomerate, is gearing up for the highly anticipated initial public offering (IPO) of its telecommunications subsidiary, Jio Platforms Limited (Jio). The IPO is expected to be the largest in Indian history, with a potential valuation of over $100 billion.

IPO Details

Strategic Partnerships and Funding

In 2020, Jio secured significant investments from global tech giants:

Recently, Jio announced a partnership with Nvidia to establish AI data centers in India, further bolstering its technological capabilities.

Top 5 FAQs and Answers

1. When is the Jio IPO expected? Answer: Target is 2025.

2. What is the estimated valuation of Jio? Answer: Over $100 billion.

3. How will the IPO be structured? Answer: As a subsidiary listing, rather than demerging Jio from RIL.

4. Why is Mukesh Ambani opting for a subsidiary listing? Answer: To provide investors with the option of investing in both RIL and Jio separately.

5. What are the benefits of Jio's strategic partnerships? Answer: Access to global expertise, funding, and technology, enhancing Jio's competitiveness in the Indian telecommunications market.

Conclusion

The Jio IPO is a significant event that is expected to reshape the Indian telecom landscape. With a massive valuation and strategic partnerships with global tech leaders, Jio is poised to continue its dominance in the Indian market and become a major player on the global stage. As the IPO approaches, investors will eagerly await more details and the opportunity to participate in this historic event.

In a recent Instagram post, the founder and CEO of Monk Entertainment, Viraj Sheth, addressed the struggles of content creation in the age of instant virality and doomscrolling. He advised against solely focusing on gaining a large following, as easy algorithm hacks make it less meaningful. According to him, true influence goes beyond fleeting visibility and requires genuine creativity and impact.

Vineet Rai, founder and Chairman of Aavishkaar Group, shares the company's ambitious goal of growing its assets under management from $1 billion to $7 billion by 2025. The Dutch development bank CEO also discusses the organization's success in finding investment opportunities in India's specialized markets.

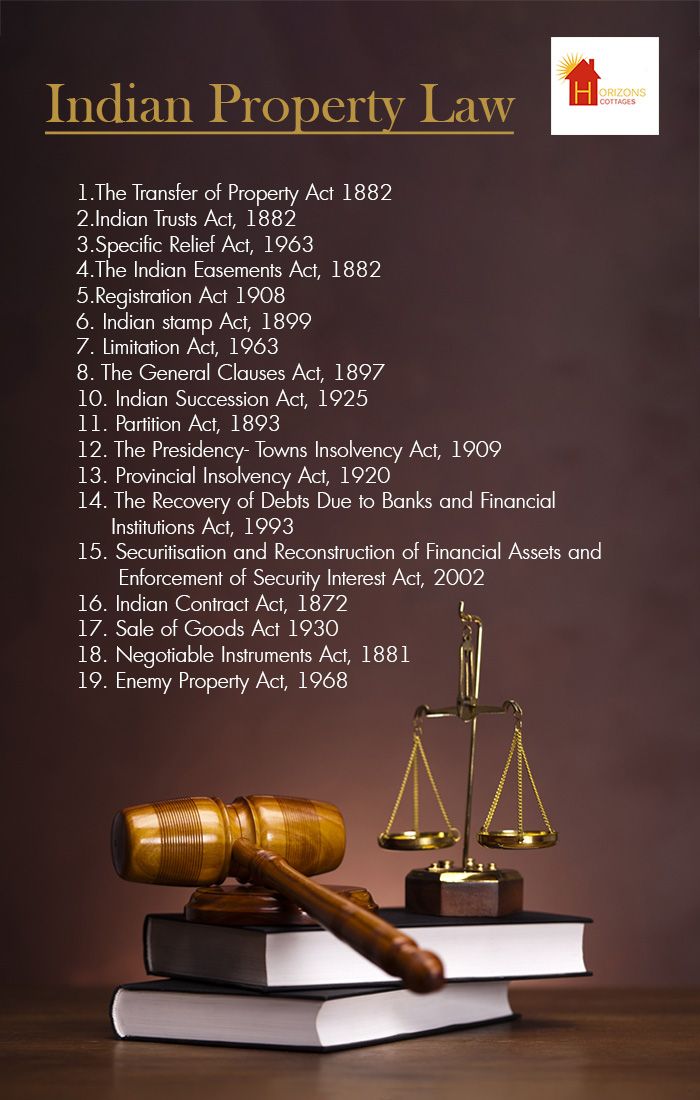

Stay updated on the latest developments and reforms in India's joint family property laws. Learn about the potential impacts and implications on your own familial property and future inheritance planning. This news will provide comprehensive coverage of the changes and important updates on this significant business and legal topic.

Ajax Engineering, a Bengaluru-based company that specializes in manufacturing concrete equipment, is starting the bidding process for its Rs 1,269.35 crore IPO today. The company has seen strong demand in the grey market and raised Rs 379.31 crore from anchor investors. It has a wide distribution network in India and abroad with continued growth and profitability. Investors should keep a close eye on this IPO and its potential for listing gains.

The State Bank of India is set to release the SBI Clerk Prelims Admit Card 2025 on 10 February along with the exam date for the 14,191 vacancies of Junior Associate (Clerk). Candidates can download their admit card from the official website, sbi.co.in, using their registration number and DOB/password. Make sure to have all necessary documents ready and follow the steps provided to ensure a smooth exam experience.

The State Bank of India has released the admit card for the first phase of the SBI Clerk recruitment exam. The exam is scheduled for February and March of 2025 and will have negative marking for wrong answers. This recruitment is for 13,735 positions for Junior Associates and candidates are advised to prepare well and download their admit cards in advance. The story also includes a mention of a woman who left her MNC job to become an IPS officer and encourages readers to check out the publication's editorial guidelines and standards.

The Board of Control for Cricket in India (BCCI) has recently released copyright regulations for the year 2025, outlining the organization's terms and policies for content usage. In a move to protect their intellectual property, BCCI has set strict guidelines and penalties for unauthorized use of their materials. These regulations cover various aspects such as copyrights, terms and conditions, privacy policies, and more, aiming to safeguard BCCI's rights and interest. As the cricket world gears up for future tournaments, these regulations may have a significant impact on the use and distribution of BCCI's content by individuals and organizations.

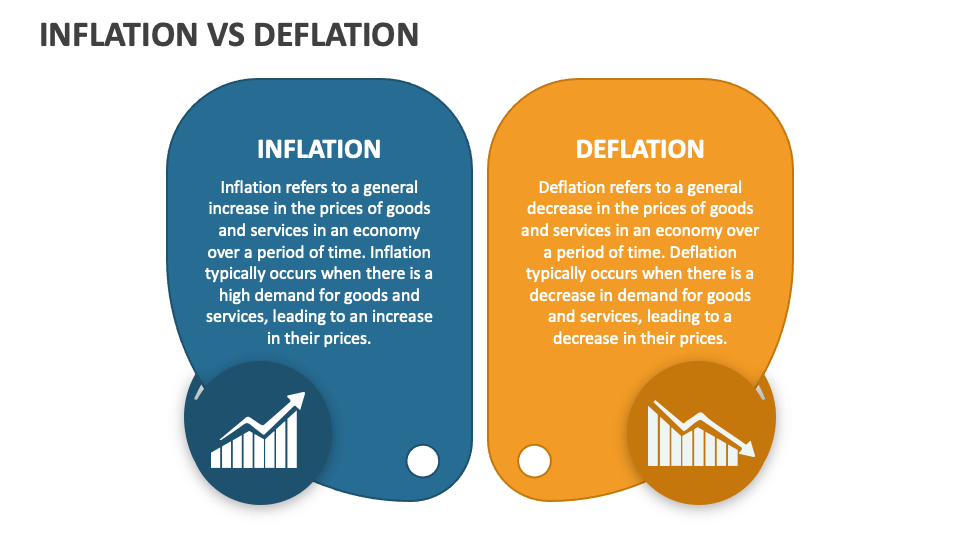

A recent study by the Research Institute of Economy, Trade and Industry sheds light on the burden of inflation tax and its effect on intergenerational imbalances. Contrary to previous studies, this research found that inflation or deflation can greatly impact the burden faced by both current and future generations. Additionally, the study suggests that implementing economic growth strategies alone will not be enough to eliminate these imbalances, and calls for concurrent reform in public finance and social security systems. These findings have significant implications for policy makers and economists.

The wait is almost over as Finance Minister Nirmala Sitharaman gets ready to present the Union Budget at 11 am today. This highly anticipated event will see several major announcements that are expected to have a significant impact on the country's economy. To fully grasp the details of the budget, it is important to understand key terms such as GDP, nominal GDP, real GDP, and capital receipts. These terms include important aspects such as economic growth, inflation, and the government's borrowing requirements, which can help individuals make sense of the budget speech. So, let's delve into the world of economics and get ready for the Union Budget 2025.

On this Chocolate Day 2025, let's celebrate love and sweetness with delicious delicacies in hand. As part of Valentine's Week, February 9 marks the day of honoring the beloved chocolate delicacies that have been bringing delight and affection to couples for generations. And as the "month of love" is believed to have been chosen as the date for Chocolate Day, it's the perfect opportunity to express admiration and gratitude to loved ones with these warm wishes and greetings.