Amidst the ongoing Israel-Iran conflict and the upcoming Indian elections, market expert Ajay Bagga predicts that crude oil prices may be affected and gold prices may continue to rise. In addition, he mentions that the market is eagerly anticipating the release of BJP's manifesto, as it may contain policies that could impact various industries. Bagga shares his insights and recommendations on navigating the market during these uncertain times.

Amidst ongoing global events, market experts are closely monitoring the potential impact on key commodities and the broader market outlook. Here's an analysis of the trends currently shaping the global market, particularly in light of the Israel-Iran conflict and the upcoming Indian elections:

Background: The ongoing conflict between Israel and Iran has raised concerns about disruptions to the global supply of crude oil, potentially leading to higher prices. Additionally, the Organization of the Petroleum Exporting Countries (OPEC) and its allies have been implementing production cuts, which could further tighten the market.

Expert Prediction: Market expert Ajay Bagga predicts that crude oil prices may be affected by the ongoing geopolitical tensions. However, he also notes that the market is closely watching the outcome of ongoing nuclear negotiations between the United States and Iran. A positive outcome could ease tensions and help stabilize oil prices.

Background: Gold is often considered a safe-haven asset during times of uncertainty. When investors perceive increased risks or geopolitical instability, they tend to buy gold, which can drive up its price.

Expert Prediction: Bagga expects gold prices to continue rising amidst the current market volatility. He believes that investors are seeking refuge in gold due to the ongoing conflicts and concerns about the global economy.

Background: India's ruling party, the Bharatiya Janata Party (BJP), is scheduled to release its election manifesto soon. The manifesto is expected to outline the party's policies and potential reforms for various industries.

Market Anticipation: The release of the BJP's manifesto is eagerly anticipated by the market, as it could provide insights into the party's economic agenda. Investors and businesses are closely watching for policies that could impact their sectors.

Q: What factors are influencing the current crude oil price trend? A: Geopolitical tensions, supply cuts by OPEC+, and the ongoing nuclear negotiations are key factors affecting crude oil prices.

Q: Why is gold considered a safe-haven asset? A: During times of uncertainty, investors perceive gold as a reliable store of value, leading to increased demand and higher prices.

Q: What is the significance of the BJP's election manifesto for the Indian market? A: The manifesto outlines the party's economic policies and potential reforms, which could impact various industries and influence investor sentiment.

Q: How is the Israel-Iran conflict potentially affecting the global market? A: The conflict has raised concerns about disruptions to the supply of crude oil, as well as increased geopolitical tensions and market volatility.

Q: What recommendations do experts have for navigating the market during uncertain times? A: Experts advise investors to regularly monitor market news, diversify their portfolios, and consider safe-haven assets like gold when necessary.

The highly anticipated Glen Sannox ferry has finally been delivered, seven years after it was launched into the Firth of Clyde with much fanfare by Scottish First Minister, Nicola Sturgeon. The project has been plagued by numerous delays, contractual disputes, and cost overruns, ultimately resulting in the nationalisation of the Ferguson Marine shipyard. This delayed delivery has caused frustration for islanders who were hopeful for a new lifeline ferry.

India has become a hub for global cooperation and progress in the business sector with a string of major events and schemes. From hosting the International Cooperative Alliance Assembly to launching the White Revolution 2.0 for the dairy sector, India has been making strides towards economic growth and development. The country also witnessed key agreements and discussions with countries like the US, Japan, and Bhutan, showcasing the strengthening of international relations and cooperation in the field of business. In addition, the Indian government's key schemes, including the Middle Class Schemes and the FCI equity infusion, have received praise and recognition from top leaders like Amit Shah. Stay updated with the latest developments in the Indian business world.

Personal finance expert Martin Lewis has raised concerns over the severe repercussions of missing a single Council Tax payment. In a recent TV segment, Lewis criticized the policy of making individuals pay for an entire year's worth of taxes within three weeks of missing a monthly payment. He also highlighted the impact of this burden on people's financial well-being, the economy, and the healthcare system. While the Local Government Association acknowledged the need for fair collection policies, they also agreed with Lewis that the use of bailiffs should be a last resort.

Vivo has expanded its Y-series in India with the launch of the Vivo Y300, equipped with advanced features and innovative technology. The smartphone offers a high-end Sony IMX882 main camera, along with AI Aura Light and a 2x portrait feature for a superior photography experience. Available in three different colors and two storage variants, the Y300 is priced at Rs 21,999 and Rs 23,999 respectively. It also comes with a high-gloss metal frame, 6.67-inch AMOLED punch-hole display, and a 5000 mAh battery with 80W FlashCharge. With a user-friendly Funtouch OS and IP64 dust and water resistance rating, the Vivo Y300 is the perfect device for tech-savvy individuals.

Tesla CEO Elon Musk praised India for successfully counting 640 million votes in just one day for their Lok Sabha elections. In contrast, California, with a significantly smaller population, is still struggling to tally the results of their presidential election which took place 18 days ago. Musk's post on X highlights the efficiency of India's electoral process and the shortcomings of the US system, which has led to a delay in vote counting in the most populous state.

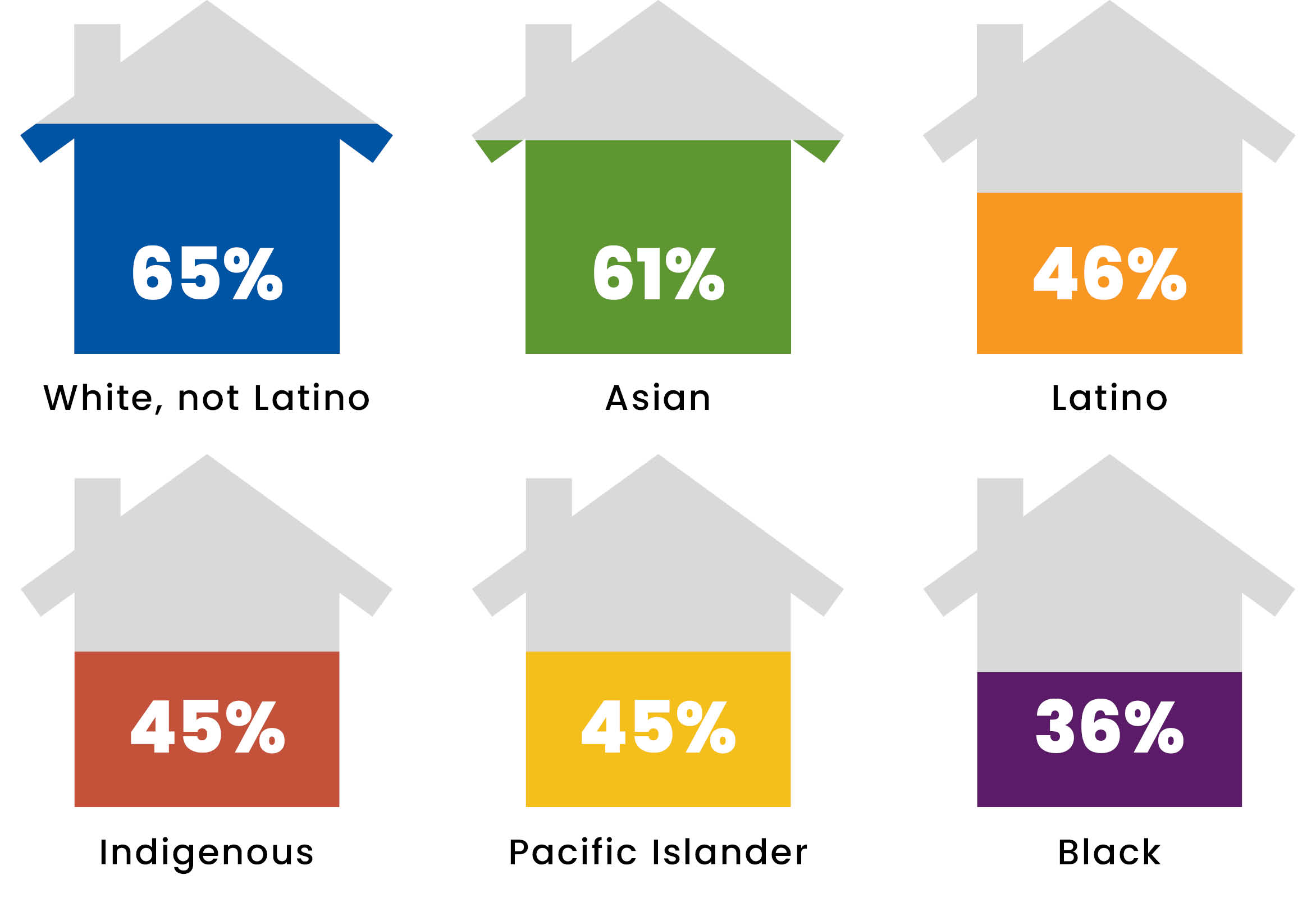

With the median price of a single-family home in California reaching a staggering $868,150 in September, the state's high home prices have created a wealth gap that disproportionately affects communities of color. According to the Legislative Analyst's Office, the cost of buying a mid-tier home has increased by 84% since January 2020, making it unaffordable for the majority of Californians. This poses serious challenges for low-income households and people of color who are already struggling to keep up with the state's high cost of living. As California grapples with mounting economic divides, the need for affordable housing solutions becomes more urgent. Help us address this pressing issue by joining our year-end campaign to raise $50,000 and support local reporting on important issues like this.

Zomato CEO, Deepinder Goyal, responds to user feedback on the company's "Food Rescue" initiative, showing his commitment towards innovation and open recruitment. The feature, launched on October 10, 2024, offers discounted meals from cancelled orders to customers within a 3km radius, aiming to reduce food wastage and provide affordable options. While there have been concerns raised about safety and fairness, Goyal points out the efforts to ensure proper packaging and limit the number of cancellations per month. The company is also exploring partnerships with food banks and charities to further reduce food wastage.

BTTV, a leading market news channel, introduces a new show called 'Daily Calls' aimed at providing viewers with expert insights and guidance on navigating the market. With access to live sessions featuring experienced analysts, the show aims to assist viewers in making informed investment decisions and building a strong portfolio. Don't miss out on this valuable opportunity to gain clarity and understanding in today's uncertain market.

Adani Group is under scrutiny for alleged violations of disclosure norms concerning a US bribery case and the subsequent cancellation of major deals by Kenya. While the conglomerate has denied any involvement in the case, stock exchanges have sought explanations and experts believe that the Securities and Exchange Board of India (SEBI) may launch an investigation. The allegations, which include a criminal indictment and a civil complaint, could have significant consequences for Adani Group's reputation and access to international markets.

Outlandish, an e-commerce startup, is opening a new brick-and-mortar store in Santa Monica's 3rd Street Promenade, featuring a first floor of branded stalls and a second floor for shopping. The store aims to mix live online selling with in-person retail, as visitors can watch influencers and sellers on livestreams and even join in themselves. The concept taps into the growing trend of live shopping in the US, with TikTok itself actively promoting and hosting events centered around live selling. This move by Outlandish is in line with TikTok's efforts to recreate the success of its Chinese sister app, Douyin, which drives billions in annual product sales.