In a long-standing legal battle over the Massey Ferguson tractor brand, TAFE, a well-known tractor manufacturer based in Chennai, has declared a legal victory against AGCO, a global leader in agriculture machinery. The Madras High Court has granted TAFE the right to continue using the brand, recognizing their sixty-year history with it. TAFE boasts a strong reputation for quality and a vast distribution network, making them a formidable presence in the global market.

Indian stock markets will shut down on November 20, 2024, due to the Maharashtra Legislative Assembly elections. This announcement by the Election Commission of India has led to a one-day market closure, with trading and settlements not taking place on the National Stock Exchange and the BSE. The next market holiday will be on December 25 for Christmas, followed by the final market holiday for the year. However, the Multi Commodity Exchange (MCX) and National Commodity & Derivatives Exchange (NCDEX) will also be closed for the day, with contracts expiring on November 20 settling a day earlier. As for the market recap on November 18, 2024, both benchmark indices ended in the red due to weak global cues and cautious investor sentiment ahead of the state elections.

Pokarna, a company with a market cap of Rs 2,231 crore, has announced a strategic investment of Rs 440 crore aimed at fulfilling the increasing demand for premium quartz surfaces worldwide. This marks the launch of the company's third Bretonstone production line from Italy's Breton S.p.A., which will set new standards for capacity and environmentally friendly production. However, the stock saw a decline of 9.96% in early trade as equity benchmark indices dropped due to a combination of factors such as retail inflation, muted quarterly earnings, and weak global markets.

On Monday, Cathie Wood-led Ark Invest made significant trades in popular tech companies such as Block Inc, Palantir, and Coinbase Global Inc. Despite Block’s positive second-quarter results, Ark Invest sold over 230,000 shares, possibly due to challenges in the streaming market. The company also offloaded shares of Palantir, despite its strong third-quarter earnings report. On the other hand, the company bought shares of Coinbase, showing confidence in the popular cryptocurrency exchange.

Zee Business Managing Editor Anil Singhvi has shared his thoughts on the support and buy zones for the Nifty50 and Nifty Bank indexes in the upcoming trading session. He expects a support level to emerge for the Nifty50 at 23,675-23,800 and for the Nifty Bank at 50,800-51,000, while a strong buy zone is predicted at 23,500-23,625 for Nifty50 and 50,200-50,375 for Nifty Bank. The sentiment for the market is currently negative, with FII and global trends being negative and DII showing a positive stance. However, the F&O trend remains neutral and the Nifty put-call ratio has decreased. The volatility index, India VIX, has also increased.

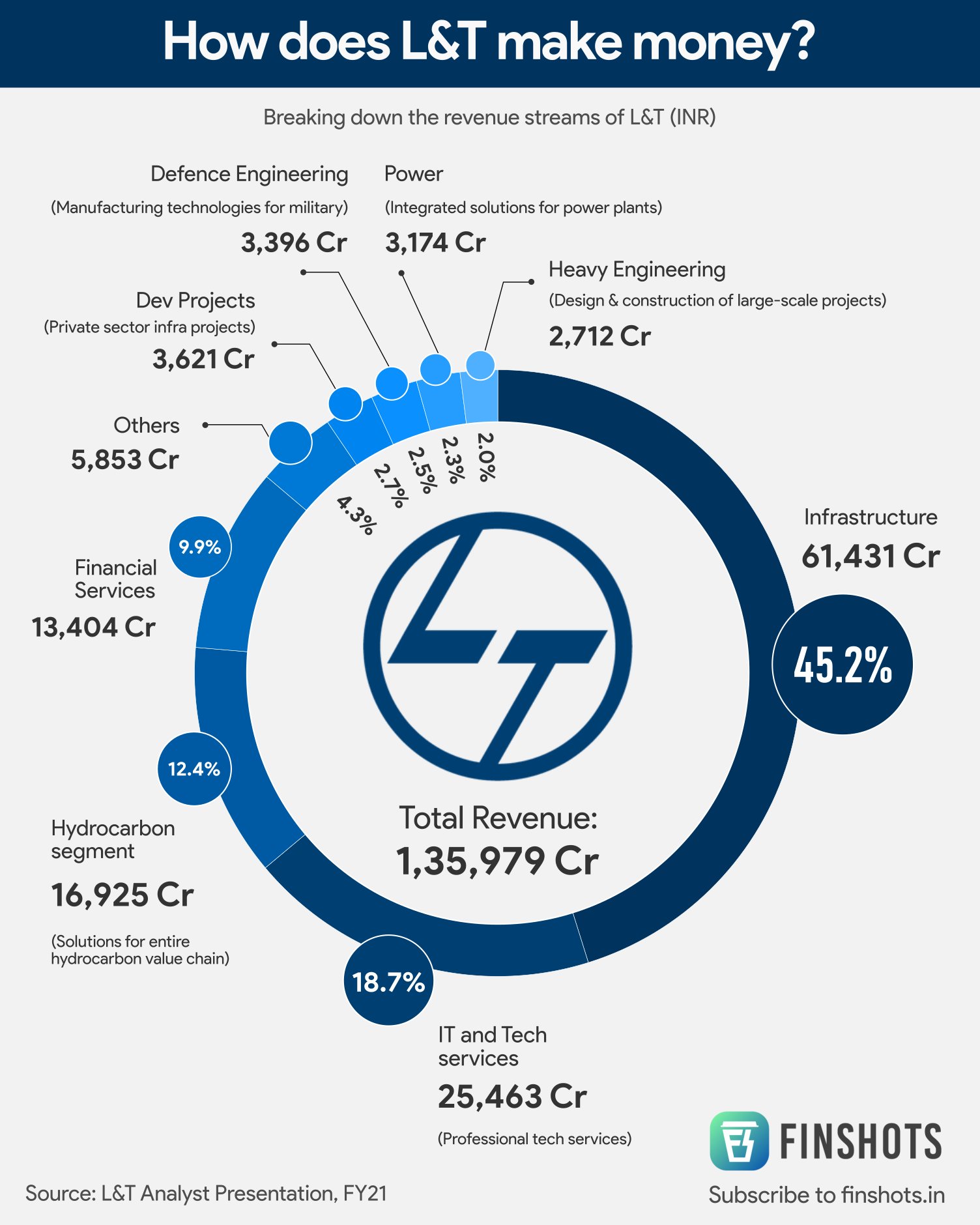

Larsen & Toubro (L&T) continues to see strong growth, with consolidated revenue reaching Rs 61,555 crore in the latest quarter. The company's international revenues accounted for 52% of overall revenues, highlighting its global presence and success. Some big names to watch in the stock market today include L&T, Tata Power, and Biocon, with many expecting significant price movement. L&T also recently announced a new project in India, involving the construction of a 15.09 km elevated viaduct, 14 stations, and a 2.61 km depot, with a targeted completion date of 30 months.

Several major Indian banks, including Axis Bank, RBL Bank, HDFC Bank, Bandhan Bank, ICICI Bank, UCO Bank, Bajaj Housing Finance, and IndusInd Bank, have reported their Q2 earnings, with varying levels of success. While Axis Bank and Bajaj Housing Finance saw profits surge, RBL Bank and IndusInd Bank shares plunged due to disappointing earnings. HDFC Bank and ICICI Bank also reported positive but more modest profit increases, while UCO Bank saw an improvement in bad loan recovery through the NCLT process. The mixed results, combined with global market trends, are driving the overall market sentiment.

In the midst of the Indian consumer discretionary industry, Dixon Technologies has caught the attention of global brokerage Nomura. With better-than-estimated Q2 earnings and a raised target, the stock is predicted to have a potential 24% upside. The company's focus on component manufacturing and long-term opportunities in the IT hardware & components segment contribute to this positive outlook. With latest updates on stock market and helpful tools such as Income Tax Calculator, Zee Business keeps you on the front line of Business Breaking News.

In a groundbreaking partnership between two major companies, Reliance Industries and Nvidia are set to collaborate on developing artificial intelligence infrastructure in India. This comes as a result of the growing demand for AI technology in the country, with RIL Chairman Mukesh Ambani emphasizing on India's large population of computer engineers. With the backing of Prime Minister Narendra Modi and Nvidia's advanced computing system, the country is poised to become a major player in the global AI market.

Royal Enfield, the global leader in the mid-size motorcycle segment, has expanded its presence in the SAARC region by launching a manufacturing facility and showroom in Bangladesh. The facility, in collaboration with IFAD Motors, will produce four of Royal Enfield's models for the Bangladeshi market. This move marks an important milestone in the company's vision to expand the middleweight motorcycle segment globally.