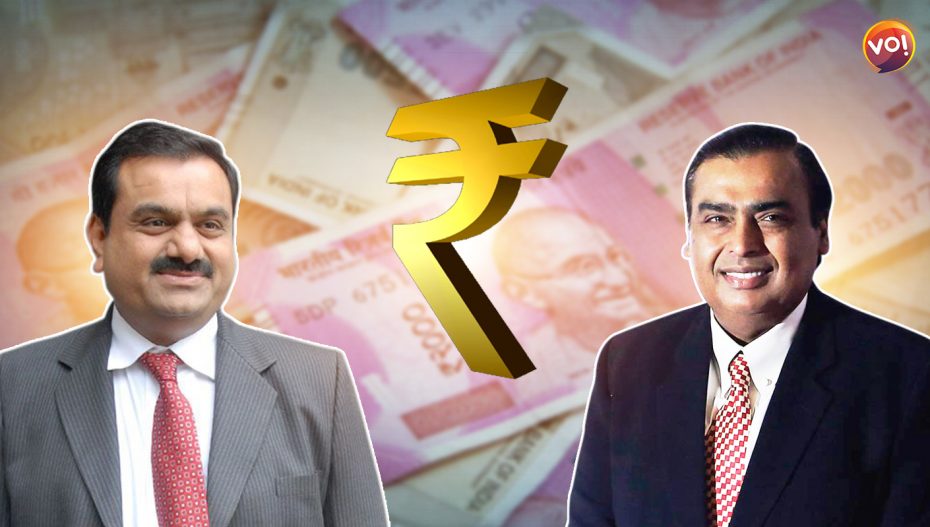

The 2024 Hurun India Rich List has been announced, revealing the latest standings of India's wealthiest individuals. In a surprising turn of events, Gautam Adani and family have dethroned Mukesh Ambani, who has held the top spot for years. The report also highlights a significant increase in the number of billionaires in India, showcasing the growing wealth and economic power in the country.

Gautam Adani Overtakes Mukesh Ambani as India's Richest Man

In a historic shift, Gautam Adani and his family have become the richest individuals in India, dethroning long-time incumbent Mukesh Ambani. The 2024 Hurun India Rich List, released on February 12th, 2024, revealed this surprising development.

Background

Mukesh Ambani, chairman of Reliance Industries, has held the title of India's richest man for years. However, Gautam Adani, the founder and chairman of the Adani Group, has rapidly ascended the ranks in recent times. His conglomerate has a presence in diverse sectors, including ports, power generation, and renewable energy.

Adani's Rise to Prominence

Adani's wealth has soared in the past year, driven by the strong performance of his businesses. The Adani Group's stock prices have surged significantly, contributing to his net worth reaching $96.6 billion, as per the Hurun India Rich List.

Mukesh Ambani's Relegation

While Mukesh Ambani remains a wealthy individual with a net worth of $85 billion, he has been surpassed by Adani. Factors such as headwinds in the telecom sector and fluctuations in global energy prices have contributed to the decline in his wealth.

Wealth Growth in India

The Hurun India Rich List also highlights the growing wealth and economic power in the country. The number of billionaires in India has increased from 131 in 2023 to 155 in 2024. The combined wealth of these individuals now stands at a staggering $719 billion.

Top 5 FAQs

1. Who is Gautam Adani?

Gautam Adani is an Indian industrialist and the founder and chairman of the Adani Group, a conglomerate with interests in various sectors, including ports, power generation, and renewable energy.

2. How did Adani become richer than Ambani?

Adani's wealth has surged in recent years due to the strong performance of his businesses, particularly in the ports and energy sectors.

3. What is the significance of Adanidethroning Ambani?

This is a significant shift in the landscape of wealth in India, as Ambani has held the top spot for many years.

4. How many billionaires are there in India now?

The 2024 Hurun India Rich List reveals that there are currently 155 billionaires in India, up from 131 in 2023.

5. What is the combined wealth of the top 10 richest people in India?

The combined wealth of the top 10 richest people in India is estimated to be around $350 billion, representing a significant concentration of wealth in the country.

Mumbai's popular Metro Line 3 faced a temporary shutdown today as the BKC Metro Station was temporarily closed for operations. According to officials, the rest of the metro line remains fully functional and the temporary closure was for maintenance purposes. The unexpected shutdown caused some inconvenience to commuters, but authorities assure that the issue will be resolved soon.

Meme stocks have become a hot topic in the stock market, with investors flocking to these highly volatile and speculative stocks. These stocks refer to those that skyrocket in price and trading volume due to social media buzz. However, investing in these stocks can be risky, as they are often overvalued and not based on strong fundamentals. While some investors have seen success with meme stocks, others caution against putting too much of one's portfolio into these highly unpredictable investments. It's a trend that may not last, and predicting when it will reverse can be a costly guessing game.

The Dow Jones Industrial Average and S&P 500 futures inched higher before the opening bell on Thursday, signaling a positive start for US stock markets. Analysts are anticipating the release of key economic data on jobless claims and crude oil stockpiles, which could have an impact on the course of benchmark interest rates. This comes after the Fed's decision to lower interest rates by 25 basis points, citing a strong economy and inflation nearing its target. Stay updated on all stock market news and more on Zeebiz.com.

Sports TechnologyEntertainment, "Trump Jokes about Elon Musk's Overbearing Presence at Mar-a-Lago" Former President Donald Trump joked about tech mogul Elon Musk's frequent presence at his Mar-a-Lago estate, making light of their close relationship. While Trump praised Musk for dedicating time to his election campaign, lawmakers noted that some within Trump's inner circle see Musk's continued presence as overbearing. Musk's involvement in Trump's transition team has sparked debate among the former president's allies, with some viewing it as beneficial and others questioning his persistent influence.

Eicher Motors Ltd., the parent company of Royal Enfield, reported a net profit of ₹1,100 Crore for the second quarter of FY25. Although revenue for the quarter increased by 3.6%, it fell short of projections. VECV, another subsidiary of Eicher Motors, saw an 8% increase in income from operations. Despite a decline in Royal Enfield's sales, the company has announced its entry into the electric mobility market with the launch of a new EV brand.

Nissan South Africa has officially opened its new headquarters in Irene, South Africa, which will serve as the hub for administrative and strategic operations in the country and its Independent Markets Africa division. The move to the new building will enhance collaboration, streamline processes, and provide a more productive and progressive work environment for the team. This decision aligns with modern practices of separating corporate headquarters from manufacturing operations and reflects Nissan's commitment to innovation and efficiency in engaging with the market and customers. The launch of the new Magnite vehicle in November also marks an auspicious month for Nissan South Africa.

Pokarna, a company with a market cap of Rs 2,231 crore, has announced a strategic investment of Rs 440 crore aimed at fulfilling the increasing demand for premium quartz surfaces worldwide. This marks the launch of the company's third Bretonstone production line from Italy's Breton S.p.A., which will set new standards for capacity and environmentally friendly production. However, the stock saw a decline of 9.96% in early trade as equity benchmark indices dropped due to a combination of factors such as retail inflation, muted quarterly earnings, and weak global markets.

NTPC Green Energy, a subsidiary of NTPC Ltd., will launch its IPO on November 19 with a price band of Rs 102-108 per share. The company will also have a shareholders category, allowing current NTPC shareholders to participate. Analysts are optimistic about the IPO, citing the company's operational capacity, contracted projects, and future development plans. With NTPC targeting 60GW of RE capacity by FY32, investors are advised to buy NTPC shares to increase their chances of IPO allotment.

ScottishPower has chosen Siemens Gamesa to supply the turbine blades for their £4 billion East Anglia TWO offshore wind farm. This agreement, worth more than £1 billion, solidifies Hull as the location for the blade production. In this interview, Chet Benham, President & COO of Viridi Energy, discusses their business and focus on renewable natural gas and its role in the energy transition. Additionally, AFRY has been selected by Electroperú to oversee the modernisation and life extension of two hydro power plants in Peru.

Nadhmi al-Nasr, CEO of Neom, the futuristic city development in Saudi Arabia, has suddenly stepped down and will be replaced by an acting CEO from the country's sovereign wealth fund. The Public Investment Fund's board deemed this a natural evolution and strategic move, but the reasons for Nasr's departure are unknown. Neom, envisioned as a 9-million-resident city with extravagant features like a floating business district and the world's tallest skyscrapers, has faced financial and leadership challenges since its announcement in 2017. With projects being delayed, downsized, or cancelled, securing foreign investors has become crucial, but the project's first phase has already exceeded its budget.