Pokarna, a company with a market cap of Rs 2,231 crore, has announced a strategic investment of Rs 440 crore aimed at fulfilling the increasing demand for premium quartz surfaces worldwide. This marks the launch of the company's third Bretonstone production line from Italy's Breton S.p.A., which will set new standards for capacity and environmentally friendly production. However, the stock saw a decline of 9.96% in early trade as equity benchmark indices dropped due to a combination of factors such as retail inflation, muted quarterly earnings, and weak global markets.

Pokarna Announces Strategic Investment, Stock Dips Amid Market Downturn

Pokarna, a leading manufacturer of quartz surfaces with a market capitalization of Rs 2,231 crore, has unveiled a substantial strategic investment of Rs 440 crore to cater to the surging global demand for premium quartz surfaces.

Investment Details

The investment will facilitate the installation of Pokarna's third Bretonstone production line from Italy's Breton S.p.A. This cutting-edge line will significantly boost capacity and enhance environmentally friendly production practices.

Market Reaction

Despite the significant investment announcement, Pokarna's stock initially declined by 9.96% in early trade. This decline was attributed to a combination of negative factors, including:

Background

Pokarna has established itself as a pioneer in the quartz surface industry, capturing a significant market share in India and expanding its global presence. The company's Bretonstone brand is renowned for its durability, aesthetics, and sustainability.

Top 5 FAQs

Q1. What is the purpose of Pokarna's strategic investment? A1. To meet the growing worldwide demand for premium quartz surfaces by expanding capacity and upgrading technology.

Q2. What will be the impact of the new production line? A2. It will significantly increase Pokarna's production capacity and enable the adoption of environmentally friendly practices.

Q3. Why did Pokarna's stock decline despite the investment announcement? A3. The decline was caused by market factors such as rising inflation, disappointing earnings, and global market weakness.

Q4. What is Pokarna's market share in the quartz surface industry? A4. Pokarna holds a significant market share in India and is expanding its global presence.

Q5. What are the strengths of Pokarna's Bretonstone brand? A5. Durability, aesthetics, sustainability, and a wide range of colors and finishes.

Outlook

While the stock market reaction was negative in the short term, analysts believe that Pokarna's strategic investment positions the company for long-term growth. The increasing demand for quartz surfaces and Pokarna's commitment to innovation is expected to drive future success.

Eicher Motors Ltd., the parent company of Royal Enfield, reported a net profit of ₹1,100 Crore for the second quarter of FY25. Although revenue for the quarter increased by 3.6%, it fell short of projections. VECV, another subsidiary of Eicher Motors, saw an 8% increase in income from operations. Despite a decline in Royal Enfield's sales, the company has announced its entry into the electric mobility market with the launch of a new EV brand.

Nissan South Africa has officially opened its new headquarters in Irene, South Africa, which will serve as the hub for administrative and strategic operations in the country and its Independent Markets Africa division. The move to the new building will enhance collaboration, streamline processes, and provide a more productive and progressive work environment for the team. This decision aligns with modern practices of separating corporate headquarters from manufacturing operations and reflects Nissan's commitment to innovation and efficiency in engaging with the market and customers. The launch of the new Magnite vehicle in November also marks an auspicious month for Nissan South Africa.

NTPC Green Energy, a subsidiary of NTPC Ltd., will launch its IPO on November 19 with a price band of Rs 102-108 per share. The company will also have a shareholders category, allowing current NTPC shareholders to participate. Analysts are optimistic about the IPO, citing the company's operational capacity, contracted projects, and future development plans. With NTPC targeting 60GW of RE capacity by FY32, investors are advised to buy NTPC shares to increase their chances of IPO allotment.

ScottishPower has chosen Siemens Gamesa to supply the turbine blades for their £4 billion East Anglia TWO offshore wind farm. This agreement, worth more than £1 billion, solidifies Hull as the location for the blade production. In this interview, Chet Benham, President & COO of Viridi Energy, discusses their business and focus on renewable natural gas and its role in the energy transition. Additionally, AFRY has been selected by Electroperú to oversee the modernisation and life extension of two hydro power plants in Peru.

Nadhmi al-Nasr, CEO of Neom, the futuristic city development in Saudi Arabia, has suddenly stepped down and will be replaced by an acting CEO from the country's sovereign wealth fund. The Public Investment Fund's board deemed this a natural evolution and strategic move, but the reasons for Nasr's departure are unknown. Neom, envisioned as a 9-million-resident city with extravagant features like a floating business district and the world's tallest skyscrapers, has faced financial and leadership challenges since its announcement in 2017. With projects being delayed, downsized, or cancelled, securing foreign investors has become crucial, but the project's first phase has already exceeded its budget.

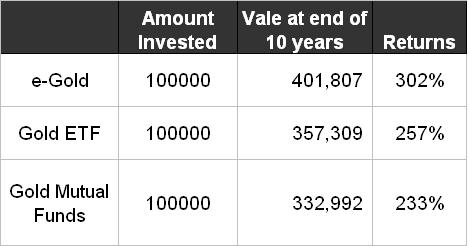

As investors, we aim to get maximum returns from our investments. However, market-linked investments can be risky. In order to diversify and ensure long-term stability, many investors turn to large cap mutual funds and gold exchange-traded funds (ETFs). In this article, we compare the performance of the top gold ETF and large cap mutual fund in terms of 10-year returns and explore the potential growth of a Rs 10 lakh investment in either option. While gold ETFs are traded like stocks and offer exposure to gold prices, large cap mutual funds provide stability through their high exposure to large cap stocks.

Vistara, a popular Indian full-service airline, has officially merged with national carrier Air India, forming the country's largest international airline and second-largest domestic carrier. The merger comes after several years of operation and will result in an enlarged entity with over 5,500 weekly flights across both domestic and international routes. The new integrated entity had its inaugural flights on Tuesday, with the Vistara code 'UK' being replaced with 'AI2XXX', and all check-in counters now bearing the Air India name. This merger marks the Tata Group's second major consolidation in the Indian aviation industry in the last two months, with the first being the integration of AIX Connect with Air India Express on October 1st.

As Bitcoin surges to a new high of $89,637, investors are attributing it to the optimism surrounding Trump's pro-crypto stance and promises to make America the "crypto capital of the planet". The surge has been dubbed the 'Trump trade', with stocks tied to the cryptocurrency market also seeing a rise. Analysts predict that Trump's potential crypto-friendly policies will lead to increased demand for digital assets and crypto-related stocks. With the talk of a crypto-friendly administration, the future of Bitcoin and other cryptocurrencies in the US market is heavily anticipated.

Kia India has revealed the name of its highly-anticipated new SUV, the Kia Syros. This cutting-edge vehicle not only boasts a stunning design, but also incorporates advanced technology and even draws inspiration from mythology. With this new SUV, Kia aims to connect emotionally with customers and provides a sneak peek through a teaser released on its official YouTube channel. From safety features to a modern and tech-savvy design, the Syros promises to deliver a powerful performance and unrivaled comfort.