ScottishPower has chosen Siemens Gamesa to supply the turbine blades for their £4 billion East Anglia TWO offshore wind farm. This agreement, worth more than £1 billion, solidifies Hull as the location for the blade production. In this interview, Chet Benham, President & COO of Viridi Energy, discusses their business and focus on renewable natural gas and its role in the energy transition. Additionally, AFRY has been selected by Electroperú to oversee the modernisation and life extension of two hydro power plants in Peru.

Renewable Energy Management: A Path to a Greener Future

Renewable energy, derived from inexhaustible sources like the sun, wind, and water, is playing an increasingly crucial role in the global energy landscape. As societies strive to reduce carbon emissions and mitigate climate change, the transition to renewable energy systems has become imperative.

Case Study: East Anglia TWO Offshore Wind Farm

ScottishPower has partnered with Siemens Gamesa to construct East Anglia TWO, a colossal offshore wind farm located in UK waters. With a total investment of £4 billion, the project is poised to generate 900 megawatts (MW) of clean energy, capable of powering over 750,000 homes annually.

The turbines for East Anglia TWO will be manufactured in Hull, UK, signifying a major boost to the local economy and creating numerous jobs. Siemens Gamesa's commitment to this endeavor underscores the growing importance of the renewable energy industry in the United Kingdom.

Viridi Energy's Focus on Renewable Natural Gas

Viridi Energy, a leading provider of renewable energy solutions, has prioritized renewable natural gas (RNG) in its business strategy. RNG is a clean-burning fuel produced from organic waste, offering a sustainable alternative to traditional fossil fuels.

In an interview, Chet Benham, President & COO of Viridi Energy, emphasized the company's commitment to RNG and its potential to reduce greenhouse gas emissions while meeting growing energy demands.

AFRY's Involvement in Peruvian Hydropower Projects

AFRY, an international engineering and design firm, has been entrusted by Electroperú to модернизировать and extend the life of two hydropower plants in Peru. These projects aim to enhance the efficiency and longevity of the existing infrastructure, ensuring a reliable and cost-effective source of renewable energy for the country.

Top 5 FAQs Related to Renewable Energy

1. What are the main advantages of renewable energy?

Renewable energy sources are clean, sustainable, and reduce reliance on fossil fuels, minimizing carbon emissions and mitigating climate change.

2. Is renewable energy affordable and cost-effective?

The cost of renewable energy technologies has decreased significantly in recent years, making them more competitive with traditional fossil fuels.

3. How can we ensure a reliable supply of renewable energy?

Energy storage systems, such as batteries and pumped-hydro storage, can help balance the intermittent nature of renewable energy sources and ensure a steady supply of power.

4. What role does renewable energy play in the fight against climate change?

Renewable energy can significantly reduce greenhouse gas emissions, particularly those associated with electricity generation and transportation.

5. How can individuals contribute to the transition to renewable energy?

Individuals can support renewable energy by choosing renewable energy providers, investing in renewable energy systems, and conserving energy.

Conclusion

The adoption of renewable energy management strategies is essential for creating a sustainable and climate-resilient future. Projects like East Anglia TWO, Viridi Energy's focus on RNG, and AFRY's involvement in Peruvian hydropower modernization exemplify the growing momentum behind this global transition. By harnessing the power of nature, we can reduce our carbon footprint, protect the environment, and secure a clean energy future for generations to come.

Nissan South Africa has officially opened its new headquarters in Irene, South Africa, which will serve as the hub for administrative and strategic operations in the country and its Independent Markets Africa division. The move to the new building will enhance collaboration, streamline processes, and provide a more productive and progressive work environment for the team. This decision aligns with modern practices of separating corporate headquarters from manufacturing operations and reflects Nissan's commitment to innovation and efficiency in engaging with the market and customers. The launch of the new Magnite vehicle in November also marks an auspicious month for Nissan South Africa.

Pokarna, a company with a market cap of Rs 2,231 crore, has announced a strategic investment of Rs 440 crore aimed at fulfilling the increasing demand for premium quartz surfaces worldwide. This marks the launch of the company's third Bretonstone production line from Italy's Breton S.p.A., which will set new standards for capacity and environmentally friendly production. However, the stock saw a decline of 9.96% in early trade as equity benchmark indices dropped due to a combination of factors such as retail inflation, muted quarterly earnings, and weak global markets.

NTPC Green Energy, a subsidiary of NTPC Ltd., will launch its IPO on November 19 with a price band of Rs 102-108 per share. The company will also have a shareholders category, allowing current NTPC shareholders to participate. Analysts are optimistic about the IPO, citing the company's operational capacity, contracted projects, and future development plans. With NTPC targeting 60GW of RE capacity by FY32, investors are advised to buy NTPC shares to increase their chances of IPO allotment.

Nadhmi al-Nasr, CEO of Neom, the futuristic city development in Saudi Arabia, has suddenly stepped down and will be replaced by an acting CEO from the country's sovereign wealth fund. The Public Investment Fund's board deemed this a natural evolution and strategic move, but the reasons for Nasr's departure are unknown. Neom, envisioned as a 9-million-resident city with extravagant features like a floating business district and the world's tallest skyscrapers, has faced financial and leadership challenges since its announcement in 2017. With projects being delayed, downsized, or cancelled, securing foreign investors has become crucial, but the project's first phase has already exceeded its budget.

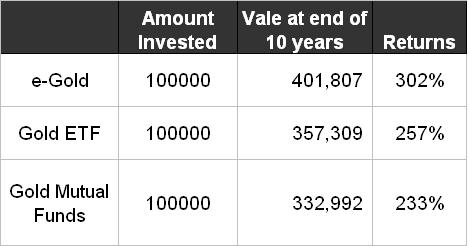

As investors, we aim to get maximum returns from our investments. However, market-linked investments can be risky. In order to diversify and ensure long-term stability, many investors turn to large cap mutual funds and gold exchange-traded funds (ETFs). In this article, we compare the performance of the top gold ETF and large cap mutual fund in terms of 10-year returns and explore the potential growth of a Rs 10 lakh investment in either option. While gold ETFs are traded like stocks and offer exposure to gold prices, large cap mutual funds provide stability through their high exposure to large cap stocks.

Vistara, a popular Indian full-service airline, has officially merged with national carrier Air India, forming the country's largest international airline and second-largest domestic carrier. The merger comes after several years of operation and will result in an enlarged entity with over 5,500 weekly flights across both domestic and international routes. The new integrated entity had its inaugural flights on Tuesday, with the Vistara code 'UK' being replaced with 'AI2XXX', and all check-in counters now bearing the Air India name. This merger marks the Tata Group's second major consolidation in the Indian aviation industry in the last two months, with the first being the integration of AIX Connect with Air India Express on October 1st.

As Bitcoin surges to a new high of $89,637, investors are attributing it to the optimism surrounding Trump's pro-crypto stance and promises to make America the "crypto capital of the planet". The surge has been dubbed the 'Trump trade', with stocks tied to the cryptocurrency market also seeing a rise. Analysts predict that Trump's potential crypto-friendly policies will lead to increased demand for digital assets and crypto-related stocks. With the talk of a crypto-friendly administration, the future of Bitcoin and other cryptocurrencies in the US market is heavily anticipated.

Kia India has revealed the name of its highly-anticipated new SUV, the Kia Syros. This cutting-edge vehicle not only boasts a stunning design, but also incorporates advanced technology and even draws inspiration from mythology. With this new SUV, Kia aims to connect emotionally with customers and provides a sneak peek through a teaser released on its official YouTube channel. From safety features to a modern and tech-savvy design, the Syros promises to deliver a powerful performance and unrivaled comfort.

On the verge of reaching a record-breaking $90,000, Bitcoin has experienced a surge in value since the election of Donald Trump as U.S. president. This growth in the world's biggest cryptocurrency is largely attributed to expectations of the Trump administration being more crypto-friendly. With allies like Elon Musk's Tesla and Trump's pro-digital assets stance, investors are confident in the success of the industry under Trump's leadership. This has also lead to an increase in demand for crypto stocks and currencies, solidifying the notion of the U.S. becoming the "crypto capital of the planet".