Waaree Energies, an Indian manufacturer of solar PV modules, will be launching its initial public offering (IPO) on Monday, October 21. The IPO includes a fresh share sale of Rs 3,600 crore and an offer-for-sale of up to 48,00,000 equity shares. The company plans to use the proceeds from the issue for establishing a new manufacturing facility and general corporate purposes. The IPO is expected to be listed on BSE and NSE on October 28.

Aeron Composite, a leading manufacturer of FRP products, has launched its initial public offering with a price band of Rs 121-125 per share. The company is looking to raise a total of Rs 56.10 crore through a fresh share sale, which will mainly be utilized for expansion and general corporate purposes. With a strong backing from anchor investors and a well-established manufacturing facility, Aeron Composite is set to make its mark in the market as it makes its debut on NSE next week.

Ola Electric, the first Indian electric two-wheeler manufacturer to go public, is gearing up to launch its IPO next month. The IPO will include a fresh issue of shares worth ₹5,500 crore and an offer for sale of 645.56 equity shares. Ola Electric is expected to have a GMP of 16% before its opening, with the IPO set at a price band of ₹72-76 per share. The company's shares will be listed on both the BSE and NSE on August 9, marking a significant milestone in the Indian electric vehicle industry.

Get ready to invest in India's leading travel booking platform, ixigo, as the company gears up to launch its mainboard initial public offering worth Rs 740 crores on June 10. With a price band of Rs 88 to Rs 93 per share, the IPO is expected to close on June 12 and to be listed on both BSE and NSE on June 18. The company has already mobilized Rs 333 crore from anchor investors ahead of its IPO. Don't miss out on this opportunity to be a part of the ever-growing travel industry in India.

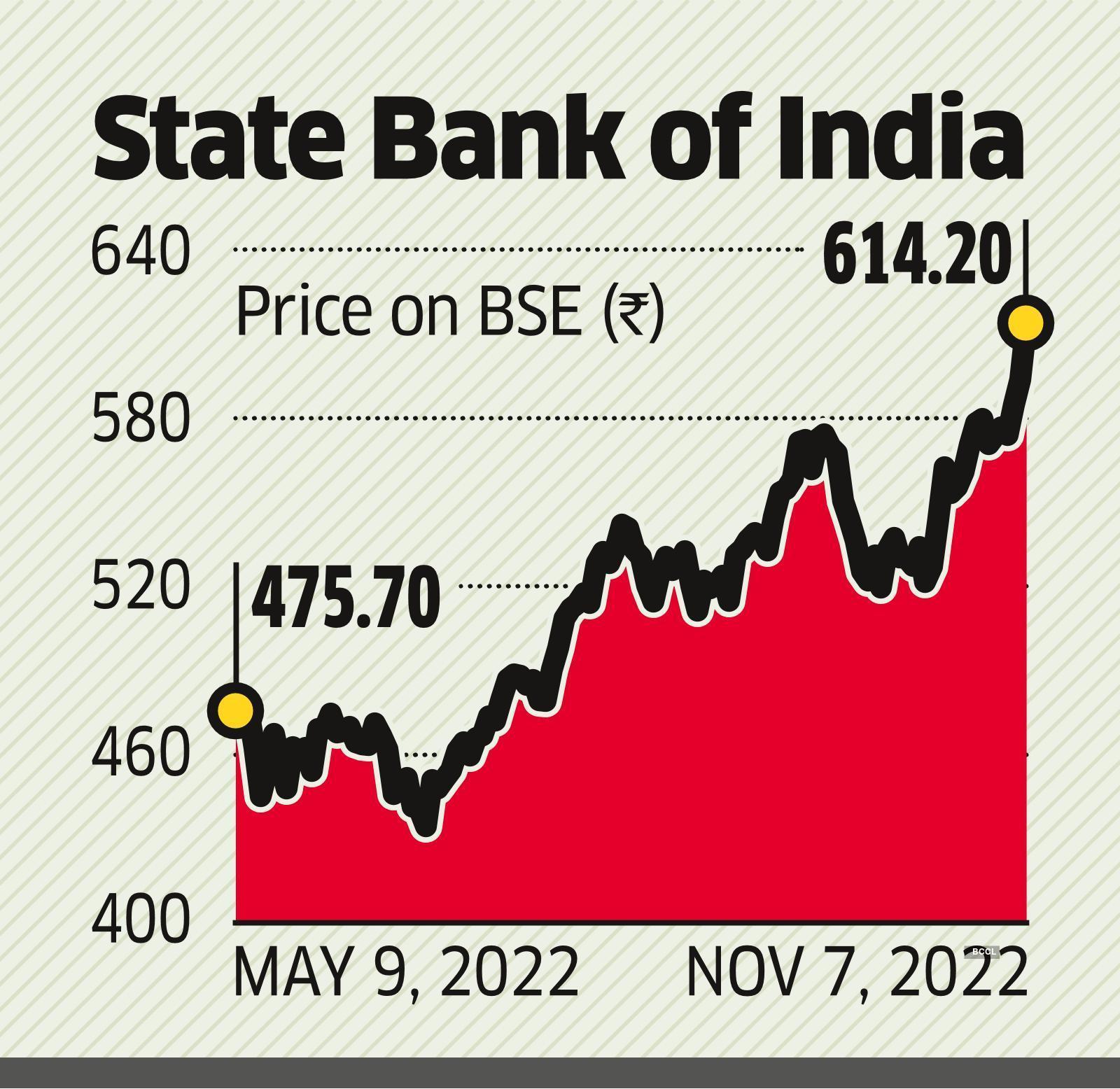

SBI's share price on the NSE saw a whopping 10% increase on Monday due to the positive sentiment surrounding the exit poll prediction of a BJP-win. This resulted in the bank's market capitalization crossing Rs 8 lakh crore for the first time. Analysts are also bullish on the stock, with a consensus 'buy' recommendation and a potential 11% upside. SBI also reported a strong profit in its March quarter results, further boosting investor confidence.

Angel One Limited, a Fintech company, saw an 8% increase in their share prices following the release of their Q4 numbers, which showed a 27% increase in profit after tax and a 64.3% increase in revenue year-on-year. The company also recently completed a capital raise of Rs 1,500 crore for future growth. With a 61.5% increase in their client base and a 79.4% increase in orders, Angel One is poised for continued success in the market.