Waaree Energies, an Indian manufacturer of solar PV modules, will be launching its initial public offering (IPO) on Monday, October 21. The IPO includes a fresh share sale of Rs 3,600 crore and an offer-for-sale of up to 48,00,000 equity shares. The company plans to use the proceeds from the issue for establishing a new manufacturing facility and general corporate purposes. The IPO is expected to be listed on BSE and NSE on October 28.

Waaree Energies IPO: India's Leading Solar Energy Player Enters Public Markets

Background

Waaree Energies is one of India's leading manufacturers of solar photovoltaic (PV) modules. Founded in 1989, the company has emerged as a key player in the country's rapidly growing solar power industry. Waaree Energies has a strong presence in both the domestic and international markets, with a global footprint spanning over 100 countries.

IPO Details

On October 21, 2021, Waaree Energies launched its initial public offering (IPO), marking the company's entry into the public markets. The IPO comprises of:

The proceeds from the issue will be utilized for:

The IPO is expected to be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on October 28, 2021.

Growth Prospects

The Indian solar power market is poised for significant growth in the coming years. Driven by government initiatives, such as the Jawaharlal Nehru National Solar Mission, the country is expected to become one of the world's largest solar power hubs. Waaree Energies is well-positioned to capitalize on this growth, given its strong brand presence, extensive distribution network, and focus on innovation.

FAQs

1. What is the price band for the IPO? The price band for the IPO has been set at Rs 224-235 per share.

2. How many shares are being offered in the IPO? The IPO comprises a total of 19,200,000 shares, including 15,269,231 fresh shares and 3,930,769 offer-for-sale shares.

3. What is the minimum lot size for the IPO? The minimum lot size for the IPO is 60 shares.

4. What is the expected listing date for the IPO? The IPO is expected to be listed on BSE and NSE on October 28, 2021.

5. What is the company's debt-to-equity ratio? As of March 31, 2021, Waaree Energies' debt-to-equity ratio was 0.31.

Indian Prime Minister Narendra Modi will be distributing more than 51,000 appointment letters to newly recruited youth through a virtual job fair in various government departments and organisations. This initiative, in its 15th edition, aims to provide meaningful employment opportunities for the country's youth and contribute to its progress. The recruitment drive, which has already offered over 10 lakh permanent government jobs since October 2022, highlights the government's commitment to tackling unemployment and empowering young individuals to participate in India's growth story. Additionally, the PM also highlighted India's partnership with 21 countries in improving migration and employment opportunities.

The Springfield Catholic Diocese's Bishop Thomas John Paprocki led a special Mass to honor the Sisters of St. Francis and celebrate the 100th anniversary of the founding of OSF HealthCare Saint Anthony's Health Center in Alton. The hospital, originally established as Saint Anthony's Infirmary, was the first Thuiner Franciscan house in the United States and has grown and adapted over the years while maintaining its founders' commitment to compassionate care. The hospital's Vice President of Operations and Special Projects credits the Sisters' determination and devotion to Christ's love for the hospital's success and continued impact on the community.

The Center for African and African American Studies at the University of Colorado Boulder is celebrating their recent receipt of a generous matching donation from Chancellor Philip P. DiStefano. With this support, the center aims to continue enriching the academic landscape and foster a sense of belonging for Africans, African Americans, and the African diaspora. Donations from individuals are greatly appreciated and will contribute to the center's growth and student opportunities. Interested in supporting the CAAAS? Contact Jazmin Brooks and join their Forever Buffs Black Alumni group or subscribe to their newsletter for updates.

In a recent podcast appearance, Ralph Lauren CEO Patrice Louvet shared his belief in a tough love approach to addressing serious issues at work. He emphasized the need for direct communication and not being afraid to use a "2X4 across the forehead" in critical situations. However, his comments have also sparked a debate on the effectiveness of this leadership style in today's modern workplace.

Tempest Advertising, a leading agency in purpose-driven creativity, has won the Gold Award in the Press Unreleased category at the 2025 IAA Olive Crown Awards for their striking campaign "Fast Fashion". Using AI technology, the campaign addresses the environmental impact of the fashion industry and calls for a shift towards more sustainable practices. With this win, Tempest solidifies its position as a leader in promoting responsible consumerism and guiding businesses towards a more sustainable future.

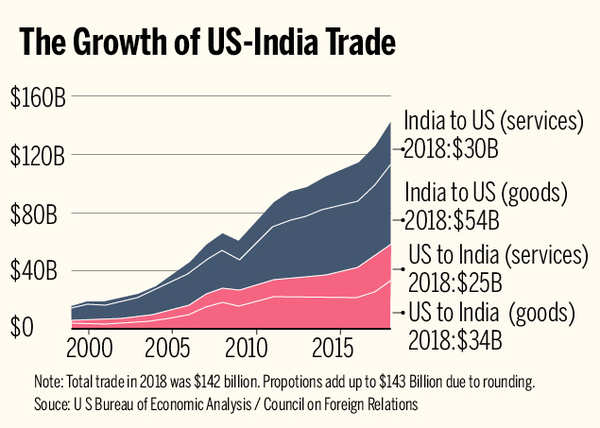

The highly anticipated bilateral trade agreement between India and the US is close to reaching a successful conclusion, according to US Treasury Secretary Scott Bessent. This deal would allow India to avoid the 26% reciprocal tariffs and increase trade to $500 billion by 2030. Negotiators from both countries are currently meeting in Washington to finalize the terms of the agreement, which is expected to be concluded by the fall of this year. With both sides eager to reach an agreement before the July tariff deadline, this deal has the potential to greatly benefit both nations' economies.

In a recent podcast interview, Ralph Lauren CEO Patrice Louvet discussed the delicate topic of giving criticism in the workplace. Louvet stressed the importance of addressing issues sooner rather than later, and how it can ultimately benefit both businesses and individual careers. He recognizes the difficulty in giving feedback, but advises a direct and honest approach in tackling major issues. However, for minor concerns, Louvet suggests focusing on employee strengths and gradually addressing weaknesses.

Suprabhat Mandal, a student from West Bengal, recently made headlines after successfully securing a position in three different banking exams. After a year of dedicated preparation, Mandal used the ADDA247 Bank Mahapack to help him learn from the basics to harder questions. Now, he is encouraging other successful candidates to share their stories and inspire others to never give up on their dreams.

British arts and crafts retailer Hobbycraft is undergoing a major restructuring of its retail operations under the ownership of private equity firm Modella Capital. While nine stores are set to close, including 72-126 jobs losses, the fate of other branches is still being reviewed. The company's CEO cited challenges faced by the retail sector as the reason for this necessary action.

In a move to boost economic ties between the two countries, US Vice-President JD Vance announced that America and India have finalized terms for a trade deal. This comes amid rising concerns over the impact of President Trump's reciprocal tariffs. Speaking at an event in Jaipur, Mr Vance emphasized the need for fair and mutually beneficial trade partnerships with countries that value labor rights and promote balanced, open, and stable global trade.