During his six-year tenure, RBI Governor Shaktikanta Das successfully steered India's monetary policy through various challenges, including the COVID-19 pandemic. Through measures such as a loan moratorium, lowering of repo rates, and loan restructurings, Das helped revive the Indian economy. His leadership also saw significant progress in digital finance and inclusive digital payments, making strides towards financial inclusion. His strict regulatory measures improved the health of the Indian banking sector and lowered inflation levels, contributing to a stable economy.

After the completion of Shaktikanta Das's three-year term as RBI Governor, the Government of India has appointed Revenue Secretary Sanjay Malhotra as his successor. With over 33 years of experience in diverse sectors such as finance and taxation, Malhotra is well-equipped to lead India's central bank. His appointment follows Das's extension, who initially took office after the sudden resignation of Urjit Patel.

On December 9, 2024, the Reserve Bank of India (RBI) made a significant change to its leadership as it announced Sanjay Malhotra as the new governor. Known for his strong consensus-building skills, Malhotra's appointment has been well-received by experts. In the upcoming RBI policy meeting, Malhotra's plans for inflation and economic growth are highly anticipated. Even with elevated rates, Governor Das believes that they will not hinder economic growth. Experts believe that the latest RBI credit policy effectively balances the concerns of inflation and growth.

In recent years, Reserve Bank of India Governor Shaktikanta Das has been recognized as the top central banker, achieving the feat for the second time. However, with India's economy facing challenges such as inflation and slow growth, Das has emphasized the need for careful consideration when striking a balance between promoting growth and maintaining price stability. In addition, the governor has called for banks to embrace artificial intelligence as a means of enhancing their operations and staying competitive. Further, Das has assured the public that the RBI is closely monitoring the markets and taking necessary action to ensure stability.

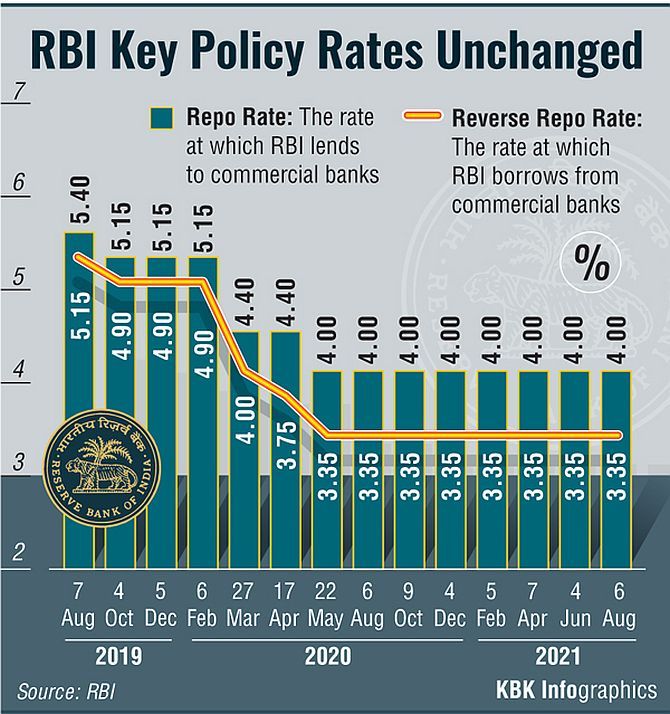

RBI Governor Shaktikanta Das announced that the Monetary Policy Committee (MPC) has decided to keep the policy repo rate unchanged at 6.5 per cent. He also stated that retail inflation remains above the targeted 4 percent, causing a need for a balanced approach towards monetary policy. The RBI also revised its growth projections for the current financial year to 7.2 per cent, with risks to the outlook being evenly balanced. Das emphasized the importance of maintaining a disinflationary approach and aligning inflation with the target in order to sustain price stability and support economic growth.

RBI Governor Shaktikanta Das will make an announcement on Friday morning regarding the next round of monetary policies, with expectations that the interest rate will remain at 6.5%. The central bank is likely to maintain its current stance on withdrawing accommodation, based on an SBI research paper that predicts a potential rate cut in the third quarter of the fiscal year. The decision will have significant impacts on the real estate sector, with experts noting that keeping the repo rate steady will support housing market affordability and overall economic growth.

RBI Governor Shaktikanta Das will announce the central bank's monetary policy decision at 10 am today, after a three-day meeting with the Monetary Policy Committee. While analysts expect the repo rate to remain unchanged at 6.5%, there might be a downward revision in FY25 GDP growth due to the high base effect. The RBI governor will also discuss current domestic and global economic situations and address a press conference at 12:00 pm. This will be the first monetary policy announcement since RBI hiked its interest rate in February 2023.

The RBI's Monetary Policy Committee has announced its decision to maintain the repo rate at 6.5%, for the seventh consecutive time. This means that for those whose loans are linked to the external benchmark, their EMIs will remain unchanged. The RBI Governor, Shaktikanta Das, has emphasized the importance of continuing to control inflation in order to ensure stable economic growth and has projected an inflation rate of 4.5% for the fiscal year 2025. Economists predict that there may be a series of rate cuts in the near future, possibly beginning in October of 2024, with a potential change in stance.

In its latest monetary policy review, the Reserve Bank of India (RBI) has decided to keep the key policy rate unchanged for the seventh consecutive time, in order to maintain stability in the economy and control inflation. However, RBI Governor Shaktikanta Das announced a new scheme for investment and trading in Sovereign Green Bonds in the International Financial Services Centre (IFSC), as well as the launch of a mobile app to widen the reach of its Retail Direct Scheme. The RBI will also continue its disinflationary policy to ensure a stable growth path for the economy.

The meeting of the Reserve Bank of India's Monetary Policy Committee, which started on Wednesday, will conclude today (Friday) with RBI Governor Shaktikanta Das announcing the latest monetary policy statement. The announcement, which is expected at 10 am, will cover decisions on key policy rates and a discussion on the current economic situation. The governor will also hold a press conference at 12 pm to address channel partners and provide further insights on the committee's decision.