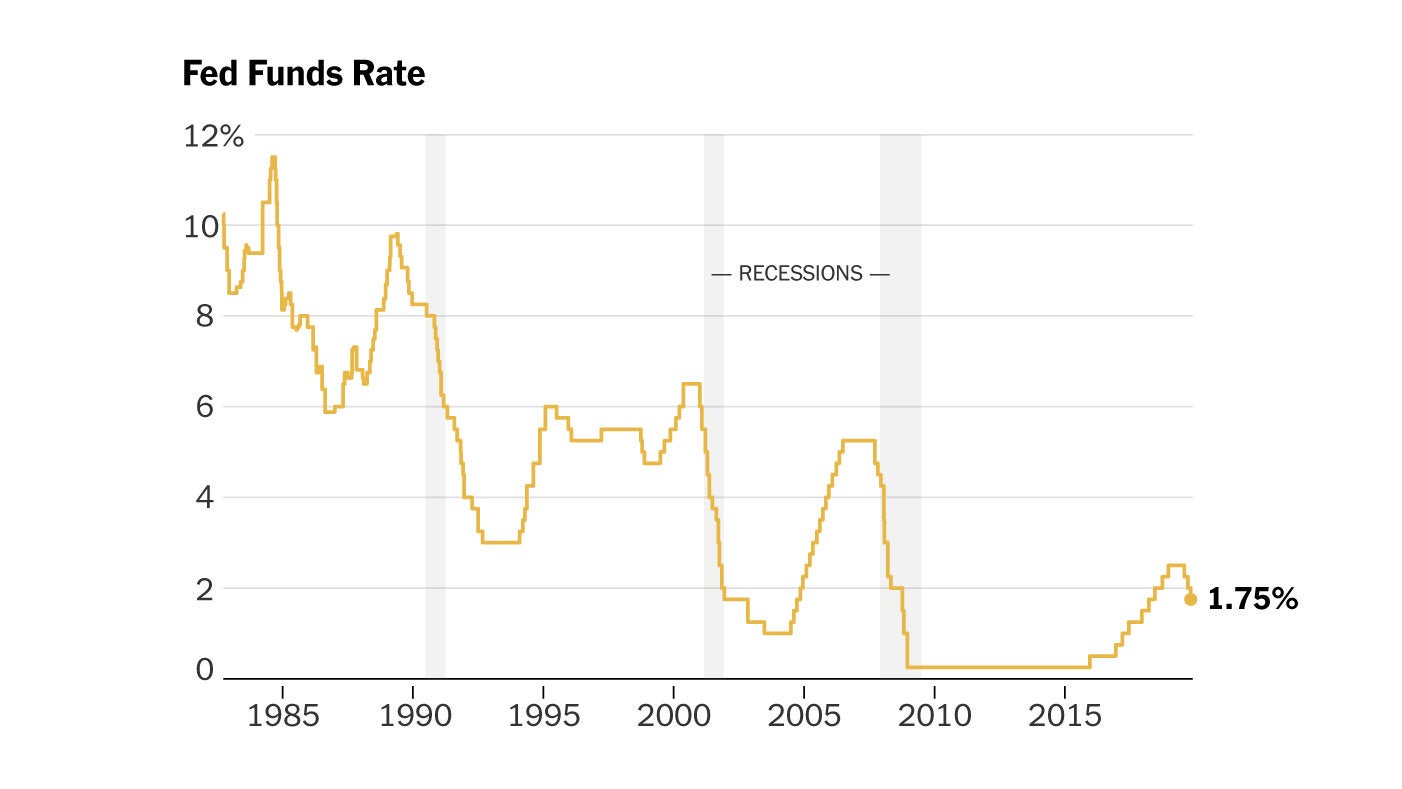

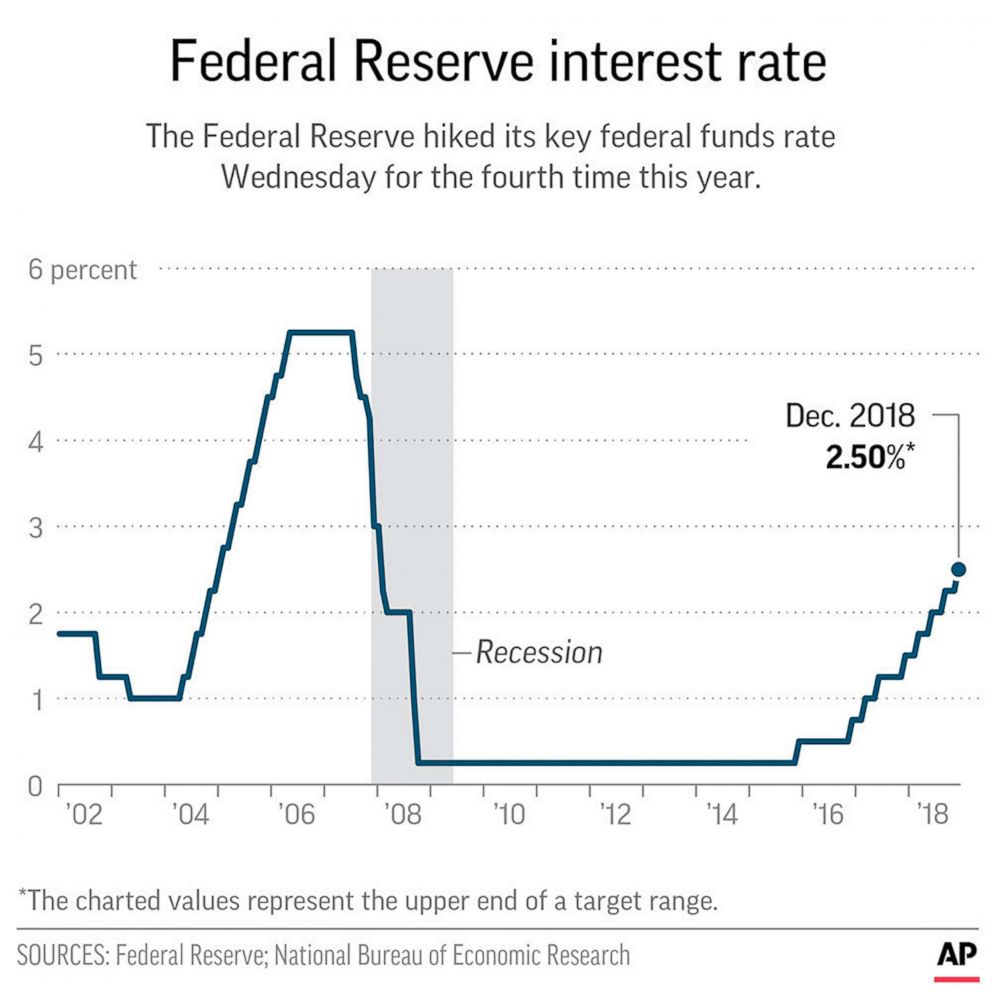

The US Federal Reserve announced a decision to cut key interest rates by 25 basis points, marking the third rate cut in three months. This move comes as the Fed attempts to keep the US economy strong and maintain a low unemployment rate. Despite the slight dip in US markets after the announcement, the Fed remains hopeful about the economy and has forecasted an increase in inflation for 2025.

Following the US Federal Reserve's decision to keep interest rates unchanged at 5.25-5.5 per cent in Wednesday's meeting, global equity markets have seen a surge. The dollar index has also taken a hit. Fed Chairman Jerome Powell, in his speech, hinted at a possible rate cut later this year if the economic outlook remains on track. He acknowledged a recent rise in inflation but expressed confidence in it heading towards 2 per cent. The incoming data on inflation will be crucial in shaping the Fed's decision on possible rate cuts.

US Federal Reserve Chair Jerome Powell affirmed that the economy would continue to grow despite elevated inflation rates, while also leaving interest rates unchanged and releasing new projections. However, the Fed still plans to implement three rate cuts this year and continue its "go-slow" approach to monetary policy. This news is positive for global stock markets and could also benefit US President Joe Biden's re-election campaign.

The Fed's decision to hold interest rates steady as expected had a significant impact on the currency market, causing the dollar to weaken and the yen to rise from near multi-decade lows. The central bank also projected three U.S. rate cuts this year, despite high inflation levels. Analysts note that the yield differential between U.S. Treasuries and Japanese government bonds will continue to put pressure on the yen, as it trades at a multi-decade low against the dollar. In contrast, the euro saw a slight increase, while Bitcoin experienced a surge of 6.4%.

Despite signs of higher-than-expected inflation, the Federal Reserve has announced that they will not be changing their key interest rate at their latest meeting. However, they have slightly raised their inflation forecasts and expect three rate cuts in 2025, down from their previous projection of four. This news comes as the Fed continues to balance a strong job market and economy with cooling inflation.

IIFL Holdings, a diversified financial services group with global presence, announced a unified customer service number, providing customers with a one-stop solution for all financial needs at their disposal. IIFL's customer care number will cater to queries and grievances related to gold loans, non-convertible debentures (NCDs), non-banking financial companies (NBFCs), insurance, and national pension system (NPS). This move by the company aims to enhance customer convenience and facilitate seamless communication for efficient service delivery.

The Federal Reserve has announced that they will not make any changes to interest rates in their most recent meeting, but they plan to potentially make three quarter-point cuts later in 2024. This news was met with positivity from investors as the stock market reached record highs. The Fed's decision was based on their unchanged outlook for the economy, despite higher-than-expected inflation in recent months. They remain cautiously optimistic and will continue to monitor the situation before making any changes.

In the recent FOMC meeting, the Federal Reserve decided to keep the federal funds rate unchanged, but made it clear through their messaging that interest rate cuts are on the horizon. Although no concrete policy changes were announced, the Fed's use of open-mouth operations signaled a shift towards a more accommodative stance. The removal of language related to further rate hikes from the official statement solidified the fact that the Fed's focus is now on assessing incoming data for future adjustments.