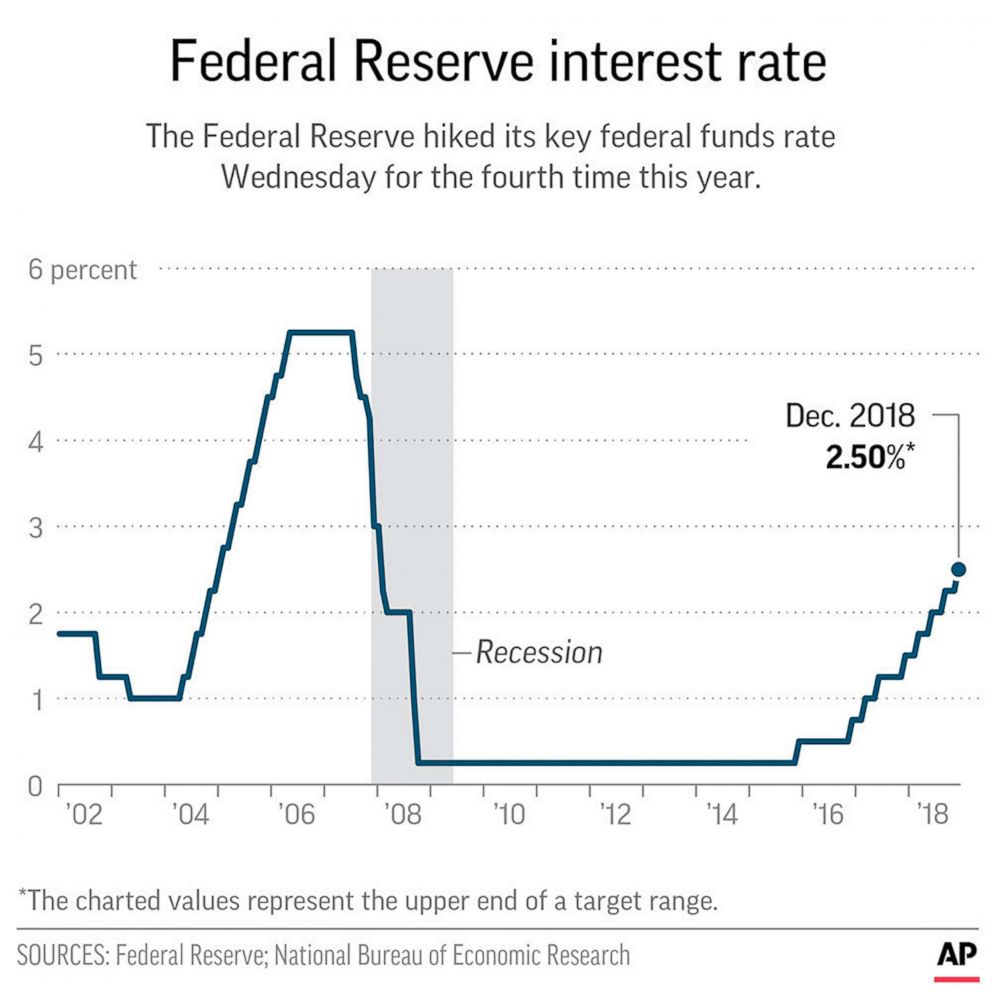

The Federal Reserve has announced that they will not make any changes to interest rates in their most recent meeting, but they plan to potentially make three quarter-point cuts later in 2024. This news was met with positivity from investors as the stock market reached record highs. The Fed's decision was based on their unchanged outlook for the economy, despite higher-than-expected inflation in recent months. They remain cautiously optimistic and will continue to monitor the situation before making any changes.

Federal Reserve Maintains Stable Interest Rates Amidst Inflationary Pressures

The Federal Reserve (Fed) recently concluded its meeting without altering interest rates, signaling a continued cautious approach towards monetary policy. However, the Fed indicated its intention to potentially implement three quarter-point cuts later this year.

Background

The Fed's primary mandate is to maintain price stability and promote economic growth. It achieves this through various monetary policy tools, including interest rates. Raising interest rates can curb inflation by making borrowing more expensive, while lowering interest rates can stimulate economic activity by making borrowing cheaper.

Rationale for Stable Rates

Despite recent inflationary pressures, the Fed has opted to keep interest rates unchanged. This decision is based on the Fed's assessment that the current inflation is largely due to supply chain disruptions and geopolitical factors, rather than excess demand. The Fed believes that these factors will eventually subside, allowing inflation to moderate.

Potential Rate Cuts

While the Fed is maintaining stability for now, it has signaled its willingness to potentially reduce interest rates later in the year. This decision is contingent upon the evolving economic outlook and inflation trends. If the economy weakens or inflation persists, the Fed could implement rate cuts to support growth and bring inflation down to its target level of 2%.

Market Reaction

The Fed's announcement was met with a positive response by investors. The stock market reached record highs as investors welcomed the Fed's cautious optimism and potential flexibility in lowering rates in the future.

Top 5 FAQs

1. Why has the Fed maintained interest rates?

The Fed believes that current inflation is largely due to temporary factors and that it will eventually moderate without the need for interest rate increases.

2. When might the Fed consider raising interest rates?

The Fed has not indicated a specific timeline for potential rate increases. It will continue to monitor inflation and the economy before making any decisions.

3. What are the potential consequences of rate cuts?

Lower interest rates can stimulate economic growth but may also lead to higher inflation if done excessively.

4. How does the Fed's decision affect consumers?

Stable interest rates typically benefit consumers by keeping borrowing costs low. However, prolonged inflation can erode purchasing power.

5. What factors does the Fed consider when setting interest rates?

The Fed considers various factors, including inflation, economic growth, unemployment, and financial stability, when making interest rate decisions.

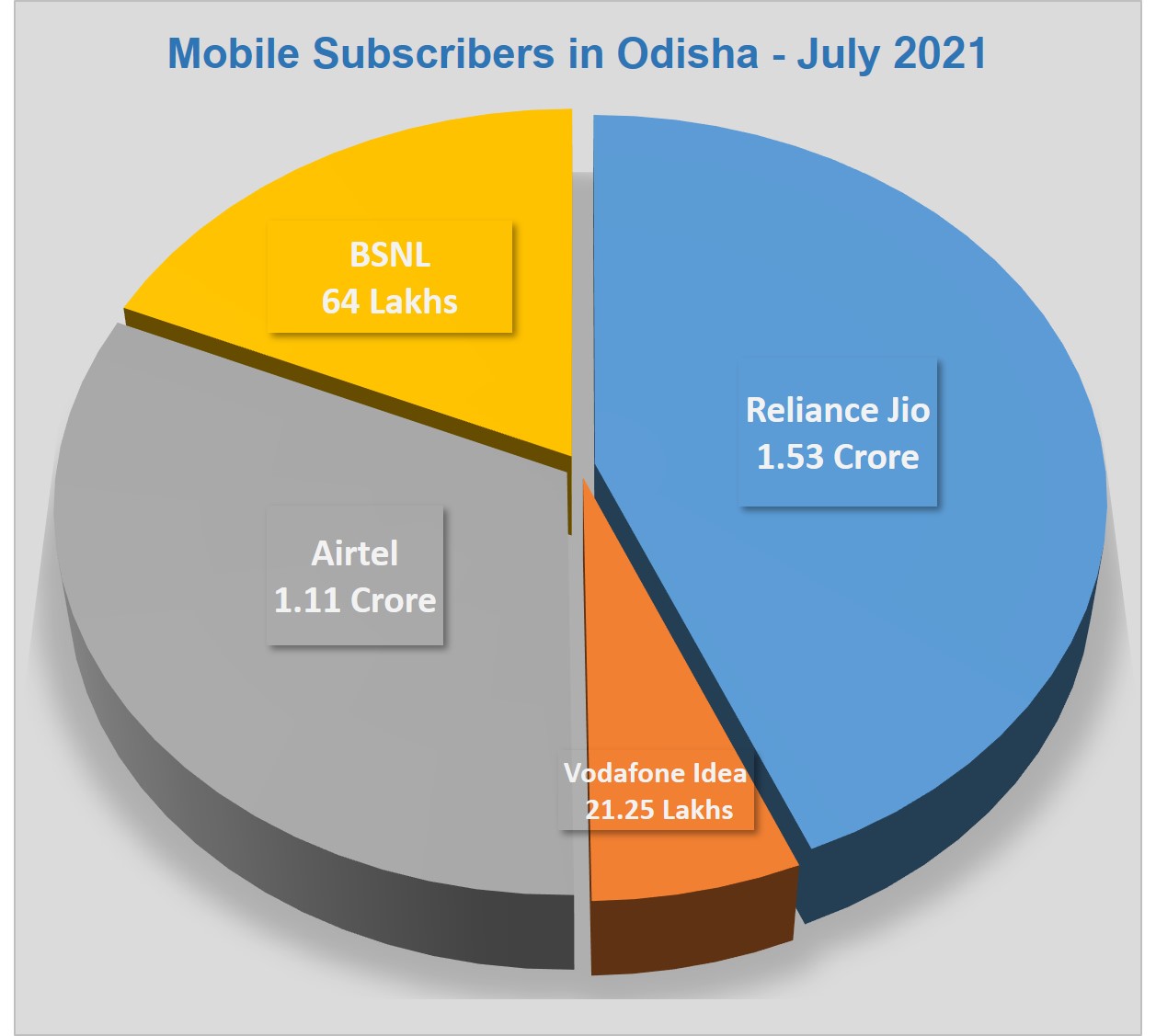

Shares of Bharti Airtel saw a surge after the company entered into a partnership with Elon Musk's SpaceX to offer satellite communication services in India, with a potential target market in remote areas. With Citi and JP Morgan maintaining a Buy rating and setting high stock targets, investors are buzzing about the company's potential for growth in the telecom industry. Despite uncertainties about regulatory approval and pricing, Airtel's new partnership has boosted the stock by 38% in the past year and 137% in the last 3 years, proving to be a lucrative investment.

The latest report from the Telecom Regulatory Authority of India (TRAI) shows that Reliance Jio added 3.9 million wireless subscribers in December 2024, solidifying its position as the dominant player in the Indian telecom market. Meanwhile, Vi and BSNL faced significant subscriber losses, with Vi losing 1.715 million subscribers and BSNL losing 0.322 million subscribers in the same period. In other news, Bharti Airtel has announced a partnership with Elon Musk's SpaceX to offer Starlink's high-speed internet services to customers in India, pending necessary approvals.

Harshil Agrotech Limited, a company with a long history in industrial design and fabrication, has recently changed its focus to the trading and manufacturing of agricultural products. This shift in the company's object clause reflects a growing trend in the market towards agro-based industries. With expert advice and support from IIFL Capital Services, investors can expect better recommendations and improved returns on their investments in Harshil Agrotech. Download the IIFL app to stay updated on the latest developments and make wise investment decisions.

In the fast-paced world of business, feedback is often seen as a reaction to isolated incidents, leading to biases and emotions that can hinder its effectiveness. To truly drive growth, leaders and HR professionals must shift the focus from immediate reactions to observable patterns of behavior. By creating a culture of psychological safety, feedback can become an opportunity for growth rather than a threat to self-esteem. However, this requires a rethinking of how feedback is delivered and received, as well as understanding common emotional responses and how to overcome them.

Telecom giant Bharti Airtel has partnered with SpaceX, owned by Elon Musk, to bring Starlink's high-speed internet to India. This marks a significant milestone for Airtel's commitment to satellite connectivity, with the venture pending regulatory approvals. The collaboration is expected to enhance Airtel's diverse service portfolio, providing reliable and affordable broadband to even the most remote areas in India. This partnership showcases Airtel's dedication to innovation and staying at the forefront of advancements in global connectivity, positioning them as a leading telecom operator globally.

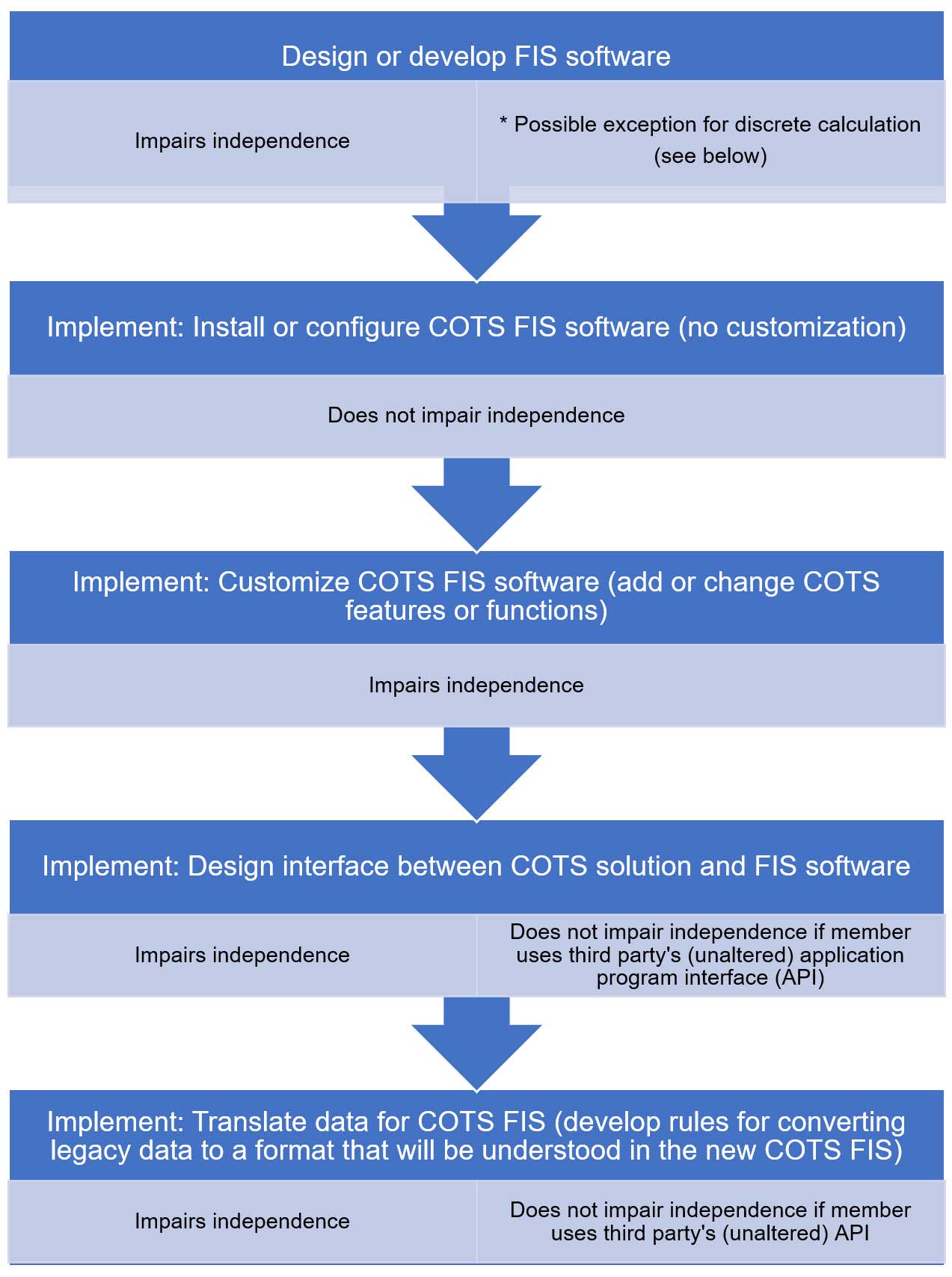

The AICPA Professional Ethics Executive Committee (PEEC) has released a discussion memorandum featuring preliminary conclusions about potential revisions to independence rules related to alternative practice structures. The memorandum aims to address the increasing prevalence of private-equity investment in accounting firms and stimulate feedback from the public. PEEC plans to use this feedback to create an exposure draft that includes a new interpretation of the independence rules, with a focus on issues surrounding auditor independence and private-equity-related entities. This initiative reflects the PEEC's commitment to protecting the public interest and ensuring the integrity of the attest function in the face of evolving industry practices.

Harshil Agrotech, a leading company in the agricultural industry, recently held a board meeting to discuss investment strategies and provide expert advice to customers. By signing up and agreeing to receive communication through Whatsapp, investors can now receive better recommendations and make more informed and successful investments. Additionally, IIFL has a dedicated customer care number for various investment services such as gold, NCD, NBFC, insurance, and NPS, making it easier for customers to get in touch with their team for any queries or concerns.

Patanjali Ayurveda Ltd. is all set to launch Asia's biggest orange processing plant in Nagpur, which aims to boost the local agricultural industry and provide employment opportunities for nearby villages. The inauguration, to be attended by Nitin Gadkari and Devendra Fadnavis, will be a step towards a zero-waste system and expanding the scope to other fruits like lime, amla, and pomegranate. This project showcases Patanjali's commitment to delivering high-quality products and tapping into both local and export markets.

Kelvin Kao, a business owner, discusses the need for a re-evaluation of traditional once-a-year appraisals and suggests alternative methods for providing feedback in the workplace. Companies are increasingly moving away from the annual review and instead opting for real-time feedback through tools like Slack or casual conversations. While this change may bring relief to some, others may question the value and effectiveness of the traditional review process. Still, the question remains - is the annual review truly obsolete or is it simply evolving?

Air India addresses allegations that an elderly passenger was injured due to the airline's failure to provide a pre-booked wheelchair at Delhi Airport. The airline maintains that the wheelchair was provided and used, but the passenger may have suffered injuries due to other factors. Air India emphasizes its commitment to providing quality service to all passengers, including those with special needs.