Wipro’s shares saw a significant surge on October 14, after the company announced that its board will discuss a proposal for issuing bonus shares in its upcoming meeting. The stock price reached an intraday high of ₹545.35 and closed at ₹550.70 per share, showing a gain of 4.04%. Bonus shares, which are issued free of cost to existing shareholders, do not impact the company’s overall market capitalization. The proposal for these bonus shares will be reviewed by Wipro’s board in a meeting scheduled for October 16-17, 2024. Investors can seek expert advice from IIFL by contacting their customer care number for queries related to gold, NCDs, NBFC, insurance, and NPS.

Background

Wipro Limited is a leading global information technology, consulting, and business process services company. Headquartered in Bangalore, India, the company has a presence in over 67 countries and employs over 250,000 people. Wipro's stock has been listed on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) since 1980.

Recent Developments

On October 14, 2024, Wipro's stock price witnessed a significant surge after the company announced that its board of directors would discuss a proposal for issuing bonus shares at its upcoming meeting. The stock price reached an intraday high of ₹545.35 and closed at ₹550.70 per share, showing a gain of 4.04%.

What are Bonus Shares?

Bonus shares are additional shares that are issued to existing shareholders free of cost. They are typically issued based on a specific ratio, such as one bonus share for every two existing shares. Bonus shares do not impact the company's overall market capitalization but can enhance shareholder value by increasing the number of shares held.

Wipro's Bonus Share Proposal

Wipro's board will review the proposal for bonus shares at a meeting scheduled for October 16-17, 2024. The specific ratio and other details of the bonus share issuance have not been disclosed at this time.

FAQs

1. What is the benefit of receiving bonus shares?

Bonus shares can enhance shareholder value by increasing the number of shares held and potentially leading to higher dividend payouts and capital gains.

2. How do bonus shares affect a company's financial position?

Bonus shares do not impact the company's overall market capitalization or profitability. They simply increase the number of shares outstanding.

3. What is the purpose of Wipro's bonus share proposal?

The purpose of Wipro's bonus share proposal may be to reward existing shareholders, increase the number of shares in the market, and potentially make the stock more affordable for retail investors.

4. What is the historical trend of Wipro's bonus share announcements?

Wipro has a history of issuing bonus shares periodically. Its previous bonus share issuance was in 2018, when the company issued one bonus share for every three shares held.

5. Should I invest in Wipro's stock based on the bonus share announcement?

Investment decisions should be based on a comprehensive evaluation of the company's financial performance, growth prospects, and overall market conditions. The bonus share announcement alone may not be enough to justify an investment decision.

Indians across the Hindu religion will celebrate Valmiki Jayanti on October 17, 2024, as they mark the birth anniversary of Maharishi Valmiki. Known as the Adi Kavi, or the first poet of Sanskrit literature, Valmiki authored the epic Ramayana, a collection of 24,000 verses and 7 cantos. The day, also known as Pargat Diwas, is celebrated traditionally on the full moon day of Ashwin in the Hindu calendar, and is commonly referred to as Panchanga. Share in the festivities with Valmiki Jayanti Wishes, quotes, greetings, and photos to commemorate the occasion.

In a much-awaited announcement, Reliance Industries may declare the record date for their bonus share issuance, doubling the shares of every shareholder. This would mark the largest bonus issue in the stock market and is being considered a Diwali gift for investors. The decision may be taken on October 14, along with the company's quarterly and half-yearly results. This is the sixth bonus issue for Reliance since their IPO, reflecting their commitment to providing continuous benefits to their shareholders.

United Airlines has seen a 70.4% increase in stock value over the past 12 months, with its fourth quarter already showing a 20% increase. This comes after the airline announced a successful third-quarter earnings report and a $1.5 billion stock buyback program. Options traders and analysts are responding positively to the news, with a surge in trading and multiple price target hikes. The stock's short interest has also increased, further contributing to the positive momentum.

Waaree Energies, a leading Indian manufacturer of solar PV modules, has announced its IPO with a price band of Rs 1,427-1,503 per share. The IPO includes a fresh share sale of Rs 3,600 crore and an offer-for-sale of up to 48,00,000 equity shares. The solar company aims to raise Rs 4,321.44 crore and has a subsidiary, Waaree Renewable Technologies Limited, leading its solar EPC business. Investors can apply for a minimum of 9 equity shares and its multiples thereafter, with bidding closing on October 23.

In a welcome move, the Indian government has announced a 3% increase in Dearness Allowance (DA) for central government employees and pensioners, effective from July 1. This decision comes just in time for the festive season, bringing joy to more than 1 crore households. Union Minister Ashwini Vaishnaw confirmed that this adjustment follows a previous 4% increase in March, aligning with the Seventh Central Pay Commission's recommendations. The estimated annual financial implication of this move is Rs 9,448 crore.

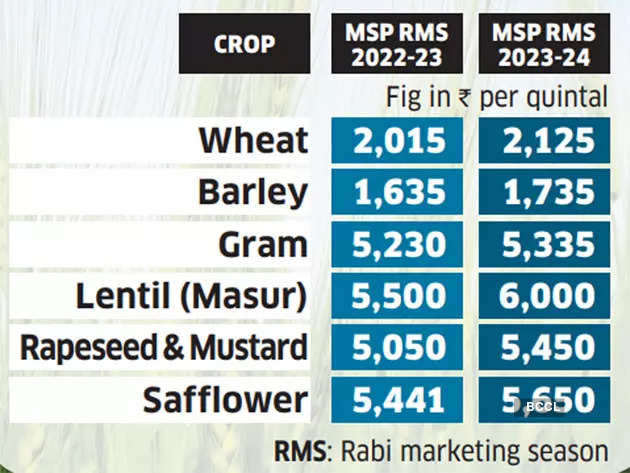

The Economic Coordination Committee, led by Prime Minister's Adviser Finance Dr. Abdul Hafeez Shaikh, has proposed a minimum support price of 1600 rupees for next year's wheat crop. This decision, which follows four previous revisions since 2010-2011, aims to boost wheat production and stabilize the market for increased profitability for farmers. In addition, the committee has also approved an increase in wheat imports through international bidding and a government-to-government deal with the Russian Federation, in order to meet the demand for wheat in the country.

Rediff Money Desk, based in New Delhi, has recently announced a wave of upcoming IPOs in the business world. These include Waaree Energies, MobiKwik, Premier Energies, Garuda Construction, Kross, Tolins Tyres, Hyundai Motor India, and Baazar Style Retail. With raising amounts ranging from Rs 69 crore to a whopping Rs 27,870 crore, these IPOs are expected to bring major changes and advancements in their respective industries. Stay tuned for potential investment opportunities and witness the growing impact of these companies in the global market.

Waaree Energies, an Indian manufacturer of solar PV modules, will be launching its initial public offering (IPO) on Monday, October 21. The IPO includes a fresh share sale of Rs 3,600 crore and an offer-for-sale of up to 48,00,000 equity shares. The company plans to use the proceeds from the issue for establishing a new manufacturing facility and general corporate purposes. The IPO is expected to be listed on BSE and NSE on October 28.

Rexel, a leading electrical and energy solutions company, saw a nearly 10% jump in its stock after announcing its rejection of a takeover bid from QXO. The bid was deemed too low by Rexel's board and analysts agree, citing the company's strong growth potential and management's history of creating shareholder value. While there are some potential risks, Rexel's solid position in the market and recent successes make it a promising investment for the future.

New Zealand's leading energy company, Contact Energy, has started feeding power from its newly built $300 million geothermal power station, Te Huka Unit 3, into the country's national grid. The station is expected to run at full capacity of 51.4 megawatts and power the equivalent of 60,000 homes near Taupō. This marks a significant milestone for Contact Energy and showcases their ability to invest, build, and deliver world-class renewable assets. Once formal compliance testing is complete, the station is expected to become fully operational by the end of the year, signaling an exciting time for the growth and potential of geothermal energy.