Rexel, a leading electrical and energy solutions company, saw a nearly 10% jump in its stock after announcing its rejection of a takeover bid from QXO. The bid was deemed too low by Rexel's board and analysts agree, citing the company's strong growth potential and management's history of creating shareholder value. While there are some potential risks, Rexel's solid position in the market and recent successes make it a promising investment for the future.

Rexel Rejects Takeover Bid, Stock Soars

French electrical and energy solutions company Rexel recently made headlines after rejecting a takeover bid from QXO, a Swiss-based company that specializes in energy and technology solutions. The bid was swiftly dismissed by Rexel's board, citing its undervaluation of the company.

Background

Rexel is a global leader in the electrical and energy distribution sector, with operations in over 30 countries. The company has a strong track record of growth and profitability, and has consistently delivered solid returns to its shareholders.

Rationale for Rejection

Rexel's board determined that QXO's offer of €42 per share significantly undervalued the company. According to analysts, Rexel's strong growth potential and management's history of creating shareholder value justify a higher valuation.

Stock Performance

Following the announcement of the rejected takeover bid, Rexel's stock price surged by nearly 10%. This surge reflects investor confidence in the company's future prospects and its ability to continue delivering strong returns.

Top 5 FAQs

1. Why did QXO make a takeover bid for Rexel?

QXO likely identified Rexel as a strategic acquisition target due to its strong market position, geographic reach, and proven track record of success.

2. What are the potential risks of investing in Rexel?

While Rexel is a solid company with a bright future, there are always risks associated with investing in the stock market. These risks include economic downturns, competitive pressures, and regulatory changes.

3. What is Rexel's long-term growth strategy?

Rexel aims to continue its growth through organic expansion, acquisitions, and partnerships. The company is particularly focused on emerging markets and digital solutions.

4. Does Rexel pay dividends to shareholders?

Yes, Rexel has a history of paying dividends to its shareholders. The company's dividend policy is to distribute approximately 50% of its net income to shareholders.

5. What is the outlook for Rexel's stock price?

Analysts are generally optimistic about Rexel's long-term prospects. The company's strong market position, diversified operations, and experienced management team support a positive outlook for the stock price.

United Airlines has seen a 70.4% increase in stock value over the past 12 months, with its fourth quarter already showing a 20% increase. This comes after the airline announced a successful third-quarter earnings report and a $1.5 billion stock buyback program. Options traders and analysts are responding positively to the news, with a surge in trading and multiple price target hikes. The stock's short interest has also increased, further contributing to the positive momentum.

Waaree Energies, a leading Indian manufacturer of solar PV modules, has announced its IPO with a price band of Rs 1,427-1,503 per share. The IPO includes a fresh share sale of Rs 3,600 crore and an offer-for-sale of up to 48,00,000 equity shares. The solar company aims to raise Rs 4,321.44 crore and has a subsidiary, Waaree Renewable Technologies Limited, leading its solar EPC business. Investors can apply for a minimum of 9 equity shares and its multiples thereafter, with bidding closing on October 23.

In a welcome move, the Indian government has announced a 3% increase in Dearness Allowance (DA) for central government employees and pensioners, effective from July 1. This decision comes just in time for the festive season, bringing joy to more than 1 crore households. Union Minister Ashwini Vaishnaw confirmed that this adjustment follows a previous 4% increase in March, aligning with the Seventh Central Pay Commission's recommendations. The estimated annual financial implication of this move is Rs 9,448 crore.

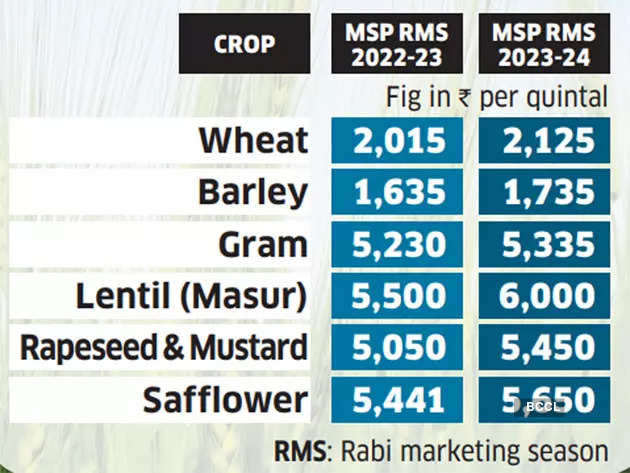

The Economic Coordination Committee, led by Prime Minister's Adviser Finance Dr. Abdul Hafeez Shaikh, has proposed a minimum support price of 1600 rupees for next year's wheat crop. This decision, which follows four previous revisions since 2010-2011, aims to boost wheat production and stabilize the market for increased profitability for farmers. In addition, the committee has also approved an increase in wheat imports through international bidding and a government-to-government deal with the Russian Federation, in order to meet the demand for wheat in the country.

Rediff Money Desk, based in New Delhi, has recently announced a wave of upcoming IPOs in the business world. These include Waaree Energies, MobiKwik, Premier Energies, Garuda Construction, Kross, Tolins Tyres, Hyundai Motor India, and Baazar Style Retail. With raising amounts ranging from Rs 69 crore to a whopping Rs 27,870 crore, these IPOs are expected to bring major changes and advancements in their respective industries. Stay tuned for potential investment opportunities and witness the growing impact of these companies in the global market.

Waaree Energies, an Indian manufacturer of solar PV modules, will be launching its initial public offering (IPO) on Monday, October 21. The IPO includes a fresh share sale of Rs 3,600 crore and an offer-for-sale of up to 48,00,000 equity shares. The company plans to use the proceeds from the issue for establishing a new manufacturing facility and general corporate purposes. The IPO is expected to be listed on BSE and NSE on October 28.

New Zealand's leading energy company, Contact Energy, has started feeding power from its newly built $300 million geothermal power station, Te Huka Unit 3, into the country's national grid. The station is expected to run at full capacity of 51.4 megawatts and power the equivalent of 60,000 homes near Taupō. This marks a significant milestone for Contact Energy and showcases their ability to invest, build, and deliver world-class renewable assets. Once formal compliance testing is complete, the station is expected to become fully operational by the end of the year, signaling an exciting time for the growth and potential of geothermal energy.

Stay updated on Hyundai's public offering which is the largest ever in India, valued at Rs 27,870 crore and opened today. Just a day prior, the company secured Rs 8,315 crore from over 200 anchor investors. This IPO is the biggest yet in India, and you can track live GMP updates and more.

Wipro’s shares saw a significant surge on October 14, after the company announced that its board will discuss a proposal for issuing bonus shares in its upcoming meeting. The stock price reached an intraday high of ₹545.35 and closed at ₹550.70 per share, showing a gain of 4.04%. Bonus shares, which are issued free of cost to existing shareholders, do not impact the company’s overall market capitalization. The proposal for these bonus shares will be reviewed by Wipro’s board in a meeting scheduled for October 16-17, 2024. Investors can seek expert advice from IIFL by contacting their customer care number for queries related to gold, NCDs, NBFC, insurance, and NPS.