A war of words has erupted in the stock market after RPG Enterprises chairman Harsh Goenka accused brokers in Kolkata of inflating stock prices and engaging in malpractices similar to the infamous Harshad Mehta and Ketan Parekh era. The Association of National Exchanges Members of India (ANMI) has condemned Goenka's statement, calling it baseless and lacking evidence, and demanding an apology. ANMI and Zee Business managing editor Anil Singhvi have also pointed out the robust surveillance measures in place by the Securities Exchange Board of India and exchanges to monitor any irregularities in the stock market.

RPG Chairman's Accusations Ignite Stock Market Controversy

Harsh Goenka, the chairman of RPG Enterprises, has ignited a firestorm of controversy in the Indian stock market with his accusations that brokers in Kolkata are engaged in malpractice and manipulating stock prices, reminiscent of the infamous Harshad Mehta and Ketan Parekh era.

Background

Harshad Mehta and Ketan Parekh were stockbrokers who masterminded massive stock market scams in India during the 1990s. Mehta, known as the "Big Bull," used dubious methods to inflate stock prices, leading to a historic market crash in 1992. Similarly, Parekh manipulated markets in 2001, resulting in losses of billions of rupees.

Current Controversy

Goenka's accusations stem from a recent surge in share prices of several Kolkata-based companies. He alleged that brokers were engaging in "pump and dump" schemes, artificially inflating prices and then selling off their holdings at inflated rates.

Response from ANMI and Zee Business

The Association of National Exchanges Members of India (ANMI) strongly condemned Goenka's statement, calling it "baseless and unfounded." ANMI highlighted the robust surveillance measures in place by the Securities and Exchange Board of India (SEBI) and exchanges to prevent irregularities.

Similarly, Zee Business managing editor Anil Singhvi dismissed Goenka's claims, asserting that the stock market is regulated with strict oversight and any attempts at manipulation would be quickly detected.

Top 5 FAQs

1. What are the specific allegations made by Harsh Goenka?

Goenka accused brokers in Kolkata of inflating stock prices and engaging in malpractices similar to the Harshad Mehta and Ketan Parekh scams.

2. How have the accused brokers responded?

Brokers have denied the allegations and stated that the recent price surge is due to strong fundamentals and not manipulation.

3. What is the role of SEBI in this matter?

SEBI is closely monitoring the situation and has stated that it will investigate any irregularities.

4. Are there any regulatory measures in place to prevent stock market manipulation?

Yes, SEBI has implemented robust surveillance systems that monitor market activity and detect any suspicious trading patterns.

5. What are the potential consequences for those found guilty of manipulation?

Individuals or companies found guilty of manipulating stock prices could face penalties, fines, or even imprisonment.

Shashi Ruia started his career under the guidance of his father and went on to establish the Essar Group as a global conglomerate. He was an iconic figure in the Indian business world, having been involved in various influential organizations such as FICCI and the PM's Indo-US CEO's Forum. His contributions to the corporate landscape will be remembered and honored by many.

Shashi Ruia, co-founder of the multinational conglomerate, Essar Group, has passed away at the age of 80. In light of this tragedy, the company has appointed Manu Kapoor as its new group chief, effective immediately. The news has garnered international attention, with even the Prime Minister of Israel expressing his condolences. The group has also announced its plans to create the world's first decarbonized refinery in the UK, showcasing its commitment to sustainability and innovation.

Shashi Ruia, the co-founder of Essar Group, passed away at the age of 81, leaving behind a diverse portfolio of assets worth $14 billion. Ruia, who began his career in 1965 under the mentorship of his father, played a crucial role in shaping Essar's growth and diversification. He was also actively involved in various national bodies and industry associations. The funeral procession will depart from Ruia House at 4 pm on Tuesday, as Essar Group and the business community mourn the loss of a visionary leader.

After seven long years of perseverance and refinement, Shantanu Deshpande, founder and CEO of Bombay Shaving Company, announced on X (formerly Twitter) that his company has finally secured a deal with top hotel chain Taj Hotels. Despite initial rejection and setbacks, Deshpande and his team never gave up and worked tirelessly to align their offerings with Taj's high standards. Deshpande also shared valuable lessons he learnt during the seven-year process, including the importance of price, customer preferences, supply chain readiness, and the power of perseverance.

The Cabinet Committee on Economic Affairs has approved the PAN 2.0 project, worth Rs 1,435 crore, to enhance the taxpayer experience. The new version aims to streamline businesses and citizen-centric operations by using technology-driven transformation and a QR code feature. Union Minister Ashwini Vaishnaw explains that there will be no need for individuals to modify their current PAN and the new card will be introduced as an upgrade. With over 78 crore PAN cards issued to date, this development is expected to benefit the majority of individuals and small businesses.

National Milk Day commemorates the birth anniversary of the "Father of the White Revolution" in India, Dr. Verghese Kurien, who played a pivotal role in transforming the country into the largest producer of milk globally. This day celebrates the importance of milk as a vital source of nutrition and its economic contributions, with a focus on Dr. Kurien's initiatives under Operation Flood that revolutionized the dairy industry and empowered millions of rural farmers. This year, on November 26, various dairy institutions across the country will honor Dr. Kurien's legacy and discuss policies and innovations to further strengthen the dairy sector.

Shashikant Ruia, Chairman of Essar Group, passed away at the age of 81, leaving behind a legacy of unparalleled contributions to the business world. Under his visionary leadership, Essar group diversified and grew into a global conglomerate, generating revenues of US $14 billion. Ruia's commitment to community upliftment and philanthropy also left a lasting impact on millions of lives. His demise has left a void in the business world that will be hard to fill.

A detailed analysis of how the BJP has performed in Maharashtra and Jharkhand, in the 25 aspirational districts designated by the Niti Aayog. According to a report, the performance of the BJP has not been very promising in these districts, raising questions about the party's policies and initiatives towards development and progress. As the elections approach, this report highlights the importance of addressing the issues faced by the people in these regions, and the need for better policies and strategies to address them effectively.

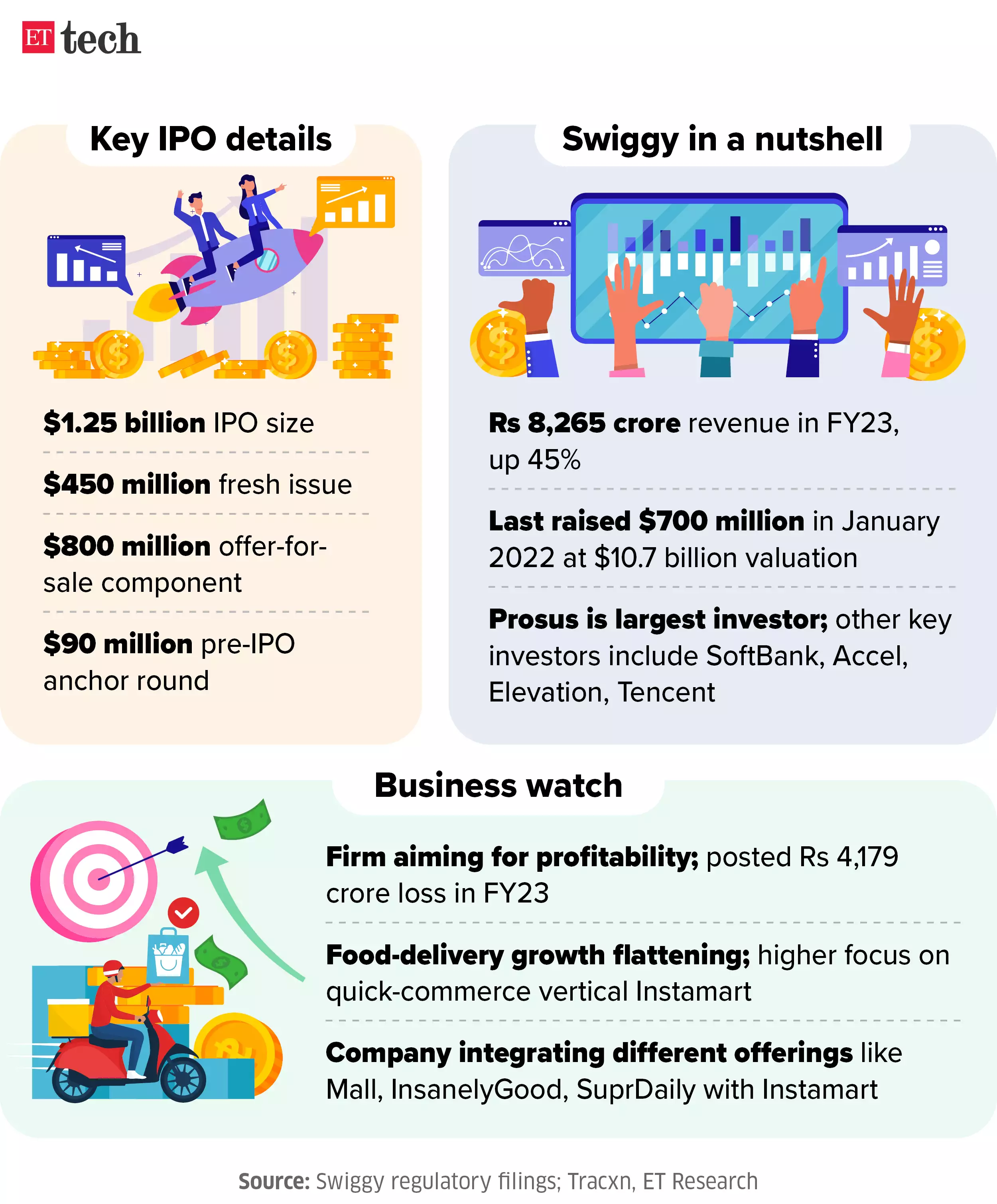

The food and grocery delivery company Swiggy Ltd is set to debut on the stock exchanges with an initial public offering of Rs 11,300 crore, making it the second-largest issue in the primary markets this year. Analysts are predicting that Swiggy's shares may see a flat or negative listing, and are advising investors who have not been allotted shares to wait for the share price to settle before buying. Despite being a major player in the e-commerce and food delivery market, Swiggy's IPO received a sluggish response, with concerns over its negative cash flow business model and high competition leading to lackluster interest from non-institutional investors and retail investors.

The allotment of shares for the highly anticipated NTPC Green Energy IPO has been finalized, with investors receiving bank debit messages. The IPO was oversubscribed by 2.55 times, with shares set to list on the BSE and NSE on November 27. In the grey market, the stock is currently trading at a Rs 4 premium, with experts predicting further improvements as the Indian stock market sees a rally. Interested investors can easily check the IPO allotment status online using the BSE, NSE, or Kfin Technologies' portals.