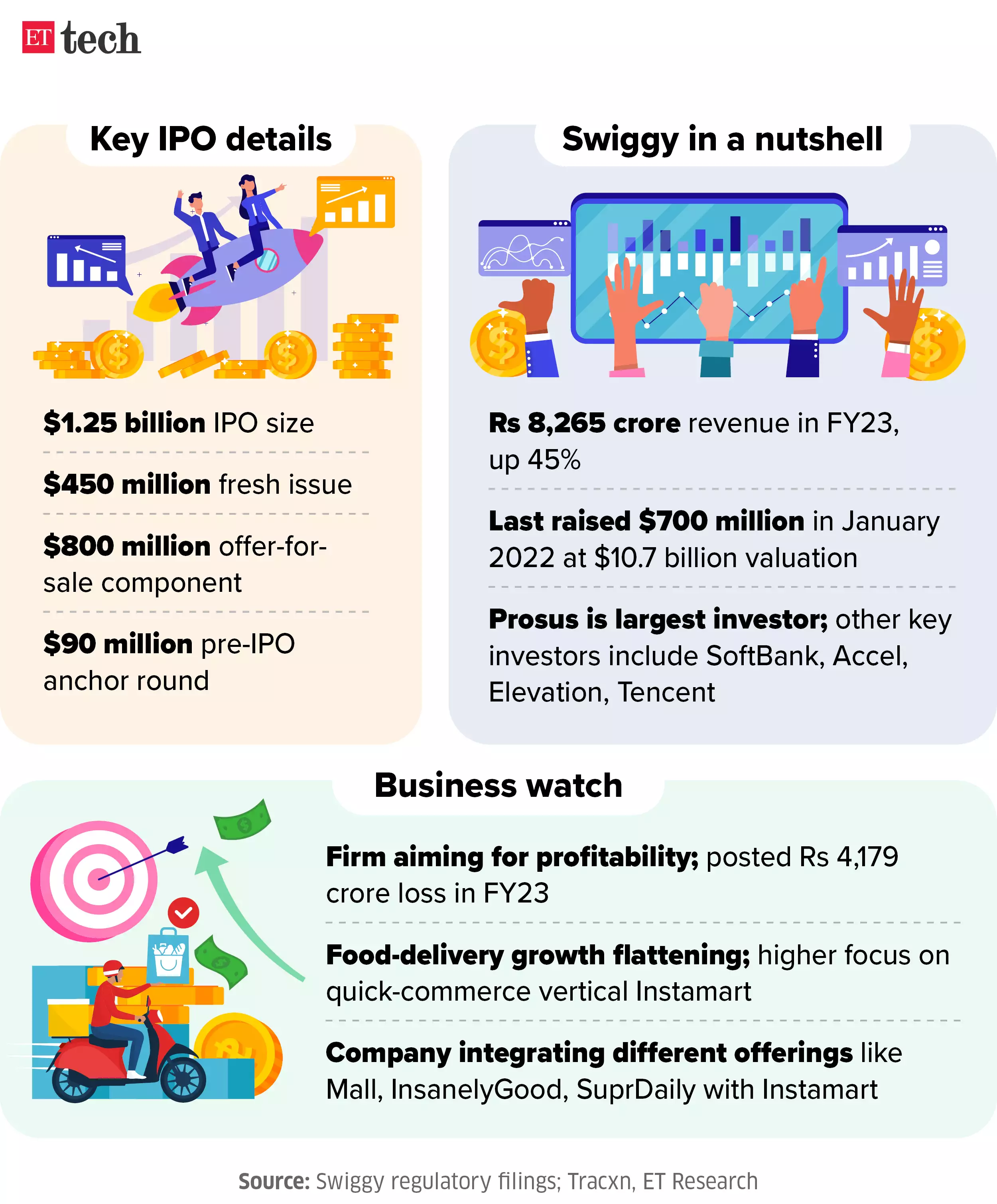

The food and grocery delivery company Swiggy Ltd is set to debut on the stock exchanges with an initial public offering of Rs 11,300 crore, making it the second-largest issue in the primary markets this year. Analysts are predicting that Swiggy's shares may see a flat or negative listing, and are advising investors who have not been allotted shares to wait for the share price to settle before buying. Despite being a major player in the e-commerce and food delivery market, Swiggy's IPO received a sluggish response, with concerns over its negative cash flow business model and high competition leading to lackluster interest from non-institutional investors and retail investors.

Swiggy's Bumpy IPO Debut: A Detailed Analysis

Background

An initial public offering (IPO) is a process whereby a private company offers its shares to the public for the first time. The company raises capital by selling these shares, which subsequently become available for trading on the stock market.

Swiggy's IPO Journey

Swiggy, India's leading food and grocery delivery company, launched its IPO on March 17, 2023, with an aim to raise Rs 11,300 crore. The offer received a lukewarm response, with concerns raised about Swiggy's negative cash flow business model and intense competition.

IPO Performance

Despite being a major player in the e-commerce sector, Swiggy's IPO witnessed a flat to negative listing on both the BSE and NSE. Shares opened at a premium of just 1-2% before declining slightly. Analysts attributed this performance to concerns about the company's profitability and intense competition.

Top 5 FAQs

1. Why did Swiggy's IPO receive a subdued response?

2. What is Swiggy's financial performance?

3. What are the key challenges faced by Swiggy?

4. What is the outlook for Swiggy?

5. Should investors buy Swiggy shares after the IPO?

Shashikant Ruia, Chairman of Essar Group, passed away at the age of 81, leaving behind a legacy of unparalleled contributions to the business world. Under his visionary leadership, Essar group diversified and grew into a global conglomerate, generating revenues of US $14 billion. Ruia's commitment to community upliftment and philanthropy also left a lasting impact on millions of lives. His demise has left a void in the business world that will be hard to fill.

A detailed analysis of how the BJP has performed in Maharashtra and Jharkhand, in the 25 aspirational districts designated by the Niti Aayog. According to a report, the performance of the BJP has not been very promising in these districts, raising questions about the party's policies and initiatives towards development and progress. As the elections approach, this report highlights the importance of addressing the issues faced by the people in these regions, and the need for better policies and strategies to address them effectively.

The allotment of shares for the highly anticipated NTPC Green Energy IPO has been finalized, with investors receiving bank debit messages. The IPO was oversubscribed by 2.55 times, with shares set to list on the BSE and NSE on November 27. In the grey market, the stock is currently trading at a Rs 4 premium, with experts predicting further improvements as the Indian stock market sees a rally. Interested investors can easily check the IPO allotment status online using the BSE, NSE, or Kfin Technologies' portals.

Shashikant Ruia, one of the founders of the Essar Group, passed away at the age of 81 after battling an illness. Along with his brother Ravi, he successfully built the Essar Group into a global business empire in various industries. The funeral procession will be held on Tuesday towards the Hindu Worli Crematorium. Ruia's passing marks the end of an era for the first-generation entrepreneur and industrialist.

The Mumbai Indians emerged as the clear winners of the IPL 2025 mega auction as they made strategic picks and successfully built a team around their retained core. With star players like Hardik Pandya, Rohit Sharma, Suryakumar Yadav, and Jasprit Bumrah, MI added valuable assets in Trent Boult, Deepak Chahar, Reece Topley, and Will Jacks to strengthen their fast bowling and batting departments. The addition of former Indian cricketer Sachin Tendulkar's son Arjun Tendulkar at his base price of Rs 30 lakh also made headlines. Here is the full squad list for Mumbai Indians after the mega auction.

India secured the top spot in the World Test Championship standings with a percentage of points won of 61.11%. This was achieved after their 295-run victory over Australia in the first Border-Gavaskar Test in Perth. Australia, who were previously at the top, have slipped to second position, while India needs three wins in the remaining four matches to secure a spot in the WTC final. The victory is significant for the team, as it is their biggest Test win in Australia.

The Central government has announced the launch of PAN 2.0 Project, an upgrade of the current PAN/TAN system, as part of its Digital India initiative. The project aims to provide taxpayers with a new PAN card with a QR code feature, ensuring a more efficient and technology-driven process for taxpayer registration. The government will be investing 1435 crore in the project, promising benefits such as improved service delivery, data consistency, and a unified portal for ease of access.

Indian equities continued their upward trend for the second day, with Nifty and Sensex both registering gains of over 1.5%. Bank Nifty also saw an increase of nearly 2%, led by gains in HDFC Bank, ICICI Bank, SBI and Axis Bank. This surge can be attributed to the positive sentiment post the state election results, which have been deemed as highly positive for the market. Analysts predict that the rally may continue for a few more days, driven by short covering and bullish momentum. Meanwhile, Asian markets also traded in the green as the US Treasury secretary selection caused a downward movement in the dollar and bond yields.

HDFC Bank's stock soared to an all-time high as it received a delivery-based buying of Rs 31,135 crore as part of MSCI rebalancing. The private lender recorded a delivery volume of 17.4 crore shares, with a delivery percentage of over 81%, driving its market capitalisation to reach an impressive Rs 13.57 lakh crore. The November round of MSCI indices rejig is expected to bring in foreign passive flows of $2.5 billion, boosting the bank's weightage in the Global Standard Index. This news has attracted the attention of investors, with BSE Ltd. also recording a high delivery turnover worth Rs 2,928 crore.