In an effort to increase retail investor participation in the debt market, the Securities & Exchange Board of India (SEBI) has reduced the face value of corporate bonds from Rs 1 lakh to ₹10,000. This move has been praised by Zerodha co-founder Nithin Kamath, who believes it will make bonds more accessible to small investors. Additionally, Sebi has announced further changes in rules for mutual funds, including the option for joint holders to nominate their fund account and allowing a single fund manager to oversee both commodities and foreign investments. These measures are aimed at promoting ease of doing business and curbing fraudulent trades.

SEBI's Initiatives to Enhance Retail Investor Participation in Debt Market and Streamline Mutual Fund Operations

The Securities and Exchange Board of India (SEBI) has implemented several significant changes to promote retail investor participation in the debt market and streamline mutual fund operations. These measures aim to enhance accessibility, transparency, and ease of doing business within the financial sector.

Reduction of Corporate Bond Face Value

Previously, corporate bonds had a face value of Rs 1 lakh, making them inaccessible to many retail investors. However, SEBI has now reduced the face value to ₹10,000, making them more affordable and appealing to a wider pool of investors. This move is expected to increase participation from individuals and households, broadening the investor base in the debt market.

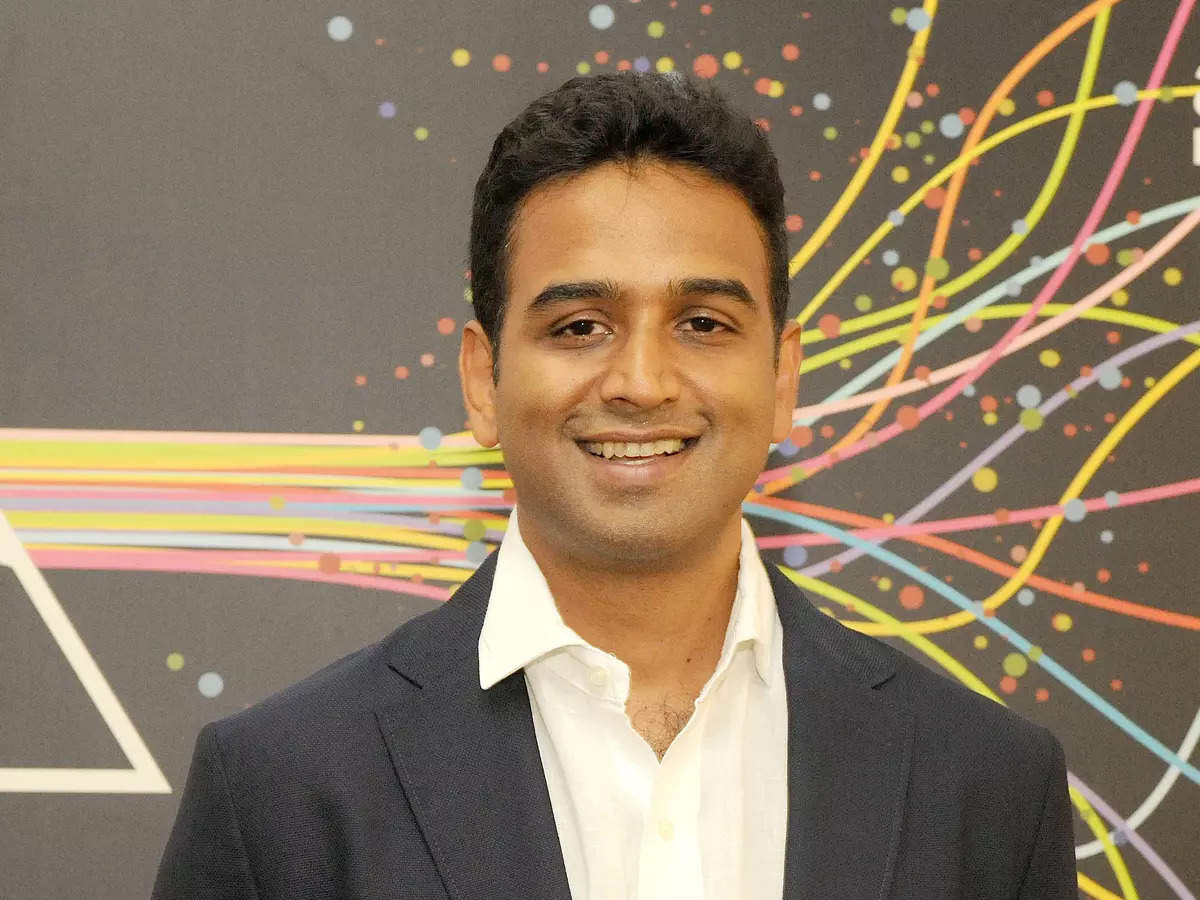

Praise from Zerodha Co-founder

Nithin Kamath, co-founder of Zerodha, one of India's leading online brokerages, has praised SEBI's decision. He believes it will make bonds more accessible to small investors and encourage long-term wealth creation. He also expressed optimism that these changes will deepen the bond market and contribute to India's financial inclusion efforts.

Other SEBI Initiatives

In addition to reducing the face value of corporate bonds, SEBI has also announced the following changes:

Top 5 FAQs and Answers

Q1: Why did SEBI reduce the face value of corporate bonds? A: To make them more accessible to retail investors and increase participation in the debt market.

Q2: What is the new face value of corporate bonds? A: ₹10,000

Q3: What is the benefit of joint account nomination in mutual funds? A: It ensures smooth transfer of funds to the designated nominee in the event of the joint account holder's demise.

Q4: Can a single fund manager now manage both commodities and foreign investments? A: Yes, under SEBI's new regulations.

Q5: What measures has SEBI taken to curb fraudulent trades? A: Increased due diligence, enhanced reporting requirements, and new regulations aimed at preventing market manipulation.

Jagdeep Singh, a self-made Indian-origin entrepreneur, has broken records as the highest-paid CEO in the world with a daily income of Rs 48 crore. With a background in tech giants HP and Sun Microsystems, Singh now leads his own company, Quantumscape, which is revolutionizing electric vehicle batteries with cutting-edge solid-state technology. This achievement not only showcases Singh's passion for innovation but also sets a new standard for corporate leadership.

Jagdeep Singh, former CEO and founder of the American company Quantumscape, has surpassed all compensation records with an annual salary of Rs 17,500 crore. With a remarkable daily earning of Rs 48 crore, Singh has set a new benchmark in the EV industry. Despite stepping down as CEO, he continues to excel in the tech and business worlds with his new venture.

Uber's underperformance in the stock market may not reflect any weakness in the company's business fundamentals. Despite the fear surrounding the potential for robotaxis to disrupt the ride-sharing industry, Uber has the flexibility, financial stability, and adaptability to remain a significant player in the mobility industry. With a strong track record of revenue and profit growth, expanding profit margins, and impressive cash flow, Uber appears undervalued and worth considering as a buy for long-term investors.

A Bengaluru court has granted interim bail to Nikita Singhania, the wife of deceased techie Atul Subhash. Atul had passed away last month, following which Nikita was accused by his family of provoking him to commit suicide. However, the court has granted her bail, allowing for further investigation into the matter. This decision by the court has brought some relief to Nikita and her family amidst this tragedy.

Amazon's chief executive Andy Jassy has announced that all staff will be expected to return to working in the office full-time starting in January. This decision has sparked backlash as it goes against the company's previous hybrid work policy and adds pressure to already overwhelmed corporate staff. Jassy's concern for maintaining Amazon's intense start-up culture and avoiding bureaucratic layers has led to these changes, potentially resulting in job cuts. However, some employees are claiming unfair retaliation, opening up a dispute with labour officials.

With the release of the official notification for SBI PO 2024 expected soon, aspirants need to start preparing early and effectively manage their time to excel in the highly competitive exam. This article provides valuable time management tips for all three stages of the exam, helping candidates stay focused and increase their chances of success. From familiarizing yourself with the exam pattern to mastering each section with strategic time allocation, this guide is a must-read for dedicated SBI PO exam candidates.

The use of AI in the insurance industry has been gaining momentum, with a recent report showing that 29% of working hours in the industry can be automated by gen AI. However, this also raises concerns about maintaining personal connections with clients and using the technology responsibly. The threat of cyberattacks is also increasing, leading to growing costs for Canadian businesses. While AI has the potential to revolutionize tedious tasks and improve fraud detection, it also poses legal and privacy risks if not properly integrated. As a result, CISRO has issued guidelines for insurance intermediaries to help them understand and mitigate these risks when using AI.

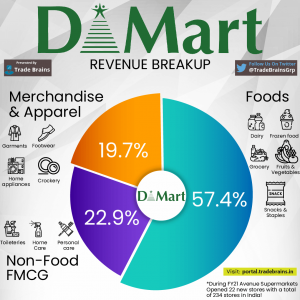

DMart, India's leading supermarket chain, saw a surge of 12.33% in its stock following a 17.18% growth in standalone revenue in the third quarter of 2021 compared to the previous year. However, concerns have been raised over increased competition in the industry, with players like Flipkart and Amazon offering home delivery at lower prices. This has led to doubts over DMart's previously unquestioned dominance in terms of price advantage. Despite this, brokerage firms like CLSA continue to suggest an 'Outperform' rating on DMart, citing its strong store addition and same store sales growth.

As Bitcoin marks its 16th anniversary, it continues to rise in popularity among investors. In just 48 hours, 11,000 BTC were removed from exchanges, indicating a strong belief in the asset's long-term potential. This trend is further evidenced by the $1 billion worth of BTC accumulated by investors since the start of the year. The approval of the ProShares Bitcoin Strategy and 11 spot Bitcoin ETFs by the SEC shed light on the increasing interest from institutional investors, with net flows into spot Bitcoin ETFs reaching $4.63 billion in December alone. Bitcoin enthusiast Tom Lee predicts that the asset could reach $250,000 in 2025, fueled by a favorable regulatory landscape and increased interest from other nations' Bitcoin reserves. With a capped supply of 21 million coins and a current price of $96,800, all eyes are on Bitcoin as it approaches this significant psychological and financial milestone.

In this edition of Traders' Diary, the Zee Business research team provides exclusive research and investment ideas on 20 stocks to track for January 3, 2025. Analysts Pooja Tripathi and Kushal Gupta share their top stock picks, including Avati Feeds, PB Fintech, Bajaj Finance, Lupin, Bank of Baroda, JK Cement, Amber Enterprises, and V2 Retail. With targets and stop losses for each stock, this diary is a must-read for investors and traders.