In this edition of Traders' Diary, the Zee Business research team provides exclusive research and investment ideas on 20 stocks to track for January 3, 2025. Analysts Pooja Tripathi and Kushal Gupta share their top stock picks, including Avati Feeds, PB Fintech, Bajaj Finance, Lupin, Bank of Baroda, JK Cement, Amber Enterprises, and V2 Retail. With targets and stop losses for each stock, this diary is a must-read for investors and traders.

Bajaj Finance: A Rising Star in the Indian Financial Sector

Background

Bajaj Finance is a non-banking financial company (NBFC) that offers a wide range of financial services including personal loans, loans, and business lending. It was founded in 1998 by Rahul Bajaj and is headquartered in Mumbai, India. The company has a strong presence in India and has expanded its operations into several other countries, including Sri Lanka and Southeast Asia.

Google Search Trends

The recent increase in Google searches related to Bajaj Finance is likely due to the company's strong financial performance and its potential for growth in the future. The company has been consistently reporting strong earnings and has a diversified portfolio of products and services. Additionally, the government's focus on financial inclusion and the growing demand for credit in India are expected to drive the growth of the NBFC sector in the future.

Top Stock Picks for January 2025

According to the Zee Business research team, Bajaj Finance is one of the top 20 stocks to track for January 2025. The team's analysts, Pooja Tripathi and Kushal Gupta, have set a target price of Rs. 950 for the stock with a stop loss of Rs. 845.

FAQs

Bajaj Finance's key growth drivers include its diversified portfolio of products and services, its strong brand recognition in India, and the growing demand for financial services in the country.

The risks associated with investing in Bajaj Finance include the cyclicality of the financial services sector, competition from other NBFCs, and changes in government regulations.

Bajaj Finance has consistently reported strong financial performance in recent years. In the financial year 2022-23, the company reported a net profit of Rs. 34,106 crore, a growth of 26% over the previous year.

Bajaj Finance has a consistent dividend payment history. The company has been paying dividends to its shareholders for over 20 years.

Bajaj Finance is planning to expand its operations into new markets in India and abroad. The company is also looking to introduce new products and services to meet the evolving needs of its customers.

Jagdeep Singh, former CEO and founder of the American company Quantumscape, has surpassed all compensation records with an annual salary of Rs 17,500 crore. With a remarkable daily earning of Rs 48 crore, Singh has set a new benchmark in the EV industry. Despite stepping down as CEO, he continues to excel in the tech and business worlds with his new venture.

Uber's underperformance in the stock market may not reflect any weakness in the company's business fundamentals. Despite the fear surrounding the potential for robotaxis to disrupt the ride-sharing industry, Uber has the flexibility, financial stability, and adaptability to remain a significant player in the mobility industry. With a strong track record of revenue and profit growth, expanding profit margins, and impressive cash flow, Uber appears undervalued and worth considering as a buy for long-term investors.

A Bengaluru court has granted interim bail to Nikita Singhania, the wife of deceased techie Atul Subhash. Atul had passed away last month, following which Nikita was accused by his family of provoking him to commit suicide. However, the court has granted her bail, allowing for further investigation into the matter. This decision by the court has brought some relief to Nikita and her family amidst this tragedy.

Amazon's chief executive Andy Jassy has announced that all staff will be expected to return to working in the office full-time starting in January. This decision has sparked backlash as it goes against the company's previous hybrid work policy and adds pressure to already overwhelmed corporate staff. Jassy's concern for maintaining Amazon's intense start-up culture and avoiding bureaucratic layers has led to these changes, potentially resulting in job cuts. However, some employees are claiming unfair retaliation, opening up a dispute with labour officials.

With the release of the official notification for SBI PO 2024 expected soon, aspirants need to start preparing early and effectively manage their time to excel in the highly competitive exam. This article provides valuable time management tips for all three stages of the exam, helping candidates stay focused and increase their chances of success. From familiarizing yourself with the exam pattern to mastering each section with strategic time allocation, this guide is a must-read for dedicated SBI PO exam candidates.

The use of AI in the insurance industry has been gaining momentum, with a recent report showing that 29% of working hours in the industry can be automated by gen AI. However, this also raises concerns about maintaining personal connections with clients and using the technology responsibly. The threat of cyberattacks is also increasing, leading to growing costs for Canadian businesses. While AI has the potential to revolutionize tedious tasks and improve fraud detection, it also poses legal and privacy risks if not properly integrated. As a result, CISRO has issued guidelines for insurance intermediaries to help them understand and mitigate these risks when using AI.

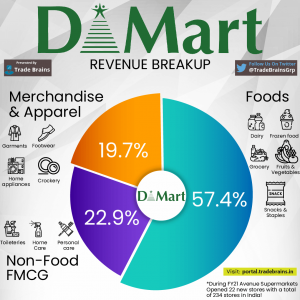

DMart, India's leading supermarket chain, saw a surge of 12.33% in its stock following a 17.18% growth in standalone revenue in the third quarter of 2021 compared to the previous year. However, concerns have been raised over increased competition in the industry, with players like Flipkart and Amazon offering home delivery at lower prices. This has led to doubts over DMart's previously unquestioned dominance in terms of price advantage. Despite this, brokerage firms like CLSA continue to suggest an 'Outperform' rating on DMart, citing its strong store addition and same store sales growth.

As Bitcoin marks its 16th anniversary, it continues to rise in popularity among investors. In just 48 hours, 11,000 BTC were removed from exchanges, indicating a strong belief in the asset's long-term potential. This trend is further evidenced by the $1 billion worth of BTC accumulated by investors since the start of the year. The approval of the ProShares Bitcoin Strategy and 11 spot Bitcoin ETFs by the SEC shed light on the increasing interest from institutional investors, with net flows into spot Bitcoin ETFs reaching $4.63 billion in December alone. Bitcoin enthusiast Tom Lee predicts that the asset could reach $250,000 in 2025, fueled by a favorable regulatory landscape and increased interest from other nations' Bitcoin reserves. With a capped supply of 21 million coins and a current price of $96,800, all eyes are on Bitcoin as it approaches this significant psychological and financial milestone.

The Chinese logistics sector has seen a significant increase in activity in the last month of 2024, with the market's prosperity index reaching its highest level. This is due to supportive policies and strong market dynamics. It is projected that the total value of the country's logistics market will exceed 360 trillion yuan, cementing China's position as the world's largest logistics market for the ninth consecutive year. Experts believe that the positive growth in the sector will continue, with noticeable improvements in production and business activities.