In the world of business, major changes have taken place as Raymond demerges its real estate business and lists it separately, while on the other hand, Stanley Lifestyles' IPO is oversubscribed multiple times within the first day of listing. However, Sebi has also made headlines by banning both Omaxe and Reliance from trading on stock exchanges. In other news, BSE and NSE have approved the demerger of Vedanta, with six independent directors being appointed for the process.

Raymond Group's Demerger and Other Business Headlines

The business world has witnessed significant developments recently, including Raymond Group's real estate demerger, the successful IPO of Stanley Lifestyles, and regulatory actions by SEBI.

Raymond Group Demerger

Raymond Group, a leading textile manufacturer in India, has demerged its real estate business into a separate entity called 'Raymond Realty.' This move is aimed at unlocking the value of the real estate portfolio and allowing the group to focus on its core textile operations. The demerged entity will own Raymond's commercial and residential properties across India.

Stanley Lifestyles' IPO Overwhelmingly Successful

Stanley Lifestyles, a homegrown homegrown furniture and lifestyle brand, witnessed a highly oversubscribed IPO on its first day of listing. The issue was oversubscribed by more than 12 times, indicating strong investor confidence in the company's growth prospects. This success marks a significant milestone in the company's expansion plans.

SEBI Bans Omaxe and Reliance from Trading

The Securities and Exchange Board of India (SEBI) has barred Omaxe Limited and Reliance Capital Limited from trading on stock exchanges. The action was taken due to non-compliance with various regulatory requirements, including delayed financial results and corporate governance issues. This move highlights SEBI's commitment to protecting investor interests.

BSE and NSE Approve Vedanta Demerger

The Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) have approved the demerger of Vedanta Limited into three separate entities: Vedanta Resources, Vedanta Aluminium, and Hindustan Zinc. The demerger aims to simplify the corporate structure and enhance value for shareholders. Six independent directors have been appointed to oversee the process.

Top 5 FAQs

Q: Why did Raymond Group demerge its real estate business? A: To unlock the value of its real estate portfolio and focus on its core textile operations.

Q: How was Stanley Lifestyles' IPO received by investors? A: Overwhelmingly successful, with oversubscription of 12 times on the first day of listing.

Q: What are the reasons behind SEBI's ban on Omaxe and Reliance? A: Non-compliance with regulatory requirements, including delayed financial results and corporate governance issues.

Q: What is the purpose of Vedanta's demerger? A: To simplify the corporate structure and enhance value for shareholders.

Q: What is the role of the independent directors appointed for Vedanta's demerger? A: To oversee the process and ensure its fairness and transparency.

Tesla CEO Elon Musk praised India for successfully counting 640 million votes in just one day for their Lok Sabha elections. In contrast, California, with a significantly smaller population, is still struggling to tally the results of their presidential election which took place 18 days ago. Musk's post on X highlights the efficiency of India's electoral process and the shortcomings of the US system, which has led to a delay in vote counting in the most populous state.

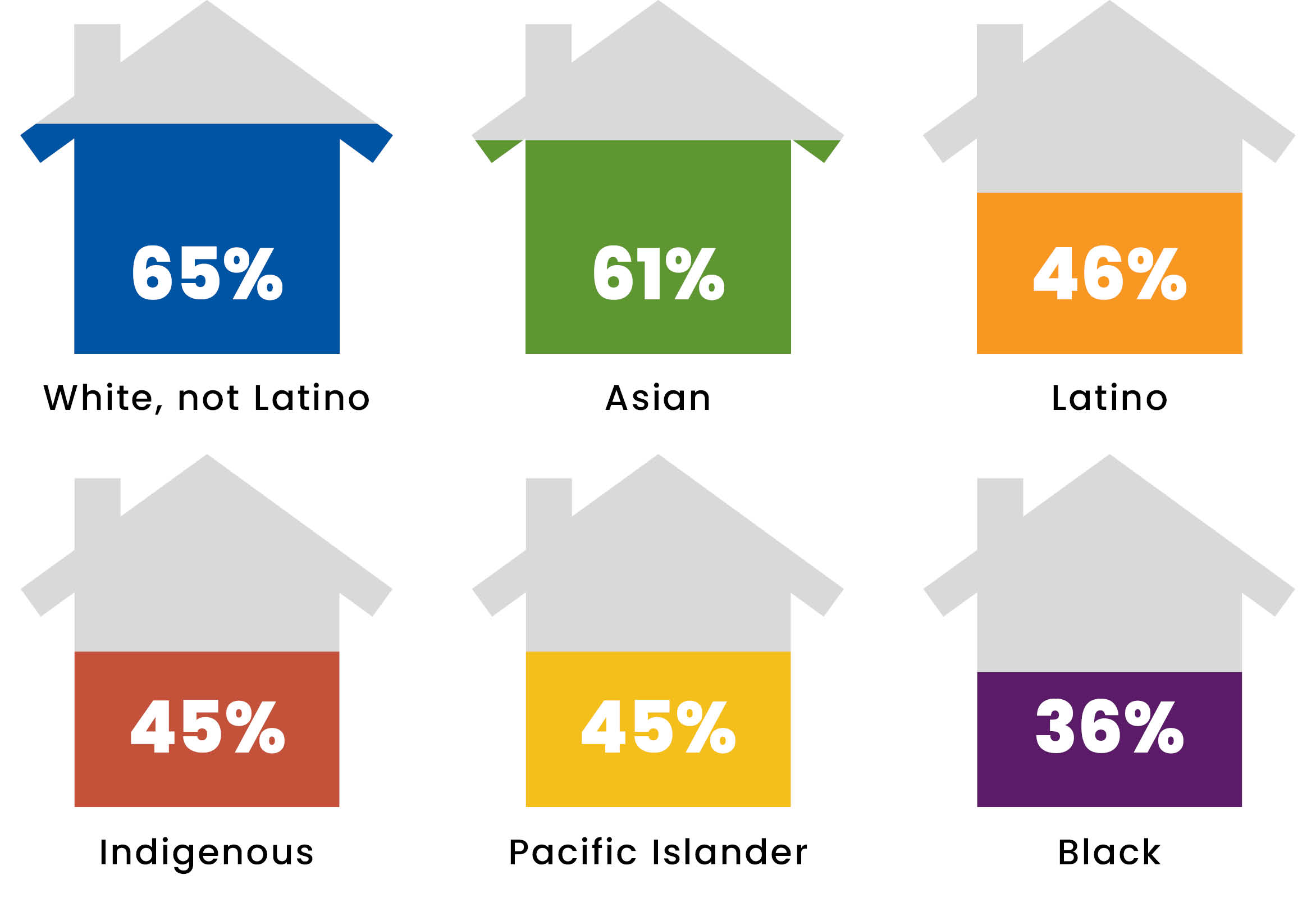

With the median price of a single-family home in California reaching a staggering $868,150 in September, the state's high home prices have created a wealth gap that disproportionately affects communities of color. According to the Legislative Analyst's Office, the cost of buying a mid-tier home has increased by 84% since January 2020, making it unaffordable for the majority of Californians. This poses serious challenges for low-income households and people of color who are already struggling to keep up with the state's high cost of living. As California grapples with mounting economic divides, the need for affordable housing solutions becomes more urgent. Help us address this pressing issue by joining our year-end campaign to raise $50,000 and support local reporting on important issues like this.

Zomato CEO, Deepinder Goyal, responds to user feedback on the company's "Food Rescue" initiative, showing his commitment towards innovation and open recruitment. The feature, launched on October 10, 2024, offers discounted meals from cancelled orders to customers within a 3km radius, aiming to reduce food wastage and provide affordable options. While there have been concerns raised about safety and fairness, Goyal points out the efforts to ensure proper packaging and limit the number of cancellations per month. The company is also exploring partnerships with food banks and charities to further reduce food wastage.

BTTV, a leading market news channel, introduces a new show called 'Daily Calls' aimed at providing viewers with expert insights and guidance on navigating the market. With access to live sessions featuring experienced analysts, the show aims to assist viewers in making informed investment decisions and building a strong portfolio. Don't miss out on this valuable opportunity to gain clarity and understanding in today's uncertain market.

Adani Group is under scrutiny for alleged violations of disclosure norms concerning a US bribery case and the subsequent cancellation of major deals by Kenya. While the conglomerate has denied any involvement in the case, stock exchanges have sought explanations and experts believe that the Securities and Exchange Board of India (SEBI) may launch an investigation. The allegations, which include a criminal indictment and a civil complaint, could have significant consequences for Adani Group's reputation and access to international markets.

Outlandish, an e-commerce startup, is opening a new brick-and-mortar store in Santa Monica's 3rd Street Promenade, featuring a first floor of branded stalls and a second floor for shopping. The store aims to mix live online selling with in-person retail, as visitors can watch influencers and sellers on livestreams and even join in themselves. The concept taps into the growing trend of live shopping in the US, with TikTok itself actively promoting and hosting events centered around live selling. This move by Outlandish is in line with TikTok's efforts to recreate the success of its Chinese sister app, Douyin, which drives billions in annual product sales.

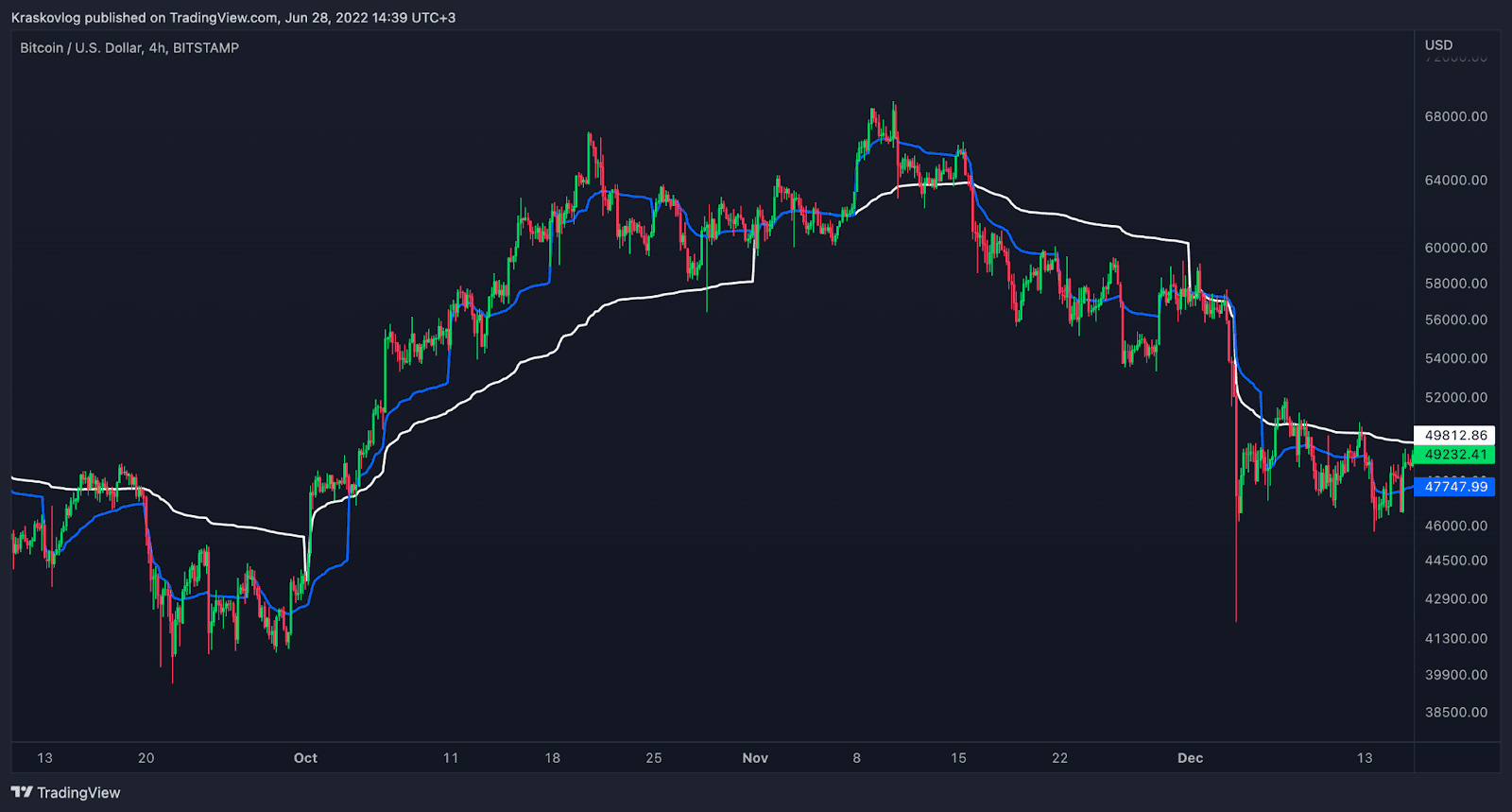

The highly volatile Mad cryptocurrency has seen a massive surge of 67% in the last 24 hours, trading at $0.00006226 as of 02:49 a.m. EST. This sudden spike in price, along with a heavy overbought RSI level of 86, signals a potential correction or pullback in the near future. However, the Mad price has managed to break above both the 50-day and 200-day SMAs, indicating a strong and sustained bullish trend. The ADX value above 60 also confirms the strength of this rally. Stay updated on this exciting development by joining our Telegram channel.

In a note released on Friday, JPMorgan addressed concerns over potential credit risk for Indian banks heavily exposed to the Adani Group, following the recent indictment of its billionaire founder, Gautam Adani, in the US. While the charges have sparked a drop in shares of state-owned banks, JPMorgan analysts have deemed the banks' exposure "manageable," with their assessment showing a low risk of default from the Adani Group. However, global and local banks are expected to take a cautious approach in providing any new funding to the conglomerate, with potential for higher interest rates due to heightened risks.

In a state of the nation address, Kenya's President announced the cancellation of major deals with Indian tycoon Gautam Adani, including an airport expansion project and power transmission lines. This decision was made in light of U.S. bribery and fraud indictments against Adani, who has been charged with securities fraud and conspiracy. The controversial deals had faced backlash from Kenyan protesters and airport workers concerned about potential job losses. Despite claims from Kenya's Energy Minister that no corruption was involved on their part, the country has now severed ties with Adani's conglomerate.

X's new terms of service, which allow the company to use user data and hold users accountable for overusing the platform, are prompting long-time users, including celebrities like Gabrielle Union, to leave the popular microblogging platform. In response, many users are turning to Bluesky, a microblogging startup, with its U.S. mobile app downloads increasing by an estimated 651% since the start of November. Despite X and Meta's larger user bases, Bluesky's growth suggests many users are looking for alternatives to X's new terms.