The stocks of major tobacco companies in India, including ITC Ltd., Godfrey Phillips Ltd., and VST Industries Ltd., saw a decline following reports of a potential 35% tax on sin goods under the Goods and Services Tax framework. This proposal, made by the Group of Ministers on GST rate rationalisation, could have a significant impact on sales and profits for tobacco manufacturers. However, it is just one part of a larger GST reform plan, including other recommendations for tax adjustments and the end of the compensation cess in 2026.

Impact of Goods and Services Tax (GST) on Tobacco Industry in India

The Goods and Services Tax (GST), implemented in India in July 2017, has had a significant impact on the country's tobacco industry. The GST subsumed various indirect taxes, including excise duty, service tax, and value-added tax (VAT), into a single unified tax system.

Background:

Prior to GST, tobacco products in India were subject to a complex tax structure. Excise duty, levied by the central government, accounted for a significant portion of the total tax burden. Additionally, state governments imposed VAT on tobacco products, which varied from state to state. This resulted in varying tax rates and complexities in the supply chain.

Impact of GST on Tobacco Companies:

GST simplified the tax regime for tobacco companies by replacing multiple levies with a single tax. However, the rate of GST on tobacco products was set at 28%, which was higher than the pre-GST combined tax rates in most states. This led to an increase in the overall tax burden on tobacco manufacturers.

In 2022, the Group of Ministers on GST rate rationalization proposed increasing the GST rate on sin goods, including tobacco, to 35%. This proposal, if implemented, would further increase the tax burden on the tobacco industry and could have a significant impact on its sales and profitability.

Impact on Consumers:

The higher GST rates on tobacco products have resulted in an increased cost to consumers. This has led to a decline in sales, particularly in the lower-priced segment. Higher prices have also made tobacco products less affordable, which could promote illicit trade and smuggling.

Top 5 FAQs on GST and Tobacco Industry:

1. What is the current GST rate on tobacco products in India? Answer: 28%

2. Is there a proposal to increase the GST rate on tobacco products? Answer: Yes, the Group of Ministers on GST rate rationalization has proposed increasing the GST rate to 35%.

3. How has GST impacted the tobacco industry in India? Answer: GST has simplified the tax regime but increased the overall tax burden on tobacco manufacturers.

4. What is the impact of higher GST rates on consumers? Answer: Higher GST rates have increased the cost of tobacco products, leading to a decline in sales and increased affordability concerns.

5. What are the potential consequences of a further increase in GST rates on tobacco products? Answer: A further increase in GST rates could significantly impact the tobacco industry's sales, profits, and competitiveness, potentially promoting illicit trade and smuggling.

In a major announcement, Indian Finance Minister Nirmala Sitharaman states that public sector banks are profitable, signaling a shift from their previous loss-making position. In order to further boost this sector, PSU banks will be launching new products to aid in credit growth. Additionally, NABARD chairman asserts that cooperative banks will also undergo digitization by 2025, while RBI urges banks to reduce inoperative accounts in an effort to improve efficiency. The launch of a savings account for rural India by HDFC bank and Union Bank becoming the first major Indian bank to join PCAF for sustainability shows the crucial role banks play in the development of the country.

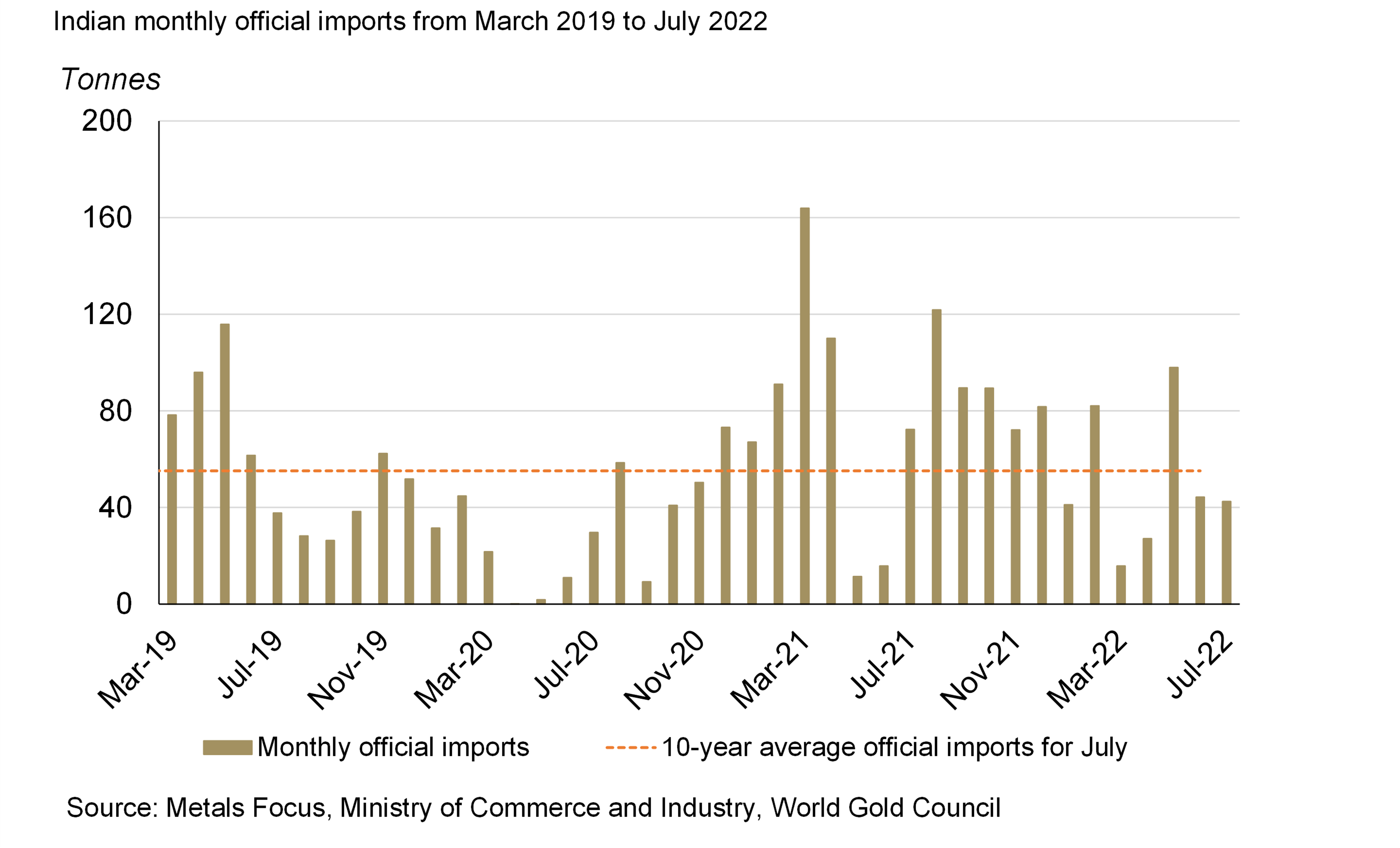

On November 30, gold prices in India witnessed a significant increase, with the price of 24-carat gold reaching Rs 78,270 per 10 grams and 22-carat gold at Rs 71,770 per 10 grams. The retail price of gold per gram represents the cost consumers pay for a single gram of gold, influenced by global economic conditions, geopolitical developments, and supply and demand dynamics. In India, the retail price is also impacted by additional factors like import duties, taxes, and currency exchange rates.

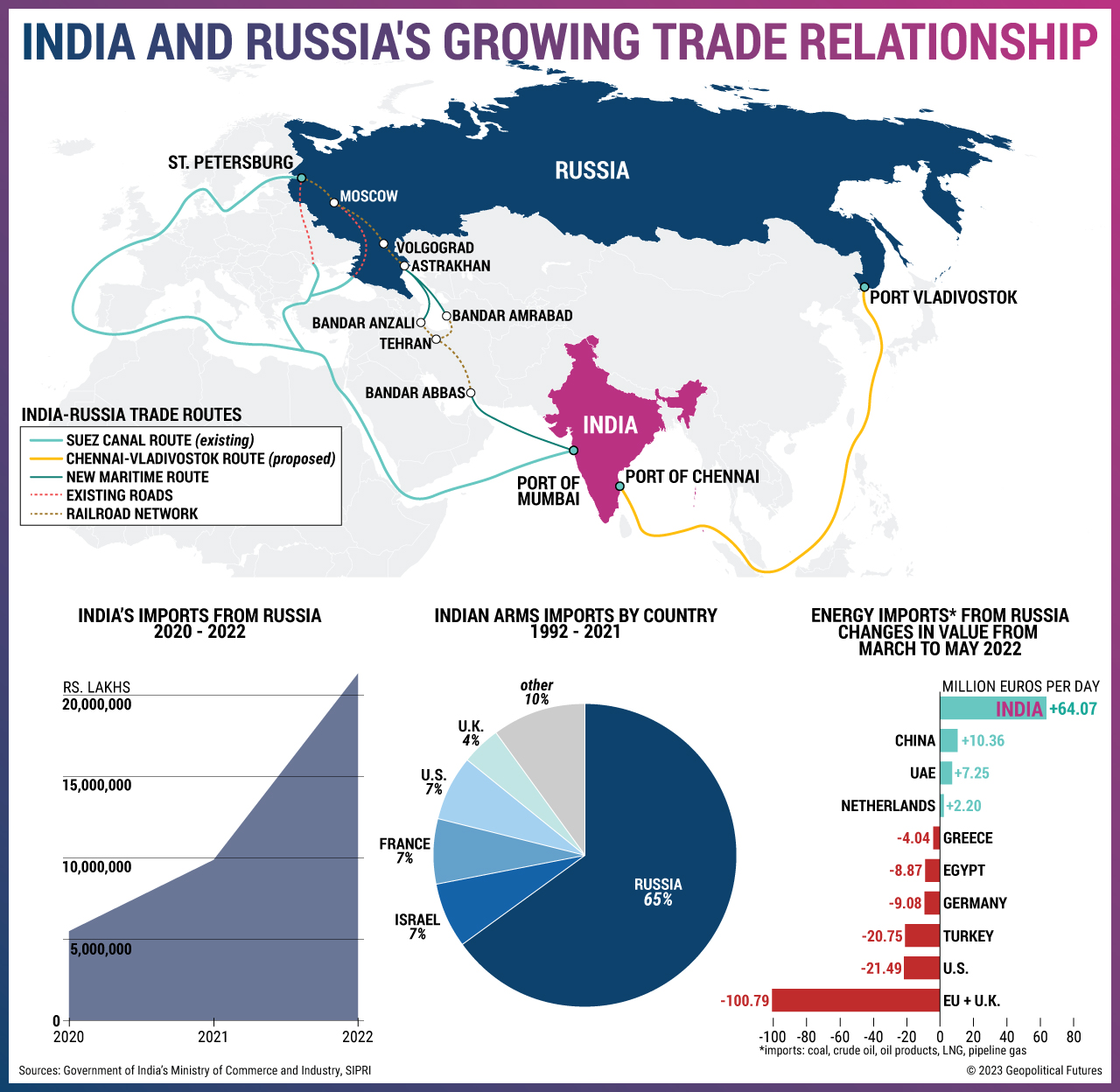

Russian company TMH, known for manufacturing locomotives and rail equipment, is looking to invest in India in order to balance the trade deficit between the two countries. In addition to manufacturing Vande Bharat coaches, they are also considering manufacturing other types of rolling stocks. This comes as a welcome move for India as the country continues to work towards reducing its trade deficit with Russia.

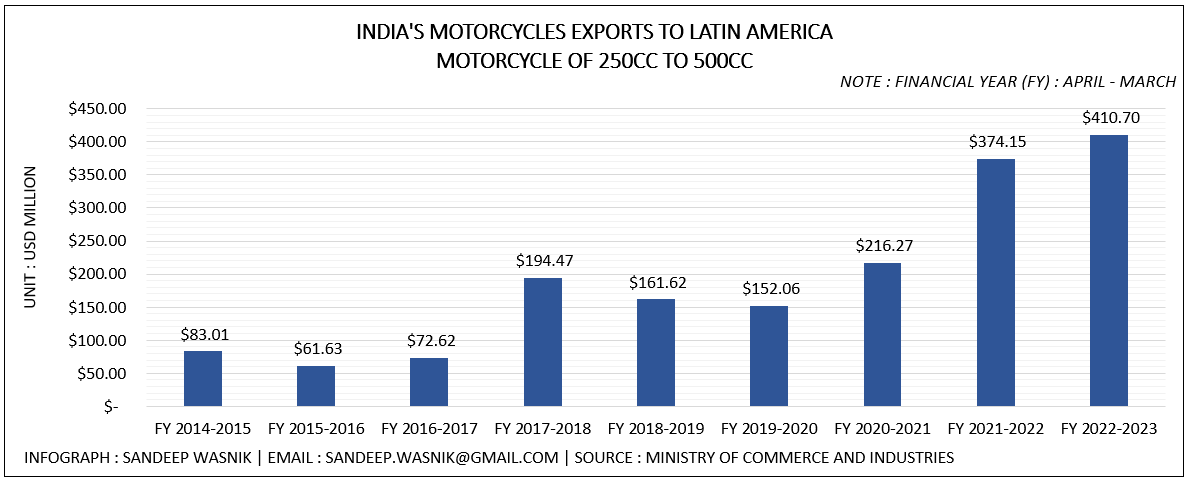

India's exports in the motorcycle and pharmaceutical industries have received a major boost in recent months. Despite facing below-expectation sales during the festive season, the motorcycle industry has seen a 5% increase in sales in November, with Bajaj Auto leading the way with a total of 4,21,640 units sold. On the other hand, India's pharma exports have surged, with the US and Europe being the key destinations. This growth has also led to the need for increased capacity at airports to accommodate the rising mobile exports from India.

After over a century since its establishment, Phoenix Mills Ltd has made their initial move into the stock market, with their headquarters in Mumbai, Maharashtra. The construction company has appointed DTS & Associates LLP as their auditors, with Atul Ruia as chairman and Bhavik Gala as the company secretary. With data and analysis sourced from reputable partners, the company advises caution and independent judgment in investment decisions.

iQOO 13 has finally been launched in India, offering high-end features at a relatively affordable price. The phone boasts the new Snapdragon 8 Elite chipset and a 6.82-inch 2K resolution LTPO AMOLED display with a fast refresh rate of 144Hz. Along with its impressive specs, the iQOO 13 also promises to receive 4 OS upgrades and 5 years of security updates. With its launch in India, iQOO is set to compete with other flagship devices in the market with its power-packed features and AI capabilities, helping it stand out from the crowd.

Popular comedian Vir Das has been announced as the newest face of footwear brand Hush Puppies. The announcement came just in time as Das became the first Indian to host the 52nd International Emmy Awards. With his wit and style, Das embodies the brand's playful and approachable image, making him the perfect fit for their comfortable and stylish shoes. The partnership between Hush Puppies and Vir Das is showcased in a humorous film, highlighting how the right pair of shoes can elevate any look.

As businesses strive to prioritize employee satisfaction and engagement, they are turning towards the Employee Net Promoter Score (eNPS) framework. This adaptation of the traditional NPS tool measures employee loyalty and satisfaction, providing insights for improving the employee experience. By addressing systemic issues identified through eNPS surveys, organizations can cultivate a supportive workplace culture that fosters trust, engagement, collaboration, and ultimately, productivity.

Skoda has entered the affordable SUV market in India with the launch of their latest offering, Kylaq. Priced at Rs 7.89 lakh, the SUV boasts a range of features that are sure to attract customers looking for a reliable and cost-effective option. With its official opening of bookings, Skoda is set to make a strong statement in the competitive SUV segment.