In a major announcement, Indian Finance Minister Nirmala Sitharaman states that public sector banks are profitable, signaling a shift from their previous loss-making position. In order to further boost this sector, PSU banks will be launching new products to aid in credit growth. Additionally, NABARD chairman asserts that cooperative banks will also undergo digitization by 2025, while RBI urges banks to reduce inoperative accounts in an effort to improve efficiency. The launch of a savings account for rural India by HDFC bank and Union Bank becoming the first major Indian bank to join PCAF for sustainability shows the crucial role banks play in the development of the country.

Banking Reforms in India: A Path to Enhanced Efficiency and Growth

The Indian banking sector has undergone significant transformation in recent times. Driven by the government's commitment to financial inclusion and economic growth, the banking landscape is poised for further advancements. The Banking Laws (Amendment) Bill, 2024, is a testament to this commitment, aiming to revitalize the public sector banking sector and enhance the overall efficiency of the banking system.

Salient Features of the Banking Laws (Amendment) Bill, 2024

Digitization of Cooperative Banks

In line with the government's focus on digitalization, the National Bank for Agriculture and Rural Development (NABARD) has announced plans to digitize all cooperative banks by 2025. This move aims to enhance efficiency, reduce costs, and improve financial inclusion.

RBI's Inoperative Account Initiative

The RBI has directed banks to reduce the number of inoperative accounts. This initiative is expected to improve efficiency, reduce risk, and free up resources for more productive purposes.

Sustainable Banking Initiatives

HDFC Bank has launched a savings account specifically designed for rural customers. Union Bank has become the first major Indian bank to join the Partnership for Carbon Accounting Financials (PCAF), demonstrating the banking sector's commitment to sustainability.

Top 5 FAQs and Answers

1. What is the status of the Banking Laws (Amendment) Bill, 2024?

2. How will the bill impact public sector banks?

3. What is the significance of cooperative bank digitization?

4. Why is the RBI reducing inoperative accounts?

5. How is the banking sector contributing to sustainability?

The Reserve Bank of India's three-day monetary policy review started on Wednesday, with expectations of a potential cut in the cash reserve ratio (CRR). The CRR is the percentage of a bank's total deposits that it is required to maintain in liquid cash with the RBI, and a reduction could signal the RBI's intention to ease monetary policy without reducing the repo rate. This move would free up significant bank liquidity and potentially stabilize the rupee.

Thousands of rideshare workers in Massachusetts are seeking to unionize through the newly formed "App Drivers Union," a joint effort from SEIU and IAM. After a recent ballot measure was passed allowing drivers to unionize, Beacon Hill legislators are set to certify the measure and the drivers will have 30 days to formally vote on the union. The measure stipulates that at least one-fourth of active drivers must vote in favor in order to create the union, and a contract would then be ratified by drivers who completed 100 trips in the most recent quarter. This move comes in response to ongoing issues with deactivation of drivers' accounts, leaving them without income and facing financial struggles.

Honda Cars India Ltd's newly launched model, the Amaze sub 4m sedan, promises to shake up the Indian automotive market with its superior safety features. Aimed at competing with rivals like Hyundai Aura, Tata Tigor, and Maruti Suzuki Dzire, the new Amaze boasts 28 added safety features, including the most affordable ADAS in India. With a reinforced body structure made of 46% high-tensile steel, Honda is confident that the new Amaze will perform well in future crash tests, surpassing even the current safety standards.

In a bid to cement its position in the fiercely competitive Indian market, Japanese car giant Honda has launched the third generation of its popular compact sedan, the Honda Amaze. With a starting price of Rs 8.00 lakh, the new Amaze promises to offer a host of advanced features and upgraded technology, enthralling the Indian customers. The introduction of this new model at competitive prices is a strategic move by Honda to expand its foothold in the Indian automobile market further.

Honda has unveiled the 2024 Amaze, its latest offering in the competitive sub-four-metre sedan market. Priced at Rs. 8 lakh for the base variant, the new Amaze features a redesigned exterior, a refreshed interior with advanced driver assistance, and a powerful 1.2-litre i-VTEC petrol engine. With tough competition from Maruti Suzuki Dzire, Hyundai Aura, and Tata Tigor, Honda aims to capture market share with its blend of updated design, advanced technology, and trusted performance in the sedan segment. Stay updated with the latest news and reviews on gadgets and tech by following us on Twitter, Facebook, and Google News and subscribing to our YouTube channel.

The new-generation Honda Amaze has been launched in India at a price range of Rs. 8-10.90 lakh (ex-showroom), making it slightly more expensive than its biggest rival, the Maruti Suzuki Dzire. However, the Honda Amaze has trumped its competition by becoming the most affordable car in India to come equipped with ADAS features through its Honda Sensing suite. Along with ADAS, the new Amaze also offers additional features such as Drive View Recorder and Walk-Away Auto Lock, making it a strong contender in the Indian car market.

Honda Cars India Ltd. (HCIL) introduced the all-new Honda Amaze, its third-generation model, in India on Wednesday. Priced at Rs 7.9-10.89 lakhs, the new Amaze will compete with popular cars in the same segment such as Maruti Dzire, Hyundai Aura, and Tata Tiago, with entry prices ranging from Rs 6-7 lakh and up to Rs 9-10 lakh. India's market prominence for Honda is evident in the fact that it is the first country to witness the launch of the highly anticipated new-generation Amaze.

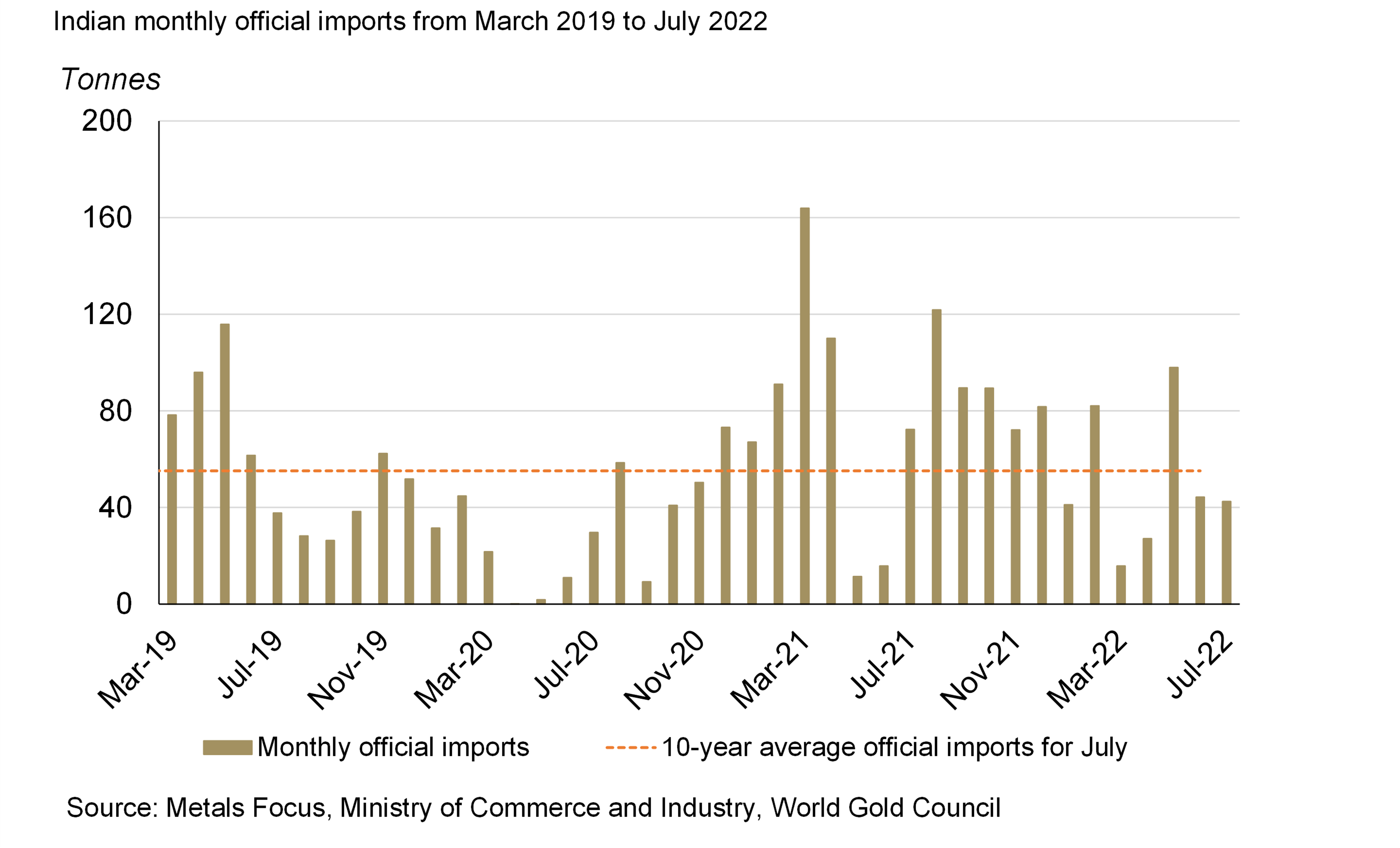

On November 30, gold prices in India witnessed a significant increase, with the price of 24-carat gold reaching Rs 78,270 per 10 grams and 22-carat gold at Rs 71,770 per 10 grams. The retail price of gold per gram represents the cost consumers pay for a single gram of gold, influenced by global economic conditions, geopolitical developments, and supply and demand dynamics. In India, the retail price is also impacted by additional factors like import duties, taxes, and currency exchange rates.

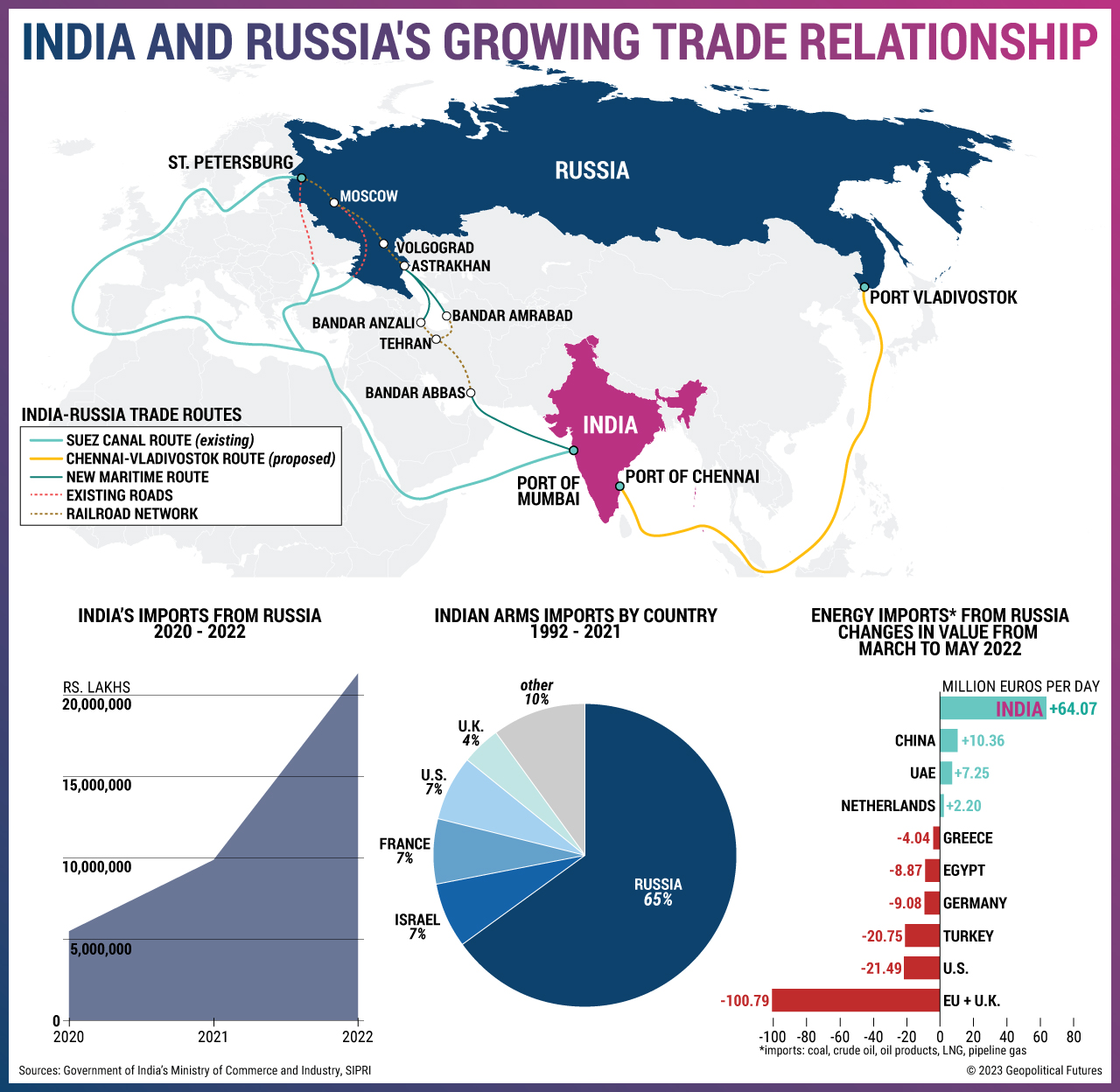

Russian company TMH, known for manufacturing locomotives and rail equipment, is looking to invest in India in order to balance the trade deficit between the two countries. In addition to manufacturing Vande Bharat coaches, they are also considering manufacturing other types of rolling stocks. This comes as a welcome move for India as the country continues to work towards reducing its trade deficit with Russia.