Josts Engineering Company Ltd, a Mumbai-based engineering company, recently announced that there is no data available for a block deal. The company is managed by chairman Jai Prakash Agarwal and has Shah Gupta & Co as its auditor. However, investors are advised to exercise caution and seek professional advice before making any investment decisions.

Josts Engineering Company Limited: Unveiling the Truth

Josts Engineering Company Limited (Josts Engineering), a Mumbai-based engineering company, recently faced scrutiny after a Google search seemingly revealed a data void regarding a block deal. This article aims to delve deeper into the background of this topic and address some of the frequently asked questions associated with it.

Background

Josts Engineering is an engineering company primarily engaged in the manufacturing and supply of heavy fabrication equipment and steel structures. According to Google search results, the company is managed by Chairman Jai Prakash Agarwal and audited by Shah Gupta & Co.

Block Deal Allegations

A block deal refers to the large-scale purchase or sale of a company's shares in a single transaction outside the normal trading hours. A recent Google search for "Josts Engineering Company Limited Josts Engineering" suggested that there was no data available for a block deal.

However, it's important to note that the absence of such data does not necessarily imply that a block deal did not occur. Block deals are not always publicly disclosed, and their details may only be known to the parties involved.

Investor Caution

Google search results also indicated that investors should exercise caution and seek professional advice before making any investment decisions related to Josts Engineering. This recommendation highlights the need for investors to conduct thorough research and due diligence before investing in any company.

Top 5 FAQs and Answers

Q: Did a block deal occur involving Josts Engineering? A: The absence of data on Google search does not confirm or deny the occurrence of a block deal.

Q: Who is the chairman of Josts Engineering? A: Jai Prakash Agarwal

Q: Who is the auditor for Josts Engineering? A: Shah Gupta & Co

Q: Is it advisable to invest in Josts Engineering? A: Investors are encouraged to exercise caution and consult with financial professionals before making investment decisions.

Q: What are some past events related to Josts Engineering? A: Information regarding past events for this company could not be identified through the provided sources.

Conclusion

The information available on Google search regarding Josts Engineering's block deal and investor caution serves as a reminder for investors to approach investment decisions with prudence and seek professional guidance. It is essential to conduct thorough research and consider all available information before making any financial commitments.

The Indian stock market saw a huge surge as the BSE Sensex jumped 1,436.30 points to settle at 79,943.71, its biggest single-day gain in over a month. The NSE Nifty also surged by 445.75 points to close at 24,188.65, with financial, auto, and IT shares leading the buying spree. However, Sun Pharma was the only laggard in the Sensex. Meanwhile, India's manufacturing sector witnessed slower growth in December, with the HSBC Purchasing Managers' Index falling to 56.4 from 56.5 in November. Despite this, the country's gross GST collection rose 7.3% from the previous year to Rs 1.77 lakh crore in December, indicating a steady recovery in economic activity.

As the 29th Dhaka International Trade Fair kickstarted in 2025, Chief Adviser Prof Muhammad Yunus emphasized the need for stronger exports by investing in the services sector. He urged the business community to explore opportunities beyond products and enhance Bangladesh's export base. In addition, the CA proposed introducing an "Entrepreneur of the Year" initiative to recognize and promote the individuals behind the country's products, along with the traditional "Product of the Year" model. The government's efforts to showcase Bangladesh's diverse products in the global market were also highlighted.

Formerly known as Grofers, Blinkit, a quick commerce company, was recently acquired by Zomato. In a cheeky social media post, Blinkit's CEO Albinder Dhindsa shared that over 1 lakh packets of condoms and 45,000 bottles of mineral water were being delivered for the New Year's Eve prep. However, standup comic Kunal Kamra raised important questions about the wages of the company's delivery partners. This incident brings attention to the exploitation of gig workers by platform owners in the gig economy.

The Kerala State Beverages Corporation has reported a whopping Rs 108 crore in liquor sales on New Year's Eve, surpassing last year's figures by Rs 13 crore. With the state already relying heavily on alcohol taxes, this increase in sales is expected to significantly boost the state's revenues. The highest sales were recorded at the Ravipuram outlet in Kochi, and with one more quarter left in the fiscal year, it is predicted that this year's liquor sales will surpass the previous year's record of Rs 19,088.68 crore.

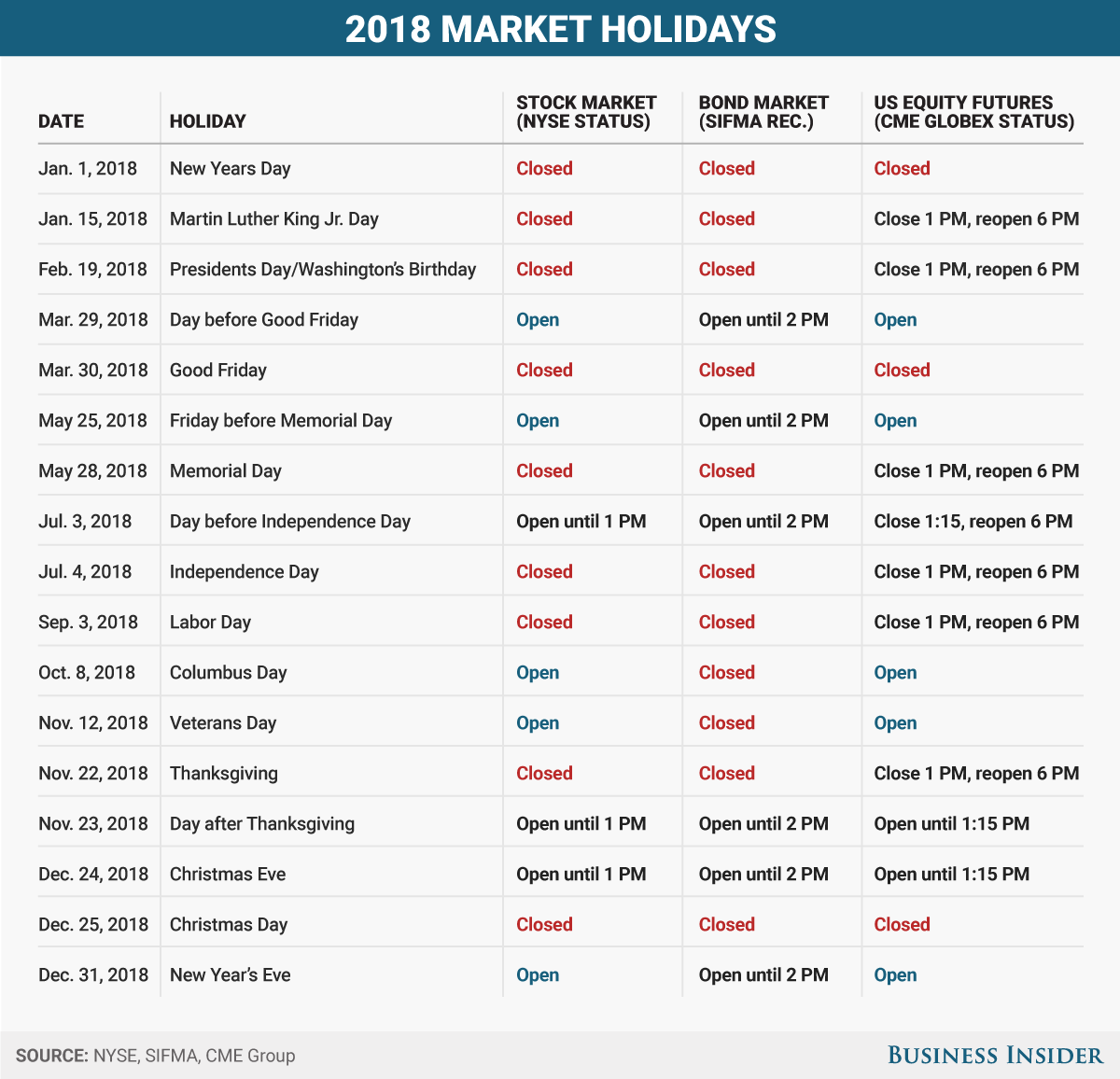

The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) have released their 2025 holiday calendar, with a total of 14 stock exchange holidays scheduled. The first holiday will be on Mahashivratri, followed by a long weekend in March for Holi and Id-Ul-Fitr. In addition, the popular Muhurat Trading will take place in October. Investors are advised to keep checking the official websites for updates on holiday timings.

As we ring in the new year, it's the perfect time to wish for abundance, happiness, and success for our loved ones. Whether it's through text, WhatsApp, or a phone call, sending personalized messages and quotes is a beautiful way to show your care and love. From motivational quotes to funny New Year wishes, make sure to spread positivity and joy on this exciting new journey. Subscribe to Zee Business on YouTube for more business and finance news.

Adani Enterprises has announced the strategic sale of Adani Wilmar Ltd, which is expected to significantly enhance its liquidity and fuel its core infrastructure verticals, including the green H2 ecosystem, airports, data centers and more. The sale is projected to generate a substantial corpus of Rs 50,000-52,000 crore and positively impact Adani portfolio's net debt-to-Ebitda ratio. This transaction marks AEL's first major move since the US Department of Justice indictment in November 2024, showcasing the company's disciplined financial approach and resilience in the face of recent challenges. With a strong war chest in place, AEL is poised to reaffirm its dominance in the infrastructure and consumer services sectors.

Unimech Aerospace, a leading manufacturing company that specializes in complex tools and engineering solutions, made its much-awaited debut in the stock market on Tuesday. With its shares trading at a premium of almost 90 per cent against the issue price, the firm's market entry was met with overwhelming response and investor interest. Despite a slight dip in the share's gains, Unimech Aerospace's maiden issue has been declared a huge success, with its IPO being oversubscribed 175.31 times. The funds raised from the IPO are slated to be utilized towards expanding the firm's production facilities and meeting its working capital needs.

On January 6, 2025, ITC announced the effective date for the demerger of its hotels business, with the shares of ITC Ltd turning ex-date for this demerger. Eligible shareholders will be allotted one ITC Hotels share for every 10 ITC shares held, with the demerger ratio set at 1:10. The ITC Hotels share price is expected to be adjusted by Rs. 22-25, taking into account a 20% holding discount and a 40% stake in the hotel business. Nuvama predicts that the initial market price for ITC Hotels shares will range between Rs. 150-175. After its initial listing, ITC Hotels will be included in Nifty50 and Sensex indices, but will then be removed at its last traded price three days after listing.

Barcelona can breathe a sigh of relief as they have found a solution to their registration problem for Dani Olmo and Pau Victor. The club's president, Joan Laporta, has been successful in securing a €100 million deal with Arab enterprises to operate the VIP boxes at the new Spotify Camp Nou. This agreement not only allows for the registration of the two players but also ensures that the club can confidently participate in the transfer market.