On January 6, 2025, ITC announced the effective date for the demerger of its hotels business, with the shares of ITC Ltd turning ex-date for this demerger. Eligible shareholders will be allotted one ITC Hotels share for every 10 ITC shares held, with the demerger ratio set at 1:10. The ITC Hotels share price is expected to be adjusted by Rs. 22-25, taking into account a 20% holding discount and a 40% stake in the hotel business. Nuvama predicts that the initial market price for ITC Hotels shares will range between Rs. 150-175. After its initial listing, ITC Hotels will be included in Nifty50 and Sensex indices, but will then be removed at its last traded price three days after listing.

ITC Hotel Demerger: Key Information and FAQs

Background

ITC Limited (ITC), a leading Indian conglomerate, anunciou a demerger of its hotels business on January 6, 2025. The demerger involves separating the hotels division from the parent company and creating a new publicly traded entity known as ITC Hotels.

Key Details

FAQs

Q1: What is the purpose of the demerger? A: The demerger aims to unlock value for shareholders by creating a separate entity focused solely on the hotels business. It will allow ITC to focus on its core businesses, while ITC Hotels can pursue its own growth strategy.

Q2: How will the demerger affect ITC shareholders? A: Eligible ITC shareholders will receive one ITC Hotels share for every 10 ITC shares held. The ITC share price is expected to adjust accordingly.

Q3: What is the expected timeline for the demerger? A: The effective date for the demerger is January 6, 2025. ITC shares will turn ex-date on the same day. Eligible shareholders will receive ITC Hotels shares after the demerger process is complete.

Q4: Will ITC Hotels be a publicly traded company? A: Yes, ITC Hotels will be listed on the stock exchange and traded publicly after the demerger.

Q5: How will the demerger impact the valuation of ITC and ITC Hotels? A: The demerger is expected to create value for both ITC and ITC Hotels. ITC shareholders will benefit from the separation of the hotels business, while ITC Hotels will be valued based on its own financial performance and growth prospects.

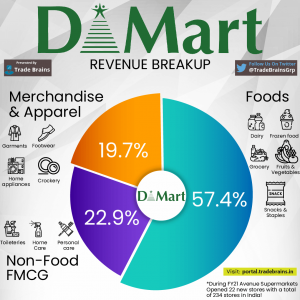

DMart, India's leading supermarket chain, saw a surge of 12.33% in its stock following a 17.18% growth in standalone revenue in the third quarter of 2021 compared to the previous year. However, concerns have been raised over increased competition in the industry, with players like Flipkart and Amazon offering home delivery at lower prices. This has led to doubts over DMart's previously unquestioned dominance in terms of price advantage. Despite this, brokerage firms like CLSA continue to suggest an 'Outperform' rating on DMart, citing its strong store addition and same store sales growth.

As Bitcoin marks its 16th anniversary, it continues to rise in popularity among investors. In just 48 hours, 11,000 BTC were removed from exchanges, indicating a strong belief in the asset's long-term potential. This trend is further evidenced by the $1 billion worth of BTC accumulated by investors since the start of the year. The approval of the ProShares Bitcoin Strategy and 11 spot Bitcoin ETFs by the SEC shed light on the increasing interest from institutional investors, with net flows into spot Bitcoin ETFs reaching $4.63 billion in December alone. Bitcoin enthusiast Tom Lee predicts that the asset could reach $250,000 in 2025, fueled by a favorable regulatory landscape and increased interest from other nations' Bitcoin reserves. With a capped supply of 21 million coins and a current price of $96,800, all eyes are on Bitcoin as it approaches this significant psychological and financial milestone.

In this edition of Traders' Diary, the Zee Business research team provides exclusive research and investment ideas on 20 stocks to track for January 3, 2025. Analysts Pooja Tripathi and Kushal Gupta share their top stock picks, including Avati Feeds, PB Fintech, Bajaj Finance, Lupin, Bank of Baroda, JK Cement, Amber Enterprises, and V2 Retail. With targets and stop losses for each stock, this diary is a must-read for investors and traders.

The Chinese logistics sector has seen a significant increase in activity in the last month of 2024, with the market's prosperity index reaching its highest level. This is due to supportive policies and strong market dynamics. It is projected that the total value of the country's logistics market will exceed 360 trillion yuan, cementing China's position as the world's largest logistics market for the ninth consecutive year. Experts believe that the positive growth in the sector will continue, with noticeable improvements in production and business activities.

The Sharjah Electricity and Water Authority (Sewa) has extended its working hours in order to provide better services to the public. The decision came after the recent instruction from His Highness Dr Shaikh Sultan bin Mohammed Al Qasimi, and is part of Sewa's comprehensive plan to enhance its services and develop its sectors. This move will help prevent issues of scarcity in the emirate and bring Sewa's services up to international standards.

The Indian Institute of Technology (IIT) Roorkee will be releasing the GATE 2025 Admit Cards on January 7, 2025. Students who have registered for the GATE 2025 examination can download their hall tickets through the official website. The admit cards were supposed to be released on January 2 but were delayed and will now be available on January 7. Here's how candidates can download their GATE 2025 admit cards.

After a recent surge, the overall cryptocurrency market is starting to cool down, but two coins have managed to stand out with remarkable gains. Urolithin A, a compound used in longevity research and part of the Pump Science platform, has surged over 100% in the last 24 hours. Similarly, the meme coin Akuma Inu has also seen a significant increase in price, reaching new all-time highs and earning a coveted listing on CoinMarketCap. These gains are likely a result of various developments and partnerships for both coins, showcasing their potential for growth in the market.

At the 16th edition of the Bangladesh Brand Forum's Best Brand Awards, mobile financial service provider bKash took the lead as the best brand, followed by Grameenphone and RFL Houseware. Other notable brands in the top 15 included Radhuni Masala, Closeup, and Daraz Bangladesh, which was recognized as the most loved brand in the e-commerce category for the fourth consecutive year. The event also saw Gree being named as the "Most Emerging Brand" for its sustained rise in brand equity index for three consecutive years.

Hyundai India has officially revealed details about its highly anticipated Creta Electric SUV, set to make its debut at the Bharat Mobility Expo in 2025. The new model offers two battery options, fast charging capabilities, and impressive performance, catering to the increasing demand for electric mobility in India. With four different variants and a selection of 10 colors, the Creta Electric is poised to make a big impact in the Indian market.

The Indian stock market saw a huge surge as the BSE Sensex jumped 1,436.30 points to settle at 79,943.71, its biggest single-day gain in over a month. The NSE Nifty also surged by 445.75 points to close at 24,188.65, with financial, auto, and IT shares leading the buying spree. However, Sun Pharma was the only laggard in the Sensex. Meanwhile, India's manufacturing sector witnessed slower growth in December, with the HSBC Purchasing Managers' Index falling to 56.4 from 56.5 in November. Despite this, the country's gross GST collection rose 7.3% from the previous year to Rs 1.77 lakh crore in December, indicating a steady recovery in economic activity.