India Post has announced the release of the third merit list for the Gramik Dak Sevak recruitment drive 2024. With 44,228 vacancies to be filled, candidates can now check their results on the official website. However, some divisions are listed as withheld due to the election code of conduct. Selected candidates should complete document verification by 4 November 2024.

India Post Gramik Dak Sevak Recruitment Merit List Released: Key Details and FAQs

Background:

India Post, a government-owned organization responsible for postal services in India, recently conducted a recruitment drive for Gramik Dak Sevak (GDS) positions. The GDS cadre assists in the delivery and distribution of postal articles in rural areas.

Merit List Release:

The third merit list for the GDS recruitment drive 2024 has been announced by India Post. A total of 44,228 vacancies are up for grabs, with results available on the official website. Candidates who cleared the previous screening tests and interviews can now check their status.

Withheld Divisions:

However, it's important to note that some divisions have been listed as withheld due to the ongoing election code of conduct. Candidates from these divisions will have to wait until the conduct is lifted to receive their results.

Document Verification:

Selected candidates are required to complete document verification at the designated post offices by November 4, 2024. They must bring original and attested copies of all relevant documents for verification. Failure to do so may result in disqualification.

Top 5 FAQs:

1. How can I check my GDS merit list result?

Visit the official India Post website and navigate to the GDS recruitment page. Enter your required details, such as application number and date of birth, to view your result.

2. What is the reason for some divisions being withheld?

Due to the election code of conduct, which prohibits certain activities that may influence the election process, results for some divisions have been withheld until further notice.

3. What documents are required for document verification?

Selected candidates must present original and attested copies of their educational certificates, caste certificates (if applicable), identity proof, and other relevant documents as per the official notification.

4. What is the next step after document verification?

Candidates who successfully complete document verification will be issued appointment letters and further instructions regarding their posting and training.

5. When will the remaining merit lists be released?

The release dates for subsequent merit lists have not yet been announced. Candidates should regularly check the India Post website for updates.

Conclusion:

The release of the third merit list for the India Post GDS recruitment drive 2024 is a significant step in the process of filling these crucial positions. Candidates who have made it to this stage are encouraged to complete document verification on time and stay updated with the latest information from India Post.

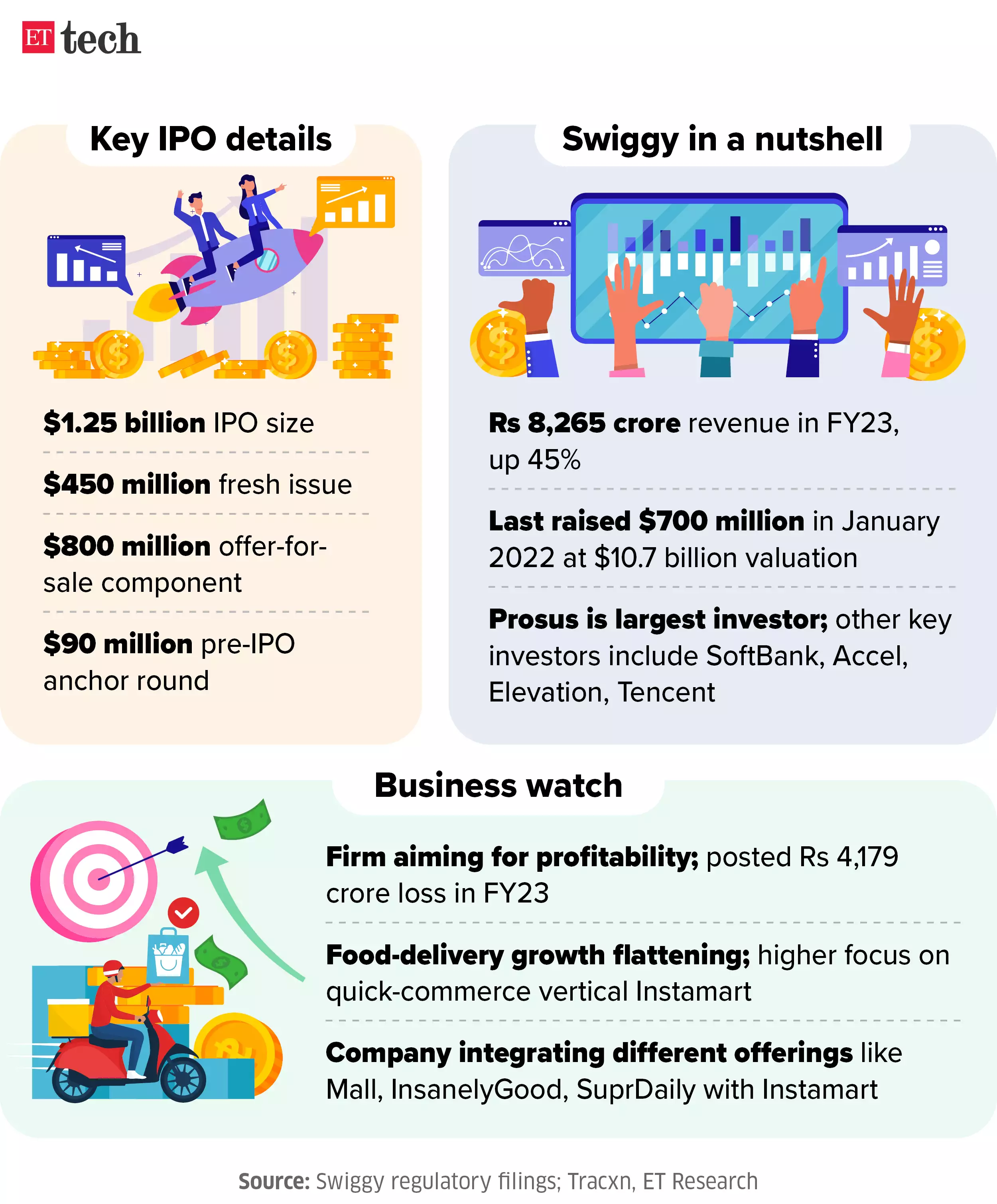

The food and grocery delivery company Swiggy Ltd is set to debut on the stock exchanges with an initial public offering of Rs 11,300 crore, making it the second-largest issue in the primary markets this year. Analysts are predicting that Swiggy's shares may see a flat or negative listing, and are advising investors who have not been allotted shares to wait for the share price to settle before buying. Despite being a major player in the e-commerce and food delivery market, Swiggy's IPO received a sluggish response, with concerns over its negative cash flow business model and high competition leading to lackluster interest from non-institutional investors and retail investors.

The allotment of shares for the highly anticipated NTPC Green Energy IPO has been finalized, with investors receiving bank debit messages. The IPO was oversubscribed by 2.55 times, with shares set to list on the BSE and NSE on November 27. In the grey market, the stock is currently trading at a Rs 4 premium, with experts predicting further improvements as the Indian stock market sees a rally. Interested investors can easily check the IPO allotment status online using the BSE, NSE, or Kfin Technologies' portals.

Shashikant Ruia, one of the founders of the Essar Group, passed away at the age of 81 after battling an illness. Along with his brother Ravi, he successfully built the Essar Group into a global business empire in various industries. The funeral procession will be held on Tuesday towards the Hindu Worli Crematorium. Ruia's passing marks the end of an era for the first-generation entrepreneur and industrialist.

The Mumbai Indians emerged as the clear winners of the IPL 2025 mega auction as they made strategic picks and successfully built a team around their retained core. With star players like Hardik Pandya, Rohit Sharma, Suryakumar Yadav, and Jasprit Bumrah, MI added valuable assets in Trent Boult, Deepak Chahar, Reece Topley, and Will Jacks to strengthen their fast bowling and batting departments. The addition of former Indian cricketer Sachin Tendulkar's son Arjun Tendulkar at his base price of Rs 30 lakh also made headlines. Here is the full squad list for Mumbai Indians after the mega auction.

India secured the top spot in the World Test Championship standings with a percentage of points won of 61.11%. This was achieved after their 295-run victory over Australia in the first Border-Gavaskar Test in Perth. Australia, who were previously at the top, have slipped to second position, while India needs three wins in the remaining four matches to secure a spot in the WTC final. The victory is significant for the team, as it is their biggest Test win in Australia.

The Central government has announced the launch of PAN 2.0 Project, an upgrade of the current PAN/TAN system, as part of its Digital India initiative. The project aims to provide taxpayers with a new PAN card with a QR code feature, ensuring a more efficient and technology-driven process for taxpayer registration. The government will be investing 1435 crore in the project, promising benefits such as improved service delivery, data consistency, and a unified portal for ease of access.

Indian equities continued their upward trend for the second day, with Nifty and Sensex both registering gains of over 1.5%. Bank Nifty also saw an increase of nearly 2%, led by gains in HDFC Bank, ICICI Bank, SBI and Axis Bank. This surge can be attributed to the positive sentiment post the state election results, which have been deemed as highly positive for the market. Analysts predict that the rally may continue for a few more days, driven by short covering and bullish momentum. Meanwhile, Asian markets also traded in the green as the US Treasury secretary selection caused a downward movement in the dollar and bond yields.

HDFC Bank's stock soared to an all-time high as it received a delivery-based buying of Rs 31,135 crore as part of MSCI rebalancing. The private lender recorded a delivery volume of 17.4 crore shares, with a delivery percentage of over 81%, driving its market capitalisation to reach an impressive Rs 13.57 lakh crore. The November round of MSCI indices rejig is expected to bring in foreign passive flows of $2.5 billion, boosting the bank's weightage in the Global Standard Index. This news has attracted the attention of investors, with BSE Ltd. also recording a high delivery turnover worth Rs 2,928 crore.

Hindustan Unilever Limited (HUL) has recently separated its ice cream business, with a valuation exercise already completed. However, the move has faced complications as a panel formed by HUL to evaluate the prospects of this business has discovered that softy ice cream mix is subject to an 18% GST. In addition, a video showing tampering of Amul ice cream has resurfaced, causing concerns for GCMMF. These developments, along with HUL's earnings and FII outflows, have contributed to a fall in the markets for the fourth day in a row. Despite this, there is a silver lining as the Sensex has rebounded, with FMCG seeing growth and Adani Energy receiving a SEBI notice for its shareholding categorization.

In a significant move, India will see its weight in the MSCI Emerging Markets Index rise from 19.3% to 19.8% in 2024, leading to an estimated $2.5 billion in passive foreign inflows. This increase is largely due to notable upgrades for several Indian companies, including Kalyan Jewellers India Ltd., Voltas Ltd., and BSE Ltd. With no Indian stocks removed, India's total representation in the index expands to 156, and an additional 13 Indian stocks have been added to the MSCI Small-Cap Index. This surge in representation not only boosts India's weight in the index but also signals potential for further growth and upgrades in the future, solidifying its position in global markets.