The Federal Reserve has cut its key interest rate for the second time this year, signaling a shift towards supporting the job market and fighting inflation. However, with uncertainties following the presidential election and potential policy changes under the Trump administration, future rate cuts may be unlikely. These future moves could potentially affect mortgage rates, which have already fluctuated in anticipation of changes in the economy and consumer spending.

The Federal Reserve, Interest Rates, and Donald Trump

The Federal Reserve (Fed) is the central bank of the United States. It is responsible for setting interest rates, which are the prices at which banks borrow and lend money to each other. Interest rates have a significant impact on the economy, as they affect the cost of borrowing for businesses and consumers.

In July 2019, the Fed cut its key interest rate for the second time this year. This move was seen as a signal that the Fed is shifting towards supporting the job market and fighting inflation. However, with uncertainties following the presidential election and potential policy changes under the Trump administration, future rate cuts may be unlikely.

Background

The Fed has been raising interest rates since December 2015. This was done in an effort to combat inflation, which is the rate at which prices rise. However, inflation has remained low, and the economy has continued to grow.

In recent months, the Fed has become increasingly concerned about the impact of the trade war between the United States and China. The trade war has led to a decline in business investment and consumer spending. The Fed has also expressed concern about the potential impact of a no-deal Brexit.

Impact of Interest Rate Cuts

Interest rate cuts can have a positive impact on the economy by making it cheaper for businesses to borrow money and invest. This can lead to increased economic growth and job creation. However, interest rate cuts can also lead to inflation if they are not used carefully.

Uncertainties Following the Presidential Election

The results of the presidential election have created uncertainty about the future of interest rate policy. Donald Trump has pledged to cut taxes and regulations, which could lead to higher economic growth. However, he has also threatened to impose tariffs on imports from China, which could lead to higher inflation.

Potential Policy Changes under the Trump Administration

The Trump administration has proposed a number of changes to the way the Fed operates. These changes include reducing the Fed's independence and giving the president more control over the setting of interest rates.

FAQs

The Federal Reserve is the central bank of the United States. It is responsible for setting interest rates, which are the prices at which banks borrow and lend money to each other.

Interest rate cuts can have a positive impact on the economy by making it cheaper for businesses to borrow money and invest. This can lead to increased economic growth and job creation. However, interest rate cuts can also lead to inflation if they are not used carefully.

The results of the presidential election have created uncertainty about the future of interest rate policy. Donald Trump has pledged to cut taxes and regulations, which could lead to higher economic growth. However, he has also threatened to impose tariffs on imports from China, which could lead to higher inflation.

The Trump administration has proposed a number of changes to the way the Fed operates. These changes include reducing the Fed's independence and giving the president more control over the setting of interest rates.

The future of interest rate policy is uncertain. The Fed will likely continue to monitor the economy and make decisions on interest rates based on its assessment of the economic outlook.

The Indian stock market saw a huge surge as the BSE Sensex jumped 1,436.30 points to settle at 79,943.71, its biggest single-day gain in over a month. The NSE Nifty also surged by 445.75 points to close at 24,188.65, with financial, auto, and IT shares leading the buying spree. However, Sun Pharma was the only laggard in the Sensex. Meanwhile, India's manufacturing sector witnessed slower growth in December, with the HSBC Purchasing Managers' Index falling to 56.4 from 56.5 in November. Despite this, the country's gross GST collection rose 7.3% from the previous year to Rs 1.77 lakh crore in December, indicating a steady recovery in economic activity.

As the 29th Dhaka International Trade Fair kickstarted in 2025, Chief Adviser Prof Muhammad Yunus emphasized the need for stronger exports by investing in the services sector. He urged the business community to explore opportunities beyond products and enhance Bangladesh's export base. In addition, the CA proposed introducing an "Entrepreneur of the Year" initiative to recognize and promote the individuals behind the country's products, along with the traditional "Product of the Year" model. The government's efforts to showcase Bangladesh's diverse products in the global market were also highlighted.

Formerly known as Grofers, Blinkit, a quick commerce company, was recently acquired by Zomato. In a cheeky social media post, Blinkit's CEO Albinder Dhindsa shared that over 1 lakh packets of condoms and 45,000 bottles of mineral water were being delivered for the New Year's Eve prep. However, standup comic Kunal Kamra raised important questions about the wages of the company's delivery partners. This incident brings attention to the exploitation of gig workers by platform owners in the gig economy.

The Kerala State Beverages Corporation has reported a whopping Rs 108 crore in liquor sales on New Year's Eve, surpassing last year's figures by Rs 13 crore. With the state already relying heavily on alcohol taxes, this increase in sales is expected to significantly boost the state's revenues. The highest sales were recorded at the Ravipuram outlet in Kochi, and with one more quarter left in the fiscal year, it is predicted that this year's liquor sales will surpass the previous year's record of Rs 19,088.68 crore.

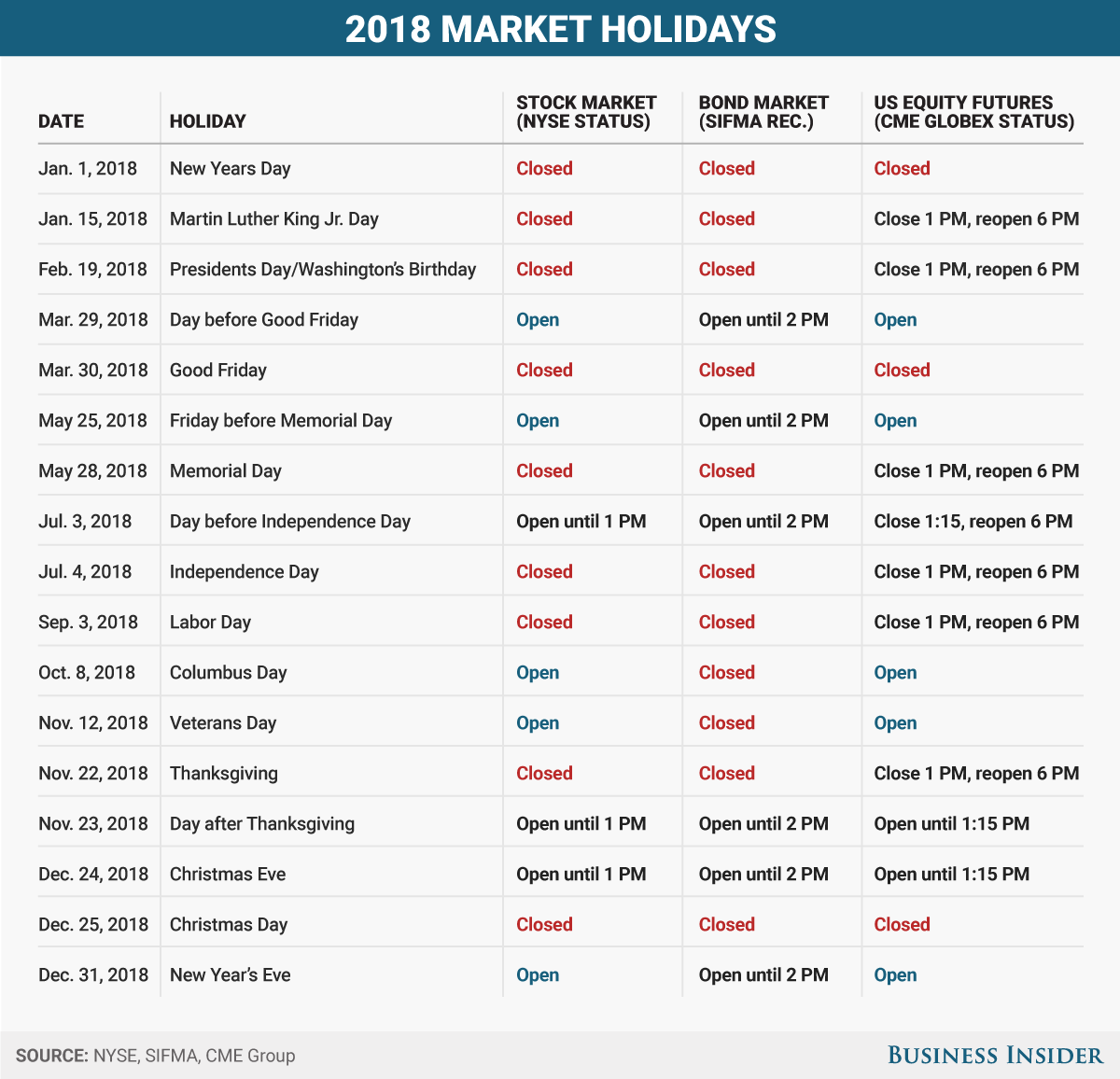

The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) have released their 2025 holiday calendar, with a total of 14 stock exchange holidays scheduled. The first holiday will be on Mahashivratri, followed by a long weekend in March for Holi and Id-Ul-Fitr. In addition, the popular Muhurat Trading will take place in October. Investors are advised to keep checking the official websites for updates on holiday timings.

As we ring in the new year, it's the perfect time to wish for abundance, happiness, and success for our loved ones. Whether it's through text, WhatsApp, or a phone call, sending personalized messages and quotes is a beautiful way to show your care and love. From motivational quotes to funny New Year wishes, make sure to spread positivity and joy on this exciting new journey. Subscribe to Zee Business on YouTube for more business and finance news.

Adani Enterprises has announced the strategic sale of Adani Wilmar Ltd, which is expected to significantly enhance its liquidity and fuel its core infrastructure verticals, including the green H2 ecosystem, airports, data centers and more. The sale is projected to generate a substantial corpus of Rs 50,000-52,000 crore and positively impact Adani portfolio's net debt-to-Ebitda ratio. This transaction marks AEL's first major move since the US Department of Justice indictment in November 2024, showcasing the company's disciplined financial approach and resilience in the face of recent challenges. With a strong war chest in place, AEL is poised to reaffirm its dominance in the infrastructure and consumer services sectors.

Unimech Aerospace, a leading manufacturing company that specializes in complex tools and engineering solutions, made its much-awaited debut in the stock market on Tuesday. With its shares trading at a premium of almost 90 per cent against the issue price, the firm's market entry was met with overwhelming response and investor interest. Despite a slight dip in the share's gains, Unimech Aerospace's maiden issue has been declared a huge success, with its IPO being oversubscribed 175.31 times. The funds raised from the IPO are slated to be utilized towards expanding the firm's production facilities and meeting its working capital needs.

On January 6, 2025, ITC announced the effective date for the demerger of its hotels business, with the shares of ITC Ltd turning ex-date for this demerger. Eligible shareholders will be allotted one ITC Hotels share for every 10 ITC shares held, with the demerger ratio set at 1:10. The ITC Hotels share price is expected to be adjusted by Rs. 22-25, taking into account a 20% holding discount and a 40% stake in the hotel business. Nuvama predicts that the initial market price for ITC Hotels shares will range between Rs. 150-175. After its initial listing, ITC Hotels will be included in Nifty50 and Sensex indices, but will then be removed at its last traded price three days after listing.

Barcelona can breathe a sigh of relief as they have found a solution to their registration problem for Dani Olmo and Pau Victor. The club's president, Joan Laporta, has been successful in securing a €100 million deal with Arab enterprises to operate the VIP boxes at the new Spotify Camp Nou. This agreement not only allows for the registration of the two players but also ensures that the club can confidently participate in the transfer market.