Bank of America (BofA) has lowered its price target for Bloom Energy (BE) and maintains an Underperform rating on the shares. The analyst believes that while utility partnerships are expected to drive growth, the company needs to focus on cost competitiveness and margin improvements in order to reach its targets. BofA's estimates for FY24 are at the lower end of the company's revenue guidance and falls short in terms of gross margins. These factors may impact the stock's performance and make it a riskier investment.

Bloom Energy: BofA Lowers Price Target Amid Profitability Concerns

Background:

Bloom Energy is a fuel cell technology company that designs, manufactures, and sells solid oxide fuel cells for power generation. The company's fuel cells generate electricity through an electrochemical process that uses hydrogen and oxygen, producing water as a byproduct. Bloom Energy targets the commercial and industrial sector, providing distributed electricity solutions.

BofA Analyst Downgrade:

On February 23, 2023, Bank of America (BofA) analyst Julien Dumoulin-Smith lowered his price target for Bloom Energy to $18 from $21 and maintained an Underperform rating on the shares. Dumoulin-Smith cited concerns about Bloom Energy's cost competitiveness and margin improvements, despite expectations of growth driven by utility partnerships.

Analyst's Concerns:

Impact on Stock Performance:

BofA's downgrade and concerns have contributed to a decline in Bloom Energy's stock price. Since the announcement, the company's shares have fallen by over 10%. The lower price target and negative analyst sentiment may continue to weigh on the stock's performance.

Top 5 FAQs:

1. Why did BofA lower Bloom Energy's price target? BofA cited concerns about Bloom Energy's cost competitiveness, margin improvements, and growth potential.

2. What is Bloom Energy's current rating from BofA? BofA maintains an Underperform rating on Bloom Energy shares.

3. What is the main concern for Bloom Energy's growth? BofA believes the company needs to focus on reducing costs and improving margins in order to reach its growth targets.

4. How has the BofA downgrade affected Bloom Energy's stock price? The downgrade has contributed to a decline in Bloom Energy's stock price by over 10%.

5. What are the key challenges facing Bloom Energy in the future? Bloom Energy faces challenges in reducing manufacturing costs, improving margins, and competing with other power generation technologies.

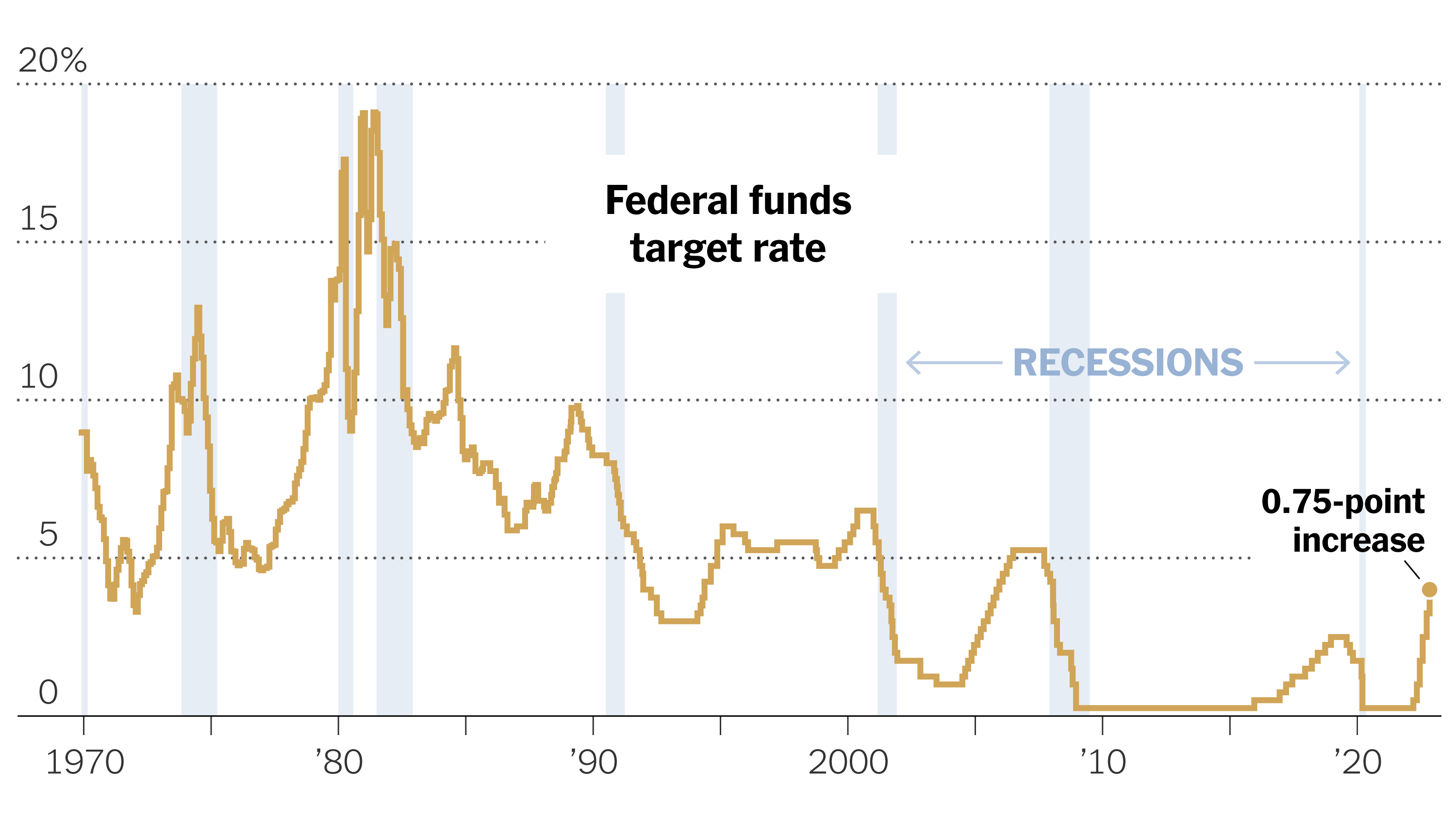

As the US inflation report shows unexpected growth, concerns rise for Federal Reserve officials who may now choose to keep rates steady. This is compounded by intensive wage growth and strong consumer demand which lead to higher import prices due to President Trump's tariffs. The possibility of a Fed rate cut in the first half of 2025 is now extremely low, and the US dollar is expected to remain strong. Investors are also watching closely as the US-China trade tensions escalate with President Trump’s recent import tax announcement.

The Adani Group, led by chairman Gautam Adani, has announced a beneficial partnership with the Gita Press, the largest publisher of Hindu religious texts in India. The Adani Group will be offering free copies of 'Aarti Sangrah' to one crore devotees heading to the Mahakumbh 2025 in Prayagraj. Additionally, they have also joined hands with ISKCON to provide meals, through a system called 'Mahaprasad Seva', to 50 lakh devotees visiting the Kumbh Mela. This initiative is a result of the Adani Group's commitment to their spiritual side and their 'Seva Hi Saadhna Hai' pledge, demonstrating their dedication to helping and serving society.

With the upcoming Global Investors Summit (GIS) 2025 in Bhopal, Madhya Pradesh Chief Minister Mohan Yadav will hold one-on-one and roundtable meetings with industrialists in New Delhi. The state's new investment policy, which includes 10 sub-policies covering key sectors such as agriculture, textiles, and defense manufacturing, will be presented by senior government officials. The summit aims to highlight investment opportunities in Madhya Pradesh and promote employment generation, innovation, and entrepreneurship, with special focus on the film sector. The summit will be inaugurated by Prime Minister Narendra Modi and attended by Union Home Minister Amit Shah.

Many commonly used words in business, such as leadership and engagement, are often used without a clear understanding of their meaning. These "suitcase terms" can lead to miscommunication and poor decision-making within organizations. It is crucial for companies to define and unpack these terms to improve leadership, workplace culture, and overall performance. This is especially important when it comes to differentiating between leadership and management, as promoting based on operational success rather than leadership ability can lead to the Peter Principle. Similarly, without a clear definition of employee engagement, companies risk promoting burnout and undervaluing the true drivers of motivation and commitment.

The largest and most comprehensive textile event, Bharat Tex 2025, has been launched by 11 major textile industry bodies and supported by the Ministry of Textiles. This event, spread over 2.2 million square feet, will showcase the diversity, scale, and capability of India's textile sector to over 5,000 exhibitors, 6,000 international buyers, and 120 countries. With over 70 conference sessions and discussions led by 100 international speakers, Bharat Tex 2025 aims to position India as a reliable and sustainable sourcing and investment destination in the global textile market. Attendees can expect to see a wide range of products, from apparel and home furnishings to technical textiles and handicrafts, while also gaining insights into important industry topics and trends.

At the Fortune India Next 500 summit, Union Minister of State for Civil Aviation Jayant Sinha discusses the challenges facing Air India, including its staggering debt of over Rs 50,000 crore and lack of interest from potential buyers. The government is now exploring alternative options to revitalize the national carrier and avoid burdening taxpayers. Sinha also highlights the potential for job creation and economic growth in the aviation sector.

In a recent Instagram post, the founder and CEO of Monk Entertainment, Viraj Sheth, addressed the struggles of content creation in the age of instant virality and doomscrolling. He advised against solely focusing on gaining a large following, as easy algorithm hacks make it less meaningful. According to him, true influence goes beyond fleeting visibility and requires genuine creativity and impact.

Vineet Rai, founder and Chairman of Aavishkaar Group, shares the company's ambitious goal of growing its assets under management from $1 billion to $7 billion by 2025. The Dutch development bank CEO also discusses the organization's success in finding investment opportunities in India's specialized markets.

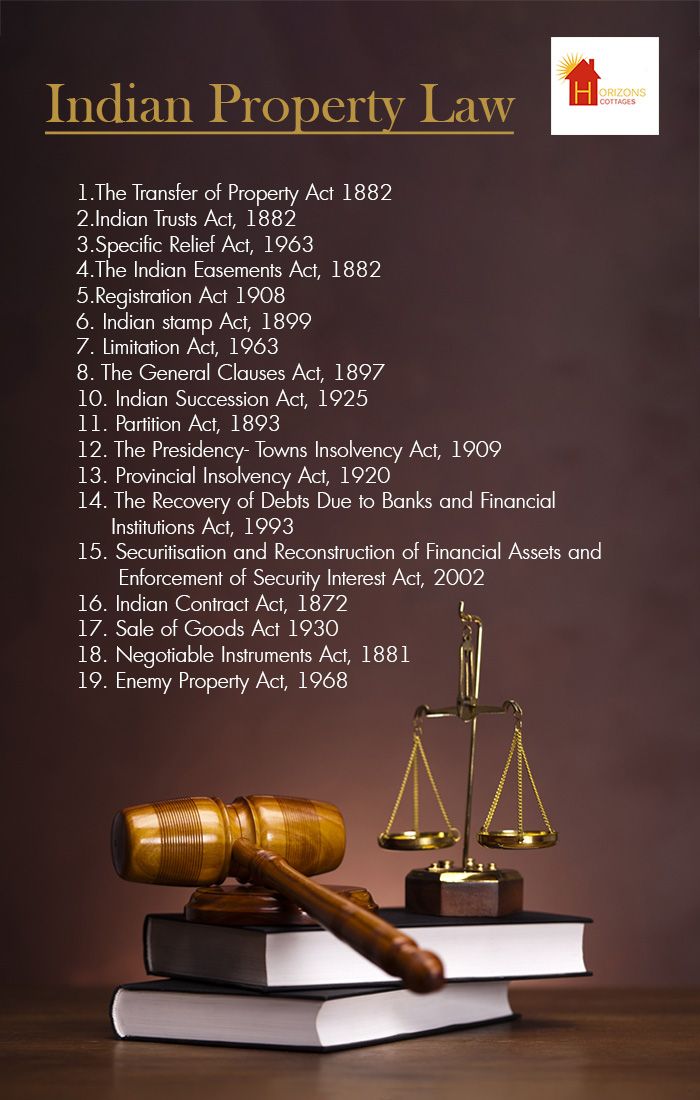

Stay updated on the latest developments and reforms in India's joint family property laws. Learn about the potential impacts and implications on your own familial property and future inheritance planning. This news will provide comprehensive coverage of the changes and important updates on this significant business and legal topic.