At the Fortune India Next 500 summit, Union Minister of State for Civil Aviation Jayant Sinha discusses the challenges facing Air India, including its staggering debt of over Rs 50,000 crore and lack of interest from potential buyers. The government is now exploring alternative options to revitalize the national carrier and avoid burdening taxpayers. Sinha also highlights the potential for job creation and economic growth in the aviation sector.

Air India's Financial Woes and the Government's Intervention

Air India, India's national carrier, has been grappling with severe financial challenges for years. The airline has accumulated a staggering debt of over Rs 50,000 crore, rendering it a burden on the Indian taxpayers. In an effort to address the situation, the government has been actively exploring alternative options to revitalize Air India and avoid further financial distress.

Union Minister Jayant Sinha's Address at IIVCA

At the recent Fortune India Next 500 summit, Union Minister of State for Civil Aviation Jayant Sinha shed light on the challenges facing Air India and the government's plans for its future. Sinha acknowledged the airline's debt burden and the lack of interest from potential buyers, highlighting the need for alternative solutions.

Exploring Alternative Options

The government has been considering various options to address Air India's financial troubles. One potential solution is to sell off a portion of the airline's assets, such as its ground handling or engineering services. Another option is to merge Air India with another domestic airline, creating a larger and more competitive entity.

Sinha also stressed the importance of job creation and economic growth in the aviation sector. He outlined plans to develop new airports, promote tourism, and invest in infrastructure to support the growth of the industry.

Top 5 FAQs

1. What is the current debt of Air India?

Answer: Over Rs 50,000 crore.

2. Why has Air India failed to attract buyers?

Answer: Due to its high debt burden and lack of profitability.

3. What are the government's options for Air India's revitalization?

Answer: Asset sale, merger, or alternative investment.

4. How does the government plan to address Air India's impact on taxpayers?

Answer: By exploring solutions that minimize the burden on taxpayers.

5. What is the potential of the aviation sector in India?

Answer: Significant job creation, economic growth, and tourism promotion.

Conclusion

The financial challenges facing Air India are a complex issue that requires careful consideration and innovative solutions. The government's exploration of alternative options is a positive step towards addressing the airline's debt burden and revitalizing the national carrier. The potential of the aviation sector in India is immense, and the government's plans for infrastructure development and job creation are encouraging signs for the future growth of the industry.

In a recent Instagram post, the founder and CEO of Monk Entertainment, Viraj Sheth, addressed the struggles of content creation in the age of instant virality and doomscrolling. He advised against solely focusing on gaining a large following, as easy algorithm hacks make it less meaningful. According to him, true influence goes beyond fleeting visibility and requires genuine creativity and impact.

Vineet Rai, founder and Chairman of Aavishkaar Group, shares the company's ambitious goal of growing its assets under management from $1 billion to $7 billion by 2025. The Dutch development bank CEO also discusses the organization's success in finding investment opportunities in India's specialized markets.

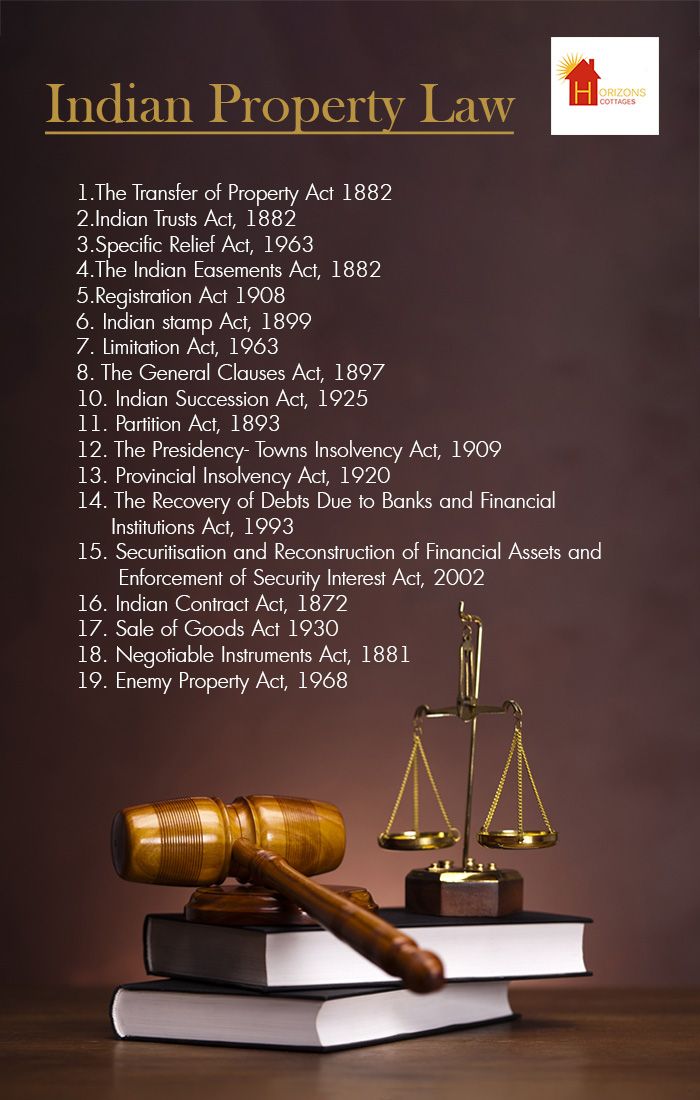

Stay updated on the latest developments and reforms in India's joint family property laws. Learn about the potential impacts and implications on your own familial property and future inheritance planning. This news will provide comprehensive coverage of the changes and important updates on this significant business and legal topic.

Ajax Engineering, a Bengaluru-based company that specializes in manufacturing concrete equipment, is starting the bidding process for its Rs 1,269.35 crore IPO today. The company has seen strong demand in the grey market and raised Rs 379.31 crore from anchor investors. It has a wide distribution network in India and abroad with continued growth and profitability. Investors should keep a close eye on this IPO and its potential for listing gains.

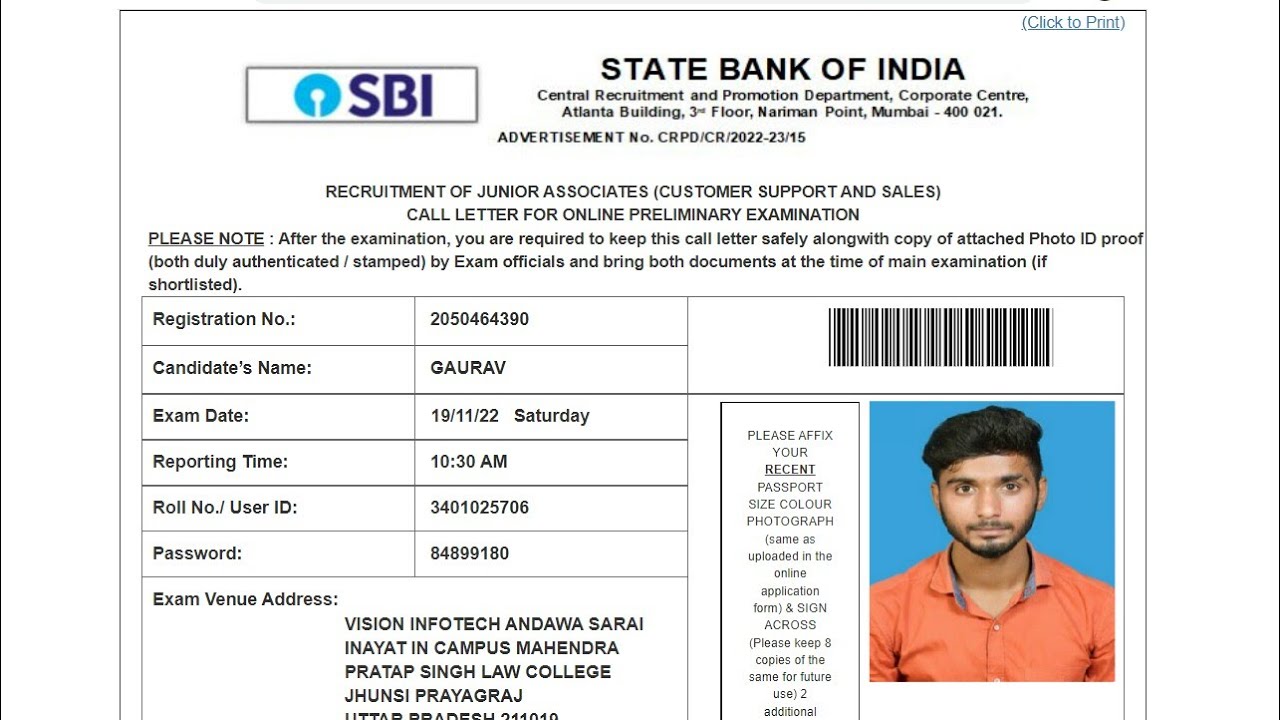

The State Bank of India is set to release the SBI Clerk Prelims Admit Card 2025 on 10 February along with the exam date for the 14,191 vacancies of Junior Associate (Clerk). Candidates can download their admit card from the official website, sbi.co.in, using their registration number and DOB/password. Make sure to have all necessary documents ready and follow the steps provided to ensure a smooth exam experience.

The State Bank of India has released the admit card for the first phase of the SBI Clerk recruitment exam. The exam is scheduled for February and March of 2025 and will have negative marking for wrong answers. This recruitment is for 13,735 positions for Junior Associates and candidates are advised to prepare well and download their admit cards in advance. The story also includes a mention of a woman who left her MNC job to become an IPS officer and encourages readers to check out the publication's editorial guidelines and standards.

The Board of Control for Cricket in India (BCCI) has recently released copyright regulations for the year 2025, outlining the organization's terms and policies for content usage. In a move to protect their intellectual property, BCCI has set strict guidelines and penalties for unauthorized use of their materials. These regulations cover various aspects such as copyrights, terms and conditions, privacy policies, and more, aiming to safeguard BCCI's rights and interest. As the cricket world gears up for future tournaments, these regulations may have a significant impact on the use and distribution of BCCI's content by individuals and organizations.

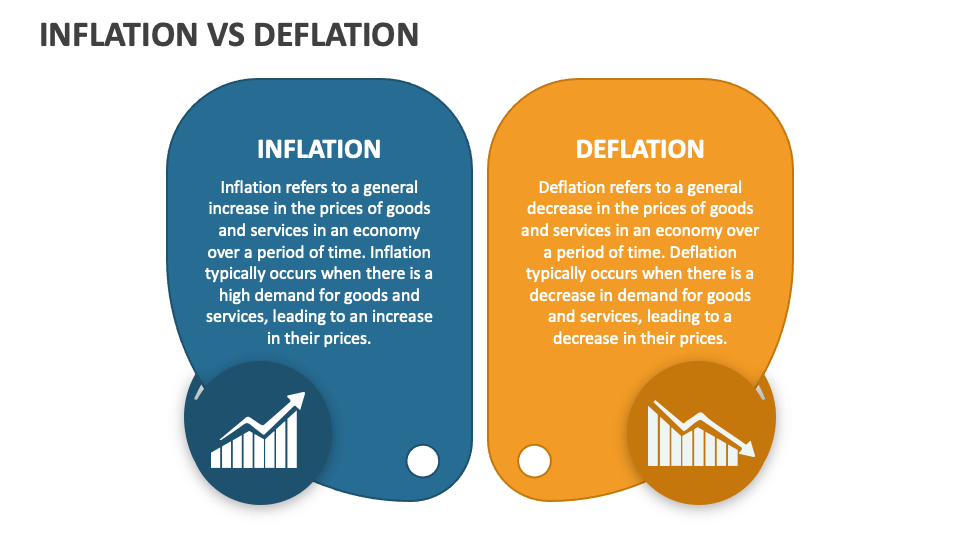

A recent study by the Research Institute of Economy, Trade and Industry sheds light on the burden of inflation tax and its effect on intergenerational imbalances. Contrary to previous studies, this research found that inflation or deflation can greatly impact the burden faced by both current and future generations. Additionally, the study suggests that implementing economic growth strategies alone will not be enough to eliminate these imbalances, and calls for concurrent reform in public finance and social security systems. These findings have significant implications for policy makers and economists.

The wait is almost over as Finance Minister Nirmala Sitharaman gets ready to present the Union Budget at 11 am today. This highly anticipated event will see several major announcements that are expected to have a significant impact on the country's economy. To fully grasp the details of the budget, it is important to understand key terms such as GDP, nominal GDP, real GDP, and capital receipts. These terms include important aspects such as economic growth, inflation, and the government's borrowing requirements, which can help individuals make sense of the budget speech. So, let's delve into the world of economics and get ready for the Union Budget 2025.