Rediff Money Desk, a prominent business news source based in New Delhi, reported that technology giants Samsung and Check Point have announced plans to expand their research and development (R&D) efforts in India following the country's budget for 2025, which emphasizes investments in AI and geospatial technology. Additionally, Enfabrica, an emerging tech company, has opened a new R&D hub in Hyderabad. The budget also brought good news for the crop protection industry, as they seek tax cuts to promote research and development in the sector. Meanwhile, Ultratech Cement's shares have plunged, causing a drop in valuation for the company.

With rapid growth in infrastructure and real estate demand, the cables and wires sector has been performing well. However, the recent announcement of UltraTech, the country's largest cement company, entering the space has caused concern among investors. The Aditya Birla Group's decision to expand into this sector aligns with their vision of providing comprehensive solutions in construction. But with UltraTech's extensive manufacturing expertise and strong connections, the wires and cables industry is expected to see significant growth, posing a new challenge for existing companies.

The Indian market showed positive signs as the Sensex and Nifty started the day with gains, ahead of the Union Budget 2025 announcement. However, top gainers on the Sensex included Sun Pharma, UltraTech Cement, IndusInd Bank, Zomato, and Adani Ports, while the top losers were Titan, Bajaj Finserv, Kotak Bank, Nestle, and Asian Paint. The Economic Survey presented by Finance Minister Nirmala Sitharaman projected India's economy to grow between 6.3 to 6.8 per cent in the upcoming 2025-26 fiscal year. However, market experts are looking for growth-stimulating measures in the budget rather than market-related taxation relief. The market response to the budget is expected to last only a few days and will be heavily influenced by trends in growth and earnings recovery.

The stock market witnessed a massive plunge, causing investors to lose a whopping Rs. 9.28 Lakh Crore. ICICI Bank saw a 2% rise in stock after reporting strong Q3 earnings, but it wasn't enough to stem the overall market trend. ICICI Pru Life, UltraTech Cement, MCX, Wipro, and Dr. Reddy's were among the companies that saw stock prices plummet after disappointing earnings reports. LIC MF, Aditya Birla, and Bank of India added to their investment portfolio by buying shares of Manorama, while HDFC Life saw a 12% surge in stock after announcing strong Q3 earnings.

Shares of ITD Cementation surged by 20% following reports of the Adani Group considering buying a stake. If the deal goes through, it would mark another major acquisition for the Adani Group in the cement industry. Amid predictions of further consolidation in the cement sector, UltraTech has announced plans to keep India Cements listed after acquiring it. This news comes as Jindal Group announces an expansion in cement capacity to 7 million tons per annum. As the Indian cement industry continues its consolidation trend, reports of the Adani Group potentially buying a stake in ITD Cementation have caused the company's stocks to soar by 20%. This comes on the heels of UltraTech's plans to keep India Cements listed after a potential acquisition. Meanwhile, Jindal Group looks to expand its cement capacity to 7 million tons per annum.

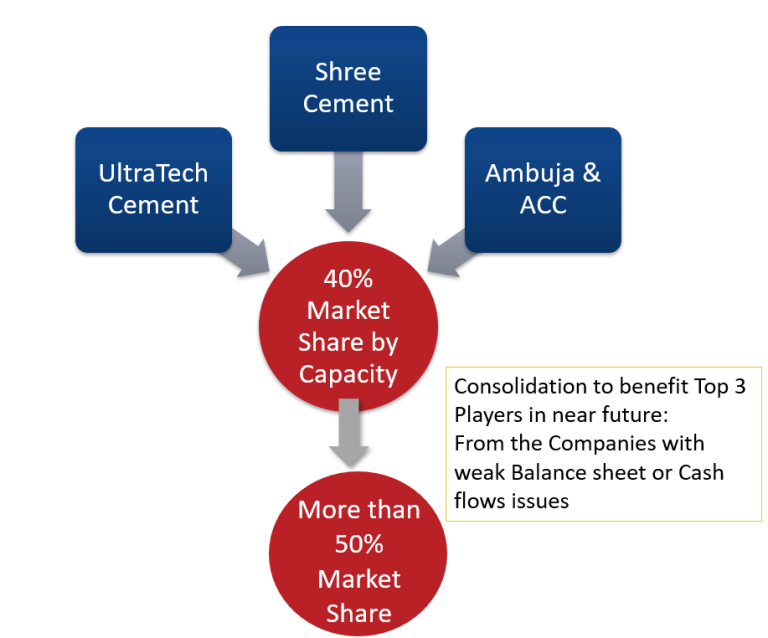

The Indian cement industry is witnessing a series of acquisitions and mergers as UltraTech Cement has acquired 23% stake in India Cements and 25% stake in UAE's RAKWCT, turning it into a subsidiary. Not to be left behind, Ambuja Cements has also merged with Adani Cementation and acquired Penna Cement. These developments, along with Dalmia Bharat's new cement mill in Tamil Nadu and a surge in demand due to infrastructure push, have resulted in a 35% increase in UltraTech's Q4 profit to 2,258.6 crores. Experts predict that this consolidation will continue, resulting in a more dominant market for UltraTech and Ambuja.

Aditya Birla Group's UltraTech Cement has announced the acquisition of a 23% stake in India Cements, a company led by former BCCI president N Srinivasan, for over Rs 1,900 crore. This move is expected to increase UltraTech's manufacturing capacity and bolster its competition against Adani Group. The acquisition was made through two block deals and UltraTech will now become the second-largest shareholder in India Cements. Adani Group had recently announced its own acquisition of Penna Cement, adding 14 MTPA to its capacity.

In a significant move, UltraTech Cement, the country's leading cement maker, announced its plan to acquire a 23% stake in its rival company India Cements for a whopping Rs 1,885 crore. This monetary investment will allow UltraTech to purchase 7.06 crores equity shares of India Cements, further expanding its already impressive capacity of 152.7 MTPA. This financial move by UltraTech is part of its ongoing expansion and acquisition strategy, which has seen a significant increase in its capacity over the past year. On the other hand, India Cement's revenue has been on the decline, prompting them to monetize some of their non-core assets to improve liquidity.

Despite a volatile session, the S&P BSE Sensex settled higher by 253 points at 73,917 levels, while the Nifty50 closed at 22,466 with a 0.28 per cent gain. Top gainers on the Sensex were M&M, JSW Steel, Ultratech Cement, Kotak Bank, ITC, Maruti Suzuki, NTPC, and Tata Motors, while TCS, HUL, HCL Tech, Nestle India, Wipro, Bajaj Finserv, and Infosys were among the top losers. BSE MidCap and SmallCap indices both closed over 1 per cent higher, while Nifty Auto and Nifty Realty indices also recorded gains. Nifty IT index, however, fell by 0.8 per cent. According to Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, the equity markets may continue to remain range-bound for the near future.

UltraTech Cement, a leading construction materials company in India, has reported strong third-quarter earnings that have exceeded Street expectations. The company's consolidated net profit saw a significant increase of nearly 68%, reaching 17.77 billion rupees, while revenue from operations also rose by 8%. These strong results have caused shares of UltraTech Cement to rise by 1.2% after the release of the earnings report.