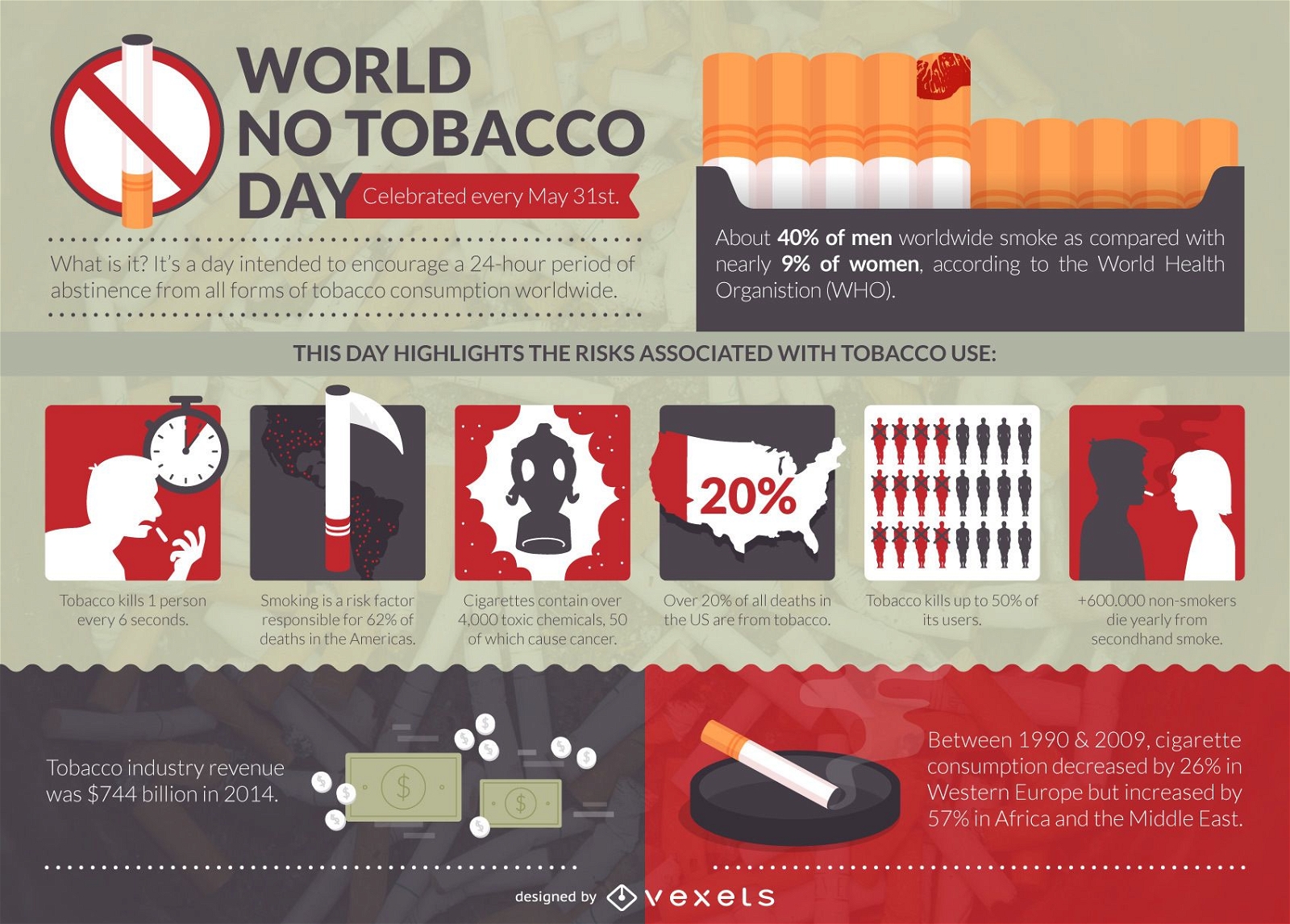

No Smoking Day, observed on March 12, began in the UK in 1984 as a campaign to raise awareness about the dangers of tobacco and help people quit smoking. Over the years, it has become a global event supported by governments and healthcare groups. This day offers practical tools and resources to make quitting easier and has a positive approach towards reducing smoking rates. With millions of deaths and economic costs linked to tobacco every year, No Smoking Day plays a crucial role in saving lives and improving communities.

The stocks of major tobacco companies in India, including ITC Ltd., Godfrey Phillips Ltd., and VST Industries Ltd., saw a decline following reports of a potential 35% tax on sin goods under the Goods and Services Tax framework. This proposal, made by the Group of Ministers on GST rate rationalisation, could have a significant impact on sales and profits for tobacco manufacturers. However, it is just one part of a larger GST reform plan, including other recommendations for tax adjustments and the end of the compensation cess in 2026.

On December 3, 2024, the Goods and Services Tax Council met in Jaisalmer to discuss important pre-budget consultations and health-related matters. Among the key decisions made were the proposal to increase GST on cigarettes, tobacco, and beverages to 35%, and the request for an extension for the GoM to submit its report on GST compensation cess. The Council also planned to discuss potential tax cuts for non-alcoholic beverages based on sugar and the rationalization of GST rates. Additionally, the meeting aimed to address concerns surrounding the GST on health insurance and the potential reduction of insurance levies.

The GST Council is planning to raise taxes on certain goods, including cigarettes and tobacco, from 28 per cent to 35 per cent, in an effort to generate additional revenue. The proposed changes will also impact the tax rates for apparel, with prices for items costing up to Rs 1,500 attracting a 5 per cent GST, those between Rs 1,500 and Rs 10,000 attracting 18 per cent, and those above Rs 10,000 attracting 28 per cent. The GoM on the tax rate rationalization is expected to make their recommendations to the GST Council on December 21.

Business "GST Council Proposes Special 35% Tax Rate for Demerit Goods like Tobacco and Aerated Beverages" The Goods and Services Tax Council recommends a significant change to the tax structure, proposing a new 35% tax rate for demerit goods such as cigarettes, tobacco, and aerated beverages. The proposal also includes rate tweaks for over 148 items, including a 5% tax on readymade garments priced up to Rs 1,500. The GoM on compensation cess has also requested an extension of six months to submit its report on the removal of cess on luxury goods.

The Indian government has issued several notices to leading companies, including Infosys, Eicher Motors, and Patanjali Foods, for alleged GST evasion. These notices have been issued for amounts ranging from 15 lakh to a staggering 32,403 crore rupees. Kerala has also made a demand for a 60% share in GST revenues for states, which was discussed in a recent GST Council meeting. While the implementation of machine registration for tobacco products has been completed by GSTN, there are still many challenges that remain in simplifying compliance with GST regulations. Indian Overseas Bank has taken a proactive step towards supporting startups by launching a dedicated branch in Chennai.

In a latest development of their ongoing family feud, Samir Modi, the founder-president of 24Seven retail chain, has demanded a whopping sum of Rs389.6 crore from tobacco manufacturing company Godfrey Phillips India (GPI) as royalty payment for using the brand name of 24Seven. The demand has put a wrench in GPI's plan of selling 24Seven to exit from the loss-making retail business. The demand includes interest charges and is defended by Samir as a rightful payment for using the intellectual property rights of 24Seven, a brand that is entirely owned by him and has 154 stores across Delhi-NCR, Chandigarh, Punjab, Haryana, and Hyderabad.

Sri Venkateswara Institute of Medical Sciences (SVIMS) in Tirupati recently organized an event for 'World No Tobacco Day' where speakers emphasized the need for smokers to quit the habit and protect children from tobacco industry interference. With various health hazards caused by tobacco consumption, the rally and speeches also aimed at creating awareness about environmental degradation due to smoking. Dr. Mohan, the organizer, credited the World Health Organization and United Nations Environment Program for spreading the anti-tobacco message globally.

In an emotional plea, former Delhi Chief Minister Arvind Kejriwal has announced that he will be surrendering on June 2 following his bail in a defamation case. Kejriwal, who has faced numerous legal battles, has urged his supporters to take care of his family while he serves his sentence. Meanwhile, the World Health Organization continues to raise awareness about the harmful effects of tobacco and its drugs on World No Tobacco Day.

In an interview on World No-Tobacco Day, popular actor Purab Kohli shares his personal journey of quitting smoking after a decade of being a smoker. He reveals how initially, he began smoking due to peer pressure and a misconception that it was "cool." However, in his late 20s, Kohli realized the negative effects of smoking and made a determined decision to quit. He emphasizes the challenges he faced and the importance of long-term commitment in breaking the habit.