Indian shares are expected to open on a positive note as GIFT Nifty futures rise, reflecting upbeat momentum in the US and Asian markets. US equities closed higher for the second consecutive session, with investors looking for bargains and economic data giving mixed signals. Nifty 50 formed a bullish pattern, with key resistance levels at 22,670 and 22,880. Foreign institutional investors continued to sell equities, while domestic institutional investors remained strong buyers. The rupee also appreciated, supported by positive domestic equities and weakened global dollar.

Union Finance Minister Nirmala Sitharaman criticizes Tamil Nadu Chief Minister M.K. Stalin's decision to remove the rupee symbol from the state's 2025-26 Budget logo, calling it an example of language and regional chauvinism. She points out that the rupee symbol was officially adopted in 2010 when the DMK was part of the ruling alliance at the Centre and warns that this decision reflects a dangerous mindset that weakens Indian unity. Sitharaman also reminds elected representatives of their constitutional duty to uphold the nation's sovereignty and integrity.

In a significant move by the Chhattisgarh government, petrol prices have been reduced by one rupee, benefiting the people of the state. Finance Minister O P Choudhary emphasized that the budget is focused on knowledge welfare and aims to bring progress through a speed strategy. The budget also includes plans to adopt the National Education Policy, establish Chhattisgarh Institutes of Technology, and develop infrastructure. However, opposition leader Bhupesh Baghel criticized the budget for not addressing issues such as farmer welfare and unemployment.

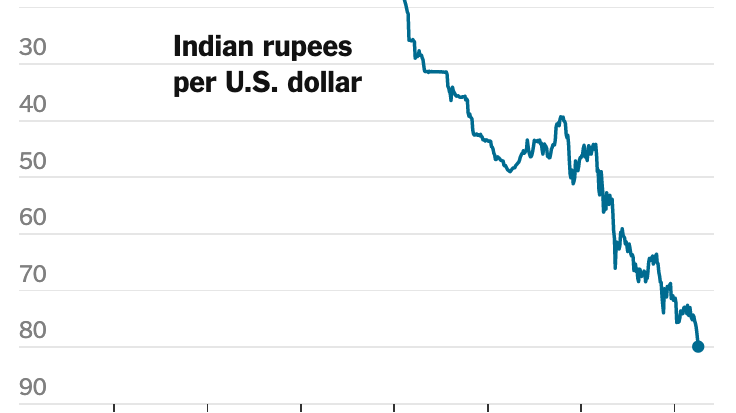

The Indian rupee has hit a record low of 86.12 against the US dollar following a stronger dollar and better-than-expected US jobs data. This trend has been further fueled by higher crude oil prices and continued outflows from foreign investors. Experts suggest that the Reserve Bank of India's decision to allow the rupee to depreciate may be a response to global and domestic pressures, including the cautious stance of the Federal Reserve and solid economic data. The market now anticipates only one interest rate cut by the US Fed in 2025.

The state of Bihar is gearing up for its Investor Summit 2024, which will focus on highlighting the investment potential and growth opportunities in the manufacturing, renewable energy, and leather industries. With major corporations like Adani Group, IOC, Shree Cement, NTPC, and NHPC announcing multi-billion rupee investments in power plants, refineries, and cement plants, the state is set to attract a huge influx of capital and boost its economic development. The summit, scheduled for December 2024, is expected to provide a platform for investors to engage with government officials and business leaders and explore potential partnerships and collaborations. With the aim to transform Bihar into a vibrant industrial hub, the state government is leaving no stone unturned to showcase its strengths and attract investments.

The Indian rupee has been experiencing volatility against the US dollar, as it hits an all-time low of 84.40 and then recovers to close at 84.72. On multiple occasions, the rupee has risen and fallen against the dollar, with the latest recorded rise being 7 paise. The Reserve Bank of India chose to keep interest rates unchanged despite the fluctuations in the rupee's value.

The Reserve Bank of India's three-day monetary policy review started on Wednesday, with expectations of a potential cut in the cash reserve ratio (CRR). The CRR is the percentage of a bank's total deposits that it is required to maintain in liquid cash with the RBI, and a reduction could signal the RBI's intention to ease monetary policy without reducing the repo rate. This move would free up significant bank liquidity and potentially stabilize the rupee.

Despite initial signs of recovery, the Indian stock market faced a decline in early trade on Monday due to persistent foreign fund outflows, IT stock sell-offs, and weak cues from US markets. The downward trend was reflected in both the Sensex and Nifty, with major companies like Infosys, Tech Mahindra, and Tata Consultancy Services among the major losers. The rupee also saw a slight recovery against the US dollar, but foreign investors continued to pull out funds from the Indian equity market, adding to the ongoing sell-off.

HDFC Bank, India's leading private bank, conducted a two-day Public Awareness Campaign (PAC) in Telangana to promote the use and acceptance of ₹10 coins. The initiative, organized in collaboration with the Reserve Bank of India, saw the distribution and exchange of ₹10 coins worth over Rs 10 lakhs. The campaign targeted different types of customers, including retailers, traders, and small businesses, and aimed to build trust and confidence in the use of coins in daily transactions. With the success of this campaign, HDFC Bank hopes to encourage the circulation of coins in smaller towns and cities.

Indian Bank Kazipet in Warangal, Telangana has recently added new features for their customers, including a mobile app for easy banking, a credit tracking system to check credit scores, and information about the bank's IFSC and MICR codes. These features are aimed at making banking more convenient and accessible for customers.