The Finance Minister, in her Budget 2025 speech, announced significant changes in taxation including a nil tax slab limit of Rs 12 lakh, increased from Rs 7 lakh, and an extended time limit of 4 years to file an updated income tax return. The threshold for TDS deduction on rent has also been raised from Rs 2.4 lakhs to Rs 6 lakhs while the exemption limit for TCS on remittances has been increased from Rs 7 lakhs to Rs 10 lakhs. Additionally, TCS on sale of goods will be omitted to ease compliance difficulties.

During her Union Budget 2025 speech, Finance Minister Nirmala Sitharaman announced that no income tax will be payable on income up to Rs 12 lakh, providing significant relief to taxpayers, especially the middle class. However, this exemption only applies if a taxpayer takes relief under various sections of the income tax act. No major announcements were made for the railway sector, as the budget focuses more on increasing allocations for railways over highways.

In her eighth consecutive Union Budget, Finance Minister Nirmala Sitharaman has announced a major relief for the middle class in India. People with an annual income of up to Rs 12 lakh will not have to pay any income tax, owing to a tax rebate and the availability of a standard deduction of Rs 75,000 under the new tax regime. However, tax experts state that individuals with zero tax liability are still required to file an income tax return, leading to a cleaner financial record.

With the announcement of the new tax regime, Finance Minister Nirmala Sitharaman has announced significant changes to the slabs and rates to benefit all taxpayers. Under the new system, taxpayers with normal income up to Rs 12 Lakhs will not have to pay any taxes, and those with income up to Rs 4 Lakhs will be exempted. The time limit for filing returns has also been extended to 4 years.

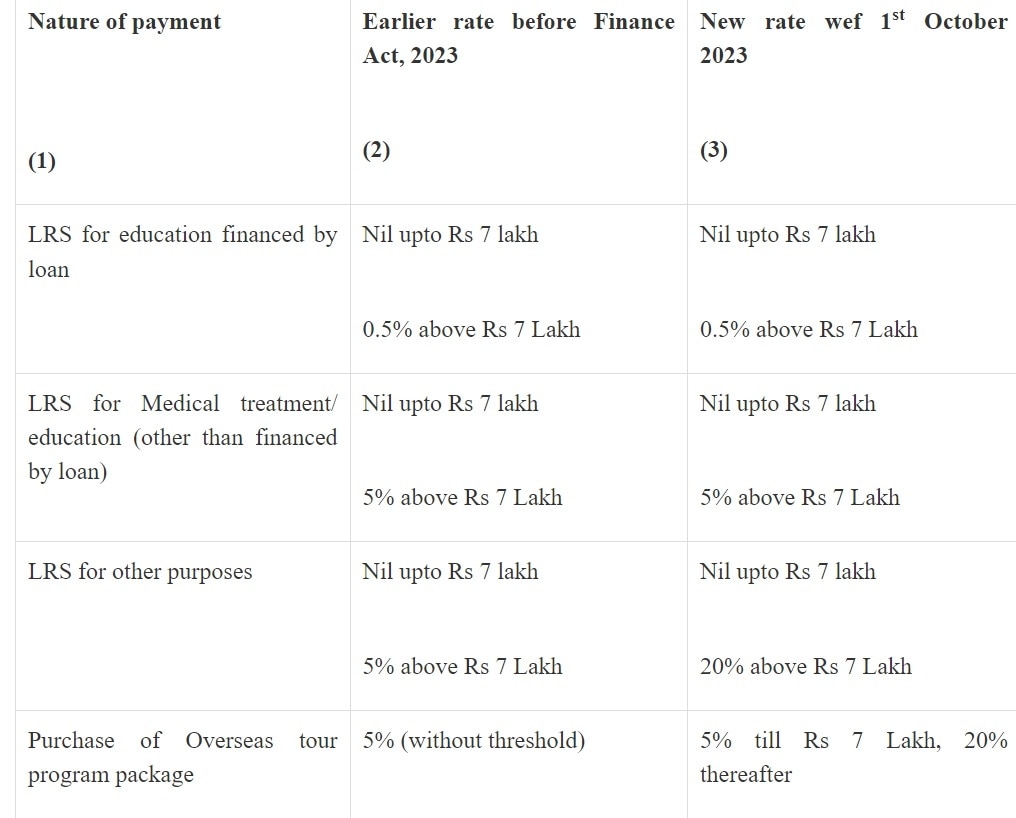

Finance Minister Nirmala Sitharaman has proposed to increase the threshold for collecting TCS on Liberalised Remittance Scheme transactions from Rs 7 lakh to Rs 10 lakh. This move is expected to benefit the travel and foreign exchange sectors, providing a boost to outbound tourism, education, and the airline industry. Experts say this hike in TCS threshold will also ease the burden on students and individuals seeking medical treatment abroad. Additionally, the Finance Minister's second Budget for the BJP government focuses on various sectors to revive the struggling Indian economy.

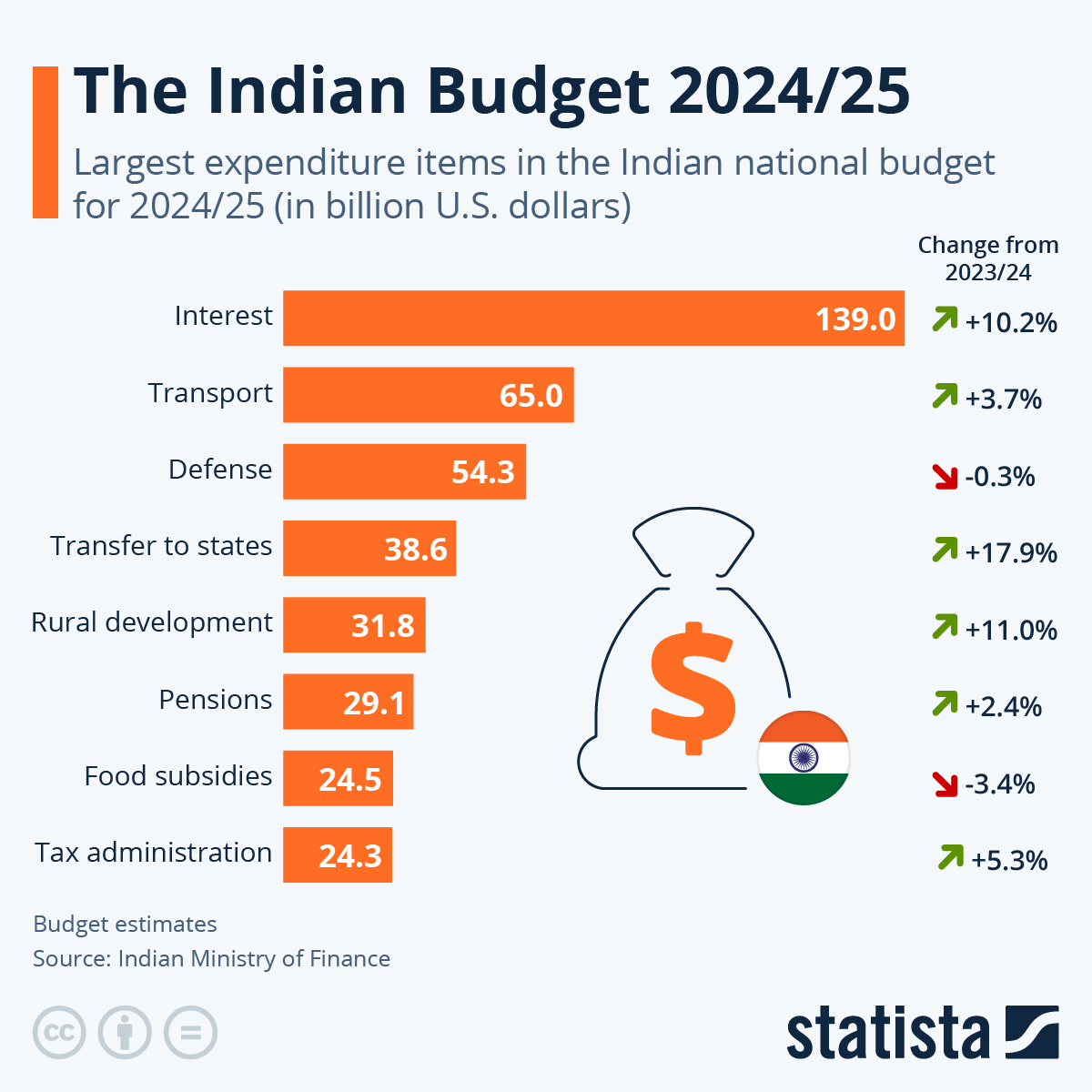

The second Budget under the BJP government led by PM Narendra Modi presented by Finance Minister Nirmala Sitharaman has a slew of surprises for taxpayers. The biggest takeaway is the massive income tax relief with an increased tax rebate level of Rs 12 lakh annually and reduced tax slabs. Despite this, the government plans to maintain fiscal discipline and reduce the fiscal deficit to 4.4% in the next financial year. However, there is a notable shift away from recent budgets with a decrease in capital expenditure growth and a focus on employment generation by boosting specific sectors.

The Indian government has announced a new Fund of Funds Scheme (FFS) with a corpus of Rs 10,000 crore to support the growth of startups in the country. The scheme, operationalized by the Small Industries Development Bank of India (SIDBI), provides capital to registered alternative investment funds (AIFs) that in turn invest in startups. With commitments of over Rs 91,000 crore from AIFs, the government plans to further expand the scheme with an additional contribution of Rs 10,000 crore. The AIFs supported by the scheme include prominent names such as Chiratae Ventures, India Quotient, Blume Ventures, and JM Financial.

In her Union Budget 2025 speech, Finance Minister Nirmala Sitharaman announced a revamp of the existing PM SVANidhi scheme for street vendors, aimed at boosting incomes for the urban poor. The revamped scheme will offer enhanced loans from banks, UPI-linked credit cards with a limit of Rs 30,000, and capacity-building support. The minister also announced the setting up of an 'Urban Challenge Fund' of Rs 1 lakh crore and an allocation of Rs 10,000 crore for 2025-26 to finance and implement proposals for cities as growth hubs.

Finance Minister Nirmala Sitharaman presented the Union Budget for 2025 and announced significant changes in the income tax slabs, with a hike in the exemption limit to Rs 12 lakh per annum. The budget also focuses on skilling initiatives, such as National Centers of Excellence and expansions in AI and IT education. The real estate sector also received a boost with measures like allowing taxpayers to claim two self-occupied properties.

Finance Minister Nirmala Sitharaman announced key measures for the MSME (micro, small, and medium enterprises) sector in the Union Budget 2025. The investment limit for MSME classification will be increased to 2.5 times and the turnover limit will be doubled, leading to growth and innovation in the sector. The government will also provide a credit guarantee cover up to Rs 10 crore and introduce customized credit cards for micro enterprises. This focus on the MSME sector, which contributes 36% of India's manufacturing and employs 7.5 crore people, is expected to boost the country's economy and create more job opportunities for the youth.