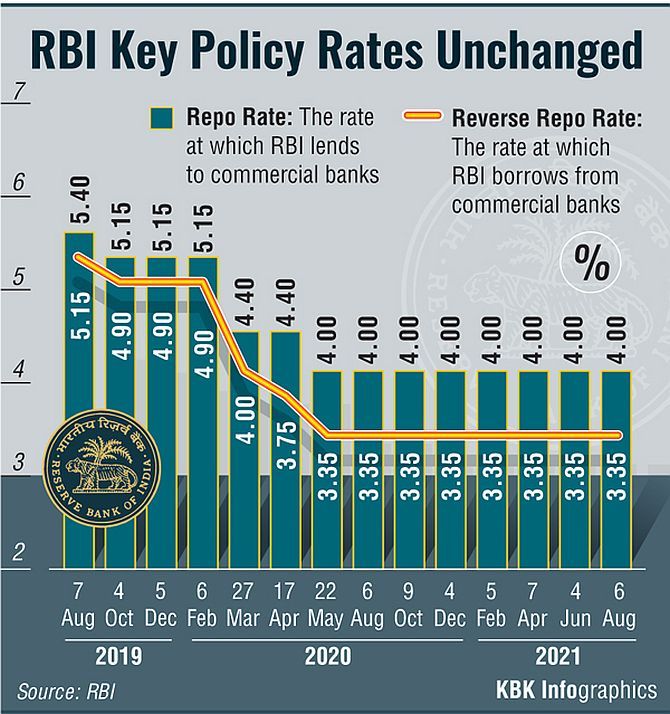

As the Reserve Bank of India's Monetary Policy Committee (MPC) convenes for its bi-monthly review, the main focus is on potential interest rate adjustments. While the current sentiment suggests the RBI may maintain the repo rate at its current level, some economists are urging for a decrease to encourage lending and boost economic growth. However, concerns over persistently high inflation figures and uncertain global conditions may lead the RBI to maintain the status quo.

The Reserve Bank of India's three-day monetary policy review started on Wednesday, with expectations of a potential cut in the cash reserve ratio (CRR). The CRR is the percentage of a bank's total deposits that it is required to maintain in liquid cash with the RBI, and a reduction could signal the RBI's intention to ease monetary policy without reducing the repo rate. This move would free up significant bank liquidity and potentially stabilize the rupee.

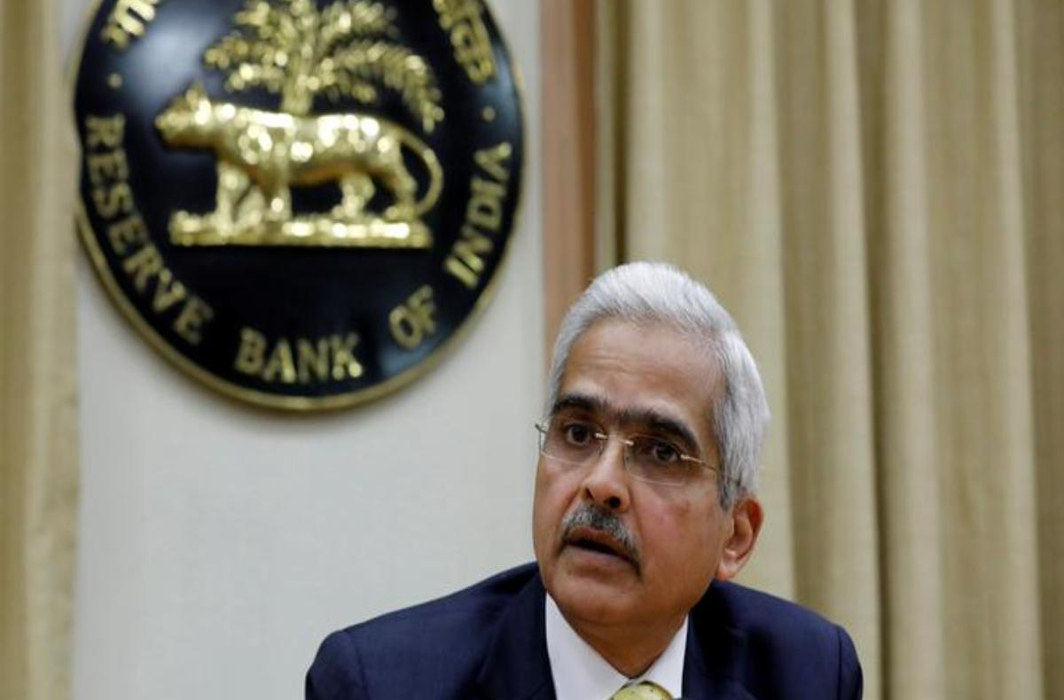

RBI Governor Shaktikanta Das announced that the Monetary Policy Committee (MPC) has decided to keep the policy repo rate unchanged at 6.5 per cent. He also stated that retail inflation remains above the targeted 4 percent, causing a need for a balanced approach towards monetary policy. The RBI also revised its growth projections for the current financial year to 7.2 per cent, with risks to the outlook being evenly balanced. Das emphasized the importance of maintaining a disinflationary approach and aligning inflation with the target in order to sustain price stability and support economic growth.

RBI Governor Shaktikanta Das will announce the central bank's monetary policy decision at 10 am today, after a three-day meeting with the Monetary Policy Committee. While analysts expect the repo rate to remain unchanged at 6.5%, there might be a downward revision in FY25 GDP growth due to the high base effect. The RBI governor will also discuss current domestic and global economic situations and address a press conference at 12:00 pm. This will be the first monetary policy announcement since RBI hiked its interest rate in February 2023.

The RBI's Monetary Policy Committee has announced its decision to maintain the repo rate at 6.5%, for the seventh consecutive time. This means that for those whose loans are linked to the external benchmark, their EMIs will remain unchanged. The RBI Governor, Shaktikanta Das, has emphasized the importance of continuing to control inflation in order to ensure stable economic growth and has projected an inflation rate of 4.5% for the fiscal year 2025. Economists predict that there may be a series of rate cuts in the near future, possibly beginning in October of 2024, with a potential change in stance.

The Reserve Bank of India, in its first monetary policy statement of the current financial year, has decided to maintain a status quo on the policy repo rate at 6.5 per cent. This is the seventh consecutive meeting that the Monetary Policy Committee has kept the rates unchanged, citing ongoing concerns about inflation remaining above the target of 4 per cent. The recent forecast of above-normal temperatures by the India Meteorological Department has added to the concerns about rising prices of vegetables and other perishable items, requiring close monitoring. However, Governor Shaktikanta Das remains optimistic about the outlook for agriculture, rural activity, and private consumption.

In its latest monetary policy review, the Reserve Bank of India (RBI) has decided to keep the key policy rate unchanged for the seventh consecutive time, in order to maintain stability in the economy and control inflation. However, RBI Governor Shaktikanta Das announced a new scheme for investment and trading in Sovereign Green Bonds in the International Financial Services Centre (IFSC), as well as the launch of a mobile app to widen the reach of its Retail Direct Scheme. The RBI will also continue its disinflationary policy to ensure a stable growth path for the economy.

The Reserve Bank of India has decided to maintain the short-term lending rate, or repo rate, at 6.5 per cent after its latest Monetary Policy Committee (MPC) meeting. The decision is in line with analysts' expectations, as the central bank remains cautious in its approach towards rate adjustments. In addition, the MPC has also projected a retail inflation rate of 4.5 per cent for fiscal 2024-25, while emphasizing on the need to maintain stability in interest rates for borrowers. As Indian benchmark indices continue to trade in the red, experts believe that this decision will provide much-needed assurance and confidence to the real estate market. Here's a summary of the latest developments from RBI's MPC meet.

The meeting of the Reserve Bank of India's Monetary Policy Committee, which started on Wednesday, will conclude today (Friday) with RBI Governor Shaktikanta Das announcing the latest monetary policy statement. The announcement, which is expected at 10 am, will cover decisions on key policy rates and a discussion on the current economic situation. The governor will also hold a press conference at 12 pm to address channel partners and provide further insights on the committee's decision.